NFTs will Revolutionize the Gaming Industry

The evolution of online games is about to disrupt the gamer economy

"Lost coins only make everyone else’s coins worth slightly more. Think of it as a donation to everyone."

Satoshi Nakamoto

The acceptance of Bitcoin in El Salvador as legal tender has catalyzed the media's attention and beyond this past week. As is often the case with the launch of new technologies, in the first few hours after the inauguration, there were some blockages and malfunctions in the download and installation of the 'Chivo' wallet that allows Salvadoran citizens to get a $30 bonus.

As I wrote in the previous newsletter, this event is destined to enter the history books. It opens up important spaces for nations and economies that until now have been forced to suffer the hegemony of the U.S. dollar and now have the opportunity to break free from the direct and indirect control of the greenback. But while the spotlight of generalist information remains focused on events that today see the realization of hypotheses that until recently were almost unimaginable, in the ecosystem continues to develop an evolution that in a few weeks begins to outline more and more the potential of a technology that in the coming years, in all probability, will make us look at the world with different eyes. That of the metaverse and augmented reality that for many today seems difficult even to imagine.

But the process of what is happening in this period does not come suddenly. We could connect the evolution of what happened two decades ago with the first experiments of parallel or virtual worlds. I'm referring to Second Life, an online virtual world launched in 2003 that saw an explosion of users in its early years. This application allowed to recreate virtual environments and choose avatars that interacted with each other as in a real context. Within the virtual ecosystem, you could use virtual dollars (Linden dollar) for trading in the same ecosystem. After the success of the first years, the user base stabilized without gathering the consensus and interest of the early days, despite the team's choice of making the code open-source that allowed interoperability with other games.

It is very likely that among the leading causes of the decline in interest was the aspect that saw the players realize that trade and activities that allowed them to earn credits could not be easily converted into the real world. It's the same concept that also governs the economy of the most popular game consoles, in recent years with a turnover of hundreds of billions of dollars annually, making the gaming sector one of the most profitable. This business turns out to be advantageous for the producers of gameplay. To have more advantages and powers, players purchase bonuses or digital items that can be used within the game itself. Once purchased, these bonuses cannot be transferred outside. This method of virtual gaming seems to be destined to disappear.

We are witnessing in these last weeks, with the explosion of the Non-Fungible-Token, a phenomenon that indicates how the users seem to be interested in buying the property of the object or an accessory, which can be an event or a bonus, aware that the property is not regulated by a team that owns the rights, as it happens for the most famous games used on the popular consoles. That means that the interoperability allowed by NFTs registered on Blockchain will allow you to transfer the property also on other game environments based on the same Blockchain that uses the same protocol (for example, the ERC-721 standard for Ethereum). Or it will be possible to resell the same NFT in the secondary market, turning it into a rare object independent of the game platform. That would happen even if, unfortunately, the game no longer exists. A possibility that would not be allowed in the traditional gaming industry.

The opportunities afforded by the new NFT technology allow developments that are still unimaginable today. The concept of owning a physical asset is transforming into owning a digital asset. For many, it might seem absurd, but many symbols of the past, such as owning a car, a watch, or a valuable physical object, are transferring to the digital world. For these and other reasons, the gaming industry, in addition to seeing upheaval in the coming years, will again be the testbed for new technology.

Decentralized Finance

In a speech on Friday, September 10, during a conference at the Eurofi Financial Forum, Benoît Cœuré, head of the innovation hub at the Bank of International Settlements (BIS), said that Stablecoins and DeFi platforms will "challenge" banking models, and that central banks "have to act while the current system is still in place - and to act now." In his speech, he made the strong case that "CBDCs will take years to be rolled out, while stablecoins and crypto assets are already here. That makes it even more urgent to start." Cœuré is currently conducting a study related to CBDCs for the BIS, so he is aware of the growth the decentralized finance industry has been experiencing over the past year, particularly since the beginning of the year.

The evolution of technology and growth in decentralized finance is increasingly highlighting the slow mechanisms that govern traditional finance. Not only that, the studies on Central Bank Digital Currency, useful to understand the timing and modalities of issuing a digital state currency, are also proving to be slow and with applications that would require more years. In the meantime, private stablecoins are raising more and more fresh capital available to be reinvested in protocols that in a few clicks and a few seconds allow to obtain liquidity that with traditional systems would take days if not weeks.

