November as turning month for Cryptos

Gains of the past few weeks undone, year-end balance sheets begin

For greater privacy, it's best to use bitcoin addresses only once.

Satoshi Nakamoto

Decentralized Finance

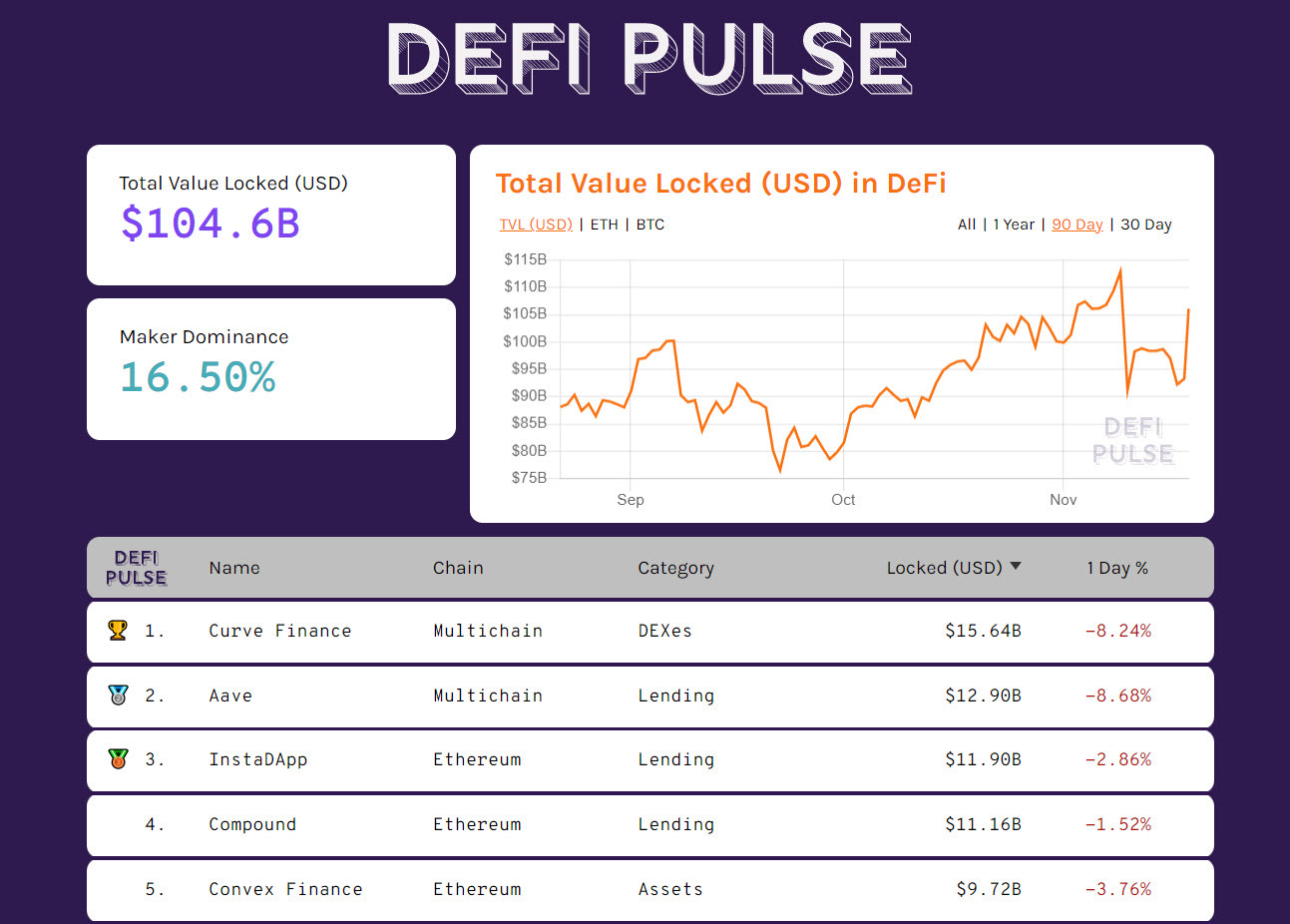

Despite the slump in digital asset prices, which from the tops of the beginning of the month are recording a loss of about 20%, the Total Value Locked (TVL) of DeFi 1.0 with $105 billion remains on par with last week's levels. Credit to Ethereum's remaining TVL with 6.5 million ETH - a number slightly higher than early November levels - and tokenized Bitcoin's strengthening with 223.8k BTC reaches its highest level ever.

