Summer 2021 indelible between NFT and Bitcoin legal tender

Bitcoin & Co: an important page of history is written today in El Salvador

Being open source means anyone can independently review the code. If it was closed source, nobody could verify the security. I think it’s essential for a program of this nature to be open source .

Satoshi Nakamoto

With September, we are approaching the end of summer, a period that once again proves to be decisive for the fate of the last quarter of the year. Many forecasts predicted a summer of waiting and possible negative consequences caused by the repercussions of the measures of the Chinese government on the restriction of the cryptocurrency trade and mining. Instead, the season has seen significant growth in the quotations of the main assets and the interest of investors, operators, and sectors directly related to the ecosystem.

I am referring to the new boom in the Non-Fungible-Token (NFT) sector and the affirmation of Decentralized Finance. Reflecting the trends of any past technological evolution, the ups and downs allow us to understand the expectations and considerations of the operators who directly and indirectly participate in the growth and evolutionary process of a new sector, in this case, that of the cryptocurrency world.

Two thermometers allow us to have direct feedback on this technological progress. The first one is the one that measures investors' moods, always very exposed to volatility; the name "Fear & Greed" expresses very well what it tracks. The oscillation recorded between the end of July and August shows the fastest bullish excursion in recent years. This data highlights very clearly how, in a few days, operators' sentiment has reversed, going from a level among the lowest of the last year to one close to the highs of last April and well above the historical average.

The second is the data coming from Ethereum's network upgrade process with the start of the EIP1559 upgrade on August 5. Despite the perplexity of many insiders, one of the most important updates that accompany the expected transition in the coming months to Ethereum 2.0, or rather from PoW to PoS, in less than a month has burned over 150,000 ETH, or 2.2 million annualized ETH corresponding to $8.8 billion per year. It was expected that the lion's share would be made by DEX (decentralized exchanges) and DeFi's various protocols, while instead, the biggest burn was made by the OpenSea marketplace, which alone accounted for 16% of all ETH burned so far.

This issue of DeFiToday pays tribute to a historic event that marks an important date destined to enter the cryptocurrency history books. Today, September 7, 2021, officially, in El Salvador, Bitcoin is recognized as a legal tender means of payment. Over the past few years, much has been written about the actual use as a means of payment and official recognition by institutions or states. Today is a turning point that sees President Nayim Bukele taking responsibility for a decision that, while bold, is undoubtedly forward-looking.

Immediately after the announcement in early June, which took place during the two-day Bitcoin2021 conference in Miami, USA, many national governments of countries in similar conditions to El Salvador, with the US dollar recognized as the national means of payment, are considering similar actions. In recent days, an article in the WallStreetJournal has again commented negatively on President Bukele's choice, warning of the risks to the country's entire economy caused by the volatility of the Bitcoin price. Once again, the negative aspects are highlighted, leaving out, instead, those that have been highlighting for a decade now the steady growth of Bitcoin's quotations, despite strong price hikes. In a period where the aggressive action of Central Banks is devaluing their currency, the choice to adopt Bitcoin as a currency will allow Salvadorans to rediscover purchasing power for imports. The opportunity will also be to revalue the country's economy in exports. Using a different system than the one that suffered for decades will also allow people to discover the possibility of investing in advanced financial products.

Just a few months ago, the mere thought that all this could happen seemed like a crazy dream. Instead, as it often happens and I have highlighted many times, technology advances rapidly, with often unpredictable consequences.

In the past, the ingenuity of the individual could be slowed down by the slow and often tricky communication between people. Today these obstacles have disappeared. For these reasons, to not remain excluded, it is necessary not only to see, but to live the changes, canceling the space-time relationship that we knew, and above all, the prejudices. Many people still keep them alive, not realizing that technology is advancing, bringing everything else with it, even without them.

Decentralized Finance

The week just ended was characterized by a piece of news published on Friday, September 3, in the WSJ where the indiscretion was announced: the US regulators of the SEC have started investigations on some decentralized finance platforms, in particular against Uniswap Labs.

Even if the news has not been officially confirmed, the attitude of some team members of the projects involved suggests that it is well-founded. In fact, there are reactions of surprise among the users who, more and more, use DEX for buying and selling tokens. The news, however, should not surprise us.

