Bitcoin is Shedding its Skin

Despite the rollercoaster of the last few days, the market is reacting by immediately recovering important levels. In contrast to prev years, the biggest drop in history is not cause for concern

Last week I started writing a story that might sound like something out of a fairy tale but is actually real. People who are ahead of their time are often called visionaries. For many, the visionary is the one who has a dream, who sees figments of his imagination come to life before his eyes. For others, the visionary is someone who can see beyond, who can anticipate the future. For this reason, visionaries are the forerunners of the revolutions that will disrupt the lives and habits of people all over the world. Before the 2000s, few would have thought, or imagined, that within a couple of decades many activities would be disrupted, some to disappear. These years have seen a revolution in communications, music, video, publishing and news. The changes of the last few years are taking place at a speed that calls for faster approaches than in the past.

Without going too far back in time by recalling how the first internal combustion cars had to be preceded by a person warning others of the danger of a still unknown mechanical means of transport, 20 or 30 years ago who would have thought that today it would be possible to have and always carry around an entire record collection in a pocket, the same collection that in the 1980s occupied entire shelves or cupboards, or to have the possibility of accessing all record collections in real-time? Or be able to communicate by voice or video with every corner of the globe. Access our data and documents at any time without having to carry them around in folders or paperwork. Take photos or videos and be able to see them immediately and decide to share them with whoever you want, whether they are near or far, thousands of kilometres away. All this requires only one condition: having an available data connection. But if you think about it, until yesterday there was one step missing, perhaps the most important one. We can do all these things I have described with ease. We can send a document as if it were the original or send a photo in real-time, but we cannot transfer money or make certain payments as quickly. And we are finding this out because often the speed of a transfer conditional on a payment is slowed down. An obstacle that becomes even more evident when the payment is made between different countries and continents.

Not only that, but opening a bank account or accessing a loan often takes a long time for many or is prohibitively expensive for others. And in an increasingly interconnected world, this is a limitation. Digital payments have streamlined some procedures, although not completely. The request for a payment or access to finance has to go through one or more intermediaries who check and authorize the transaction. But today these limits are overcome by a form of digital, or rather virtual, money that is an alternative to traditional money. And if until recently it was thought that the transition still needed some time, today the transition has begun to speed up. More and more people are beginning to feel the need to use tools that are more streamlined and in step with technological innovation. What has happened over the last 10 years has served to consolidate the foundations of a financial revolution without making too much noise except for short periods. In the last few weeks, the price of Bitcoin has come back to make noise again, breaking new records and doubling its previous peak in 2017 in just a few days. The coming months will be even more turbulent, not only because of the price swings. Governments and financial institutions around the world can no longer ignore what is happening. The silent revolution has started to make noise... and a lot of it!

DeFi

An explosive start to the year also for Decentralized Finance. The boom in registered trades on centralized platforms (CEX) has also been reflected on decentralized platforms (DEX) which offer users the ability to trade tokens without the need for registration or other control procedures. At more than $27.5 billion in the middle of the month, trading volumes on DEXs exceeded the volumes traded for the entire month of December. If the same rate of growth continues over the next few days, the total volume is set to double the monthly record of September 2020, which closed at just under $29 billion. This record is set to be broken in the next few hours.

To get a more direct benchmark, total trading volume on DEXs has grown 110% on a monthly basis since mid-December 2020. Considering that $142.9 billion have been traded since January 2020, in just two months - since November 2020 - over $62 billion have been traded, representing 43% of total volume over the past year. If the trend continues with this intensity in the coming weeks, it will give prominence to decentralized finance, forcing existing projects, or other new ones that will be launched, to offer services that are accessible on a large scale even to users who are not familiar with the current access procedures.

Uniswap is becoming increasingly popular among trading and AMM (automated market maker) projects. With over $12.4 billion total traded in the last 7 days, Uniswap's DEX traded $5.7 billion. That's 2% growth on a weekly basis but with an increase in market share from 42% to 46.5%, to the detriment of other decentralized platforms.

After the meteoric rise of SushiSwap - Uniswap's vampire project - in recent weeks, total trading volumes dropped by about $200 million to $2.7 billion with a market share of 22.2%.

