Bitcoin Trailing Ethereum

Month of glory for major cryptos. A new metaverse world opens

It doesn't matter who tells you a longest chain, the proof-of-work speaks for itself

Satoshi Nakamoto

Decentralized Finance

The development that has grown TVL (Total Value Locked) from 20 to over 100 billion USD in one year, attracting more and more users of the new decentralized finance systems, is also attracting traditional funds and institutions. And this ever-closer marriage of the old and new financial classes, for many more traditionalists, becomes the core reason for the impending revolution in the class of new financial products. For the innovators of the new digital financial world, on the other hand, this aspect moves away from traditional projects, looking for alternatives on the Blockchain.

For this reason, it becomes necessary to start separating the 'traditional' activities, born and developed on the Ethereum network, defined as DeFi 2.0, from those that are developing and also growing in a massive way in these last weeks.

Analyzing the capital immobilized on the Ethereum network of Defi 1.0, the value appreciation of the main assets, particularly of Ethereum that in these last hours marks a new historical price record at $ 4,405, makes the TVL rise over $ 106 billion, a new historical record.

After weeks of absolute domination, Aave's project, with the largest blocked counter value of about $ 18 billion, is nicked by

Maker, which registers an increase in LTV of 40% in one month.

Third position in the ranking for Curve Finance, with an LTV above $15 billion for the first time.

Blocked assets on the other competing Blockchains (Binance, Solana, Avalanche, Polygon, Terra) recognized as DeFi 2.0 reach the $80 billion mark, an important value if we consider the explosion of these alternative protocols in the last quarter.

Adding to these values also those of Bitcoin tokenized and used on protocols of the Blockchain cataloged in DeFi 1.0 and 2.0 and those of the Lighting Network, the total exceeds $247 billion.

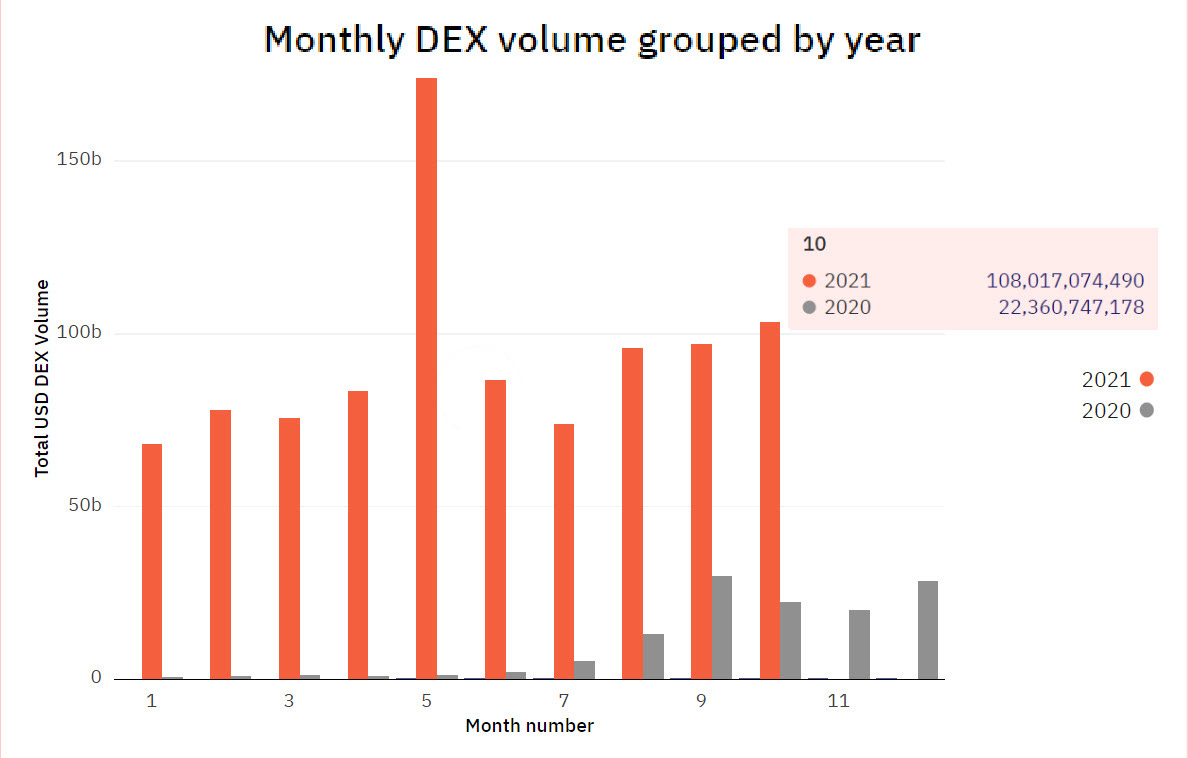

Uniswap's DEX over the past seven days has traded just under $17 billion, returning to its highest level in months. Of that, about $3.8 billion is traded in the last 24 hours for the V3 version, bypassing the total daily volumes of the other DEX leader, dYdX.