In Defipulse's rankings, Curve Finance's $15.6bn project rises to the top spot, undermining for the first time after several months of absolute dominance Aave's protocol, which drops to $12.9bn, a 28% loss from TVL records at the end of October. Total TVL locked in projects identified in DeFi 2.0 loses just over $3 billion from the levels of recent days, dropping to $82 billion. Adding the value of the wrapped BTCs to these numbers, the total TVL immobilized by users on all decentralized finance projects stands at $250 billion.

Uniswap's DEX for the first time surpasses 21 million unique users who have used this protocol since its launch date. The DEX, in the last seven days, has traded a total counter value of about $20 billion, cannibalizing with 76% the entire turnover exchanged on the traditional protocols of DeFi 1.0.

Since the beginning of the month, total trades have been over $81 billion, maintaining an average weekly trade volume above the average volume of the last few months. Should the trend hold through the end of the month, the total volume will record the second most traded month ever among traditional DEXs.

Non Fungible Token

With the term Metaverse today, we begin to imagine a world until recently considered futuristic and that, instead, today we can already consider a reality that begins to take shape. As it happened for cryptocurrencies, the first years may be confusing and intended for users more accustomed to technology without excluding risks. Scenarios narrated in the science fiction novel "Snow Crash" by Neal Stephenson in 1992 where for the first time, the term Metaverse was coined. A world that uses the Internet to create a virtual reality where people use their digital avatars to live an online world through visors and headsets. It makes an impression 30 years later to read a novel that had imagined a world that today is coming true.

In these days in Lugano (Switzerland), from November 15 to 21, is taking place the digital week organized by the city of Lugano in collaboration with Lugano Living Lab and Poseidon Group where it is presented the exhibition "Non-Fungible Tangible." In the beautiful setting of the palace of Villa Ciani are exposed 26 NFTs, and crypto-art works owned and made available by Poseidon Fund of 17 of the most famous and appreciated international artists such as XCopy, Hackatao, Beeple, Federico Clapis, Dangiuz, and Giovanni Motta. Among the events organized in the round table moderated by Amelia Tomasicchio of Cryptonomist, the speakers Roberto Gorini of Noku, Lars Schikling of Kellrhals Carrard, and Luca Ambrosini of Pepper discussed the current state of development of the NFT technology, projecting the possibilities of the near future that will pass to gaming and that in this evolutionary process is finding the most direct applications.

Despite the positive feedback, the weekly volume of total trades remains lower than those traded in recent months. In recent days there has been a notable increase for the Bored Ape Yacht Club project, up 400% since last week. A growth that drives associated projects such as Mutant Ape Yacht Club - a collection launched last August of up to 20,000 Mutant Apes that can only be created by exposing an existing Bored Ape to a vial of Mutant Serum or by minting a Mutant Ape in the public sale - and the recent collection of Lil Baby Yacht Club launched on November 15, which in 24 hours has collected trades for over 1,400 ETH. The collection is home to rare images that take their cues from BAYC's original monkeys and is facing criticism from the community, which may call for the delisting of these images from OpenSea's marketplace.

Of the top five highest auctions in the last week, the top three are right up there, with Bored Ape Yacht Club's image of BAYC #8650 awarded for 450.01 ETH at an exchange rate of $1,900,464.23. They are followed by BAYC #1837 purchased for 333 ETH ($1,573,335.09) and BAYC #6696 for 250 ETH ($1,150,298.01).

