October as redemption month after latest cryptocurrency turmoil

More and more opportunities for new financial instruments

The nature of Bitcoin is such that once was released, the core design was set in stone for the rest of its lifetime.

Satoshi Nakamoto

In less than a week, the cryptocurrency sector puts a turbulent month behind it. A ride led by Bitcoin recovers the losses accumulated in September by doubling the recovery of these early days of October, posting a rise that exceeds 14%. Even Ethereum does not disfigure, replicating the gain with the same performance.

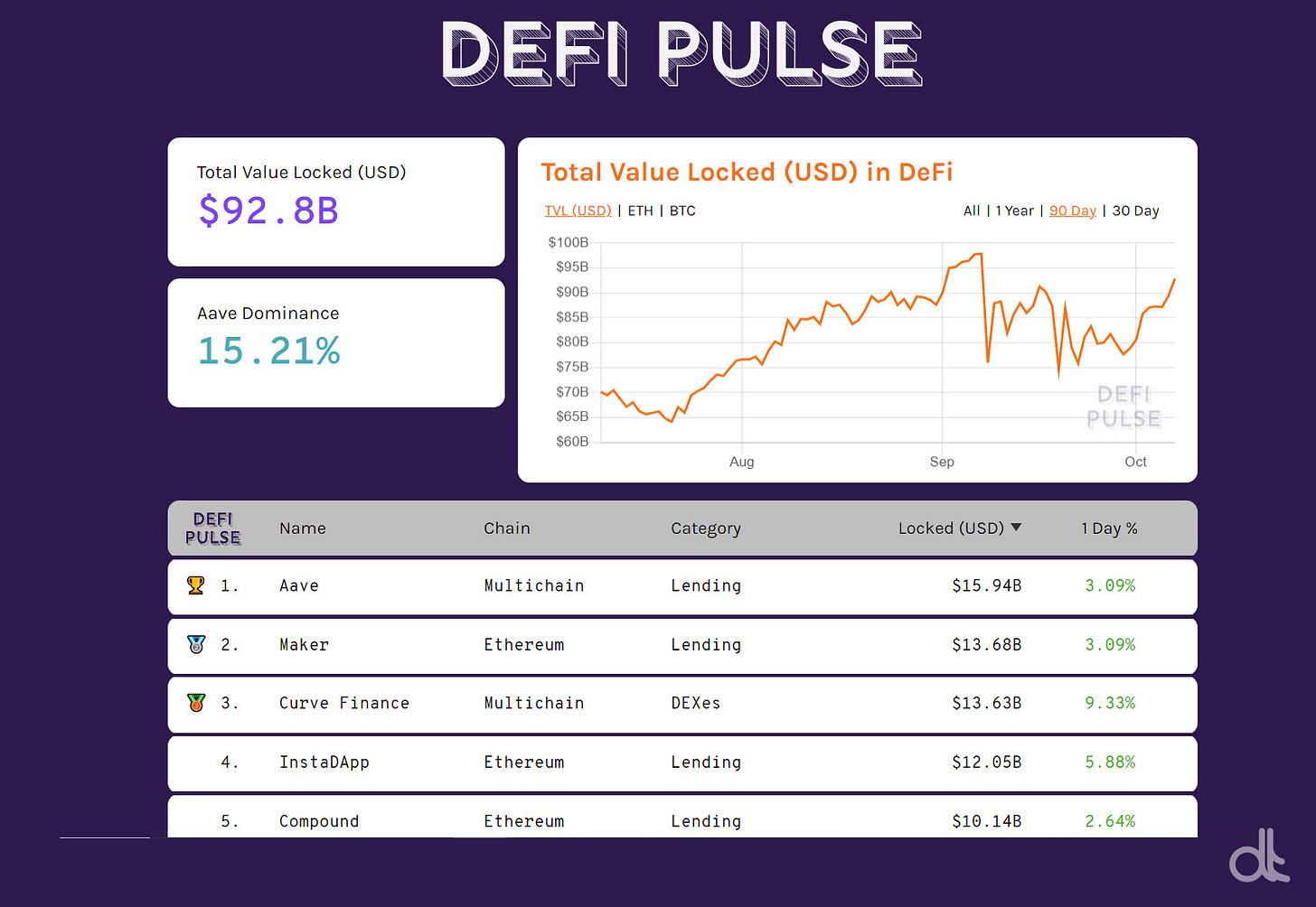

However, what attracts the attention of investors and many analysts concerns what is happening in the decentralized finance sector, which in the last week has renewed the interest of users for DeFi protocols, with the first 30 tokens making gains mostly in double digits, except for the Compound token that pays another exploit for a bug verified a few days later.

Many indicate that this new vigor to the DeFi ecosystem has been buoyed by the need of many Chinese investors to find escape routes to yet another Chinese government ban, which has forced some exchanges, such as Binance and Huobi, and mining pool services such as StarkPool, to limit or ban many operations.