Over the past week, the strong volume growth records a 13% increase on a weekly basis for DEXs on the Ethereum network, pushing the total traded since the beginning of the month to over $108 billion, capturing the second best month ever for traded volume.

Fantom - Fantom Opera Mainnet

Catching our attention this week is a token named Fantom $FTM.

Fantom uses the Fantom Opera Mainnet to offer its users improved performance, privacy, and scalability solutions compared to other blockchains.

The Fantom network was created to improve all network features and remove any limitations of previous blockchains, thus improving speed and reducing transaction costs.

The Fantom Opera Mainnet is fully decentralized and open-source; this ensures countless developers can deploy contracts on decentralized DeFi, NFT finance projects, and even bridge solutions that connect different Blockchains together.

Fantom uses a high-speed mechanism to bring transactions to completion, called Lachesis, which allows it to operate at much higher speeds than other blockchains, thus bringing a significant improvement on transactions per second (tps).

But that's not all; Lachesis also implements the integration of the Opera Fantom blockchain with Ethereum Virtual Machine (EVM), which is also compatible with the Ethereum blockchain.

That allows developers to build countless types of contracts, as needed, that can be integrated with other blockchains and adapted to infinite kinds of cases.

Fantom's flexibility allows it to build on both Ethereum and Opera mainnet blockchains, but the function and vision of the Fantom team always remain to act as an integrator between the other blockchains.

Each blockchain built on the Fantom ecosystem remains independent and present on its own computer; you can create tokens of different types, which can interact with each other and benefit from the Opera mainnet blockchain.

The ecosystem solves the problem of scalability and network overload, thanks to the independence of each blockchain from each other, offering unique solutions and ensuring integrations between blockchain and tokens, a totally innovative concept.

Fantom blockchain is secure and user-friendly, thanks to the Proof-of-Stake consensus algorithm. Moreover, Lachesis can provide high-level security to all blockchains, ensuring a clean and transparent blockchain for everyone.

This ecosystem is integrating all previous blockchains, improving where there were gaps. The team has the vision to offer all users the ability to build, integrate and improve projects on this ecosystem.

Fantom is building the infrastructure of a blockchain with better features than the previous ones to improve the technology and the quality of the products offered to its community.

*Please Read our Disclaimer

Non Fungible Token

The announcement of the name change from Facebook to Meta by Mark Zuckerberg is destined to change the future of social networks and our digital and real lives. During the presentation of the new project, the founder of the most famous social network used images that integrated its representation with different virtual worlds called Metaverse.

This term will enter more and more into our common jargon, as our real lives will be increasingly integrated with the worlds of augmented reality. Unlike previous experiments in the past, the metaverse worlds will be an extension of our real lives. Applications will not only move from Non-Fungible-Tokens that will increasingly connect physical works and collections to digital and virtual ones, but we will be equipped with glasses and screens that will filter reality, providing us with the same sensations and giving us the impact of actually experiencing them. However, the Metaverse will be a world projected by lights and screens.

Facebook's entry into the Metaverse will make this transition even faster than I could have imagined a few months ago. The Metaverse is the future that I had hypothesized several times in these pages and believed that this would happen within the next decade. But now that the door has been opened by the number one social network in the world, none of the others will want to stay behind.

The week saw a moderate increase in trading volumes despite Axie Infinity's leading project at $113 million remaining in line with volumes traded last week. Volumes from Bored Ape Yacht Club and CryptoPunks are back on the rise, reclaiming the spotlight by netting four of the top five weekly auctions.

The rare image of CryptoPunks #1422 with hood and pipe changed hands for 500 ETH, representing a counter value of just over $2 million. That is an appreciation of over 4 million times in 4 years for this image. The previous owner had managed to get it for $74 in August 2017.

