The real Robinhood will be Decentralized

What happened on the exchange used by small investors with zero commissions opens up many doubts paving the way for the adoption of decentralized exchanges

When you are in the front lines you can see what the next necessary innovation will be. When you are behind, you have to spend your energy catching up. (Robert Noyce)

The week that has just gone by can be described as historic. There have been events that are not only newsworthy but are destined to shift the equilibrium. For many, the GameStop saga may already seem to have vanished, however, to think that it has, would be a serious error that is limited merely to the analysis of the stock price. After last week's glories, GameStop's prices are returning to the levels where the saga began a few days ago. Other stocks listed on Wall Street's financial exchanges have also suffered the same fate, as have silver prices, another financial instrument under the lens of Reddit's social networking group, which on Sunday night, at the opening of commodity prices, recorded a gap-up of over 6%. This has never happened in the history of the second best-known precious metal. The actions of 'pumping' prices upwards have also spread to some of the cryptocurrencies with up-and-down raids that are enough to set off the nerves of many experienced speculators with a lot of adrenaline but little or no experience of the mechanisms that govern financial markets, not only the traditional ones.

Last week's decision by the Robinhood exchange to suddenly stop trading sent its users into a rage as they suddenly realised how a unilateral decision by a centralized controller can decide to halt activity. This is not the first time such a decision has been made, not only by an exchange but also by the entities that control the exchanges. We have often witnessed trading activities being halted for some time (days or weeks) mainly for short selling of securities. A decision that may seem honourable but which at the same time disrupts the market and the independence between supply and demand of any financial market.

And this is the point that I consider much more relevant than the steered rise in prices. The aspect of having an open market in the future where people do not have to worry if those who regulate trading decide to intervene and suspend activities. A financial marketplace that is always open 24 hours a day and 365 days a year, regulated by open and interconnected programmed codes. This market already exists and those who read this newsletter already know it: it is called DeFi - Decentralized Finance. It is a constantly growing sector that is going beyond the most optimistic estimates. Not only in terms of funding, which has increased by 100% since the beginning of the year - from $15 billion to $33 billion - but also in terms of the value of tokens linked to decentralized projects and the increase in adoption. In the last six months, the new addresses of users using decentralized exchanges have grown from 238,000 to over 1,340,000, an increase of 430%. The growth of this sector is consistent with a market demand that is increasingly interested in exploiting the new potential. The problems of some smart contract codes that in recent months have put in crisis some protocols programmed with some bugs have not created the flight of users that many announced. On the contrary, it has made it possible to find the right solutions for a sector that is still young and in many respects immature, but which is showing that it is beginning to change financial balances and paradigms that were impossible to imagine until recently. But a mass entry at this time would not be sustainable for the current structure of decentralized protocols. The future is already here, we just need to be patient enough to wait. And not a long time, just the right amount of time. It is essential to be aware of this.

Decentralized Finance

The growth of Decentralized FInance continues unabated. The current numbers would have been hard to imagine at the beginning of last year. Day after day, the numbers are setting new records, with double- and triple-digit increases even within a few weeks.

