PayPal Beats Them All

In the face of the rumours of the last few months that have never been confirmed so far, the move by PayPal heralds a new era...

For the people operating in the sector it was expected and it was only a matter of time, for the most sceptical it was an illusion of the cryptomaniacs. Yet, exactly one year after withdrawing from Facebook's Libra project, the payment giant PayPal Holding Inc., a leader in online payment with over 346 million active accounts worldwide, has officially confirmed that from next year users will be able to use cryptocurrencies to shop at the 26 million merchants who accept payments via PayPal.

Image source: Reuters

The service will already be available in the coming weeks to US account holders who will not only be able to use it as a funding source for purchases, but will also be able to buy, sell and store cryptocurrencies on their Paypal account. But that's not all. Just a few hours ago, following the big announcement that has put the entire sector in turmoil with particular benefits for the cryptocurrencies approved in the basket (Bitcoin, Ethereum, Bitcoin Cash and Litecoin), rumours are spreading on Bloomberg's website that PayPal is negotiating to acquire BitGo, a company offering a custody service and the first in the US to be approved as a broker-dealer for the transfer and holding of cryptocurrencies.

What is happening in these hours will result in a cascade process forcing other payment giants not to lose precious ground. As stated in the PayPal official press release "the migration to digital payments and new forms of payment continues to accelerate, driven by the Covid19 pandemic, increasing interest in digital currencies for central banks and consumers..." The road is paved. If until a few months ago interest in cryptocurrencies seemed to be marginalised to a niche of technologists, today the narrative has definitely changed. This is also demonstrated by what has happened in the last few hours. Last week's update (Nota interna: inserire link di atterraggio) summarizes how the stablecoin sector has evolved in just a few months.

This change is confirmed by the volumes generated by the issuance of new liquidity of the two main stablecoins, Tether USDT and USDCoin. In less than 48 hours, in the midst of a bullish uptrend for Bitcoin and all the major cryptocurrencies, more than 450 million Tether USDT coins were minted, while USDCoin - a stablecoin regulated by the Coinbase exchange and Goldman Sachs' Circle platform - traded more than $566 million in less than 24 hours, increasing its capitalization by $53 million to over $2.8 billion. One week later, the total capitalization of the entire stablecoin industry grew by $500 million to $21.5 billion, the highest ever. While Tether continues to remain the absolute market leader with 75.3% of the market with over 96% daily trading, the second stablecoin, USDCoin, continues to slowly gain market share. Since last Friday the market capitalization has increased by $68 million, or 0.1% of total capitalization.

DeFi - Decentralized Finance

At over $2.8 billion, the volume traded on DEXs (decentralized exchanges) in the last week remains stable, reaching a total of over $9.4 billion since the beginning of the month. The volume is lower than that recorded in September, reaching over $25.7 billion and setting an absolute monthly record.

With over $620 million, the Curve DEX is gaining ground against the Uniswap DEX, which at $1.6 billion is down to 55% from 70% of last week's total turnover on decentralized trading platforms.

DEXes Volume

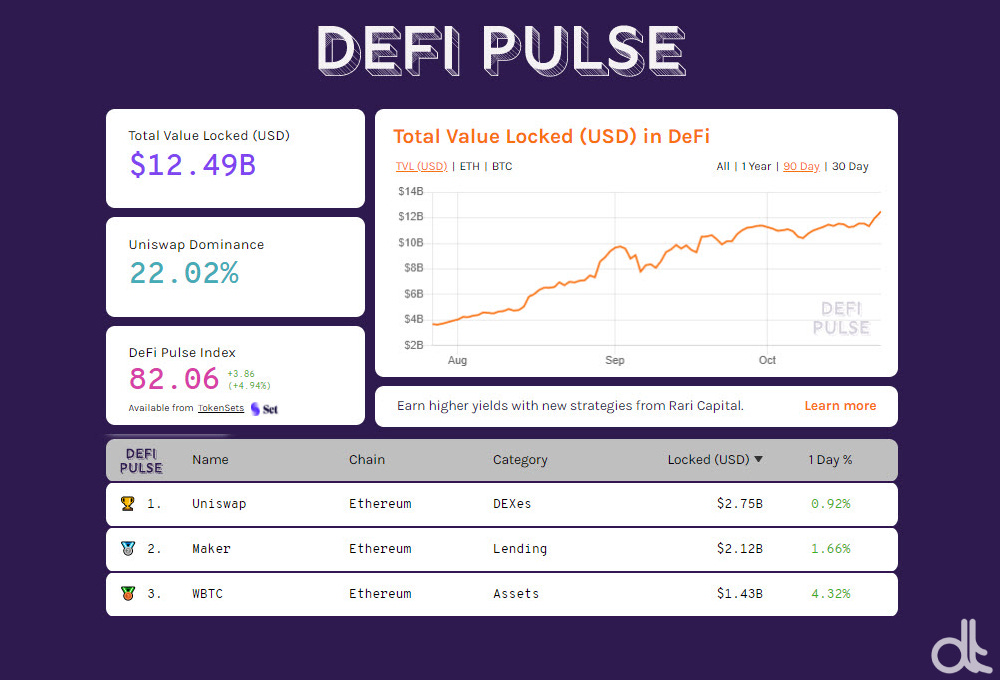

TVL (Total Value Locked) continues to set new absolute records in decentralized finance. More than $12.5 billion is the total collateral locked in DeFi projects. The Ethereum record was set during the week with over 9.2 million ETH locked.