In the last week, new records for total capitalization for Stablecoins, which for the first time exceeded 126 billion dollars. After approaching USD 100 billion, the general decline in assets brings the TVL (Total Value Locked) back to just below USD 90 billion. The total number of BTCs locked for the first time goes over 203k, while closures of many immobilized positions on Ethereum prevail, dropping to 7.2 million, the lowest level in the last month.

For all the top 5 protocols users use, the total assets locked exceeds USD 10 billion each. Aave's protocol remains the leader, with over USD 15 billion in counter value. A loss of USD 3 billion from last week's highs suffered due to a drop in prices, as the number of locked assets remains unchanged.

The tensions of the last week make exchanges fly, which for the first time exceed $21 billion since the previous report, with a 10% increase over the last seven days. Credit to the first three protocols used that realize the highest volumes ever with:

- Uniswap with $13.3 billion,

- Sushiswap above $3.1 billion, and

- Curve at 1.3 billion traded in the last seven days.

Hegic: Win Big, Play Less, Hegic will do the Rest

Today we want to talk about a crypto project suitable for traders who would like to avoid centralized exchanges and buy ETH and WBTC put and call options on decentralized platforms: its name is Hegic!

Many of you have surely already heard about this project thanks to the listing on Binance, but for those who hear about it for the first time today, we will explain how it works and why it could become a project with a multi-billion dollar market cap.

How does HEGIC work?

To use Hegic's on-chain options, just go to this page and connect an Ethereum Web 3.0 Wallet like Metamask. You will be faced with a simple screen where you can buy Put and Call options for the two largest cryptocurrencies (as of market cap): ETH and WBTC (Wrapped Bitcoin).

The best qualities of Hegic are that you won't have to pay fees of any kind (the protocol covers fees from the latest version), and you won't have to worry about liquidity, as at the moment, the project has grown so much that it can even execute orders over a million dollars.

The main goal of Hegic is to compete with Binance and all the first-class names, but offering all the conveniences that a DEX can afford, namely: No KYC (so you can trade completely anonymously), no account required (other than the ethereum wallet, which registers without email or personal data) and no chance of BAN (which is quite common in various CEXs).

In short, if Uniswap has become the leader of decentralized exchanges for novice traders, HEGIC could become the leader of decentralized exchanges for professional traders. Making things better is the team behind Hegic, which is COMPLETELY anonymous!

Usually, financial products of this caliber are often subject to investigations and problems with various governments due to the anonymity offered to traders, and the SEC or other regulators may try to shut down the protocol by attacking the team. In this case, however, that risk disappears, as Hegic's founders have never revealed their identities.

All we know about Hegic is a made-up name on Twitter and Discord, namely -is she really a woman?- Molly Wintermute. Molly also recently clashed with Binance staff, as a member of the cryptocurrency exchange platform's team had asked for more information about Hegic's future. Molly publicly responded that she doesn't disclose anything in advance to anyone (and in what tone!), especially to an exchange that could use such information to do inside trading!

Hegic Options will definitely have a bright future, and the numbers achieved so far can confirm this thesis:

- The protocol has been active since February 2020;

- So far, more than 6400 put and call contracts have been traded;

- Hegic token holders are more than 5000;

- Settlement providers are more than 1500;

- The protocol has generated more than $10 million in revenue;

- About 1600 holders use Hegic's staking function!

Behind the project is also the HEGIC token.

The HEGIC token today quotes $0.16 cents with a market cap of $94 million (and a fully diluted valuation of almost half a billion dollars).

In the past, it has touched an all-time high price of $0.64 in February 2021 and a much lower price than it is today of only 4 cents in September 2021 (in the famous post-summer 2020 Defi fall).

Should the project continue to work as it is these months, the price will surely break the highs and follow the trend of similar projects like Synthetix. We suggest buying some tokens and putting them in staking to forget them and hope for a massive future gain!

