The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust

Satohi Nakamoto

Decentralized Finance

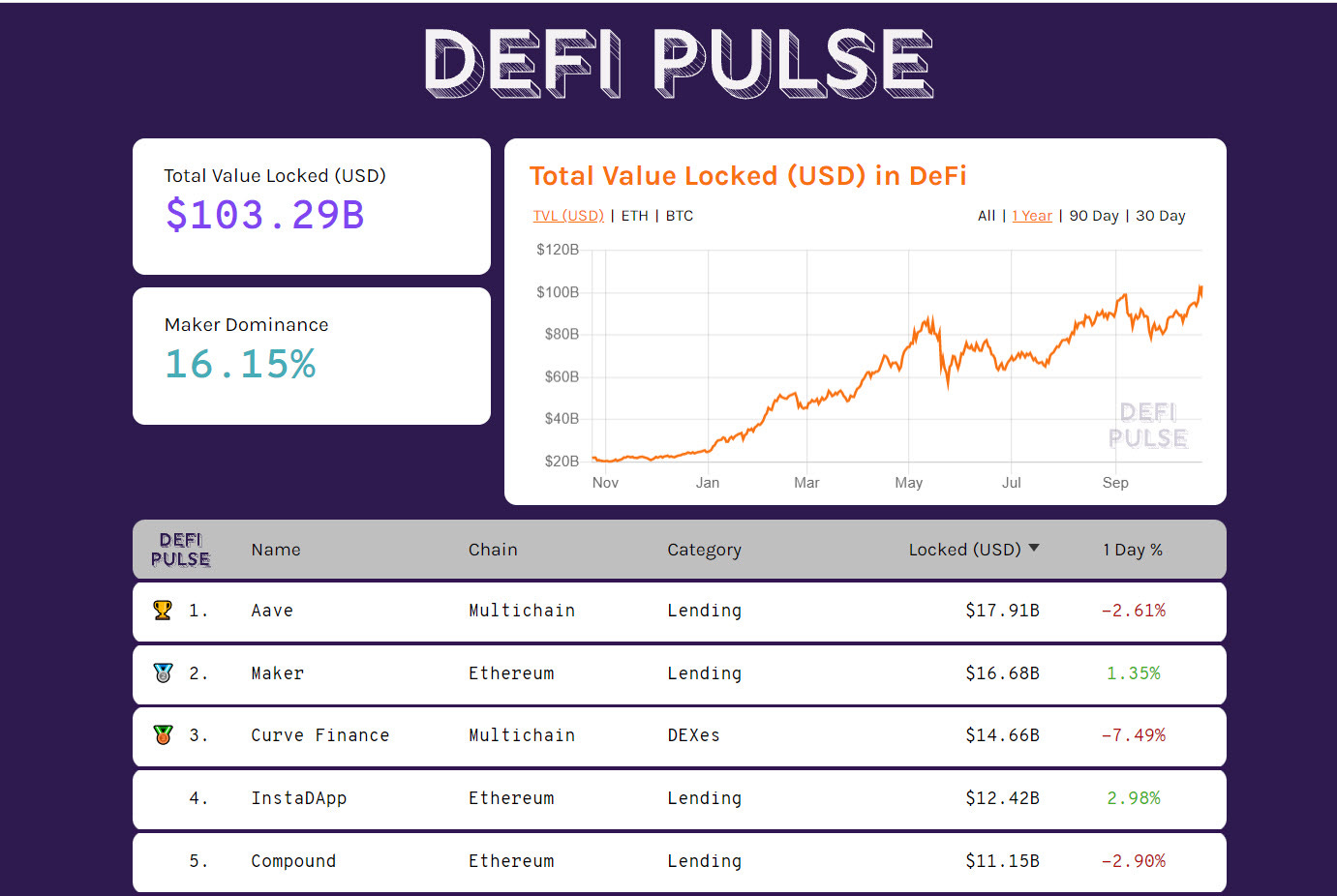

For the first time, TVL (Total Value Locked) breaks the $100 billion wall. Thanks to the recent bull run that pushed Bitcoin and Ethereum prices to new all-time highs, this is a historic milestone.

With over 211k pieces, the number of BTC tokenized on the ERC-20 protocol set a new all-time high. At the beginning of the year, the number of BTC tokenized was 118k, thus manifesting a 79% increase in just over ten months. While at 7.5 million, the number of ETH immobilized on DeFi protocols is still far from the highs of about 8 million reached at the beginning of April.