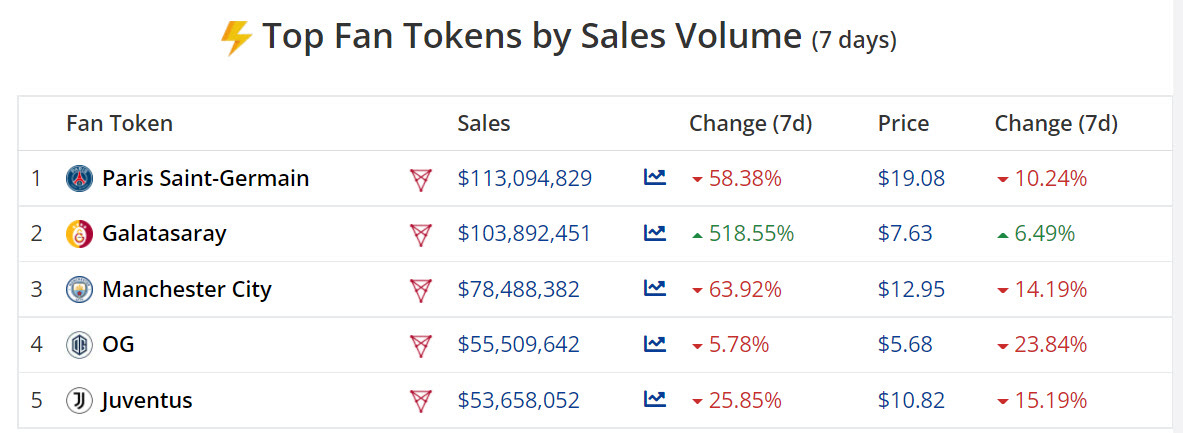

Over the past seven days, there has been a general slump in volumes for fan tokens, with trades halved for Paris Saint-Germain tokens, although at $113,094,829, it remains the highest volume club and Manchester City with $78,488,382. The only token with volumes rising sharply from 16,000 to 103,892,451 USD (+518% in the last week) is the Turkish club Galatasaray Spor Kulubu.

DeFiToday interviewed Niro Perrone

Niro Perrone is among the emerging artists present at the exhibition "The Future is Unwritten" promoted by the City of Lugano at Villa Ciani from November 15 to 21.

His story from unknown until a few months ago today brings him to be approached to high names in the field of digital art and present in the collections of Poseidon Fund and Vincent Van Dough, to become a source of inspiration for other traditional artists who have remained invisible.

DeFiToday interviewed him:

- How did you start to create NFTs?

Hi Cryptonomist, thanks for having me.

I discovered the world of crypto art in a very curious way: in February 2021, a friend contacted me saying, "Hey, one of your illustrations has been sold on OpenSea for 22 ETH". At the time, I didn't even know what OpenSea was, let alone what Ethereum meant. Upon seeing the image, I quickly realized that the piece was a work I had done on commission for $130 on Fiverr. At the time of purchase, the user did not want to buy the license for commercial use but had no qualms about using my illustration for profit.

From there on, I gave myself a chance and started to upload my first works on Foundation.

- Why have you been fascinated by the NFT world?

The first thing that struck me was this great sense of brotherhood and mutual respect that gravitates around the community. We help each other without expecting anything in return.

Personally, seeing more and more artists talking with their works sold out in every marketplace regardless of how many followers they have on their social pages is priceless.

- What was your career before NFTs?

Before immersing myself in the NFT world, I was pulling out my creativity between synths and samplers. I had an electronic music label that released vinyl in every corner of the world, I was a producer, and I was putting out records all over Europe.

- Can you tell us some highlights of your art career?

My artistic career started less than a year ago.

Entering SuperRare allowed me to be noticed by collectors such as Vincent Van Dough, Poseidon, Gblsts, Colborn, Deej.

But for the moment, I can say that having seen one of my works exhibited at the show The Future is Unwritten in Lugano along with the sacred monsters like Beeple, XCOPY, Dangiuz, Giovanni Motta, Hackatao, Fabio Giampietro, Nicola Caredda, and many others ... was my greatest satisfaction.

- How do you create your NFTs? What's your style, and what do you want to communicate?

My works are born from the need to express a personal vision of things, often inspired by everyday life, by current events mixed with past historical episodes. Honestly, I do not even know what style is mine; I take the pen and start to make sketches on paper of what goes through my mind. Then I experiment with the subjects on Procreate, and when everything starts to take shape, the sketch goes to Photoshop, where I meticulously build the work until I get the desired result. Long, poignant, involved operations that make my life a hell and heaven at the same time.

