GameStop is just another financial Titanic

After years of financial domination, the Pandora's Box of the Big Players, for years masters of finance, has been blown open. For the crypto sector, it is time for Ethereum.

Let's be clear. This newsletter is independent. The exclusive content that you will often find at the end of these pages (e.g. this week's interview with Daniel Larimer - former CTO of Block.one) is intended to bring value to the readers of these pages. Gaining insight into the views and opinions of industry leaders allows you to build your own knowledge. Leave out the comments of others, especially the so-called financial tourists, those who pose as experts for the short time it takes to sell you a product or service and then seek to recycle their expertise in other sectors. The same warning applies to those who today claim to be able to assess the changes taking place, in this case in the financial sphere, using the same yardstick adopted a few years ago, if not decades. The same people who, a few months ago, considered cryptocurrencies to be a mere speculative instrument and close to failure, while today they extol their potential. Having said that, let's start with the facts. For the few who have not followed the GameStop affair, I recommend reading this article first and then continuing reading the next few paragraphs.

Over the last couple of days, many financial "experts" have commented on the incident, pointing the finger at this wave of clueless people who have knocked out the power of a hedge fund. Most of the comments were limited to analyzing what happened in the price dynamics, few realized to understand the reasons that led to the discovery of the "Pandora's box". The origins of this "social revolt" are linked to the 2008 crisis, which, after burning through the savings of millions of US citizens and others, ushered in a new era of easy money for the well-known, creating huge asset inflation, enriching billionaires and accelerating wealth inequality, and consequently increasing the discontent of ordinary people, who in recent years have suffered the loss of purchasing power while the big players in finance have increased their wealth.

This has been provoked by what we can define as ordinary people who, unlike a few years ago, can afford to challenge the big players in finance, the ones in the luxury salons. The same people who have been speculating for decades on the backs of savers and listed companies. Hedge funds, i.e. unscrupulous speculative funds, have often been the cause of financial failures, the bankruptcy of listed companies and even bankruptcies that were paid for by savers. The game of influencing share prices and markets has always been known, often despised, but always accepted as part of the game. Those who have known finance for a long time have experienced many similar situations. But always caused by big players such as banks or financial institutions, as well as hedge funds, which with their huge capital can cause the rise or fall of listed securities.

Today, the loss of one of the best-known hedge funds, Melvin Capital, is seen as the attack on the big bad wolf by a pack of sheep. But strangely enough, instead of understanding the reasons that redeemed the pride of the herd of sheep by finding a way to rebel against an oppressor who for a long time often caused the good times, today the wolf is defended by many, even unintentionally. What is not clear is the motive and the intent of a redemption born and implemented by a group of small investors and speculators who decided to raise the price of GameStop's shares, which for 18 months had been the subject of downward speculation by some hedge funds. The same hedge funds that in the previous housing crisis of 2008 had celebrated the bankruptcy of many companies and investment funds that had the savings of millions of workers in their bellies.

As was reported in the article by The Cryptonomist, I believe that what has happened in these hours marks an event that opens up new scenarios that were previously unthinkable. Yesterday, a similar event enacted by the same WallStreetBets group on the social network Reddit, took place for the shares of American Airlines (ticker Nasdaq: AAL). This time, immediate action was taken. The Robinhood exchange, which is famous for offering low-commission or free trading, decided to halt trading on the shares and put a stop to what was happening. Within minutes of the official opening of trading on the Nasdaq, shares were up more than 30%. After the blockade, the buying spree deflated, leading the shares to close the day with an increase of 8%, back to the levels of the day before.

But as of today, the GameStop effect is unhinging the financial power known until yesterday. Today the crowd becomes aware of the possibility of confronting the financial institutions that have been rigging the game for decades. So many small drops of water create an ocean that can swallow even a ship that seemed as unsinkable as the Titanic. The financial elite is faltering more and more. Bitcoin and cryptocurrencies are no longer considered a nerdy currency to buy wool socks or buy drugs. That bubble called Bitcoin that seemed to burst every time now looks more and more like a pin.

I will address the implications that will shift the rules of financial engagement increasingly towards Decentralized Finance in next week's newsletter.