The Aave protocol remains the leader with $17.9 billion, close to the all-time record of $18.1 billion set at the beginning of September, followed by MakerDAO with its $16.7 billion. An increase of about $2 billion in the last few days is due to a growth of more than 10k BTC locked on the protocol in the previous week alone. It is followed in the third position by Curve Finance's multichain with $14.8 billion, the new TVL record for this increasingly used project in stablecoin trading.

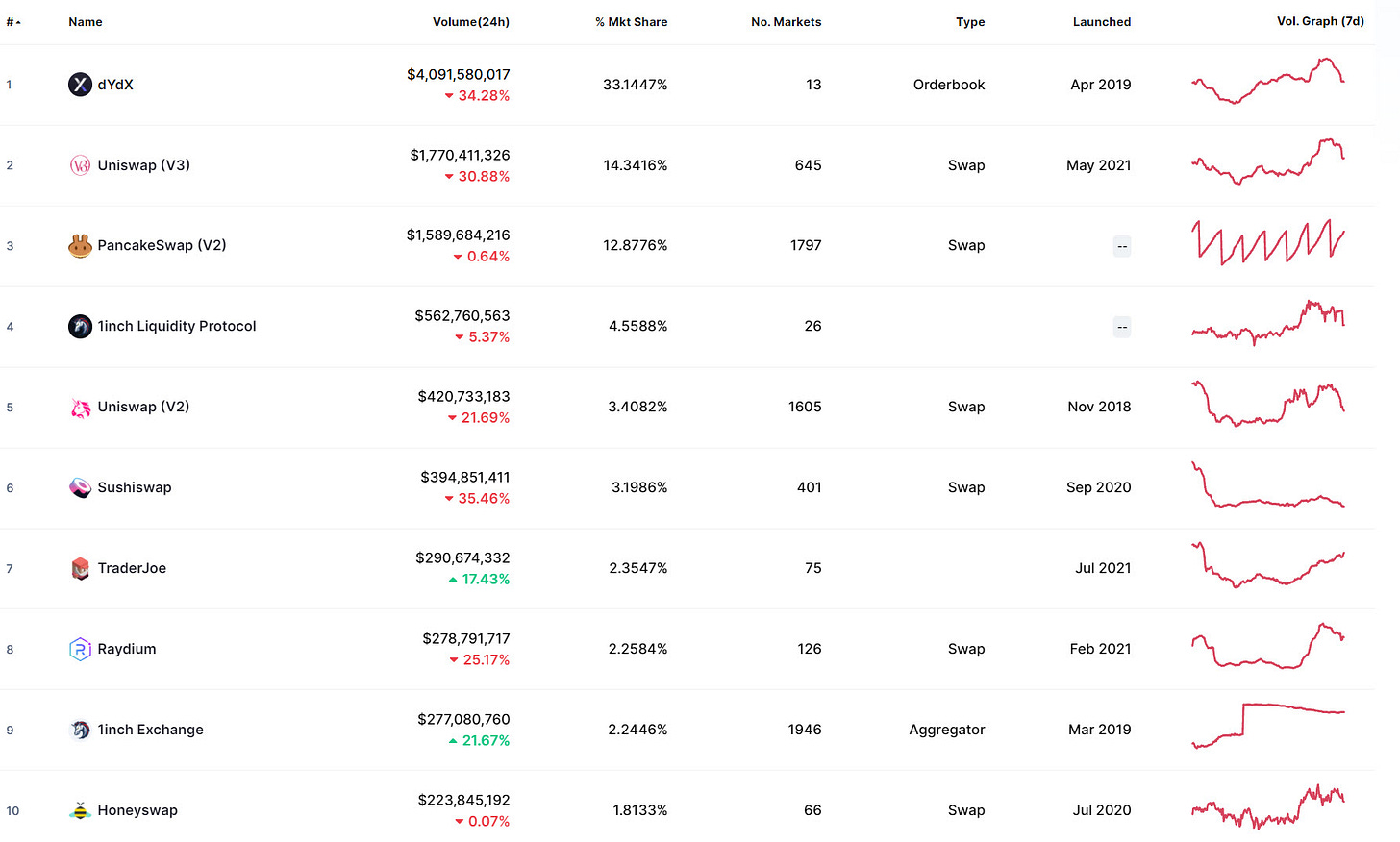

With over $20 billion traded in the last week, the DEX of dYdX confirms itself as the leading decentralized exchange and is increasingly used by users; its volumes double those of the famous Uniswap. The dYdX DEX is increasingly attracting users; this is also evident from the general numbers of use of all other DEXs. In fact, excluding dYdX from the calculation, the trading volume has been $61 billion since the beginning of the month, with a lower average than in the past months.

