Supports on Fireproof

Trading volumes decreased but derivatives volumes are increasing to new highs. The expiration of Friday 25th marks a new record of the natural end contracts

From 2017 the month of September proved to be a month of weakness, closing with decreases of 7% (2017), 5% (2018) and 14% (2019) for Bitcoin.

This trend, short of twists and turns which should not be excluded in a sector that often reserves surprises, seems to continue for the fourth consecutive year.

For Bitcoin, the balance has been negative since last week, although among the big names, BTC best contains the bearish moves.

The queen of the cryptocurrencies is able to better absorb the fall, stopping the loss under 4% (at the closing prices on Thursday evening).

Ethereum's performance in the last seven days is worse, as it returns under 340 USD, losing 10% from last Friday's levels.

Despite market tensions, activity on the Ethereum blockchain continues to show signs of being in good shape. Last week, thanks in part to the launch of the UNI token on the Uniswap DEX (decentralized exchange), the number of daily transactions rose to over $1.4 million for the first time, with transaction costs jumping over $11 million, the second highest ever.

Both events helped set an all-time record for Ethereum's total hourly fees of over $938,000.

Since the beginning of the month Bitcoin has been selling more than 12%. The altcoins are worse off by more than 21%, driven down by Ethereum, which is down 28%.

BTC vs ALTS

Decentralized financial services know no rest, even during the tensions of the last few days that have triggered many cover-ups due to the lack of liquidity of the loans granted by depositing tokens as collateral.

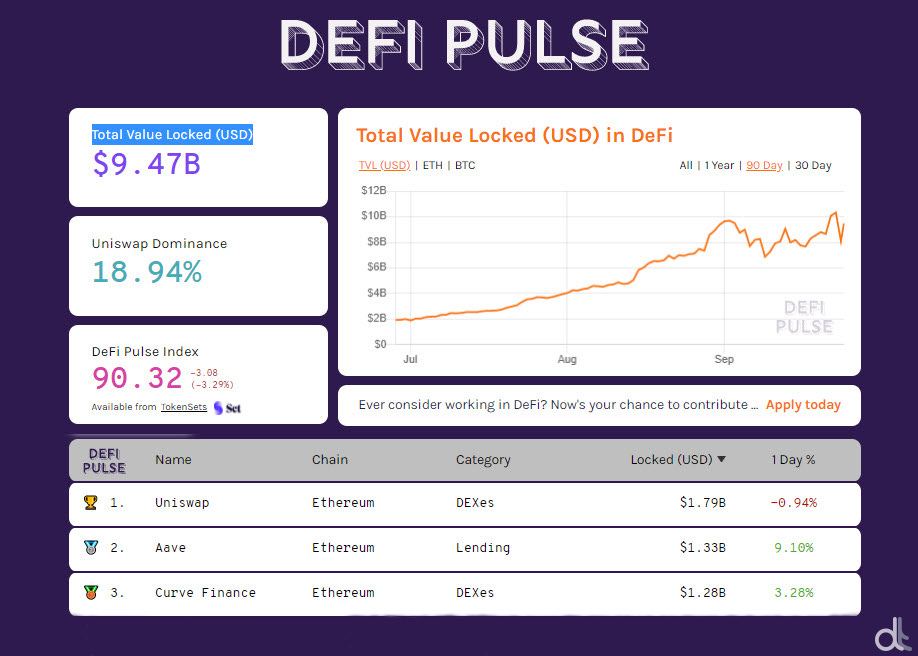

Although dropping around $2 billion in US dollar value, from the highs reached on September 23rd at over $10 billion, the amount of tokens used by investors as collateral continues to grow, according to DeFiPulse - a double-digit record for the first time -. There are just under 8 million ETH and over 119,000 tokenized BTC that investors have chosen to lock in on the various decentralized protocols, even for short periods, obtaining double-digit returns.

The frenzy involving the entire DeFi sector is attracting increasing interest even among the less experienced. However, even those already familiar with the subject are increasingly looking for new projects or tokens that can offer interesting earnings in the short term.

This interest also increases the risk of fraud.

In the last few hours, a scam has taken place on a Telegram channel and involved, via invitation, many of the main influencers in the sector, orchestrating a pump and dump scheme for a token called $FEW.

This type of scam, sometimes with the aim of raising a few tens of thousands of dollars, as in this case, discredits the entire industry still in its infancy. It becomes necessary, therefore, to raise the guard on security in general, on personal responsibility in trusting new projects supported by unknown people or teams.

