Bitcoin: October becomes "Uptober"

Along with April, October is the best month of the year for cryptocurrencies

We don't have to worry about a chain of custody of communication. It doesn't matter who tells you a longest chain, the proof-of-work speaks for itself.

Satoshi Nakamoto

With a gain of +25%, October confirms the statistic: along with April, it proves to be the best month of the year. For these reasons, it is sympathetically referred to as 'Uptober.'

Analyzing Bitcoin data, in the last six years, only 2018 closed with a modest monthly loss (-3.8%), in contrast to April, which ended with a loss in the year 2015, with a similar deficit value.

Between the two months, October has the better average (+72%) compared to an average of +23% in April. As I pointed out in the September 20th issue of the newsletter, the last quarter of the year is influenced by the closing of the previous quarter. To this, I would add that October always has a strong influence on the total performance of Q4.

Only in 2019, with a gain closure of +10% - the lowest positive performance in the last 8 years for October - did the quarter end with a total loss of 13%. For this reason, the month of October is awaited and followed with great attention by professional traders, who observe and consider statistics a valid operational reference.

In this first half of the month, the attention is once again rising for the themes that have emerged, attracting attention and capital in the previous months. After a cooling down of the trades recorded for the whole month of September, the volumes of trades for decentralized finance and NFT are rising again, for the latter an important diversion of capital for fan tokens and gaming.

But what is emerging is the increased interest from institutional investors, with volumes returning to rise and open interest for both derivatives (futures and options) at their highest levels since the beginning of May.

Investments for ETF or similar products issued and investments by U.S. Corporate treasuries also hit a new record high these days with over $68 billion total, accounting for 11% of all Bitcoin issued to date (about 18.8 million).

Analyzing part of the data, it turns out that since the beginning of the year, the growth of total instruments as ETFs or the likes (for example, the most famous Grayscale Investment Trust, which alone collects over $36 billion) together with the treasuries of the U.S. Corporate, records a growth of +138%.

But it is precisely this last figure, the U.S. Corporates, which has recorded a growth of 1,000% since January 1st.

The recent words of the FED's president, Jerome Powell, and the SEC's Gary Gensler, disavowing many previous statements in favor of a possible ban on Bitcoin and cryptocurrencies, are once again attracting the attention of investors, along with the new billionaires active in the cryptocurrency sector, who entered the Forbes list of the top 400 wealthiest people in the USA.

The recent list published by Forbes shows the cryptocurrency sector recording a total estimated value of $55.1 billion. Of this, almost half, $22.5 billion, belongs to Sam Bankman-Fried, CEO of the FTX exchange. In addition to veteran Chris Larsen, Ripple's Co-Founder who appeared on last year's list, with assets of $2.7 billion, now estimated at over $6 billion, there are Coinbase CEO Brian Armstrong ($86 billion), Cameron and Tyler Winklevoss, owners of the Gemini exchange, Coinbase Co-Founder Fred Ehrsam, and Jed McCaleb of Ripple. A list destined to grow in the coming year as well.

Decentralized Finance

DeFi 2.0 is the narrative that has been catalyzing discussions on Twitter in recent days. What happened last summer with Uniswap delisting 100 tokens of its DEX created a discontent that made many turn their nose up at it so much that they started to consider using alternative methods and chains. Not only that, Ethereum's growth, both as a network and as quotations, is still not having a major impact on commissions, which in recent days have gone back up again, remaining on average between 15 and 20 USD for each transaction. That is happening despite the recent London update that among the various proposals applied also concerns the EIP 1559 that accompanies the transition to Ethereum 2.0, and for this reason defined by many as a hard fork.

DeFi 2.0 tokens are listed on the Avalanche, Solana, and Fantom blockchains, alternatives, and competitors to Ethereum, and in some respects are reviving the emotions of DeFi 1.0 of the mid-2020s. That was the time when tokens such as Aave, Sushi, MakerDAO, Uniswap, and others now referred to as the BlueChips, started to run with daily performances of even triple digits.