BitDAO token - Decentralized Autonomous Organization DAO

This week the one that caught our attention is the BitDAO token.

BitDAO is a DAO token, meaning it is a type of token that represents a Decentralized Autonomous Organization. Its network features a blockchain protocol governed by the token holders, who therefore have decision-making power.

BitDAO's vision is to help improve decentralized finance and technologies through research and development of token economies and by providing liquidity and funding to various collaborations between projects.

The BitDAO platform will offer the development of decentralized DeFi technologies, privacy technologies, and NFTs, and guarantees to reward its developers with $BIT tokens. BitDAO uses Gnosis safe to collect assets in the treasury, which is commonly used by cryptocurrency projects for multi-sig control over Ethereum addresses (store treasury).

Everything will be secured by a system of voting and proposals from the token holders, who then have decision-making power through the use of the blockchain. The potential benefits of the ecosystem are endless; that's why BitDAO welcomes all the cryptocurrency community with open arms, intending to balance the distribution of the token and rewarding the holders.

The $BIT Token is a classic ERC-20 created on the Ethereum Blockchain. Its researchers aim to develop the token and provide integrations on other Blockchains, funding the development of bridges and token swaps to get more collaborations to build their ecosystem.

Among the most prominent backers and partners of the project, we find the Bybit exchange. Still, there are many other well-known names, including Pantera Capital, Dragon Fly Capital, and several equally notable investors and investment funds.

Precisely for this reason, the token price this week has made a remarkable pump, jumping from $ 1.8 to $ 2.4 in less than two days. The token is easily purchased on the Bybit exchange, and we, therefore, remain attentive to further developments of the project that could push the price further upwards.

*Please Read our Disclaimer

Non-Fungible Token

Trading volumes are cooling down again. Among the most popular projects in the last week, only CryptoPunks have increased on a weekly basis, although this should not be misleading as last week the volume drop was over 70%.

The leader Axie Infinity with $123 million traded, remains in line with last week's volumes. In the ranking of the top 10 most traded projects, it is up to The Shiboshis to have the best increase in recent days. Half of the total $12.8 million was traded on October 15th, the second day of the project launch, sending the collection sold out.

It is a new project regarding 10,000 SHIBOSHIS NFTs supported by the decentralized Shiba Inu community, created with unique traits such as laser eyes or party hats.

Volume drops for ArtBlocks. The generative art project dropped to $11.9 million (-43%). Bored Ape Yacht Club manages to keep in line with last week's volumes, trading just over $20 million. Credit to the auction of Bored Ape #8585 King's Crown, awarded on October 20th for 696 ETH equivalent to a counter value of $2,705,138. That is an x11k appreciation for this monkey since the project's launch. The first trade on May 1st was for 0.08 ETH, at the time equal to $228. For BAYC's project, this is the second-highest value auction since its inception.

The other highest auctions of the week follow two NTFs sold on SuperRare and two on CryptoPunks.

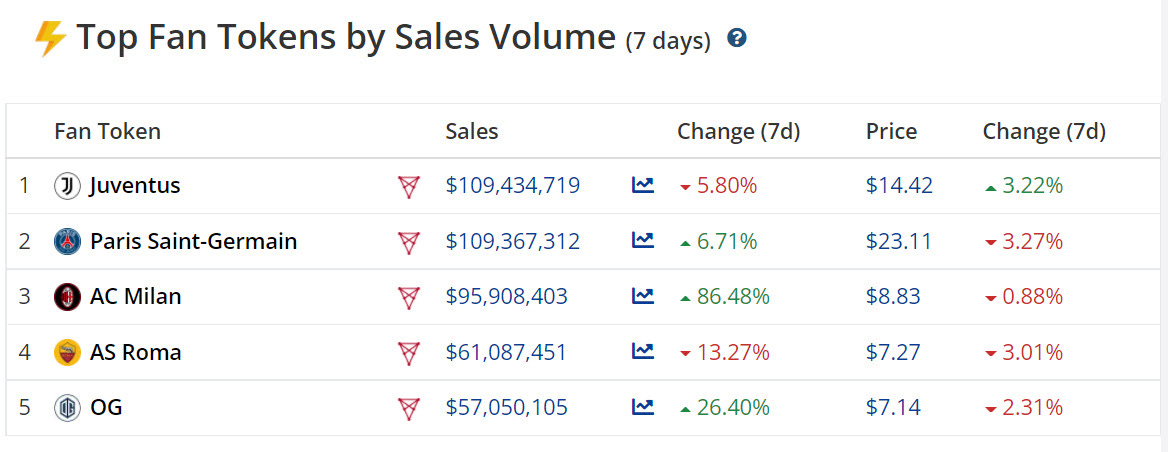

Also, this week, the Juventus fan token is the busiest along with the Paris Saint-Germain fan token, tied with trades of $109 million each. Italian club fan tokens continue to remain a favorite. In fact, among the top 5 most traded tokens, in addition to the Juventus F.C., we see A.C. Milan and A.S. Roma.