*Please Read our Disclaimer

Non Fungible Token

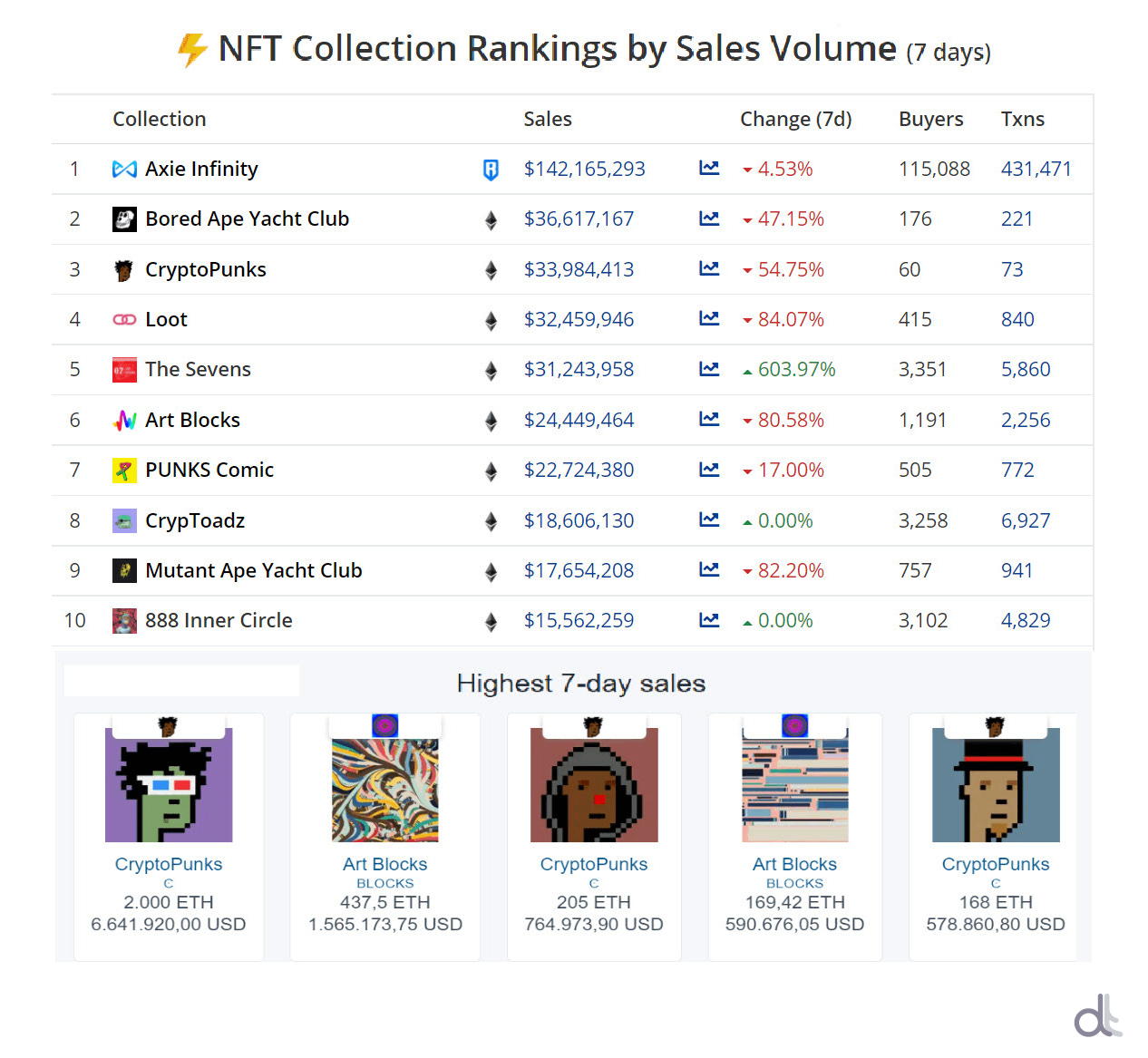

After a record-breaking month of August, which also dragged trading into the first week of September, trading volumes have slowed over the last seven days. Among the top 10 projects by volume, only the late The Sevens registers a growth. A result that benefits from the recent launch of the new project characterized by images of faces with masks, that with the promotion and word of mouth activity on Twitter has transformed in over $31 million the turnover on the leading platform of OpenSea.

Axie Infinity is back on top with $142 million from over 431k transactions, followed by Bored Ape Yacht Club with $36 million and CryptoPunks with $33 million. After last week's record-breaking performance that undermined Axie Infinity after more than two months of dominance, Loot's project slips to fourth place with $32 million, suffering a weekly volume drop of more than 80%.

Among the main projects, there are those defined as 'generative art,' which is becoming increasingly popular in the evolution of Non-Fungible-Token. That is a form of art that, taking its cue from an original image created by the artist, generates other random images arranged by an algorithm chosen by the artist himself. The most popular project, Art Blocks, which in the last seven days exchanged $24 million and with the work Fidenza #135 is the fourth-highest auction of the week. The generative art series launched last June by artist Tyler Hobbs has seen the prices of the works traded on OpenSea's marketplace fly from 0.17 ETH, the minting price, to a maximum of 1,000 ETH for the work Fidenza #313 awarded on August 23.