In the last few days, the hashrate - the value that indicates the computing power of the network - of Bitcoin had returned to the levels of early June, to the days when the Chinese government had announced to ban Bitcoin mining in the entire nation.

These days, what is happening highlights how banning cryptocurrency use can become a boomerang for governments or institutions implementing such restrictive actions. Despite the announcements of the past years, when many politicians hinted at a ban on cryptocurrency activities, today, the policy in the management of the phenomenon seems to have undergone a change of course. In this case, the action of the Chinese government may give the rest of the world pause for thought, first and foremost the policy and decisions of the competent US bodies.

During the President of the Federal Reserve testimony, Jeromie Powell, before the Committee on Financial Services of the House on matters related to the economy, a Republican representative was called into question through a question posed by Ted Budd. The provocation consisted of whether the United States would follow the example of the recent Chinese bans, as Powell urged the federal government to regulate the cryptocurrency market, but not talking about a ban.

Statements that increasingly open up the possibility of approval to new financial instruments.

Decentralized Finance

For decentralized finance, September closes with the third highest trading volume ever, with 92.2 billion USD. The figure elaborated by Dune Analitycs does not consider the trading volume processed on the dYdX protocol, which in recent weeks has seen over 6.5 billion USD processed even in a single day, surpassing the trading volumes of emblazoned centralized exchanges (CEX) such as Coinbase.

The latest squeeze issued by the People's Bank of China has severely impacted CEXs, both in terms of volumes and token value, leading to the liquidation of many positions worth hundreds of millions of dollars on major exchanges such as Huobi and oKEx, benefiting decentralized finance protocols instead.

For the first time, the decentralized protocol 1inch - an aggregator of major exchanges to find the best exchange price between various listed tokens - surpasses 46k weekly traders using the exchange, doubling the total number of weekly traders on the Sushiswap protocol (23k traders). In addition to Uniswap, which has more than 150k unique weekly traders and remains the sector leader, dYdX has been advancing with more than 110k traders in the last week.

After one month, the Total Value Locked (TVL) returns above 90 billion USD, although the number of ETH locked (7.6 million) remains in line with last week's levels. At the same time, that of tokenized BTC (203 thousand) goes slightly down by about 4k BTC compared to the absolute tops of the end of September. Aave's protocol surpasses $15 billion in counter value immobilized by users, followed by Curve, which for the first time takes the second position for TVL with over $ 13.4 billion, the highest level ever for the decentralized liquidity pool.

Non Fungible Token

The volume of Fan Tokens continues to grow, generating a turnover of over 676 million USD in the last week, highlighting the growing interest of users in sports tokens developed on the Chiliz blockchain. A trend that began last year with the advent of the NBA Top Shot project and now sees soccer teams involved.

In the last seven days, the OG Esports token with 134K USD surpasses the volume traded on the tokens of the Juventus ($129k) and Paris Saint-Germain ($123k) soccer clubs, thus making itself the protagonist of a 153% increase on a weekly basis.

Among the Non-Fungible-Token projects, AXIE Infinity continues to hold its own, with $127.7 million in the last week and over 487k transactions.

The largest and best-known game developed on the Ronin Blockchain has reached a valuation of $30 billion, raising this week a $152 million funding led by VC a16z controlled by the company Andreessen Horowitz, leader of investments in new technologies.

The success of the project created by Sky Mavis has been reflected in the price of the $AXS token, which, with a gain of 70%, has the second-best increase of the week, among the top 100 tokens with the highest capitalization.

In the last hours, the price of the $AXS token fluctuated just above 125 USD after reaching 155 USD for the first time since its launch.

In second place is CryptoPunks by trading volume with $70 million, up 37% weekly. CrypToadz's project takes third place with a volume of $54 million, overtaking ArtBlocks by $3.5 million.

CrypToadz's new little amphibian game in a single day, Sunday, October 3, traded over $19 million on OpenSea's platform. The sudden interest in toad avatars dragged OpenSea volumes over $136 million on the same day, reaching the highest level of trading in the past month.

Despite shrinking numbers for generative art images, ArtBlocks' Ringer #109 auction fetched 2,100 ETH, representing a counter value of $6.9 million, the highest of the week. In third place, the cover of Time magazine for the May 10/17, 2021 issue, created by Beeple, sold in the last hours for 715.5 ETH, equivalent to a counter value of $2.5 million. The cover, made last May, had been purchased for 130 ETH, equal to $325K at the time. In less than five months, the work has appreciated in value by 700%.

5 hottest DeFi news of the week

Anyone Seen Tether’s Billions?

