The Crypto Drop is not Scary

After more than a month of bullish sprees, a break is needed to absorb the accumulated excesses. Ethereum scored a new ATH and kept the bullish structure solid, while Bitcoin is taking a break

Welcome back,

these days we are witnessing price depreciation across the industry. A decline that comes after more than two months of vertical increases. Two weeks after the historical peak of the market cap, which rose to over 1.1 trillion dollars, the total capitalization has now fallen below 850 billion. For many people, the rise in recent weeks had revived their dreams disregarding the most basic financial rules, forgetting that financial anarchy has never been a good advisor for any form of investment. An upswing of such disruptive intensity, which seemed to know no end, could not be sustained over a long period. Even in long-term bullish phases, supply and demand have to find the right balance. And when this balance is upset, it is in the natural logic of the market that finding the right balance means that downsizing is necessary. And right now the new phase, which we can define as bearish in the short term, is necessary to bring the right balance so that the price dynamics do not enter into a distortion of value that would lead to an unhealthy market. This is a universal rule in the financial world, consequently we can define it as valid for Bitcoin and all its siblings, as well as any other instrument regulated by supply and demand. These days are a great lesson to understand how greed and lack of knowledge are a deleterious mix not only for finances, but also for the health of the investor or trader.

In the previous weekly updates, I warned of the danger that a prolonged rise, with sometimes impetuous intensity, began to be dangerous for those who started to feel the sensation of having lost the train. An emotional cognition that, when it begins to be perceived by the trader or investor, creates a cognitive dysfunction that leads to serious mistakes. The warning to increase the caution does not derive only from a perception that can be dictated by the experience, but also from signals that arrive from hedging instruments used by professional investors or operators that do not move following their emotions but have as their main purpose to make money, or at least not to lose them. For this reason, I advise to always read technical analysis using not only the analysis of the price chart but also the study of the operative structures built on options, an instrument used by professionals to hedge, sometimes to cancel, the operative risk.

I believe that the readers of this newsletter should not only find operational indications for the sole purpose of increasing their chances of profit. This would mean that this newsletter will be on a par with many others whose mere aim is to cultivate the illusion of profit. And in an industry like cryptocurrencies, it is very easy to come across advice on how to become rich quickly with little or no risk. By doing so, you not only put your financial and psychological safety at serious risk, but you will not find pleasure in reading these pages. Reach the end of this newsletter feeling first and foremost satisfied by the knowledge you have gained. Only in this way you will have the pleasure to enjoy valid and useful information not only finalized to read price forecasts but to assimilate useful information forever helping you to better understand some dynamics that are easy and known but often forgotten or ignored.

For this reason, from the next issue, I will explain scientifically what is happening in this period starting with the aspect defined as "the fear of regret".

DeFi

As predicted last week trading volumes on decentralized trading platforms (DEXs) have surpassed the previous record set last September. Since the beginning of the month, over $42.6 billion have been traded on DEXs. That's over $14 billion from the previous record and a volume that on a monthly basis is up 127%.

