Bitcoin: Second Consecutive Rise

New historic record for Ethereum

"I'm sure that in 20 years there will either be very large transaction volume or no volume"

Satoshi Nakamoto - 14th February 2010

Decentralized Finance

The choice of Facebook to lead the change in the world of social media with the metaverse seems to have opened the way, or rather the highway, to other giants of the Fintech world. In recent days Microsoft has also entered the field. During a conference last Tuesday, CEO Satya Nadella confirmed that the company is following 90 new services or updates, all aimed at enhancing projects in the metaverse.

On the occasion, he stated that: "In a sense, the metaverse enables us to embed computing into the real world and to embed the real world into computing bringing real presence to any digital space." That means that the digital world we have used and known until today is destined to change and be entirely revolutionized.

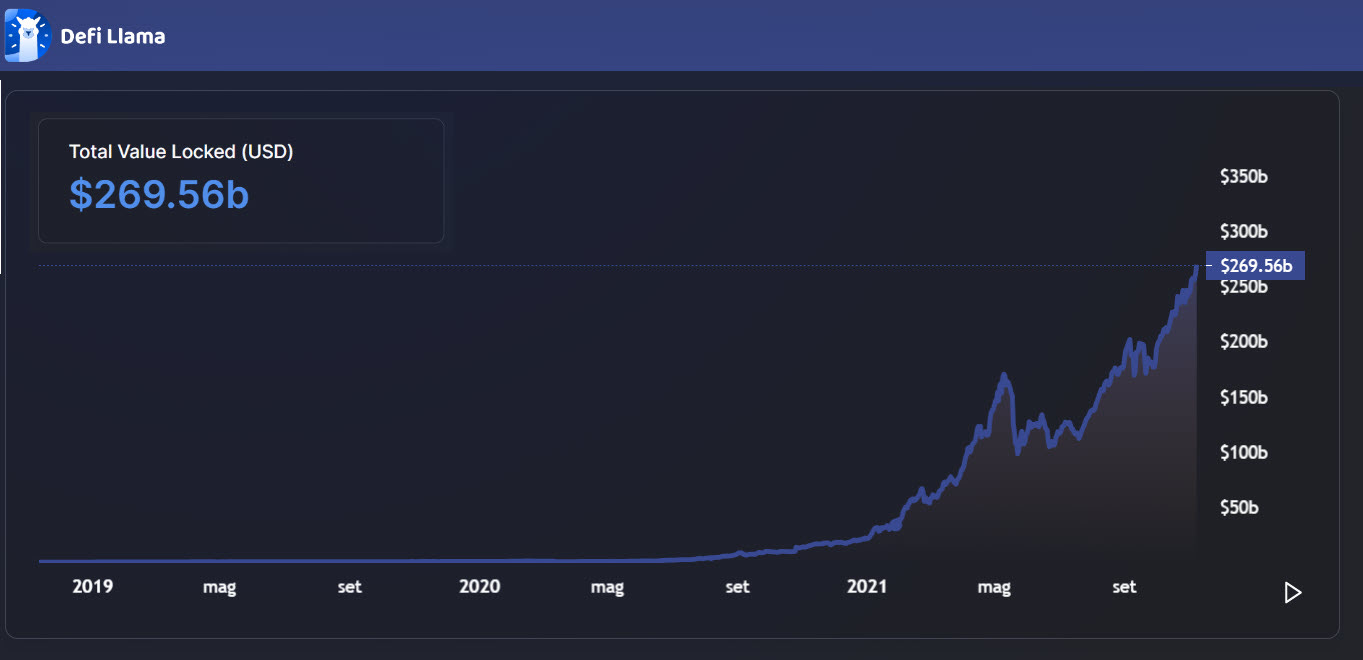

DeFi 1.0's Total Value Locked (TVL) above $106 billion sets a new all-time record. This record is also followed by DeFi 2.0 that, adding over $5 billion since last week, reaches a new high of $85 billion locked on decentralized finance projects designed on Blockchain alternative to Ethereum.

Adding also the counter value of the 3.1 million wrapped Bitcoins (WBTC), the total immobilized in the decentralized finance ecosystem exceeds $257 billion, the highest peak ever.

With 3.2k BTC locked in Bitcoin Layer 2, representing a counter value of $197 million calculated at the current Bitcoin price ($61,720), the Lightning Network sets a new all-time record.