Trader Joe's protocol, described as the Avalanche Chain's Uniswap, had a blocked value of just over $20 million in mid-August 2021. After two months, the TVL (Total Value Locked) was over $1.2 billion in mid-October.

Exponential growth is also being realized for the neo-tokens DeFi 2.0 that, on the emotional wave of the new decentralized unicorns discovery, in the last week have recorded stellar performances, with quotations increased even 15 times. Among these, the SPELL token, part of the new Abracadabra Money ecosystem, a few hours after listing on the FTX exchange, is undergoing fluctuations of up to 60% on the same day.

For DeFi 1.0, the week records a total trading volume of just over $15 billion, in line with last week. An October turnaround that in total records a trading volume of less than $40 billion. Should this trend continue for the second half, October will record the worst or one of the lowest volume months of 2021.

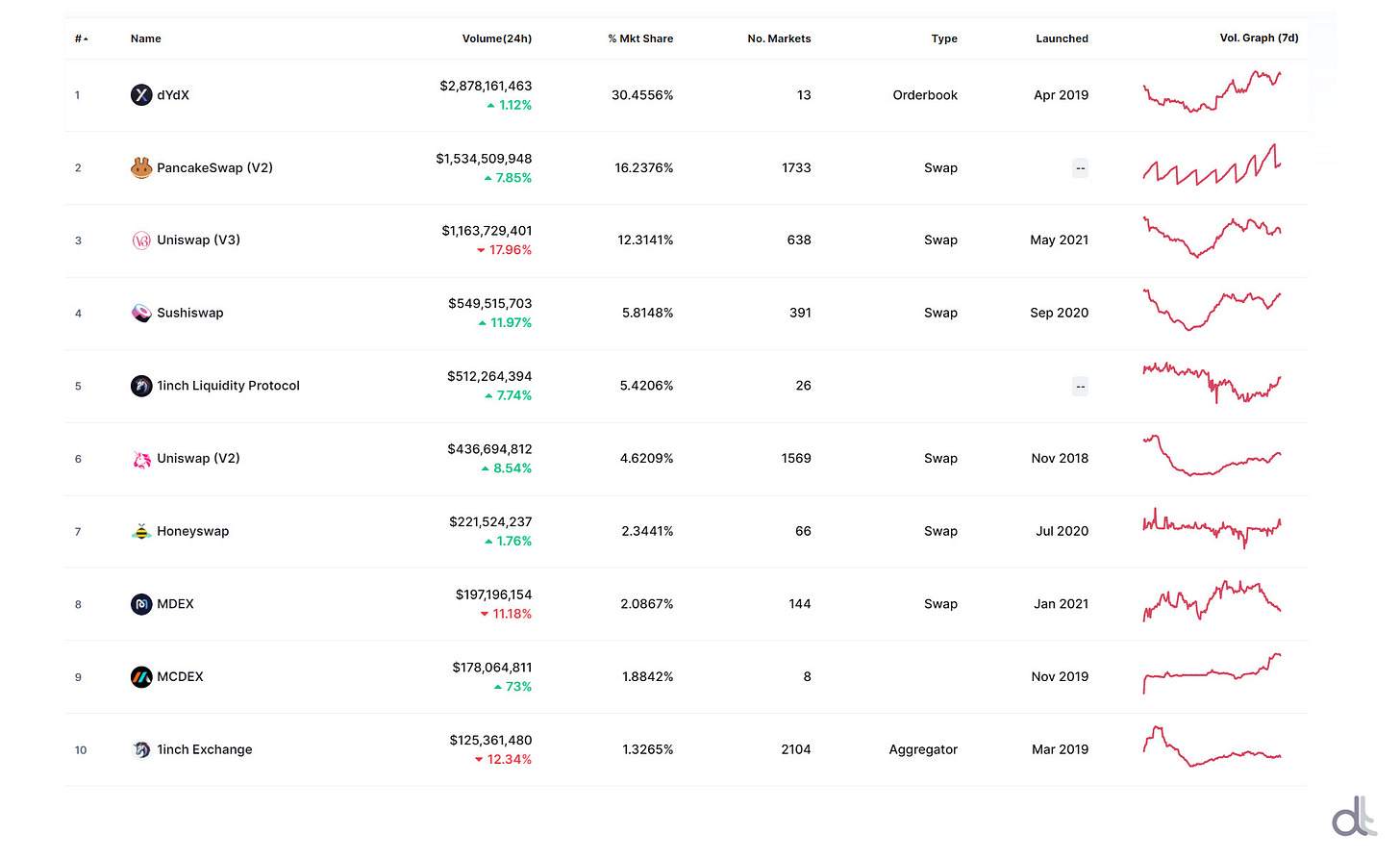

dYdX DEX continues to post higher volume than the emblazoned Uniswap this week as well. Intense activity on PancakeSwap, along with the 1inch aggregator, which are the DEXs with the higher number of tokens. Currently, the DEX 1inch allows the exchange of 2104 tokens, while 1733 tokens are supported on PancakeSwap, compared to 1569 on Uniswap.

Total Value Locked (TVL) calculated by DeFiPulse is back above $93 billion, the highest level in the last month. Since the beginning of October, with a total of just over 7 million, the number of ETH locked on the various protocols has been decreasing. Should the trend reverse and with the price of Ethereum holding out above $3,600, it is likely that the $100 billion LTV wall touched for the first time on September 7 at $98 billion will be broken.

Non Fungible Token

General contraction in weekly volumes continues the trend that began in late September. In countertrend Axie Infinity, with $135 million weekly, remains in line with last week's movements. In the second position with $119 million by volume, the new project MekaVerse. Launched last week, it's a collection of 8,888 generative Mekas, featuring hundreds of images inspired by Japan Mecha universes. Each work is original and unique to prioritize quality over quantity and create a future metaverse.

Despite the 73% drop in volumes for CryptoPunks on a weekly basis, two auctions enter the top 5 highest. These are two Nerds with glasses, #9898 sold in the 4th auction for 380ETH or $1,352,268, and #1182 sold in 1st auction for 312 ETH or $1,112,062.