Total Value Locked in DeFi

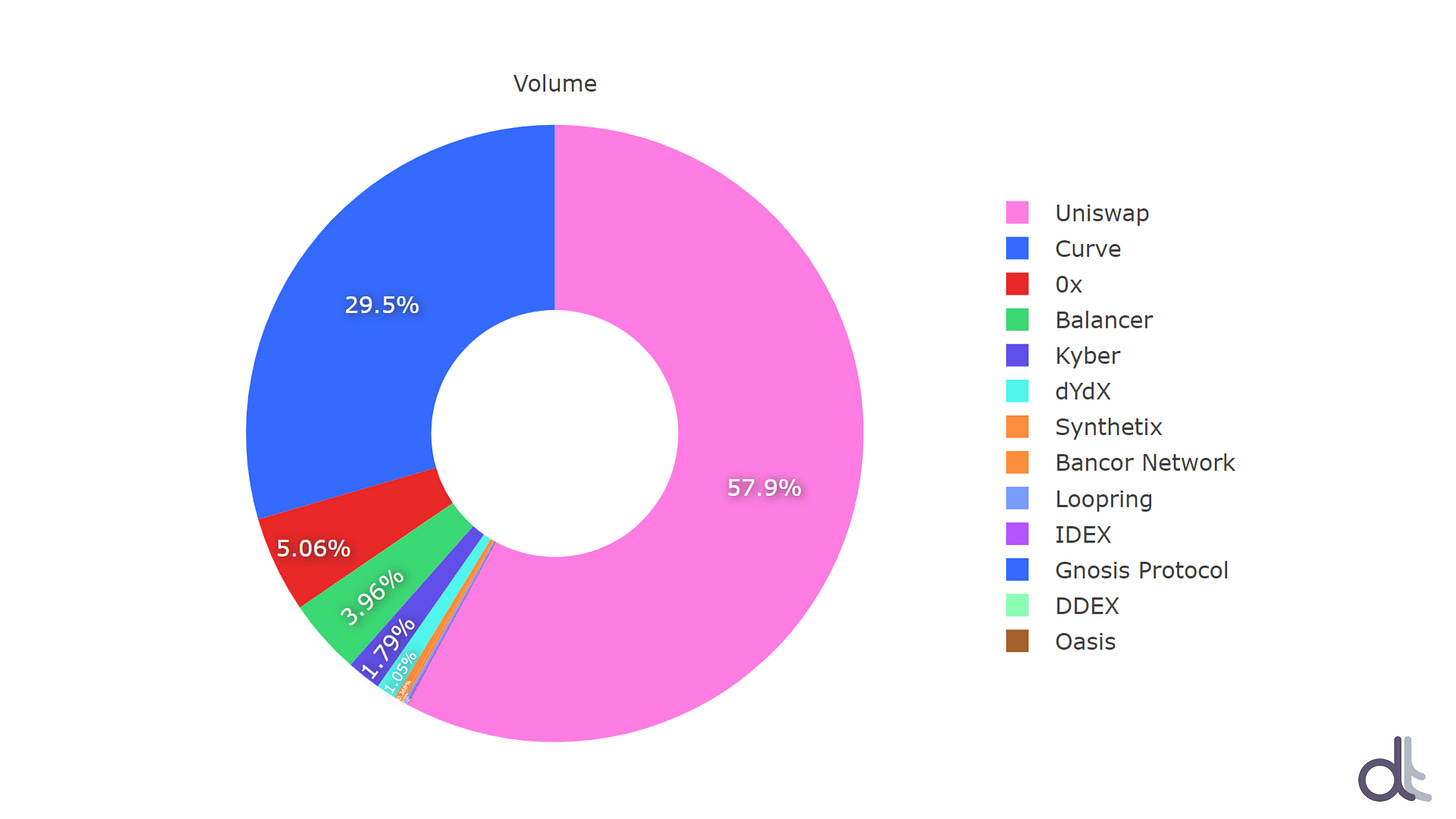

In the last week, the trading volume on DEXs has increased by 3% on a weekly basis, rising to over $20 billion traded since the beginning of the month, breaking the previous record set last August.

DEX Total Volume

The decentralized exchange Uniswap remains the undisputed leader with 62% of total trades, followed by Curve with 26%.

DEXes Volume

5 hottest DeFi News of the week

UNI and the most traded tokens on Uniswap

Crypto Hedge fund looks for $50M to buy DeFi tokens

PureStake raises $1.4 million to launch Ethereum-compatible network on Polkadot

Analysis and Operation

by Federico Izzi

Bitcoin (BTC)

The attempt to break the support in the 10,450-10,500 area is rejected, witnessing a return of prices in the 10,800 USD area in the last few hours.

The price fluctuations of this last week of September do not change the technical picture described in the previous update (insert link substack previous report). The technical and psychological support of the 10,000 USD remains an area to defend in order not to attract bearish speculation that could push prices down to the 9,000 USD area, abandoned at the end of July. Upwardly, it is necessary to overcome the resistance at 11,300 USD, a level around which defences in options are increasing.

Over the past seven days, options operators have slightly increased their coverage of support areas by trying to raise the first level of protection to USD 10,200. The 9,950 USD support is confirmed. At 21:00 UTC on Friday, September 25th, more than 90,000 BTC options contracts, worth over $1 billion, will close at maturity. This is the largest expiration in quantity and value ever since it became possible to trade this type of derivative instrument on Bitcoin. The increasing use of derivative contracts makes it clear that several operators prefer to use financial instruments to hedge risk or to speculate in particular periods of uncertainty or laterality, opening strategies that guarantee an almost certain return in the event of both upward and downward directional movements.

For the second time in a few days, derivative contracts on Bitcoin options reach new historical records. Yesterday, Thursday, September 24th, with an open interest of over $2.2 billion of options remaining open, the highest peak ever was reached.