The Curve protocol held third place among the most popular projects with $1.4 billion. Meanwhile, interest in 0x is growing, rising to 9.3% of dominance with more than $1.1 billion, an all-time record for this project.

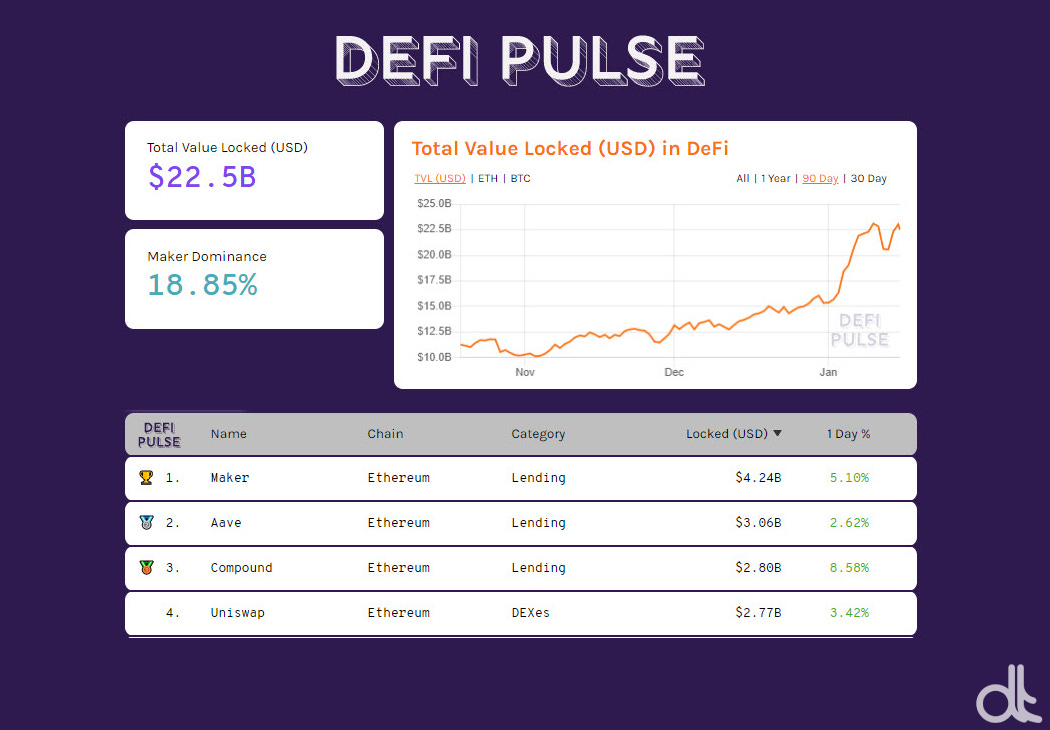

DEXes Volume Last 7 Days

Over the course of the week, the total value locked (TVL) on all decentralized finance projects exceeded $23 billion for the first time. However, the value of the tokens did not reach new highs, in fact the new record is due to users choosing to return to lock Ethereum tokens and Bitcoin issued on the ERC20 network, both of which are up from last week's levels, attempting to reverse the trend that since the peaks of October 2020 has seen a regular outflow that, despite the change in trend in recent days, is not yet over.

Total Value Locked in DeFi (TVL)

The Maker lending project remains the leader, raising more than $4.2 billion, followed by

Aave, which for the first time ever surpassed $3 billion of locked collateral.

Compound and Uniswap, both of which are above $2.7 billion in locked value, remain in third place.

5 hottest DeFi news of the week

Tether arrives on Hermez

Brian Brooks warns of “new risks” in the world of decentralized finance

Nexus mutual expands its DEFI offerings

Uniswap's growth lead bites back over Yearn Finance’s SushiSwap merger

Animoca Brands NFTs hit revenue records in 2020

Technical Analysis

Bitcoin (BTC)