The Juventus Fan Token with $305 million total trades the highest volumes of the week, followed by Paris Saint-Germain with $115 million, as the only French club in the top five for the most traded volumes.

This month, a noteworthy curiosity from the Crypto world is the BEYOND THE VOID art exhibition, tokenized on SuperRare.com starting on opening day, Sunday, October 17, at 6 p.m. The art event features Fontana and Hackatao through their respective works of art, beyond the limits of the canvas for Fontana, beyond the limits of physicality for Hackatao. The pair of artists revisit Fontana through accurate research of mid-twentieth-century art history's pivotal points that deserve to be decrypted, combining different eras into a single concept.

The exhibition will be live at the Ca' la Ghironda Museum in Bologna and online, opening its doors virtually at 5:30 p.m. on Hackatao's Twitter profile and Zanini Arte's Instagram page. A place where physical space-time limits are overcome and an opportunity to interconnect with the crypto community, the exhibition curated by Eleonora Brizi will have a digital platform through which visitors can chat directly with Hackatao during the meeting and the live presentation.

To learn more: https://hackatao.com/beyond-the-void

MekaVerse - The most anticipated NFT project of 2021

MekaVerse is an NFT project launched a few days ago that has gathered the attention of 250,000 users on Discord and 210,000 users on Twitter. It is the most hyped project ever seen in the NFT world, thanks to the excellent pre-launch marketing strategies (such as the publication on Forbes) and the respectable design.

MekaVerse is a collection of 8,888 different NFTs called Mekas and inspired by the Japanese Anime universe. These NFTs were minted 1 week ago, at the cost of 0.2 ETH per NFT, and only a few lucky ones managed to get access to the mint, as there was strong interest but very few places available. Immediately after the launch, the price of MEKAS skyrocketed, then stabilized at 5-6 Eth per piece, or an increase of 25-30 times the cost of the MINT.

Recall that everyone bought NFTs without ownership at launch, as all traits were hidden until Wednesday, October 13 at 17:00 CEST. On the same day, there was the Reveal of these NFTs, and as it always happens, a strong dump in the price floor caused by the sale of the less rare MEKAS. At the time of writing, the floor is about 3.5 ethereum per NFT.