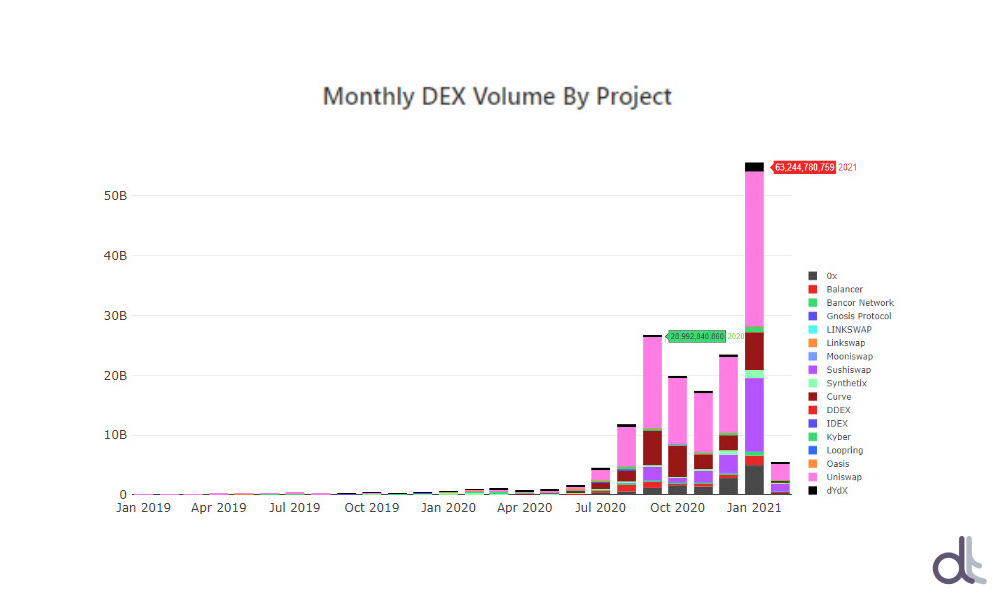

DEXs Volume Monthly

The total trading volume on decentralized exchanges, the so-called DEXs, for the whole month of January was more than $63 billion, doubling the previous record of around $29 billion set last September. This trend seems to be confirmed for the month of February as well, with daily trading averaging around $2 billion these days.

In the last week, since Friday, January 29th weekly trading volumes have risen above $12.2 billion, setting an all-time high and a 90% increase on a monthly basis.

The number of active trades rose to over 183,000 unique addresses over the past seven days, 70% of the total amount is accounted for by Uniswap, which remains the leading DEX with $6.7 billion traded and an increase of $1.5 billion since the last update.

SushiSwap, Uniswap's vampire project, also grew, confirming its second position in terms of value traded with $3.2 billion.

The Curve protocol was third.

DEXs Volume Last 7 Days

In recent days there has been growing interest and usage in the 1inch project, a protocol that provides liquidity from several DEXs allowing the aggregation of trades in order to obtain the best commission price. In the last week, with over 17,000 trades the 1inch protocol is the second most used project.

With over 134,000 trades and a value of $6.7 billion, Uniswap's protocol accounts for 50% of the total weekly trades. SushiSwap strengthened, gaining market share to over 24% for the first time, whereas Curve, while maintaining the previous week's trading volume, dropped to 7.8%.

DeFi's strong momentum is also confirmed by gains in governance tokens linked to decentralized finance projects. The Top10 best rises of the week are largely occupied by DeFi tokens, all of which registered triple-digit rises. Among the best is the 0x (ZRX) token, which is up triple digits at +130% from last Friday's levels. After more than two years of difficulty, suffering the repercussions of the crisis in the entire sector, ZRX revisits $1.5. Level abandoned in May 2018. Since the lows of late December 2020 when prices bottomed at $0.3, ZRX's price has increased 4x in value.

Total Value locked in DeFi

The Total Value Locked (TVL) of the decentralized finance projects for lending, funding and trading, in these hours, exceeds $34.4 billion, new absolute records. Unlike a month ago, the disruptive growth is also caused by the rise of the locked Ethereum and Bitcoin in protocols. Since last week, the number of coins that users have decided to lock for additional returns has grown by more than 600,000 ETH and 4,000 BTC. With over 7.6 million ETH and 48,180 BTC to date, the total number of tokens is at its highest since mid-November.

5 hottest DeFi news of the week

The Sandbox will sell its tokens on Coinmarketcap

Pnetwork launches Wrapped EOS on Ethereum

Cosmos to fund Ethereum projects

Yearn Finance DAI has been drained

Technical Analysis

Bitcoin (BTC)

For the king of cryptocurrencies, the past seven days have confirmed the high volatility of the past two months. The index that measures daily swings on a monthly basis rose over 5% for the first time since April last year. The raids saw prices move between $32,000 and $39,000. Technically, however, the medium-term picture has remained unchanged since last week. In fact, this range of $7,000 corresponds to the movement of a week ago, precisely on Friday, January 29th, when Elon Musk's tweet and Twitter bio referenced #bitcoin causing an explosion in volumes, recording over $23.6 billion, the second-highest trading day ever for Bitcoin. The movement then receded, as did the euphoria and the remarks of Musk who in recent hours has repeatedly cited sympathy for the Dogecoin token.

The fluctuations of these days provide a positive signal with the holding of the former resistance of $32,000, which has now become support. On the other hand, the failure to break the $39,000 level attempted twice in seven days, confirms the importance of the resistance not only on a technical basis - the $39,000 area coincides with 75% of the Fibonacci retracement that takes as reference the absolute historical highs of early January and the double low of late January - but also for being the first level used by traders in options derivatives to hedge bearish positions. This indication was present in the operative update of last week's newsletter.