5 hottest DeFi news of the week

Tesla Q3 report: $1.26 billion in Bitcoin and crypto

US pension fund invests $25 million in Bitcoin

Ethereum breaks all-time high after Bitcoin

Major DeFi founders back play-to-earn game that hopes to be next Flappy Bird

Following Bitcoin’s all-time high, DeFi TVL hits a record high above $233B

Technical Analysis

Bitcoin (BTC)

New record highs for Bitcoin, which breaks previous April highs and pushes to within a step of 67,000 USD. The breaking of the previous record, which lasted just over 24 hours, triggered the profit-taking, causing prices to slip just below the previous record. A movement that is not worrying at the moment and can be contextualized within a classic bullish movement.

Technically, we are close to ending the monthly cycle that began in late September, so, if in line with the previous ones, the next hours that accompany us with the closing of the week will be indicative to begin hypothesizing the structure of the next monthly cycle.

Levels to be monitored next week:

° Upside: Being in uncharted terrain, in the current technical condition, the reference level is the absolute highs of 66,958 USD established on Wednesday, October 20th. The breaking of this resistance would project the price to the 70k USD area, the next level calculated using the Fibonacci extension.

° Downside: the current monthly cycle indicates a clear and distinctly bullish approach. The coming hours must identify the level where the current monthly cycle will close. If the price should remain above 60k USD, there are high chances that we will witness new historical records in the coming days. If, on the other hand, the closure will extend below this support area, any descent to the 53k USD area would not affect the bullish force, although it would reduce it.

BTC Options

The rise of the last few days, which has caused prices to take off at new all-time highs, has also animated operations on derivatives. Both futures and options registered an increase in Open Interest, which reached new absolute records on October 20th.

The strategies set in the last 48 hours are choosing to hedge the risk of further rises. It means that professional traders consider the recent record a level from which it is preferable to take advantage for a few days instead of waiting before accompanying new rises. Analyzing the strength between Put and Call, there is a 1:2,5 ratio in favor of the latter, with the most used strike levels between 65.700 and 68.900 USD. That is the wall to be knocked down to witness a continuation of the rise in the coming days. On the downside, there are no important protections up to the 54,500 USD area, in line with the technical support level indicated above.

Ethereum (ETH)

After a few hours from the new historical record of Bitcoin, the moment of euphoria was also reflected on the queen of Altcoins, which failed to update the record for a handful of points. In fact, on Thursday, October 21st, the price of ETH stopped at 4,370 USD.

Also here, the profit-taking has triggered a prevalence of selling that is causing, in these hours, a retracement and return of the quotations to test the area 4,000 USD, psychological support close to the technical support of 3,950 USD that coincides with the previous relative highs at the beginning of September. They were tested for the first time last weekend, before the breakup occurred on October 20th. Technically and cyclically, the structure is similar to that of Bitcoin, so the next few hours will be essential to identify a support area where the price of ETH will go to establish the closure of the current monthly cycle, also for Ethereum that started with the triple low at the end of September.

Levels to monitor next week:

° Upside: Yesterday's high of USD 4,370 becomes a level to be exceeded decisively to trigger re-coverings by bearish traders who seem to have increased their positions with the long-term double high.

° Downside: a continuation of the weakness in the short term has room to return to test the former resistance of 3,950 USD. That will be the first level to monitor in the coming hours. The bullish structure of the current monthly cycle will not be compromised with prices above 3,450 USD, a level that corresponds to 50% of the Fibonacci retracement and the lows relative to the first part of October.

ETH Options

Also for Ethereum derivatives, the Open Interest has risen to the highest levels since the records of last May. Here operators continue to prefer operations set to the upside; in fact, the ratio between Put and Call 1,3:1 is still slightly in favor of the former. On the upside, protections are primarily set for strikes at 4,130 and 4,220 USD. On the downside, there is a clear concentration between 3,600 and 3,500 USD, levels just above the technical support indicated above. For Ethreum, the next trend will be established as prices break out of these levels.

Disclaimer

The analysis presented exclusively reflects the author's point of view and does not represent operational advice or a trading signal and should not be seen in any way as a service of financial advice or solicitation of public savings and should not be taken in any way as a service on which to base investment decisions.