With $24 billion traded in the last week, volumes on Ethereum's main DEXs remain in line with the previous week's. Growing trade value on Uniswap with $16.3 billion generated by over 261k traders using this DEX in the last week. Weekly volumes with 68% of the entire sector cannibalize other projects. Record-breaking volume week also for PancakeSwap DEX, designed to exchange BEP20 tokens on the Binance Smart Chain, with over $20 billion traded in the last seven days.

Non Fungible Token

The NFT.NYC conference held last week in New York City attended over 5,500 people and involved 600 speakers. It was a three-day event that saw the famous financial plaza of Times Square illuminated by 15 themed billboards featuring the most famous NFTs.

The first edition of the event took place in 2019 with a few hundred attendees. The growth in numbers, both in the value of exchanges and in people's interest, shows how the sector is destined to occupy an increasingly important space in the world of art and creativity, opening up to now unknown possibilities.

In the first week of November, trades on the leading project Axie Infinity are growing again, with about 700k transactions collecting $191 million. An increase of 69% compared to last week's numbers. Among the top 5 most traded projects, with $22 million, is Parallel Alpha climbing to the fourth place in the sales ranking, bypassing Bored Ape Yacht Club that slows down with volumes under $20 million. Parallel Alpha is a project born in March 2021, registering the peak of volumes and notoriety in August and exchanging even $10 million in a single day (August 18).

It is the animated image of the project SUPR#10 by SuperRare that unseats all the other best auctions occupied by CryptoPunks by taking the podium of the most expensive auction, awarded for 1,330 ETH, equal to a counter value of 6,024,993 USD. That is the fifth-highest auction of a digital object or rare image ever.

CryptoPunks #9943 was sold for 185 ETH or 834,140 USD, making it the fifth-highest auction in less than two years. During the first auction at the end of August 2019, the image of the punk with a cigarette sold for 0.5 ETH, at the time equal to 84 USD.

Decisive trade increase of more than 110% for the Fan Token of Paris Saint-Germain with a weekly volume of $196 million, followed by the three Italian clubs Juventus FC (+3%) at $68 million, AS Roma (+31%) at $59 million and AC Milan (+10%) at $56 million. Except for the latter, the price of all other tokens has risen since November's opening prices.

Blockchain Monster Hunt - The First Multi-Chain NFT Monster Hunt

Finally, a game on blockchain that reminds us of Axie Infinity: Blockchain Monster Hunt. This project, created and led by a first-class team (among the founders, important ex-figures of Facebook and Google), already represents a great reality in the NFT world. But let's see how it works.

Blockchain Monster Hunt is an NFT game that has lived on different blockchains since the first day of its launch: Ethereum, Binance Smart Chain, and Polygon. By using different blockchains, BMH is able to minimize the fees required to participate in the game, making it inviting even for those who are new to the game. To play the game, all you have to do is connect a compatible wallet, then choose the blockchain you want and start hunting for monsters, buying them during the various official auctions or on secondary markets at the end of the auctions themselves. Finally, you'll have to use your monsters in battles to earn ERC20 tokens called BCMC (currently priced around $3.2 per piece).

The great thing is that each new block generated on the various blockchains can bring with it a new monster, making the game mysterious and full of surprises! Blockchain Monster Hunt's roadmap is very rich and is divided into several categories:

Sandstone (Q1 2022): NFT Flash Loans, staking, and farming will arrive, and also skills for your favorite monsters;

Granite (Q2 2022): The big arrival of Metaverse LAND NFT, a cross-chain marketplace, and the evolution of Monsters;

Prismarine (Q3 2022): Battles in the Metaverse, Mining on new blockchains, Mobile App for iOS and Android, and Tournaments (yet to be discovered).

In short, a project driven by super experts and a nice clear vision. Could the BCMC token be the next AXS? We will see this in the coming months. Meanwhile, we must specify that the token has a price 100 times higher than the presale. Not bad, isn't it?

by Disnac

*Please Read our Disclaimer

5 hottest DeFi news of the week

Binance Lab invests in Star Sharks metaverse

The Matrix in 100,000 NFT: in new avatars from Warner Bros

5 reasons why blockchain-based gaming economies are the future

DeFi can be 100 times larger than today in 5 years

Ethereum Alternatives and Gaming Tokens Outperform BTC and ETH

Technical Analysis

Bitcoin (BTC)

Bitcoin closes with another rise (the second consecutive), the first week of November, confirming the hypothesis that the good monthly closure of October would have positive reflections also for the opening of the following month.