BTC Chart

Over the course of the week, hedging strategies for options professionals changed operations. Even though the protection of the $39,000 resistance remained, the strength decreased. Fears of a possible break-up to the upside moved call option protections to the $40,000-40,300 area. In addition, unlike last week, downside protection positions in Put options have definitely increased. This signal indicates that the holding of technical support levels decreases the probability of a bearish continuation, as was evident in the previous two weeks. The strength of Put options increases below 35,000 USD and up to 34,000 USD highlighting the importance of this support range necessary to keep the trend positive even in the short term. Currently, the strength of Put options (downwards) exceeds that of Call options (upwards) for the first time since mid-December.

BTC Options

Ethereum (ETH)

The excellent momentum continues for the queen of altcoins, currently reaching new highs. After breaking through the $1,425 mark, Ethereum's price has been entering uncharted territory for the past three days. A context that increases the euphoria, causing prices to climb close to $1,700, resulting in a rise of about $300 in just a few hours. To find a similar movement for Ethereum it is necessary to go back to January 2018, during the explosive final phase of the ICO boom. Technically, the rise has not come unexpectedly. Although Ethereum's rise has been overshadowed by Bitcoin's performance during the past two months, the robustness of Ethereum's technical structure built over the past few months, repeatedly highlighted in previous newsletters, is confirmed with recent record highs. Since the beginning of the year, Ethereum's performance has exceeded 130%. Among BlueChips, only Polkadot (DOT) and Cardano (ADA) have done better, both with gains close to 200% since January 1st.

Looking at the daily chart of Ethereum, a clear upward trend is immediately apparent. Tracing a trendline that joins the rising lows from late December to today (orange line on the chart) the angle of inclination exceeds 45°. An unsustainable trend in the long period but that highlights the strong jump upwards of the prices sustained for over a month. A rise of this intensity leaves ample room for downward movement that can be exploited by speculation. At current levels ($1670 area), even a drop of more than 15% would not compromise the short-term trend. For the medium term, there is no danger except for a 50% fall from current levels. This would mean halving the value and bringing prices back to the $800 area.

ETH Chart

The rise of the last few days and the breaking of the previous all-time highs has caused the downside positions to be stopped and hedging strategies to be repositioned. This has supported the fast upward rush of $300 in a few hours due in part to the opening of long positions to cover the losses of short positions. At the moment, hedges have moved above $1,700 but only for protection against further rises in the short term. Since we are in the middle of the uptrend, options analysis does not provide useful operational indications, even on the downside. It is necessary to follow the movements and wait for the next few days in order to understand where the option traders will identify the levels where to set the next strategies.

ETH Options

Interview with artist Federico Clapis, who is now entering the NFT world

Why NFTs? How did you approach crypto art?

I started observing the trend of CryptoKitties and cyberpunk years ago with great interest. It was still early days for crypto art, but now it is definitely the right time and I am happy to make it official. I have big plans in this respect.

What are the challenges for a "traditional" artist when approaching crypto art?

Artists who come from academic or institutional worlds often relate to a world that is not so forward-looking. The art market is still governed by a few over-70s, and this affects the mentality of artists who have to adapt to certain dynamics. I believe that only those who have their eyes set on the future can be free from it.

What will your artworks represent and when will you publish them? Will they be sold on an auction basis?

In my works, I try to represent the emotional states of the human soul, often through the metaphor of technology. As part of my new venture into the NFT world, I have developed digital versions of my best-known works. The first release will be next week on Superare. I intend to publish very little but of good quality, one drop every few months. Each drop must be an event worthy of the work in question.

The artworks will not be sold in proper auction-style, but I will collect bids starting from 3.5 ETH.

Are you thinking of expanding the project to AR or gaming? Seeing as NFTs lend themselves well to these sectors...

I am crazy about virtual reality and as soon as I will reach a good number of drops, there will be many collaborations with galleries and museums in VR.

How long have you been interested in crypto? How did you get started?

I approached the crypto world in 2018 when I was commissioned to create the first large bronze work aimed at representing the future. Sponsored by Eidoo, it was exhibited in two major squares in London and gave me the opportunity to explore this topic with great attention and enthusiasm.

Now is the time for crypto art; bronze and cement sculptures will turn into new digital gold. NFT is the magic word.