Open interest on options is an indicator representing the number of derivative contracts remaining open for Call and Put options. Given the difficulty of choice and the guarantees necessary to obtain the possibility to trade on these instruments, these are usually instruments used for the most part by professional operators with high financial resources. This is why a careful analysis of the strategies used helps to identify the operational levels chosen to hedge the risks taken on by buying or selling the underlying asset.

Ethereum (ETH)

Despite the sharp jump in the last few hours that has allowed Ethereum's prices to recover more than 8%, the week is about to end in red, cancelling out much of the rebound developed in the previous two weeks. The failure to exceed USD 395 continues to highlight the lack of purchases needed to allow a real bullish recovery.

In the day of yesterday the prices have again tested the support of the 315 USD, already evidenced a critical level to protect in order not to awaken dangerous volatility and to increase the bearish speculation (cit. prec newsletter). The lows at the beginning of the month, in the 315 USD area, remain crucial. A break-down could cause dangerous volatility to explode).

Despite the 315 USD static support test, prices remain within the channel already highlighted last week. With the passing of the days, the possibility for prices to come into contact with the trendline that accompanies the bullish trend increases through the rising lows since mid-March.

Traders in options continue to remain cautious by keeping hedging upwards between USD 385 and USD 405. The downturns of the last few days also bring down the first levels of protection in the event of an upward trend change, increasing the resistance (former support) to USD 355-360 to be overcome in the event of a reversal. Downwardly, it remains important to continue to defend the 315 USD support even if a new test would weaken the defences already tested twice since the beginning of the month.

The new US guidelines on stablecoins

The Office of the Comptroller of the Currency (OCC) has issued new guidelines on stablecoins in the US. This is an interpretative letter addressed to banks holding deposits used as reserves for stablecoins.

In this letter, stablecoins are first defined as cryptocurrencies designed to have a stable value compared to other types of cryptocurrencies, which often experience significant volatility.

In reality, stablecoins are not really cryptocurrencies, but tokens, i.e. they do not have their own blockchain, but they run on a blockchain of a real cryptocurrency.

Moreover a particular type of stablecoin is defined as being supported by assets such as fiat currencies, and redeemable in the same underlying fiat currency with a 1:1 ratio. In this case, the issuer can deposit assets in a bank account with reserve function, as a guarantee that the issuer itself has sufficient assets to support the value of the stablecoin.

This type of deposit is allowed, provided that the bank holding these reserves verifies on a daily basis that the bank account balances are always equal to or greater than number of tokens in circulation.

In other words, the OCC excludes the possibility of making fractional reserves for stablecoins collateralized in fiat currency, i.e. emitting more in volume than the value of the reserves. The OCC also stresses that banks holding these reserves must comply with all applicable laws and regulations, as well as provide for a compliance review that includes the Bank Secrecy Act (BSA) and anti-money laundering rules.

It should be noted, however, that these guidelines only apply to US banks, while for example, it is well known that the reserves of the main stablecoin collateralized in dollars, USDT, are held in banks located in other countries.

Moreover, sinceUSDT does not hold 100% of its cash reserves in bank accounts, these guidelines seem to prevent US banks from being able to hold the deposits of the world's most widely used stablecoin, perhaps favouring other US-born stablecoins, such as USDC or GUSD.

USDC is in fact issued by an American company (Coinbase), and is the second largest stablecoin in the world, rising from $500 million to $2.4 billion in capitalization in a year (+350%). In addition, OCC's current Acting Comptroller of the Currency, Brian Brooks, was previously Coinbase's own Chief Legal Officer.

Perhaps the most interesting thing about this interpretative letter is that the OCC actually seems to accept without any particular problem both the existence of the stablecoins and the fact that traditional banks can hold their reserves, provided that they cover 100% of the value of the tokens issued. After all in this case the total amount of money really in circulation does not change, and there is no interference with the monetary policy of the central banks.

It remains to be seen whether the central banks themselves, and the institutions that deal with the payment system, consider stablecoins a threat or not.

Uniswap: the most popular DEX is updating to V3

Despite the recent decrease in volumes, Uniswap is still the most popular DEX in the world with about 253 million volumes in 24h.

And with the recent launch of its UNI token, which is now the 6th most traded token on the platform, Uniswap also decided to update itself to V3.

This V3 might provide cheaper fees and less volatility, or at least this is what developer Hayden Adams said almost one year ago about this update:

In fact, it is not still clear when this update will happen or how the platform will be improved, but a lot of people are waiting for a layer 2 solution to solve these issues: capital efficiency and slippage are, in fact, the two biggest problems for Uniswap at the moment.

And fees are not something Uniswap can control as they depend on the Ethereum gas price and network congestion, so a layer 2 solution can be a good solution. This V3 update might happen in 2021 but, again, the Uniswap’s team didn’t say anything about this.

However, Uniswap is working with Plasma on a Layer 2, so there are high chances that this V3 will include this solution.

L2 improvements are:

Scalability of 200 TPS;

Almost zero fees;

Native meta-transactions;

Optimistic rollup by utilizing OVM.