In DeFiToday's editorial of September 8, our analyst Federico Izzi wrote:

"The first SEC Chairman Gary Gensler during the Aspen Security Forum's national security event. His call urged lawmakers to regulate the crypto world by calling it a wild west. In particular, his appeal called for speeding up the framing of "decentralized platforms, which undermine the operation of banks and cryptocurrency exchanges."

The following commentary pointed out that his words would not fall on deaf ears; thanks to his past, he is considered among the most prestigious figures and roles in the rooms of political and financial power. Not even a month later, the hunch has been confirmed! The regulator's action will not be easy, as the various decentralized financial protocols allow interoperability between the multiple projects without a real and unique "control room."

Moreover, the action of repression against one - in this case, it seems that Uniswap Labs is the one most directly involved - would move the mass of volumes on other DEX protocols, for example, Sushiswap and others present in the table of the list below. Certainly, this may lead to tensions and fears among the various users and consequently to repercussions that may be negatively reflected in the short term.

At the moment, the reaction from users does not seem to have affected the use of DeFi projects. In the last few hours, the Total Value Locked (TVL) exceeds $ 100 billion. A historical goal: for the first time, the wall of eight zeros has been knocked down. That is due to the prices of the two main assets used (BTC and ETH) and the choice of keeping the assets locked on the various DeFi protocols without being influenced by price fluctuations, as was the case until a few months ago.

Paradoxically between Ethereum and Bitcoin is the choice to transform the latter into an ERC20 token. In fact, the number of Bitcoins wrapped in these last hours exceeds 200k BTC, wrapped on different projects that allow making more agile and usable the use between the various financing and lending programs.

For the first time, five projects exceed $10 billion in the overall ranking. Aave's multichain financing protocol maintains an unchallenged podium with over $18 billion, a new all-time high.

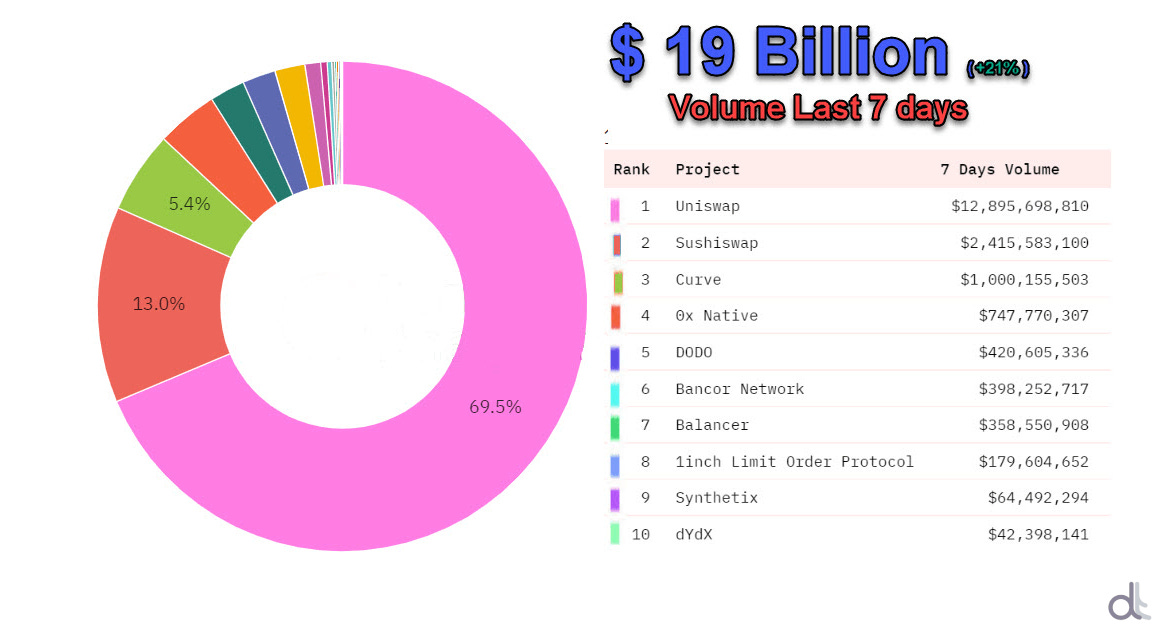

With a 20% growth on a weekly basis, trading volumes on DEX (Decentralized Exchange) return above $19 billion weekly. This increase allows for over $94 billion traded in August, the second-highest record ever, behind only last May.