The relentless growth of tokenized bitcoin reached over 173,147 BTC, of which:

just under 111,000 BTC wrapped in the liquidity of the WBTC project with a countervalue of over $1.4 billion, consolidating the third position in the ranking of the main decentralized protocols;

behind the Maker lending platform which, for the first time, is above $2.1 billion;

Uniswap remains the leader, with more than $2.6 billion of collateral locked.

Total Value Locked in DeFi

5 hottest DeFi News of the week

Exclusive: Bitfinex integrates pNetwork

Ethereum doubles Bitcoin because of DeFi

The most excited projects on Polkadot

BitMex lists new futures

Technical Analysis

by Federico Izzi

Bitcoin (BTC)

The rise in the last few days lays the foundations for a weekly closure among the first three since the beginning of the year. At the values of Friday afternoon (around 13,000 USD) the week's performance was close to 13%, below only the two weeks in April when the weekly balance exceeded 15%. If Sunday evening closes at or above current levels, the gain of more than $1,450 since Monday's opening is confirmed as the best nominal increase since July 2019. A weekly closing above $11,500 will establish the highest level since January 2018, when the market was in the middle of the bearish storm that ended in late 2019.

These numbers, if confirmed, will increase general interest. The signals from professional investors using derivatives to hedge risks are growing. During the week, the Open Interest (overnight open position) on future derivatives with over $5 billion reached its highest level since early September. The Open Interest future on the Chicago Mercantile Exchange (CME - the world's leading financial centre for futures and derivatives trading) rises to $800 million (2nd position behind OKEx), the highest level of OI since August 20th, 2020.

New absolute records for Open Interest on options derivatives rose to $2.6 billion. Breaks in resistance levels over the past few weeks (11600 - 12200) have triggered the hedging of bearish positions, triggering the buying rush to stop losses. Currently, only the positions to hedge downward reversals remain open. Only a return below 10,600-10,500 USD would trigger some alarms. It is necessary to wait for the next few days to understand the positioning of new strategies to protect recent purchases. Exceeding the technical resistance at 13,150-13,200 USD could trigger a new bullish run.

Ethereum (ETH)

After an initial uncertainty that seemed to cage the prices of Ethereum in the congestion present since the beginning of September between 325 and 390 USD, the breaking of the upper base has awakened the purchases that in these hours push the prices to review the 415 USD area. A crucial threshold that will have to confirm the breaking over the weekend, to increase the probability of revising the highs at the beginning of August in the 455 USD area. Otherwise it is necessary for Ethereum to absorb any bearish movement by keeping prices above 340 USD, an area where the dynamic trendline that combines the increasing lows of the last seven months passes.

The rise in the last two days has swept away the barriers of Call options at 390 and 415 USD. In these hours, the 415 USD area has become a truce area between supply and demand. Positions are being moved to area 420 to protect the new rises. This will be the area to be overcome in the coming days to validate the holding of the 415 USD. On the downside, the first defences with Put options coincide with the 340 USD support level indicated above.

Interview with Bitpanda

Besides crypto you also trade metals, such as gold, silver and palladium. Did their demand increase or decrease during the pandemic?

The latest pandemic has already caused a major shift in behavior - the infamous cash-loving European citizens have started to use cards more. People have really started to switch to using digital payments in a massive way. For the first time in the history of credit and debit cards, plastic has overtaken cash as a method of payment, according to a report.

This is already what I feel to be a huge indicator of a culture and mentality shift, albeit a small one. We’ve seen an increase in demand for our services as well: With everyone staying indoors, and many businesses being asked to remain closed to contain outbreaks, investing got a whole new relevance for people.

Especially the interest in gold has soared; it has proven to be the safe haven asset it is historically known to be.

Due to the possibility to buy crypto with fiat through your partners in Austria (Bitpanda to go), purchases of cryptocurrencies have increased, how much?

Bitpanda is all about the ease of use. Our users can set up a Bitpanda account within minutes via desktop and iOS and Android app fully in Italian and start investing 24/7 with a minimum of one euro.

Bitpanda To Go is the result of a partnership between Bitpanda GmbH and the Austrian Post AG - a nice add on because we strongly believe that this new option will make people more comfortable with buying crypto.

With over 400 post branches and more than 1300 post partners throughout Austria, Bitpanda To Go is available everywhere. All it takes to redeem codes is a verified account with light or full verification on Bitpanda. The coins are deposited directly in the user’s wallet and they can dispose of them freely and instantly. Bitpanda To Go is a nice add-on and is well received among Austrians.