5 hottest DeFi news of the week

1) Elrond: $1.29 billion in incentives for Maiar DEX

2) Gemini set to invest $400m in the metaverse

3) DeFi, scams and thefts worth $10 billion

4) Chainlink Keepers now live on Polygon to improve dApps

5) Mintable: new update for the NFT marketplace

Technical Analysis

Bitcoin (BTC)

The price reversal of the last few days cancels out the rise accumulated in the previous month, which at the beginning of November pushed the quotations to mark a new absolute high just a step away from 70,000 USD (1). That was an area that in the previous update I had indicated as a bullish target zone to be monitored.

After touching 68,950 USD (2), profit-taking prevailed, causing the prices to fall by over 15% in less than ten days and revisiting the levels of mid-October (3).

Technically, the movement is part of a physiological retracement after a strong rise accumulated in October, conquering the podium of the best month for performance and gains since the beginning of the year. From the record of the beginning of the month, the retracement goes beyond 25% (4) (59,200 USD area), with room for a descent to the 49,200 USD area (5), which corresponds to 50% of the Fibonacci retracement calculated from the lows of the end of September (6). Furthermore, the current descent confirms the structure of the two-month cycle that began with the double minimum at the end of September (6), and that should end by the end of November (7). The hypothesis was developed in recent weeks on these lines and so far has respected the predictions.

Levels to be monitored next week:

° Upside: In the context of the end of a monthly and bi-monthly cycle, it is recommended to wait for the conclusion of the downward movement to identify a valid area of support where to start setting the next bullish operations. Useful to follow the supports identified with options strategies.

° Downside: The failure to hold 57,500 USD (3) - the area of price oscillation in the last 24 hours - identifies the next target in the 54,000-55,000 USD (8) area, which corresponds to the accumulation movement of the first part of October that accompanied prices to new highs in the following days. An eventual descent below these levels opens space to return to test the 49,200 USD area (5).

BTC Options

There has also been a change in strategy for the positions of derivative traders, with a marked increase in positions regarding Call options with a Put:Call ratio=1:2.8 in favor of strategies to hedge upside risk. While on the upside, more strikes highlight hedging positions between 64,500 and 68,500 USD creating a solid wall; on the downside, there is only one strike in the 56,600 USD area, to be defended in order not to risk further slides and with the possibility of extending the decline by another 10-15 percentage points from current levels.

Ethereum (ETH)

Barring any resounding reversals, the week is set to end on a downtrend. After eight consecutive weeks in the green, that is the first and the longest streak since the beginning of the year, which, from the last week of September to the first week of November, recorded a 50% increase.

This week's decline cancels the gains accumulated since the last week of October, bringing quotations back to test the psychological threshold of 4,000 USD (3) and a step away from the technical support of 3,900 USD (1), area that in the second part of October created the basis to launch prices to the new historical highs of 4,864 USD (2) established at the beginning of November.

Levels to monitor next week:

° Upside: The achievement of the bullish target in the 4,760 USD area, calculated with the projections of the Fibonacci extensions identified with the updates in recent weeks, was an opportunity for profit-taking and now becomes an important resistance to be observed when the price will return to rise again. At the moment, there are no signals to support an upward turn in the medium to long term. For these reasons, we recommend caution.

° Downside: It is necessary to carefully monitor the holding of the support in the 3,900 USD area (1), a level that corresponds to several technical levels: a) lows of the second part of October; b) previous historical highs of early September; c) 50% of the Fibonacci retracement calculated from the lows of late October and highs of early November.

ETH Options

The signals arriving from the setting of protection on the upside highlighted in the previous update warned of an increase in the possibility of a return to the downside, as occurred and still in progress. The strategies to hedge upside risks have increased in the last days, with a Put:Call options ratio=1:2 in favor of Call. The recent historical highs are the strike with the highest number of open positions, reinforcing the above technical resistance. While on the downside, protections are spread between 3,700 and 4,000 USD.

Disclaimer

The analysis presented exclusively reflects the author's point of view and does not represent operational advice or a trading signal and should not be seen in any way as a service of financial advice or solicitation of public savings and should not be taken in any way as a service on which to base investment decisions.