Decentralized Finance

As anticipated in the newsletter from January 15th, trading volume on DEXs, decentralized exchanges, has doubled the previous all-time high recorded in September. With two days to go before the end of the month, just over $2 billion is needed to cross the $60 billion mark since the beginning of the year. A figure that exalts 2021 by meeting the expectations that see this year as the turning point for decentralized financial services with the result of speeding up the tokenization of physical assets. This is an epoch-making turning point that will radically change finance, securities and real estate trading as we have known them to date.

Since last week, trading volumes on the main DEXs have contracted slightly (-16% since Friday, January 22nd), while the MtD growth index (monthly) has remained unchanged, having risen over 127% since the beginning of the year.

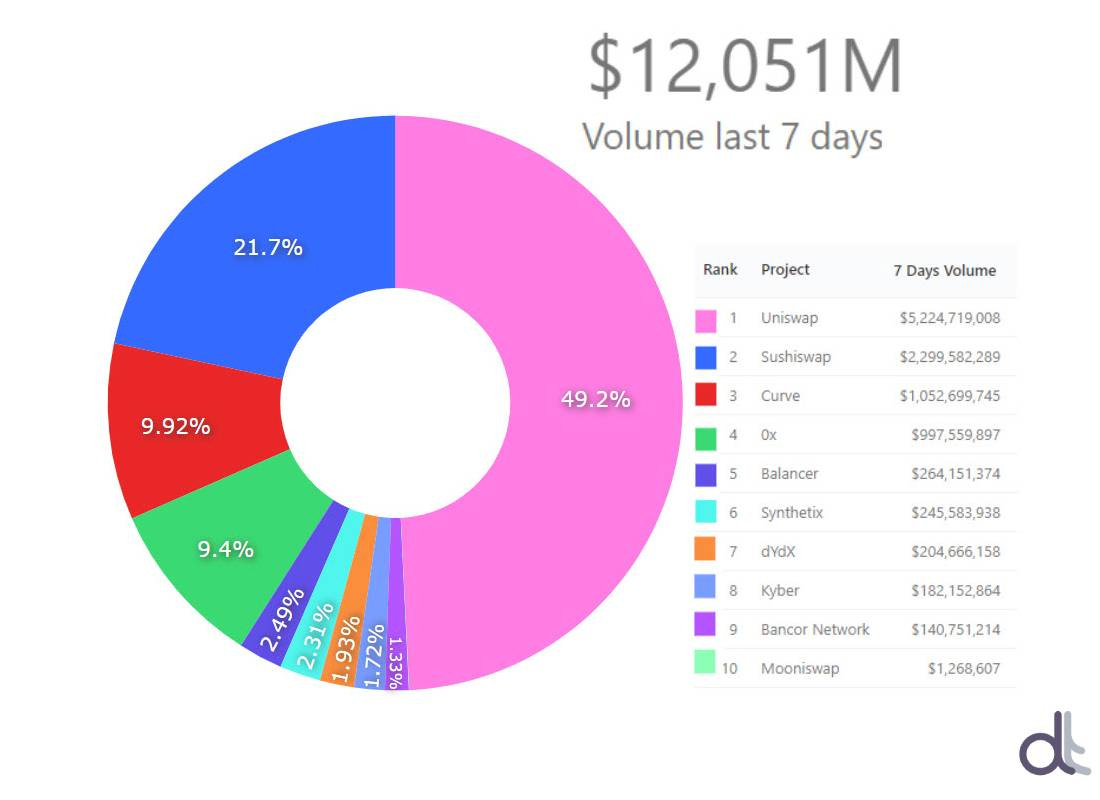

Uniswap remains the undisputed leader among decentralized trading platforms with over $5.2 billion exchanged in the last 7 days, accounting for 49% of total trading volume. Over 115,000 trades were executed in the last week. This is about 9 times more than the number of trades recorded by the second platform 1inch (16,400 trades) and 15 times more than the vampire DEX of

SushiSwap (10,700 trades) born from the fork of Uniswap's code, which remains in second position with $2.3 billion of volume traded in the last week, equal to 21.7% of the entire market.

Curve remains in third place with 10% market share despite a ⅓ percent decrease in trading volume since last week to just over $1 billion.