Soros has also invested in Bitcoin

Cosmos sees 1 million transfers in a month across the ecosystem

Compounding problems: $65M more COMP at risk as devs wait for time-locked bug fix

Massive airdrop and AXS staking catapult Axie Infinity to a new all-time high

Continuum World - Play-to-Earn

This week our focus shifts to a new project called Continuum World.

Continuum World is an MMO, a massively multiplayer video game where players can choose a unique character to collect resources, build unique buildings, socialize, interact with objects, and collect UM tokens.

Continuum World's vision is to create a virtual world where all players become partners in the game and can be paid for every action performed, thus focusing on the concept of a play-to-earn game.

The leading Continuum team, composed of game and blockchain experts and designers, foresees three years of development for the game, focusing mainly on creating a unique world through unique NFTs and the development of a Social Economy.

The Continuum world, in fact, offers unique features for its players, especially for farming; the project focuses on the development of a large community attracted by the opportunity to be able to collect more and more UM tokens.

We expect a vast audience, the game will be available on PC and mobile, and players of all ages can participate.

The UM Token offers the opportunity for all its users to earn money by playing. Still, the UM token is also a Project Governance token and grants players the ability to make decisions or vote through the blockchain.

The Continuum team is committed to supporting a fully decentralized protocol with the UM token as the primary token in this economy, ecosystem, and video game.

The UM token is a classic ERC20 token based on the Ethereum blockchain, but unique NFTs of ERC721 and ERC1155 are present in the video game. The game protocol uses Polygon Network to achieve lower transaction costs in the video game.

So let's watch out for possible exponential growth of the newly launched UM token in Q4 2021, while the game's beta will be released in Q1 2022.

The game looks like a lot of fun, offering possibilities for collaboration between players in the community and earning money while playing. I expect that it could attract many users from all over the cryptocurrency community, so watch out for Continuum World and its development.

*Please Read our Disclaimer

Technical Analysis

Bitcoin (BTC)

After traveling in uncertainty for the entire summer, with prices remaining below 50k USD, and rejecting the timid breakout attempt in early September (1), the breakout in the last few hours triggered the re-covering of downside positions. They accompanied the rally on Wednesday, October 6, closing the day with +7.3%, the second-best since early October.

In just 7 days, the rise canceled the weakness accumulated in September and, with a +28%, managed to revisit the levels at the beginning of May.

In a few days, the trend is reversed and goes back to being bullish, with prices recovering 75% of the decline accumulated during the descent from the top of April (2) to the minimum of mid-July (3).

Levels to be monitored next week:

° Upside: the holding of the former support of 52k USD, also in the coming days, will confirm the consolidation of the new monthly cycle for the second consecutive month set to the upside. A push above 55k USD will push the quotations above 57k USD, opening high possibilities to revisit 60k, the top of May, (4) in the following days.

° Downside: The bullish structure at the moment reduces the chances of a dangerous reversal that will happen only with a return of prices below 42k USD (5), the September lows, and the level of the beginning of the current monthly cycle.

BTC Options

The breaking of the 50k USD triggered the covering of the bullish protections. I remember that this level was considered an important area to defend in order to maintain short positions. The confirmed break of this level supported the purchases, making the quotations rise by 4k USD in a few hours. We need to wait for the next few days to understand the levels at which professional derivatives traders will return to evaluate hedges.

Ethereum (ETH)

The divergence of the cyclical structure that last weeks opposed Bitcoin's quarterly cycle, with the upward movement of the previous few days, confirms that the benchmark 2-month cycle present on Ethereum is the one that has driven the upward turn of the entire sector, including Bitcoin. Despite this signal, Ethereum's 22% rise since the beginning of the month, while respectable, proves to be less intense than what is driving Bitcoin.

The crossing of USD 3,200 (1) quickly accompanied prices over USD 3,600 (2), the highs of mid-September, just a step away from 75% of the Fibonacci retracement that takes as reference the highs (3) and lows (4) of September. Also, for Ethereum, the period of weakness accumulated throughout the second part of September has been canceled in a few days.

Levels to be monitored next week:

° Upside: the exceeding of 3,630 USD, the highs of Wednesday, October 6. In all likelihood, they will project quotations to revisit the 4,000 USD.

° Downside: alarm signals only with a return below 3,000 USD, currently a level more than 15% away from the quotations of the day.

ETH Options

The recent rise has modified the hedging of positions on the upside, moving the protections between 3,600 and 3,750 USD. These will be the levels to be monitored for the next few days in case of a return of bullish strength. A break accompanied by volumes will project prices to test the resistance of 4,000 USD. Downside protection increases, confirming how the sentiment of the operators has changed.

Disclaimer

The analysis presented exclusively reflects the author's point of view and does not represent operational advice or a trading signal and should not be seen in any way as a service of financial advice or solicitation of public savings and should not be taken in any way as a service on which to base investment decisions.