The MekaVerse, the planet where the Mekas live, is divided into 4 factions, namely the Original Meka, the Mirage, the F9, and the Gadians, who are the Titans in charge of the planet itself. To know the rarity score of each Meka, just visit a site like Golom.io and select the MekaVerse collection.

The trading volume around Meka is truly record-breaking, as it currently marks as many as 33 thousand ETH traded in less than a week. This milestone brings MekaVerse to 22nd place on OpenSea's all-time trading list. Only yesterday, it surpassed huge projects like the Sandbox, Zed Run, My Curio Cards, and many others. We're sure this project will continue to make waves as it has also captured the interest of Cozomo de Medici (Snoop Dogg), Van Dough, and many other Series A collectors.

5 hottest DeFi news of the week

On Ethereum the first NFT magazine: collectible covers and top 10 to discover all the industry leaders

Coinbase NFT: the announcement of the new marketplace

Browser-based DeFi wallet XDEFI launches public version

Elon Musk’s Tesla is already $1 billion in profit from holding Bitcoin

Russia considers new energy tariffs as Chinese crypto miners relocate

Technical Analysis

Bitcoin (BTC)

The BTC price ascent to 58,500 USD in the last few hours confirms the bullish setting of the current monthly cycle that began in the last week of September (1) and that in just three weeks scores a rise of +44%, revisiting the quotations of the beginning of May.

Respecting the analysis reported in the previous issue of DeFiToday, where it was hypothesized the return of the price above 57k USD, the current technical structure seems destined to bring the price back to the 60k USD area. If this happens in the next few days, it increases the chances of revisiting the absolute highs of mid-April by the end of November, when the current two-month cycle is scheduled to close. In fact, with the September minimum (1), in addition to the monthly cycle, the new and current bi-monthly cycle also began, which respected the structure of the previous one in May (2) - July (3) that has been accompanying the regular rhythm of time cycles since the beginning of 2021.

Levels to be monitored next week:

° Upside: confirmation of the price above 57k USD will increase the probability of rising above 60k USD and then revisiting 65k USD, the absolute highs set on April 14th.

° Downside: no sign of weakness at the moment. A return below 52,500 USD (4) will trigger the first alarm. Only a break below 47k USD will reverse the current trend from bullish to bearish, changing the structure of the current monthly cycle.

BTC Options

Put options hedges are growing with a 3:1 ratio with Calls, signifying that professional traders are accompanying the current rise. The only protection of the resistance area between 58,600 and 59,650 USD is weak, confirming a general sentiment favoring new rises.

Ethereum (ETH)

After the divergence of the past weeks, the technical structure of Ethereum aligns with that of Bitcoin. The only difference between the two assets is the intensity, which for Ethereum, records a 35% gain from the lows of late September.

The price of Ethereum returns to the 3,750 USD area, the highest level of the last month. For the queen of Altcoins, it will be important to recover the 4,000 USD (1), the highs of early September. A condition that would open the way to revisit the historical highs just above 4,300 USD (2) established in mid-May last.

Levels to be monitored next week:

° Upside: the confirmation of the overcoming of 3,700 USD (3), equal to 75% of the Fibonacci retracement that takes as reference the highs and lows of September, increases the chances of seeing prices again in the 4,000 USD (1) area by the end of October, where the closure of the current monthly cycle is expected.

° Downside: only a return below 3,200 USD will reverse the current trend.

ETH Options

There is a balance between Put and Call options with a 1:1 ratio. The difference is that, while the protections with the Put are spread in a range between 3,300 and 3,100 USD, the Call are concentrated in 100 points between 3,650 and 3,750. A break-up and confirmation of the price above this level open up the possibility of a rise to the 4,000 USD area in the coming days. At the moment, in fact, there are no hedging strategies adopted by professional operators that suggest a fear of trend reversals.

Disclaimer

The analysis presented exclusively reflects the author's point of view and does not represent operational advice or a trading signal and should not be seen in any way as a service of financial advice or solicitation of public savings and should not be taken in any way as a service on which to base investment decisions.