Despite the above news, Uniswap's DEX, with over $12 billion traded in the last seven days, remains the most used project covering 69.5% of the total volumes and over 108 thousand traders using the protocol.

They are followed at a distance by Sushiswap with $2.4 billion, equal to 13% of the total volume, and

Curve with $1 billion, equal to 5%.

The 1inch aggregator, a protocol that allows finding the best exchange rate between the various DEX, reaches $ 2 billion of weekly volumes traded for the first time.

Ecovo - Plastic Neutral

This week our attention shifted to a sustainable project called Ecovo, which aims to improve the future of man and the planet.

Ecovo's project has as its objective the transformation and elimination of plastic and the cleaning of water to reduce environmental pollution, a topic of great importance.

Ecovo Community is an aggregation of people who believe in a better future and have a concrete vision of what can be done to improve it. Plastic pollution is a big problem that affects the whole world indiscriminately, and Ecovo is definitely a great incentive to try to solve it.

You can join the telegram community through the following link.

The project aims to take care of the planet and allow the disposal of the largest amount of plastic to all its users until reaching the Plastic neutral level, as described in the following introductory video:

Through a new platform created directly on the website https://ecovo.com/, users will be able to buy plastic and dispose of it through facilities worldwide.

To improve the quality of life and people, Ecovo has decided to rely on the creation of a token developed on the Ethereum blockchain, called CSR.

The CSR token represents the sign of the concreteness of the project that aims to expand globally. Ecovo's next goal is to expand the number of global establishments worldwide and obtain important partnerships among the largest environmental organizations, non-profit organizations, and humanitarian associations.

But that's not all; the project has also set itself the task of improving the Foundation by increasing the number of activities where the token can be spent and rely on institutional collaborations.

Therefore, this topic could be transformed into a concrete and sustainable reality to improve the quality of life of man and the planet in the immediate future.

For this reason, Ecovo aims to involve the largest number of users within the platform and build a global community present worldwide.

If each of us would actively participate in the disposal of plastic, we could achieve a cleaner world and excellent results on the quality of life of the people who live in it.

Meanwhile, Ecovo continues to grow and offer innovative services and incentives to people who reach the platform, proving to be an increasingly relevant and exciting reality.

*Please Read our Disclaimer

Non Fungible Token

The turnover of the NFT sector continues to grow, and in August, it recorded a new record with over $4 billion in one month. These numbers make pale the previous period of glory of last spring when the Non-Fungible-Token phenomenon exploded.

The last euphoria concerned, in particular, the world of art and artistic works. Today, instead, thanks to the versatile nature of NFTs, the new explosion of interest and volumes embraces the world of Collectibles and Gaming. Numerous projects and events characterize this second phase, so it becomes difficult to summarize many of the most interesting projects in a few lines.

This week we must highlight the great interest in the new project Loot, launched by the co-creator of Vine, video sharing platform in 2012 acquired by Twitter and then later abandoned.

That is an evolution of the previous project Blitmap launched last March, which recreates a fantasy universe. Together with 16 other artists, Hofmann created 100 images measuring 32x32 pixels that remixed together to create 1,600 images representing as many characters building stories in the fictional universe.

The change of hands of these images has caused prices to rise in a short time, so much so that the least expensive one has come to be worth about $100k in the last few hours, reaching a total capitalization of $180 million. In addition to this, there are 7,777 images of bags that Hofmann has freely offered for mint, which were sold out in minutes and immediately resold at higher prices.

Thanks to this new idea, the user is allowed to create the design of each bag, an idea that will allow inspiring other similar projects. Loot's project has trafficked $207 million in less than seven days, knocking Axie Infinity off its throne after weeks of absolute domination. With over $67 million weekly, Bored Ape's Yacht Club project moves into the sixth position, celebrating official promotion and entering the Olympus of mainstream collecting. On Thursday, September 9 at 10:00 a.m. EDT, two BAYC-branded NFTs will go up for auction in the Sotheby collection. Estimates for both lots exceed $18 billion.

From the idea of well-known artist PAK, the LostPoets project was launched. It consists of 65,536 NFT pages generated from 1,024 original NFTs. All pages were sold within the first 48 hours of the launch phase. Each page allows you to claim a Poet NFT offering the opportunity to create a card with a unique and original story.