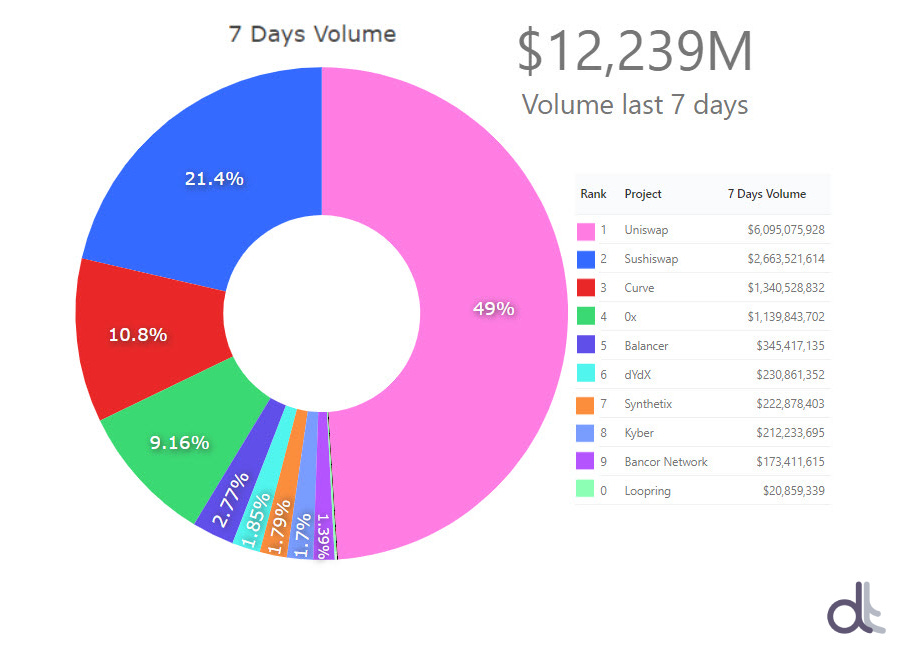

The Uniswap DEX continues to grow. Among the top 10 decentralized exchanges, it has seen the strongest increase in trades over the past seven days, climbing to over $6 billion with a daily average of about $1 billion. Uniswap's market share grew from 46% to 49%, while

SushiSwap's grew from 21% to 22% and

Curve, the third-largest DEX by trading volume, grew from 10% to 11.6%.

More than 80% of all daily trades go through these three DEXs. That's a sizeable slice of the market.

DEXes Volume Last 7 Days

In the last 24 hours, Total Value Locked (TVL) has reached a new record high of $25 billion. This is thanks to the prices of Ethereum, which recently, despite the slide of the last few days, remain at last week's levels, while growing in total value locked as a result of the number of ETH that have grown by about 1 million pieces since last week. The number of tokenized BTC also grew by over 5 thousand BTC from last Friday's levels, now at just under 38 thousand BTC in total.

Total Value Locked in DeFi (TVL)

Maker, the decentralized lending platform (below you can read an exclusive article written by the Maker team) continues to lead the way as the project with the highest value of tokenized collateral, rising to over $4.5 billion for the first time in its history.

It is followed by Aave and Uniswap, the latter of which continues its head-to-head battle with

Compound for third place.

5 hottest DeFi news of the week

Wombat integrates DeFi platforms on EOS

Arbitrage on DeFi exploit SaddleFinance launch day

Optimism ‘Soft Launches’ Ethereum Throughput Solution With DeFi’s Synthetix

Technical Analysis

Bitcoin (BTC)

Despite a recovery in the final hours of this Friday, the week is set to end in the red for the second consecutive time. This has not happened since last year, when three consecutive weeks between the end of February and mid-March ended with a negative balance. From the historic highs of $42,000 reached on January 8th, the price of Bitcoin has fallen about 30%, marking the second double-digit decline since the beginning of the year. In three weeks, it is the second drop with an intensity of more than 25%. The first time, between January 8th and 15th, the price rebound began in the $30,000 area and returned to close to $40,000 after three days. This time around, the movement reached the $29,000 area, thus testing the crucial 50% Fibonacci level calculated using the mid-December lows and the recent highs as reference points. At the moment I consider these values to be valid, insofar as taking the previous lows as a reference widens the possibility of a downward extension to levels 30% away from the current levels. A movement that if it were to occur in the next few days would begin to change the general technical picture that at the moment continues to remain bullish in the medium to long term.