The podium for the highest auction of the last week is taken by CryptoPunks #8857, a rare image of Zombie with 3D glasses, awarded for 2,000 ETH, equal to a counter value of 6,641,920 USD. That is the third-highest auction ever. The picture had been granted on May 2, 2018, for 2.5 ETH, at the time equal to 1,663.06 USD!

Despite the new collapse of over 55% of the traded volume in the last week, Paris Saint-Germain's Fan Tokens, with over $1.5 billion, remains the most traded sports football club. It is followed by English club Manchester City with $793 million. Thanks to the entry of AS Roma with over $318 million, for the first time, two sports clubs - along with Juventus - have entered the top five for weekly volumes traded.

5 hottest DeFi news of the week

The evolution of online games is about to disrupt the gamer economy

Zabu token price flatlines after $3.2M attack on Avalanche blockchain

Arbitrum’s TVL surges to $1.5B as DeFi degens ape into ArbiNYAN

MicroStrategy Buys 5,050 More Bitcoins:

Coinbase plans to raise $1.5B via debt offering

Technical Analysis

Bitcoin (BTC)

The second week of September ends with a decline of 11%, the worst since last May, highlighting substantial profit-taking triggered by overcoming the psychological resistance of 50,000 USD (1). The lack of support from buying volumes did not attract new purchases, making the hooking of the next resistance level at 56,000 USD (2), which coincides with one of the Fibonacci areas, fail. The ascent of the price above 50,000 USD (1) lasted less than 48 hours, marking the break's failure. The confirmation of the breaking of a level is an important technical signal that, in the case of failure, indicates a lack of strength and consequently increases trend reversals. The descent of the price to the 43,000 USD area (3) confirms this hypothesis.

BTC levels to monitor for the week:

° Upside: If correct the setting of the monthly cycle, in line with the regularity of the previous ones, this week we should witness the end of the cycle that began on July 19 (4) with the price at current levels in the 43,000 USD area (3). For this reason, it will be important to wait for the conclusion of the cycle and the beginning of the new monthly cycle. Operationally it is necessary to wait for the return of the price above 47,500 USD (5) in order to start evaluating short-term upward operations, while in the medium term, it is required to exceed 49,000-50,000 USD.

° Downward: The medium-term support of 43,000 USD (3) will have to reject any bearish attack in order to keep intact the good bullish structure of the current quarterly cycle that began with the minimum of July (4). Otherwise, do not go below 41,000 USD in order not to compromise the medium-long term bullish structure.

BTC Options

The strategies of professional operators in derivatives confirm the technical levels indicated above. On the upside, hedges are increasing with important defenses spread between 49,500 and 54,000 USD. On the downside, hedges are all concentrated in defense of the support of 43,000 USD. Any slip below this level would increase volatility.

Ethereum (ETH)

The caution advised in the previous newsletter proved to be correct. A few hours after posting, the price started to reverse the bullish trend, ending the day with a decline of -12.6%, marking the worst daily loss since last June. A decline that drags in the red with a loss of -13% on a weekly basis, as for Bitcoin the worst since last May. Following the decline, in the coming days and still, now, the price continues to oscillate within two important Fibonacci support areas between 3,300 (1) and 3,050 USD (2). These are the levels to be defended in the coming days to avoid further downward extension.

The conclusion of the current quarterly cycle, which began with the double minimum in the 1,600 USD area between the end of June and mid-July, is expected between the end of September and the beginning of October. With the decline of the last week, it is necessary to follow the setting of the weekly sub-cycles before starting to set new operations on the upside.

ETH levels to monitor for the week:

° Upside: To return to evaluate upside operativeness even in the short term, it is necessary to wait for the recovery of 3,450-3-500 USD (4). Anticipating an entry before this area does not find the support of any signal of any technical indicator, except the short-term oversold.

° Downward: Decisive is holding the psychological support of 3,000 USD (2) and the technical support of 2,800 USD (3). Otherwise, a slide below this area could attract downward speculation that would benefit from ample room for maneuver.

ETH Options

Since last week, positions to protect against possible declines have been growing at the above technical supports. Defenses spread between 2,900 and 3,100 USD, while on the upside, the main positions are located in the 3,450-3,600 USD area. The ratio between Put and Call becomes 1:1, confirming the increase of Put opened in the last week.

DISCLAIMER

The analysis presented exclusively reflects the author's point of view and does not represent operational advice or a trading signal and should not be seen in any way as a service of financial advice or solicitation of public savings and should not be taken in any way as a service on which to base investment decisions.