Among the top 5 highest auctions of the last week, in the first place, the rare CryptoPunks Zombie #6275, which in only 6 hours changed hands twice with an appreciation of 30%. The sale for 1,000 ETH (3.9 billion USD) on September 4 after six hours and 26 minutes recorded a new sale for 1,319 ETH, equal to 5.1 billion USD. The particular story that in a few hours has 'yielded' a gain of $1.2 billion was carried out by the same trader and influencer Pransky known to the chronicles for having purchased last week a fake Bansky NFT and then managed to recover the entire amount through the action of tracing the hacker who had perpetrated the scam.

Fan Tokens volumes remain stable, with Paris Saint-Germain continuing to retreat from the mid-August tops, losing another 60% from last week's peaks. Despite the drop, PSG's volumes register over $200 million traded in the last week, doubling those of Spanish club Atletico Madrid, which exceeds $100 million, and Juventus team with $70 million.

5 hottest DeFi news of the week

El Salvador’s historic milestone. Bitcoin legal tender of the country

Ruler and Cover DeFi protocol closes down amid mass developer exit

Lobby Lobsters NFT drop raises $4M in one hour to support DeFi lobbying efforts

Coinbase wants to integrate Polygon (and is giving away Bitcoin)

MetaMask surpasses 10M monthly active users as DeFi continues to surge

Star Atlas: Metaverse as the Future of Web

Co-founded by early cryptocurrency adopter, CFA charterholder and portfolio manager Michael Wagner, Star Atlas presents itself as a Space-Themed Massively Multiplayer Game with space exploration, territory control, and geopolitical dominance.

"We are building this out as a triple-A quality game. - Michael Wagner -"

The game will use Unreal 5 as the core engine, providing cinematic quality gaming and the Serum DEX protocol for its fast and low tx cost. Pointing to reach billions of users, the team opted for Solana as the protocol to build out its blockchain-driven metaverse. That is because of its 50.000 tx/s, providing low latency for the gamers avoiding exposure to lags. The tx cost is also very minimal, with fees around a fraction of a penny.

“Star Atlas will provide the most powerful opportunity in human history for players to realize economic benefits through the extraction of in-game virtual earnings into real-world income. This integration optimizes Star Atlas' long-term goals by plugging into Solana's thriving community, ecosystem, and best-in-class technology. The overall vision for Star Atlas is not possible on any other blockchain.” - Michael Wagner -

The game will start as a web-based experience, moving to the 3D world around the end of 2021 and the beginning of 2022. The initial release will have iterative features release and upgrades so the user can start playing and earning ATLAS and POLIS tokens instead of waiting for the 3D world to be live.

The tokens mentioned have two purposes:

ATLAS: used as the in-game unit of account and given as a reward.

POLIS: Star Atlas DAO governance token.

The team already completed the NFT marketplace, released the cinematic teaser giving you a taste of how the game will be in the future and started the ATLAS token generation events on FTX, ApolloX, and Raydium.

The registration process will start in the coming days, including faction selection, the release of leaderboards for factions, clans, and individual players, with a unique take on the in-game security of user handles via the Solana Naming Service. Throughout the Q4 of 2021, the game will see the implementation of features such as land ownership, mining claims, orbital stations, and, of course, the map of the entire metaverse.

As pointed out by Wagner, this metaverse will provide a vast amount of opportunities, forming new bonds and friendships or even becoming an entrepreneur in it, where, i.e., you can fill the gaps supporting other players by having the refuel station that others use during their missions, etc.

“The metaverse will lead to the greatest job economy and job market that the world has ever seen.” - Michael Wagner -

By CryptoDim

*ATTENTION: Please Read our Disclaimer

Technical Analysis

Bitcoin (BTC)

After several attempts, the price manages to overcome the psychological threshold of 50,000 USD (1). The upward breakup is not too easy; in fact, it took three days to have the first timid confirmations with the price that in these hours revisits the threshold of 53,000 USD (2) preparing the way to hook the 56,000 USD (3), the threshold where 75% of the Fibonacci retracement calculated from the absolute references of the highs of April 14 (4) and the recent lows of July 20 (5) passes.