DEXes Volume Last 7 Days

Total Value Locked (TVL) on DeFi projects continues to grow, rising to $26.5 billion in recent hours. This record is supported by the growth of both Ethereum tokens, which are back above 7 million units locked in the various decentralized financial protocols, and tokenized bitcoin, which have risen above 44,000 BTC, mid-December levels. The number of BTC locked is halfway between the record highs of the end of October (over 61,000 BTC) and the lows of the beginning of January (just under 30,000 BTC).

70% of users decide to lock tokenized bitcoin to take loans on the Compound platform, which is the most used decentralized project with over $3.3 billion.

Aave retains second place in the ranking with $3.8 billion.

The Maker lending platform retains its leadership position, surpassing $4.7 billion in total locked collateral for the first time.

Total Value Locked in DeFi

The growth of the DeFi sector is rewarded by the prices of governance tokens for major projects, which have risen to their highest levels in recent months. Weekly gains of over 70% for Uniswap and Aave. Both are currently setting new all-time highs.

5 hottest DeFi news of the week

Aave sets a new record

Coinbase bets $25M on DeFi using Terra stablecoins

Mark Cuban has created his own NFT

Reddit to collaborate with Ethereum

Technical Analysis

Bitcoin (BTC)

It took a tweet from Elon Musk to shake the prices of Bitcoin, which had been asleep for over a week in a sideways channel, which snapped a few hours ago when the resistance of 34,000 USD (1) was broken. This level corresponded to the dynamic bearish trendline that accompanied the short-term bearish trend from the beginning of January, which began with the top of January 8th, when Bitcoin prices set an all-time record of 42,000 USD (2). With the rise of the last few hours, the short-term trend is reversed from bearish to bullish. It will be necessary to wait for the next few hours of the day to see if the reversal will be sustained by other new purchases not just caused by the euphoria of an authoritative tweet.

Volumes are a necessary growth factor to sustain a real uptrend. The decline in actual trading volumes on Bitcoin continues, which on the one hand is a positive factor, the downtrend is due to the lack of purchases and not the sale of the underlying asset, but on the other hand, if this trend were to continue for another few days, the signal would start to worry. In the last week, for three consecutive days, the daily trading volumes of Ethereum - calculated in countervalue in US dollars - have exceeded those of Bitcoin. This is a rare occurrence and has not happened for over three years.

Bitcoin Chart

The rise in the last few hours, has shaken the positions of options traders. Having broken through the first resistance of 34,800 USD (the area indicated in last week's analysis and corresponding with the bearish dynamic trendline indicated above), it moves the protections just above the current daily highs in the 39,000 USD area. The strong rise changes the balance of the hedges with Put options (downside protection) that increase surpassing that of Call options, which were higher until yesterday. It will be important to follow the price evolutions in the next hours and in the two days of the weekend. A further bullish extension of prices above 39,500 USD will trigger further purchases also supported by the Call options sold in these hours. On the other hand, a return of prices below 34,000 USD (former resistance now support) would make up for the losses suffered in recent hours by bearish investors and rebalance derivative portfolios.

BTC Options

Ethereum (ETH)

It is not surprising that Ethereum has held its ground, confirming its excellent technical structure this week. In recent days the price of Ethereum has distinguished itself from Bitcoin by maintaining a bullish approach even in the short term, unlike Bitcoin which is trying to recover the resistance levels valid in the medium and long term. The rise of the last few hours absorbs all of the bearish movement of last week, which with the low of Friday, January 22nd recorded a loss of 25% from the historical high of 1,440 USD (3) reached three days earlier. Volumes also indicate the health of the bullish structure. In the last week, only once, on Saturday January 23rd, the total volume countervalue was below 5 billion dollars, a daily trading volume barrier that was violated for the first time at the end of November.

Technically, there are no worrying signs in the short term. However, it is good not to lower our attention, especially in a phase that seems to be risk-free. For intraday trading, the first signal that could lead to a downward move is the fall below USD 1,200-1,150 (1). For multi-day operations - from weekly to monthly - the support to be monitored remains the 1,100 USD area (2), already recommended in last week's update.