BTC Chart

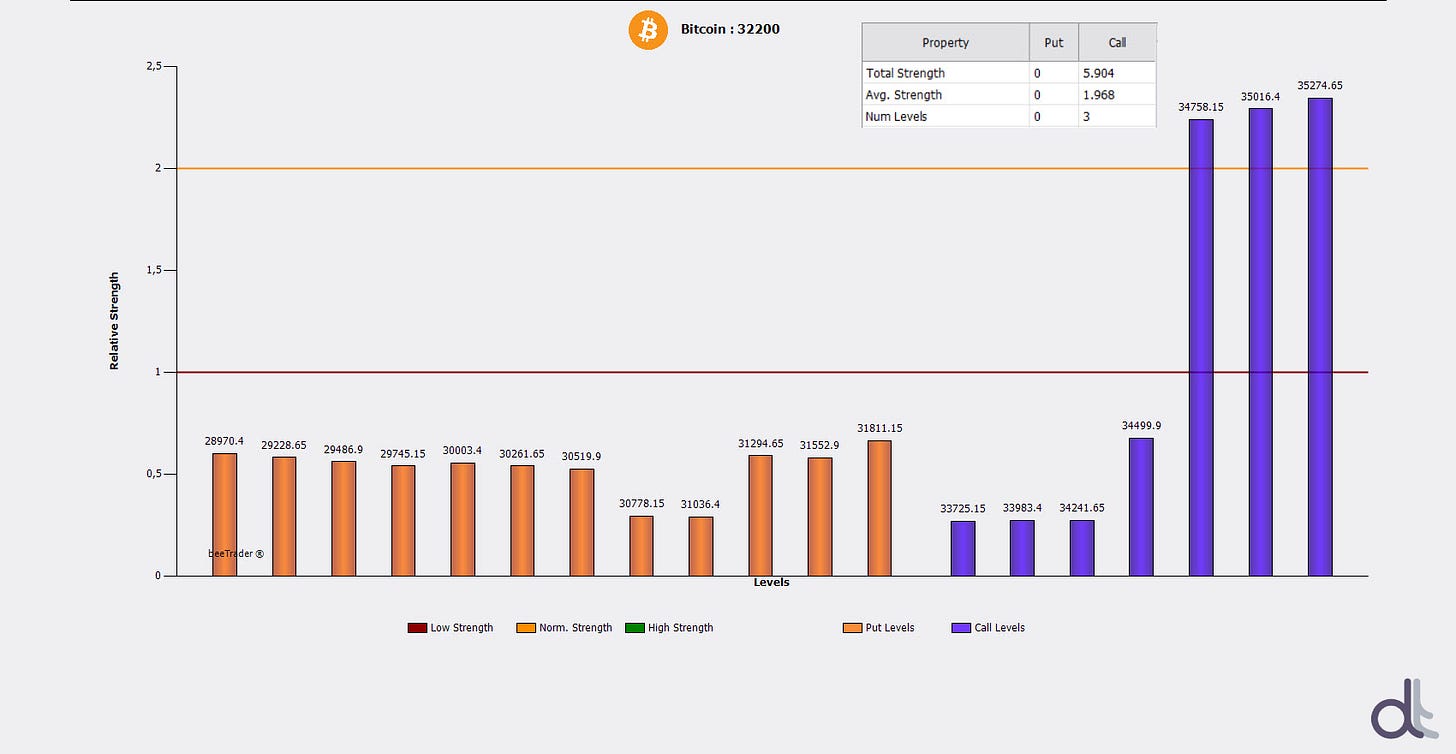

The declines of the last few days have swept away the downward hedges with Put options, increasing the upward ones with Call options. At the moment, the downward hedging effort is not supported until the $25,000 area, while upward hedging is increasing above $34,800, which is considered by options traders as the first real crucial resistance level to be recovered in order to consider the return of the uptrend that would trigger the first real hedges.

BTC Options

Ethereum (ETH)

The ongoing decline does not spare the price of Ethereum, although the descent does not cause any particular concern. This is thanks to a recently recorded new all-time high for Ethereum on Tuesday, January 19th, when prices reached $1,440 for the first time. Profit-taking caused prices to slide about 300 points and stop before the previous lows last week below $1,000. This technical structure confirms that Ethereum is a good medium to long term asset, but unlike Bitcoin, it is also a good short term asset. For this reason, the fears of the descent of these days do not raise particular concerns. The current bearish movement can be contextualized in a solid bullish trend, confirming what has already been written in previous issues of this newsletter where the consolidation of a valid bullish structure present for several months has been repeatedly highlighted.

For Ethereum, a first short-term warning signal would only arrive with prices below $1,000. Only a descent with prices below 700 USD would begin to provide a first signal of concern for the medium and long term trend. A weekly close (Sunday) above $1,250 would provide a signal of a good hold and possibility to expect new records in the short term. Support from volumes is also needed.

ETH Chart

Options traders strongly increase upside hedging in Call options. The 1:6 ratio between Put and Call options shows that professional traders prefer to hedge the risk on the continuation of further declines. On the downside, hedges start just below $1,100, confirming the importance of the lows of the last few hours, but they do not find particular strength. This is a clear sign that the hedges are not so important as to guarantee a new immediate rebound in the event of a return below these levels. To the rise, however, there are numerous levels chosen in order to cover the risk of the return of the bullish force. At the same time, a move above $1,420 would be accompanied by a rush to cover, increasing buy orders and consequently triggering rapid upward movements.