The upward movement at the moment is not supported by valid buying volumes that would confirm the solidity of the climb. It seems more that the whole thing has been supported by professional traders that started to open bullish structures since last week. In fact in last week's issue of DeFiToday was written: " ...in the previous few hours there has been an increase in Put options, and this means that the possibility of new rises is beginning to be evaluated".

From an operational point of view, this is a useful signal to evaluate the cyclical structure. With overcoming the previous highs, the new monthly cycle started with the double minimum of August 26 / September 1 (6) is outlined. If time confirms the regularity of the rhythm of the direct sub-cycle, the next 24/48 hours (by September 9) will be essential to identify the minimum reference to start evaluating the strength of the following weekly cycle.

BTC levels to be monitored for the week:

° On the Upside: Being close to the closing of the first weekly cycle that began on September 1, assumed by Thursday, September 9, it is necessary to monitor the holding of the former technical and psychological resistance of 50,000 USD (1). If the price continues to fluctuate above this level, there will be a signal of strength that would open spaces for further rises and new period highs, projecting the launch towards the Fibonacci resistance of 56,000 USD (3) in the coming days/weeks.

° On the Downside: at the moment, there are no bearish signals. The first danger comes with a return below 50,000 USD, a level that also coincides with the bullish trendline that joins the rising lows since mid-July. An eventual extension below 50,000 USD (1) has ample room for maneuver up to the area 43,000-41,000 USD (6).

BTC Options

The bullish structures that began to be set up last week are further confirmed by the analysis of options and the Open Interest values for both futures and options derivatives, which have returned to the levels of May. The increase in multiday positions shows how professional traders are returning to evaluate operations that are no longer short-term. An indication that usually accompanies the uptrend. In order to have the right confirmations, it will be necessary that the upward trend of the Open Interest is also confirmed for the course of the week.

The analysis of the options shows a fall of the Call options indicating the closure of many hedges placed in the last weeks to defend the rise. The ratio between Put and Call options rises to 4:1. The operators prefer to cover themselves from a possible reversal supporting the range 46,000-42,000 USD. While on the upside, the threshold of 53,550 USD remains the only barrier to protect, indicating that a rise beyond this area would not find resistance to accompany rises towards the resistances noted above.

Ethereum (ETH)

With the rise of the last week, Ethereum reinforces the bullish structure by putting in a performance of 130% since the July lows. Since the beginning of the year, the price of Ethereum gains 430%, five times greater than that of Bitcoin, highlighting a year that is currently proving to be the second-best in history for the queen of Altcoins.

Although only for a few hours, over the weekend, the price managed to surpass the threshold of 4,000 USD (1), a level abandoned in mid-May, bringing it one step closer to the absolute historical records reached on May 12 at 4,373 USD (2). The lack of support from buying volumes has repelled the price that returns to test the 3,700 USD (3) in these hours.

The fast ascent that in 4 days (from August 30 to September 3) pushed prices from 3,200 (4) to just over 4,000 USD (1) did not leave reference supports, thus implying wide spaces of oscillation in the short term. For this reason, it will be necessary to arm ourselves with patience and wait for the price trend over the next few days to identify a support area that will be created with the closure of the 15-day cycle hypothesized for next weekend.

ETH levels to be monitored for the week:

° On the Upside: the bullish momentum that in 8 days marks a performance of 25% needs a healthy break to allow the price to find valid support where to consolidate and then restart. Only an overcoming of the 4,050 USD (2)

accompanied by rising volumes could change this scenario.

° On the Downside: the danger of a rapid ascent as occurred in recent days is not leaving valid operational reference supports. For this reason, it is necessary to wait for the next few days to identify an area where to consolidate and evaluate the following upward movement. It is essential to monitor the 3,350-3,400 USD area, previous highs of August, which has now become the medium-term support, between 10 and 15% away from current levels.

ETH Options

The fast rise of the last days is making the openings of the hedges above 4,000 USD prevail. The Put to Call ratio is 1:4. Both data showed that most traders believe that the rise has found a high where to start taking profits. Only an extension of the price above 4,130 USD will change the defensive structures. On the downside, 3,300 USD area (a level that coincides with the technical analysis) is the first support strike used to defend any downward turn.

DISCLAIMER

The analysis presented exclusively reflects the author's point of view and does not represent operational advice or a trading signal and should not be seen in any way as a service of financial advice or solicitation of public savings and should not be taken in any way as a service on which to base investment decisions.