ETH Chart

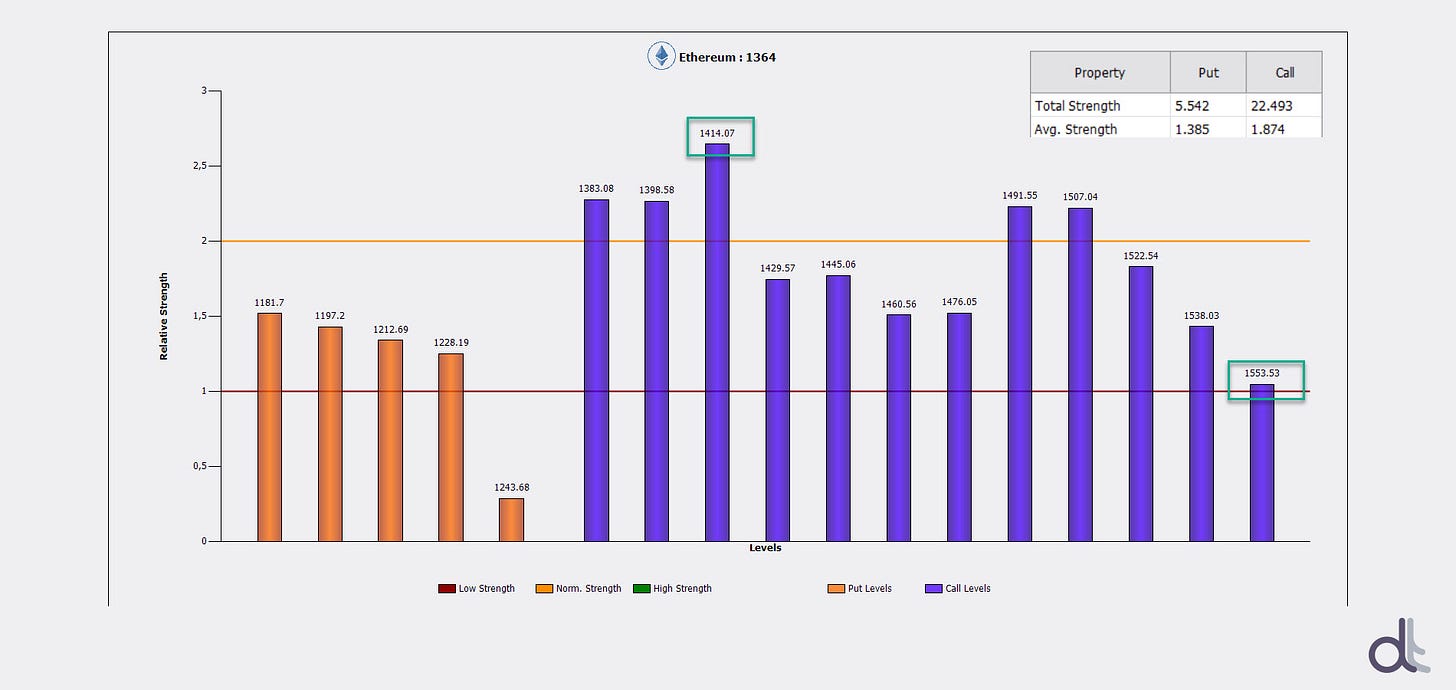

The strategies of options professionals remain cautious. Traders maintain upside protection with a clear prevalence of Call options (upside), four times higher than Put options (downside). As evident from the chart below, hedges between USD 1,400 and USD 1,550 are massive. This is the range to be monitored in case of further bullish stretches where traders' hedges will intervene. A break accompanied by buying volumes would quickly push the price towards new bullish shores. But, in order to see a new rally, it is necessary to maintain the purchasing volumes elevated. Conversely, a descent of prices would not find any barriers until the area of 1,100 USD, a level that corresponds to the technical area indicated above. The wide operating range leaves room for short-term speculation and the possibility of quick intraday excursions.

ETH Options

Exclusive interview with the former Block.one CTO

Did your decision to leave Block.one depend on the way the next products were to be created, or was it something else?

I left block.one to pursue decentralized technologies that empower the people instead of making people dependent upon the services of regulated centralized entities. Block.one has a duty to the shareholders and to build products that comply with regulations; therefore, block.one will never be able to build and promote technology that frees people from dependence upon the powers that be. Truly decentralized technologies are hard to monetize and regulate as there are no centralized points of control where fees can be extracted or regulations can be enforced. This makes it difficult to justify R&D expenses on such technology to shareholders as the liabilities outweigh the profit potential.