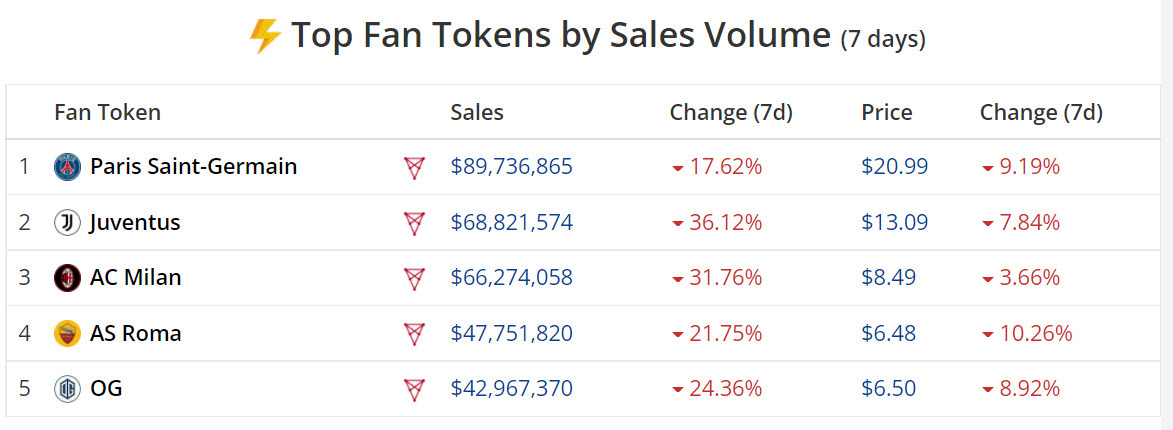

Interest in sports fan tokens is cooling, with the traded volumes of the top five all falling into double digits, dragging down the market value of individual tokens as well. That of French club Paris Saint-Germain is the most traded, with $89 million in seven days. Among the top five clubs, there are three Italians, precisely Juventus FC with $ 68 million, the only one that every month registers an increase in volumes traded and the value of the token that stands just above $ 13. AC Milan follows them with $63 million and AS Roma with $43 million.

5 hottest DeFi news of the week

Ethereum competitor Near launches $800M developer fund as DeFi competition heats up

Facebook’s new name announced: Meta

Another hack against Cream Finance: $130 million stolen

Gamestop is looking for an NFT expert

The NFT Magazine: Hackatao will design the magazine’s front cover

Technical Analysis

Bitcoin (BTC)

With a rise of more than 40%, the month of October closes respecting statistics and expectations, confirming itself as the second-best of the year and opening up space to continue to rise in the next two months that will accompany us to the end of the year.

Statistically, in the last seven years, only in 2019, the positive closing of October was not replicated in November and December.

Since the beginning of the year, the price of Bitcoin has recorded a rise of more than 110%. That is the best year ever, with a gain of over 32,500 USD in 10 months.

Levels to monitor next week:

° Upside: the week's trend confirmed the analysis of the last update with prices lining up at the close of the monthly cycle. The slide below 60,000 USD (1), recovered in a few hours, demonstrates the excellent bullish setup of the monthly cycle. If it were to confirm the closure above this psychological level, it would lay the groundwork for a bullish month of November. It is necessary to monitor the holding of the support of 55,000 USD (2) in case of a strengthening of the sales.

° Downside: only a return of the price below 53,000 USD (3) would start to crack the bullish structure of the cycle that began with the double minimum of late September. This level coincides with the 50% Fibonacci retracement calculated from the September lows and the recent historical records established last week. Price fluctuations above 53,000 USD (3) consolidate the bullish structure building the basis for the next uptrend in the medium-long term.

BTC Options

Once the operating strategies of the professional traders were successful, and the monthly premiums were collected, we are back to repositioning the positions for the coming weeks. Unlike last week, there is a prevalence of positions to protect against possible declines, with a balanced ratio between Put and Call options. Analyzing the most used strikes, downwards area 53.000 - 55.000 USD is the one protecting the bearish; levels in line with traditional technical analysis levels. On the upside, instead, it remains crucial to break 67,500 - 68,000 USD to launch prices in the 70,000 USD area.

Ethereum (ETH)

Also, for Ethereum, the month of October confirmed the statistics, with prices rising above 4,450 USD in the last hours, recording new historical records. A monthly rise that goes over 45%, marking the second-best month since the beginning of the year. Although January closed with a rise of more than 78%, the price recorded a gain twice as large, precisely 1,370 USD against 578 USD in January. With a 7% gain since Sunday's price-fixing, Ethereum puts in its fifth consecutive week in green, trying to attack the record set between last March and May of six straight weeks preceded by the positive sign.

Levels to monitor next week:

° Upside: With the achievement of new records, the price enters uncharted territory. The only valid technical indications are the projections to identify the following targets and the intensity of the bullish force. Overcoming projection n.4 at 4,160 USD (1) identifies the next target n.5 in the 4,760 USD area (2). A target that needs a healthy consolidation of the price above 4,000 USD before being reached (3).

° Downside: A price return below 4,000 USD will not negatively affect the monthly trend that would be concerned only with slides below 3,600 USD.

ETH Options

Also here, the strategies of professional traders went in goal with the closing of monthly options in profit. As indicated in last week's update, traders favored new price rises. The bullish hypothesis remained valid also in these hours of repositioning of the new strategies. In fact, the ratio between Put and Call options sees the prevalence of 2:1 in favor of the Put. An indication that increases the possibilities in favor of continuing the bullish trend also for the next few days. Analyzing the operators' strategies in derivatives, only a return below 3,700 USD could provoke a reaction in favor of selling. A level that coincides with the technical analysis area indicated above.

Disclaimer

The analysis presented exclusively reflects the author's point of view and does not represent operational advice or a trading signal and should not be seen in any way as a service of financial advice or solicitation of public savings and should not be taken in any way as a service on which to base investment decisions.