Bitcoin has had a busy week so far, with prices fluctuating between 30,000 and 40,000 USD, sending the daily volatility index back above 4%, a level not seen since April. After reaching a new all-time high of 42,000 USD on Friday, January 8th, profit-taking prevailed for four days, pushing prices down to near 30,200 USD. This drop of over $11,000 was the worst ever loss in value in the history of Bitcoin. In percentage terms, that's a 28% drop in just a few hours. In the last year, only the mid-March 2020 drop had suffered a greater percentage loss (-51%) in such a short period of time. Despite this slide into the $30,200 area, buying has resumed and prices have now returned to the $40,000 area. A recovery of over 30% in four days. Technically speaking, the sudden recovery confirms the bullish trend that began in mid-December, reinforcing the support of the bullish trendline that unites the rising lows from the mid-December low just below USD 18,000. Taking the long term as a reference, the descent below the first support in the 32,000 USD area, equal to 25% of the Fibonacci retracement from the March 2020 lows and the recent high at 42,000 USD, indicates a still solid uptrend despite the rollercoaster of the last few days.

Maintaining a long-term technical and cyclical view, i.e. with a time reference to 3-6 months, at the moment a first danger signal would only arrive with drops below 30,000 USD, which would open up space for extension to the 23,000 USD area. As explained in the previous update, the rapid rise of recent weeks has left a lot of ground to cover. It is necessary to create and consolidate valid reference supports for short and medium term traders.

BTC Chart

After more than two weeks of waiting, traders in options are returning to their positions. And on Bitcoin they are returning to do so while maintaining caution. Looking at the new hedging strategies, traders consider the area between 40,200 and 41,800 - down between 0.5% and 5.5% from last week's all-time highs - the resistance levels to hedge in case of further rises. On the downside, the area of 36,200 USD should be protected. A level that coincides with a previous Fibonacci upward extension (calculated before the break of 20,000 USD), as well as having been an intense trading area on January 12th, following the end of the last few days' decline.

BTC Options

Ethereum (ETH)

A similar movement for Ethereum prices, although the pace of the movement was slower. From the high at 1,350 USD set on Sunday, January 10th, the reversal ended two days later in the 920 USD area with a loss of over 400 dollars, or 31%. To find a worse decline by value and percentage it is necessary to go back three years, to the same period in January 2018. The fall ended just below 1,000 USD, a level immediately recovered in the following hours, returning above 1,200 USD. Technically, there is confirmation that the 25% Fibonacci retracement is holding, calculated from the March 2020 low - which coincides with the March 2018 low - and the recently recorded high. In the long term, the trend remains firmly set to the upside, technically better structured than Bitcoin, although the rise at the beginning of the year has left spaces with few technical references that can be exploited by short-term speculation.

A return below 900 USD finds it easy to lengthen the descent to the 700 USD area, while on the upside, a stretch above the recent highs finds as its only target reference the historical highs of 1,420 USD in January 2018.

ETH Chart

Options traders are tightening their defences on the upside, preferring to protect themselves from a possible return of prices to recent relative highs and further stretching in the area of the absolute historical highs in the USD 1,420 area. In fact, the ratio of Put (downside) to Call (upside) options is 1:12. This means that options traders, mostly professionals, are not expressing any particular tension in the event of a return of bearish strength and prices below 1,100-1,000 USD again. This confirms that for Ethereum there is the possibility of downward movements even with a higher intensity than that recorded this week, without jeopardizing the medium and long term uptrend.

ETH Options

Are there risks for USDT?

Could Tether's recent legal troubles cause liquidity problems for USDT?

The first thing that needs to be said is that in the short term Tether was only required to hand over to the judge the documentation relating to the $850 million that seemingly disappeared a few years ago.

This sum was later found, because in reality it had only been blocked due to legal problems relating to the bank that held it on behalf of Tether.

In other words, there seems to be nothing in the short term that could cause a Tether liquidity crisis, and therefore a collapse in the value of USDT.

But the question remains open as to the long-term sustainability of an organization like Tether.

It has to be said that Tether claims to have collateral for 100% of the USDT tokens in circulation, and that none of the ongoing court cases accuse them of the contrary, or of manipulating the price of bitcoin.

However, this does not detract from the fact that about a quarter of these holdings are not in USD, but in other assets that are not publicly known, and that new legal fronts against Tether may also be opened in the future. Nevertheless, to date, there seems to be no concrete reason to believe that Tether could realistically have a liquidity crisis.