Eth Options

Crypto: Where to Start? From Understanding to Action

First of all, an important note: this is not a guide on how to make money but just an article with some suggestions for approaching and understanding the much discussed cryptocurrency world.

Lately there is a lot of talk around cryptocurrencies because of the bull market, and curiosity has increased even among those who recently were indifferent or even wary or suspicious of crypto. . Because of my work, I get so many questions, both from people I know - friends, relatives - and from people who find me online, and I'm very happy to answer because I like to help understand the mysterious world of the blockchain.

However, in my opinion, these questions are often not the "right" ones to approach this world: "So should I buy?" "How do I make money?" "Where do I go to buy Bitcoins?".

Instead, what we should ask ourselves first of all is: "What does it consist of?" "Where does the value come from?" "Where is the potential? And how can I take advantage of it? ”.

My advice is always the same: first learn and then act.

In fact, in this short article I want to suggest some useful sources to begin understanding blockchain and cryptocurrencies, and then using these wonderful products in a conscious way.

What Is Blockchain?

We have all heard of Bitcoin. But before the concept of Bitcoin it is necessary to understand what the technology behind it is: the Blockchain.

These are the three videos that I usually recommend, clear and suitable for everyone:

A very easy 7 minutes video with graphics by Simplilearn:

Beautiful and competent Bettina Warburg explains a difficult concept such as the Blockchain to different types of interlocutors, from a child to an expert:

What Are Cryptocurrencies?

Once you understand (roughly) the concept of Blockchain, you can move on to understanding what cryptocurrencies are and what the differences are between them. In addition to the best known Bitcoin and Ethereum, there are many other digital coins. In fact, there are several blockchains (thousands) and as many cryptocurrencies, and each cryptocurrency may run on one or several different blockchains.

To learn a little more, you can read this article that explains in simple terms the different main cryptocurrencies and read a blogpost on the different types of cryptocurrency tokens on the Maker Blog.

How To Begin?

The first move to do is to open your wallet. There are different types of wallets and the main distinction is between hot and cold wallets. To understand which one best suits your needs it is very useful to learn more by reading this blogpost.

It can be said that there is a different level of "risk" for the various wallets and the greatest risk for newcomers is making mistakes due to lack of familiarity. It has happened to me many times to try to help those who have lost money due to these problems which, unfortunately, are often impossible to remedy.

That's why, for those starting out, I would like to suggest reading this review about the best solutions in terms of UX and security and this article if you are particularly interested in DeFi wallets.

And What Can Be Done Afterwards

The adventure begins here. When you buy your first virtual coins and then decide what to do with them: you can "hold" them hoping for their value to increase; invest and earn interest on them; use them to pay with debit cards supporting crypto.

In addition, you can access the magical world of DeFi (Decentralized Finance), which has been talked about a lot in the last period as the growth of its value in a short time has been astonishing.

DeFi is an alternative financial system accessible to anyone, which allows access to any financial product (including loans) transparently, easily, fast and without intermediaries. In countries with underperforming financial systems, DeFi can be a solution.

Deep Dive

This very short article can be useful to understand how to approach the world of cryptocurrencies conscientiously and sensibly. Part of my job is to easily communicate something that has enormous potential but that can seem (and in fact often is) very complicated, and to help its expansion.

Here are other small tips and sources of knowledge that I recommend in order to learn more:

The story of the birth and growth of Ethereum and the future of the internet as we know it, written by Camila Russo - The Infinite Machine

Finematics on Youtube

On Telegram there are several group chats where you can learn and express all doubts

The Maker blog, where there are various educational posts to learn a little more about DeFi.

Maria Magenes has been a devoted member of the cryptocurrency industry since 2018. She currently serves as the Maker Foundation’s Community Development Lead for Europe and Africa and previously worked with Aave, a Finnish company offering cryptocurrency lending and credit default swaps for retail users in the United States and worldwide.

by Maria Magenes

Join our Telegram Channel!