Have you seen an increase in the number of institutional customers on your platform?

In the past six months, we recognized that more and more institutional investors are now using our platform to build direct positions in the cryptocurrency market. This applies for a lot of crypto-fund managers that are now getting more backing from institutional investors that see the crypto market as an alternative investment strategy.

The greater visibility of reputable investors warming up to digital assets also helps fuel growing confidence within the community. Given how young Bitcoin is as a new asset class, it’s absolutely incredible to see how much the market already matured within roughly a decade.

The longer Bitcoin can prove its appeal as a store of value and digital gold, the harder it will get for institutional investors to explain why they are not adding it to their portfolios.

With the emergence of decentralized finance, do you think that users will migrate en masse?

DeFi is short for Decentralised Finance. As the name implies, it’s pretty broad but the most important thing you have to know is that most projects in this space try to recreate financial services in a decentralised manner.

Think earning interest, getting loans, trading synthetic assets and so on without relying on any third-party or intermediary. Instead, you put your trust in computer code, or more precisely, in smart contracts running on, mostly, the Ethereum blockchain.

At Bitpanda, our goal is to give our users access to the latest trending assets with high demand. Therefore, we have identified six of the most popular DeFi assets (UNI, YFI, SNX, DOT, COMP and MKR), and integrated them to our platform.

Are decentralized exchanges (DEX) an enemy for your business? To what extent?

Decentralized exchanges have been around for a while and are now receiving a lot of attention again. In our opinion, the technology is interesting; that’s why we have our own interoperability project called Pantos to actively participate in the development of a useful open source protocol.

We are of course watching the space, but most newbie users are opting for easy-to-use services like Bitpanda for good reasons. They are simply not willing or not able to use decentralized services, because you need quite some technical knowledge for most of those platforms. There are also risks involved, because even on a DEX someone has access to the keys and is writing the code.

The recent attack on KuCoin saw the loss of almost $300 million, do you have protection measures and even insurance to cover customers?

At Bitpanda, we work every day to offer the highest security to our users. An easy verification process gives you access to an intuitive, fast and secure trading experience.

Bitpanda is a fully compliant company and offers state-of-the-art security that includes the mentioned PSD2 payment service provider licence. This in combination with strict regulations and oversight from the Austrian Financial Authorities, makes us a safe place to invest.

Are you planning to launch your own debit card in the future?

In Western European countries heavily affected by the pandemic, offline transactions decreased by 60% YoY after the lockdown, according to an analysis. The current fintech response with debit and credit cards has been influenced by the needs and priorities of millennials, who look to fintech for something beyond a free account with a card.

What is the most common error and the most frequently asked questions you receive?

Over the last few months, the world of cryptocurrency has heated up significantly: Therefore, “When moon” is the most frequently asked question. But I have no answer - the market holds the power in determining prices.

Are there any updates for the introduction of your Launchpad?

2020 was all about development from an Austrian based crypto-player into Europe’s leading neobroker. We had a lot of exciting updates this year with some being just around the corner. From announcing expansion in Spain, France, Turkey and Italy to a lot of progress on the product side. We launched a game-changing product: the Bitpanda Crypto Index, an easy, automated way for anyone interested in cryptocurrencies to invest in slices of the crypto market. We also partnered up with Raiffeisen Bank International to implement their technology on RBI Coin, an e-money pilot solution. In addition, we just closed one of the largest Series A funding rounds of 2020. It's a major vote of confidence in Bitpanda and especially in our vision. This investment will play a huge part in supporting our growth strategy and our mission to become the leading investment and trading platform in Europe.

Based on what do you list a token on your platform?

Overall we focus heavily on due diligence when it comes to listing new assets. What we definitely don’t want is to offer a cryptocurrency that is not around anymore or completely lost traction in, let’s say, 5 years, as we don’t know the time horizon of our users and want to give them safe access to investing in every asset we offer mid- to long-term on our platform.

That said, it’s key for us as a company to ensure that the digital assets we offer on our platform maintain a certain relevancy over time. This is especially important for users who want to invest with a longer time horizon, as we want to make sure that there is still demand for a certain digital asset in, let’s say, two or three years.

That’s why we put in a lot of time into identifying and deciding on the most promising candidates to list. Our tools here: Careful research and by listening to the Bitpanda community.

Which is the country with the most crypto activity and what is the most traded asset?

Spain is the EU market with the relatively highest crypto adoption of approximately 10% - this is reflected by a high activity level of our Spanish user base.

Overall, Bitcoin is the most traded asset, according to our data. Ethereum makes the second most traded digital currency after Bitcoin, followed by our own Bitpanda Ecosystem Token (BEST), the key to getting the most out of Bitpanda. It offers the growing community of around 1,3 million Bitpanda users a wide range of rewards and benefits for use on Bitpanda products and services.

It’s a matter of fact, that we aim to educate our users about the potential risks and rewards of digital assets. The importance of a diversified portfolio is something that is communicated regularly, also the fact that a less volatile asset like gold is a good fit to throw into the mix.