Despite this, concerns are circulating in the crypto sector about USDT, with its main competitor, USDC, seemingly taking advantage of them. Until November of last year, USDC's market cap had never exceeded $3 billion, while it is now close to $5 billion. In other words, it has grown 60% in a month and a half.

Stablecoins MarketCap

At the same time, USDT's market cap has also grown in the same period, from $19bn to over $24bn, an increase in value equal to USDC's entire capitalization, but less than half the percentage increase of USDC itself. Moreover, USDT's dominance among USD-anchored stablecoins has fallen from 78% to 74% over the past month and a half.

It is possible that this dynamic is significantly influenced by concerns about the outcome of the legal proceedings against Tether.

In the last few hours, many USDT token holders are choosing to lighten their positions by switching to USDC. This activity is also creating high fees for swaps on some exchanges. Looking at the liquidity pools on Uniswap - a leading project among decentralized exchanges (DEX) - liquidity has been growing for both stablecoins over the past few days, with particular strength for USDC, which has been growing at an average of 5% daily, while USDT's trend remains stable at 1% daily. Since the start of the year, trading volume has been growing for USDC, in contrast to USDT which is contracting by more than 20% on a daily basis.

Elrond to become the "natural platform for DeFi"

- Can you introduce us about your company, Elrond?

We are a team of entrepreneurs, researchers, and developers that can literally build rockets. But we decided to turn our attention to blockchain instead. This technology has the potential to transform the world we live in, but current popular implementations such as Bitcoin and Ethereum are slow and inefficient.

Our digital wallet and global payments app "Maiar" is scheduled for Jan. 31.

Through Maiar, Elrond is positioned for an accelerated growth period, aiming to gain widespread mainstream adoption because in addition to crypto, the app aims to gradually provide the same features as PayPal, Venmo, and Google Pay but without collecting any personal information and at much lower fixed fees.

- What will be the trends in 2021 for the crypto market?

Perhaps the most important insight is that when we zoom out the blockchain space is firmly anchored on a rapid growth and expansion trajectory.

The profound implications of a high bandwidth and inexpensive global financial system are profound, and the "crypto markets" are headed towards a multi-trillion dollar opportunity.

We believe that the next Amazon or Google is perhaps a smart contract away.

- What do you think about DeFi?

There is a lot of experimentation happening in the DeFi space and real interest is there. The recent rise of DeFi to a total value of several billions of dollars shows a lot of potential for such products.

I think Elrond will become the natural platform for the DeFi ecosystem, thanks to our high throughput, inexpensive costs, and interoperability. We have 24 DeFi projects that are already building on Elrond’s technology to deploy meta-liquidity pools, interoperability with off-chain assets or data, DEXes, stable coins and more.

With the right performance, costs, products, and tools the DeFi space will grow to become a driving force for global financial innovation. More traditional institutions will consider decentralized products as a complement or improvement for their services, as we've already seen with banks offering custody for crypto assets or wealth management funds gaining significant exposure to digital assets.

- Can you give us some data about your project? (E.g. users, downloads, countries etc)

+15,000 Transactions per second, 6s latency, $0.001 per transaction

80.000 active blockchain accounts

2169 validator nodes running the network

1.2 million transactions executed since our 30 July 2020 mainnet launch

Community: 135,000 people follow us on Twitter, Facebook and Telegram

185,000 people have signed up for Maiar early access

- How fast is your blockchain and how it can compete with Ethereum?

Elrond is a public blockchain that has delivered the first truly scalable sharding architecture solution, which is able to deliver more than 15,000 transactions per second and can scale even further, having achieved 263,000 transactions per second in public tests.

Compared to the 7 transactions per second of Bitcoin and 14 transactions per second of Ethereum, the top two cryptocurrencies at this time, Elrond is akin to what broadband internet was to the early days of slow internet connections.

- What are the use cases for your blockchain?

Elrond lends itself well to financial innovation. Its WASM Virtual Machine has performant smart contracts execution capabilities. Our economic model offers 30% of fees spent on a smart contract as royalties to its author, creating new business models.

The high speed and inexpensive transfers make Elrond a great backend for high volume domains dealing with payments, supply chains or Internet-of-Things (IoT).

Our token model enables customizable NFTs for gaming use-cases

Join Our Telegram Channel!