Prices that in these hours return to touch the historical records of October 20 (1), with quotations close to 67k USD.

The technical structure also confirms the hypothesis previously developed in recent newsletters that speak of a two-month cycle that began with the double minimum at the end of September (2) and will end at the end of this month (3). With the minimum of October 28 (4), the first monthly cycle ended, and the current one began, which benefits from the good closure of the previous one and gives the impetus to the next one.

Levels to be monitored next week:

° Upside: If the current bullish momentum that in these first hours of the new week registers a performance (+4.5%) exceeding the entire gain of last week (+2.8%) manages to push the price over the historical highs of October (1), it will be necessary to understand if the current monthly cycle that began at the end of October will also be supported by the same bullish momentum that characterized the previous three months.

If so, the price would reach the target of 70k USD (5) in the next few days, calculated using Fibonacci extensions. One of the few effective technical methodologies when the price, as in this case, is in uncharted territory.

° Downside: At the time of writing these lines, no bearish signal emerges. But even in such conditions, it is necessary not to lower the guard and monitor support areas useful to follow the current bullish trend. A first danger will come only with a return of the price below 60k USD and the breaking of the lows of late October in the 58k area (4). Even large oscillations above these levels are part of a normal bullish context.

BTC Options

The first indications of last week with an increase in Put options continued to be confirmed in the following days, with the strength of Put options surpassing that of Call options. Translated in simple words, derivative operators, after having anticipated and accompanied the rise of the last few days, are increasing their positions with Put options to protect themselves from an eventual directional change to guarantee the gains accumulated until now. Analyzing the chart of the positions currently in charge, it appears that a push of prices above the previous historical highs (66.950 USD) would not find obstacles to reach 70k USD and even more. On the downside, the support in the 56,500 - 57,500 USD area will be protected with teeth.

Ethereum (ETH)

The clean structure that Ethereum prices have consolidated already since the past weeks continues to confirm the new historical records set in recent hours. In fact, ETH quotations have reached 4,765 USD (1) for the first time, increasing the gain that since the beginning of the year records a performance of +540%. If these numbers were to confirm or improve, it would be the best rise since 2018 in percentage terms. By a total unit gain of over USD 4,000, this would be the best ever.

Also, for these reasons, the trading volumes on the spot markets in recent days have repeatedly recorded higher volumes than those of Bitcoin, showing a high interest from traders, investors, and simple users. Under the technical aspect, the rise confirms the optimistic hypotheses repeatedly developed in the previous updates of the past weeks on these pages.

Levels to be monitored next week:

° Upside: Prices reach like a sniper the target n°5 at 4,760 USD (1) identified in last week's update, confirming the validity of the bullish structure that accompanies the trend of Ethereum since the double minimum of July. The bullish trend from the lows of late September (2) so far has not shown any sign of uncertainty, making it difficult to identify, as well as for the structure of Bitcoin, a minimum reference to confirm the closure of the previous cycle and the beginning of the new monthly cycle.

At the moment, it does not matter who is positioned on the upside, even if it begins to be necessary to increase caution to set new operations on the upside.

° Downside: A clean uptrend without structural flaws like this has not happened for a long time. Better, in fact, than the substantial rise of last May (3) that, unlike the current one, had undergone a push too fast without creating reliable support areas, thus opening the space for an equally fast decline, as then happened (4). Instead, this time the short-term support areas are clearer and more evident.

ETH Options

Hedging positions used by professional derivatives traders indicate that confirmation of prices at current levels and above the 4,670 - 4,780 USD area opens up room for further upside for Ethereum prices. Despite the bullish euphoria and the new records, traders again show caution by triggering in the last hours strategies to protect gains. For this reason, a failure to confirm prices above 4,600 - 4,700 USD in the coming days should trigger a first weak alarm. On the downside, only a return below 4,200 USD should start the increase of profit-taking on bullish positions set in recent weeks.

Disclaimer

The analysis presented exclusively reflects the author's point of view and does not represent operational advice or a trading signal and should not be seen in any way as a service of financial advice or solicitation of public savings and should not be taken in any way as a service on which to base investment decisions.