As a developer, you have designed and implemented several projects, which one has given you the most satisfaction?

Every project I have worked on has brought its own kind of satisfaction. The EOSIO software was a huge technical achievement while the now fully independent hive.blog community is a huge achievement in creating technology that led to community independence and self governance.

Bitcoin has failed as a payment system, do you think the EOS blockchain is an ideal "layer" for that kind of transactions?

I believe that EOS must become a more competitive form of money if it is to see the capital gains that many in the community associate with success. Bitcoin is less divisible than gold when you consider the minimum transaction fee. EOS, being far more divisible, may have better qualities for money. Moving Bitcoin to EOS will certainly help make BTC more divisible, but it will centralize custodianship of BTC while simultaneously making EOS less competitive as an independent currency. What is more valuable, shares in a stock exchange or the shares traded on the exchange?

In the coming months the "power up model" will be implemented on the EOS blockchain, can you explain the advantages over the current system?

The new “power up model” reduces the capital costs of transacting on the EOS network. When EOS.IO was released it was structured such that if you staked 1% of all staked EOS then you could execute 1% of all transactions. In this way “transactions were free” for EOS holders because you never lost your stake. The problem with this model is that it tightly coupled the value of EOS to the capital cost of transactions. Namely, you would have to stake thousands of dollars worth of EOS in order to perform a couple dozen transactions per day. Considering most people have almost no savings, this was a high barrier to mass adoption. Under the new model, users can “rent” the bandwidth. Instead of buying thousands of dollars of EOS, they can now pay a couple dollars per month for the same bandwidth. Transactions are still “free” if you use the rewards from staking to cover the costs of renting bandwidth. This decouples the value of EOS from the cost of transacting on the network.

In your book "More Equal Animals" there is a critique of traditional lending and borrowing, does the same apply to DeFi?

My book makes the argument that all contracts should be capable of being represented as a “smart contract”. The key component of a “smart contract” is that there are no “unbacked promises” and that “title” to any asset can only be held by one person at a time. Stated more concretely, assets that are not governed by a smart contract are never at risk to a smart contract.

Is a real democracy possible on the blockchain or will we always end up with a plutocratic system?

As long as you do token-weighted voting you will have a plutocratic pareto-distributed kind of control. To reach a “democracy” on a blockchain requires strong identity and a hierarchical federation of independent blockchains. Any individual blockchain is “logically centralized” and at a large scale would cease to be democratic. True democracy requires that the members maintain the ability to secede and that they minimize their dependency on any logically centralized organization.

Some people complain about EOS not performing because of the lack of influence and marketing of Block.one, what do you think?

I think that is like blaming the company behind the open source “QuickBooks” software your business chose to adopt for the failures of your business. To achieve the price success that the EOS community is looking for requires a community adopting EOS as a currency and this means keeping EOS from being considered a security.

EOS.IO was sold as software that enables any community to adopt it and operate a “smart contract platform”. Each community's tokens were represented as a percentage of the available network capacity. EOS has been incredibly successful at attracting the majority of daily blockchain transactions and demonstrating the lowest-latency, highest-throughput global network.

Since the launch of EOS.IO 1.0, block.one has dramatically improved the quality of the EOSIO software and increased its throughput by an order of magnitude. During this same time the price of EOS has been relatively flat. Clearly, the technical performance and price performance are independent variables.

We have all witnessed what happened to XRP now that the regulators are going after Ripple. Block.one maintaining clear separation between its work on the EOSIO protocol and the communities use of the software to operate a decentralized blockchain has been for the benefit of the various communities. Without this clear separation the EOS token might have suffered a similar fate to XRP with delistings from major exchanges and even greater price declines.

Soon you will start developing on EOSio, is there a particular area that interests you or are there several?

I am extremely interested in technologies that enable free speech and maximize decentralization of power. I am also interested in pursuing governance structures similar to those outlined in my book.

Do you follow any projects/apps on EOS in particular that are worth checking out?

I have followed many of the DeFi projects on EOS. I particularly like the work the everpedia and liquidapps teams are doing.