NFTs are Revolutionizing Digital Culture

The Non-Fungible-Token fever is overshadowing last week's rises with Bitcoin returning close to 58,000 USD and regaining all of its late February decline.

"Buy not on optimism, but on arithmetic."

Benjamin Graham

Don't deny it, in the last few days your social media feed and walls have been flooded with news about NFTs, Non Fungible Tokens.

Do not worry if you have been wondering what it is.

Relax. You're not the only one.

In the past few months during the CryptoFocus episodes (recordings at this link) when commenting on the year 2020 and the probable keywords that would characterize 2021, I pointed out three of them in order of importance: DEcentralized FInance, StableCoins and NFTs.

It only took two months to overturn the ranking.

Unlike the previous narratives, which were initially and for a long time only debated by insiders in the field of blockchain, cryptocurrencies and decentralized finance, the NFT narrative was instead endorsed by those who do not qualify as 'crypto experts'.

I am referring to content creators, such as art or music artists, who, instead of resorting to a gallery owner or agent, have been trying to figure out how to use a Metamask wallet to mint their own unique digital token to launch at an online auction and achieve sales with staggering numbers.

In February, the volume of business on the main platforms that list and facilitate the buying and selling of non-fungible tokens grew 29x (Messari data) for a total value of around $800 million.

Messari NFT Sales Volume

In two months (January and February) it exceeded the fundraising of the entire year 2020.

Numbers that are tempting for many, both small and large creators of digital and physical content, the latter with a certification of authenticity of the metadata.

The latest news is about Christie's record auction in its New York gallery, which closed at $69.3 million for the unique digital work created from a 21.06x21.069 pixel jpg file by the artist Beeple: "Everydays: The First 5,000 days".

The most popular digital artist, also known as Mike Winkelmann, has so far minted and sold around 840 digital artworks, recently stating that he did not know what a Non-Fungible-Token was until last autumn.

The sale marks a turning point in the history of art and blockchain technology. It is the third most expensive work by a living artist sold at auction.

The same fate also befell other works of art such as paintings by Frida Kahlo, Dali and Paul Gauguin. Behind them, only a painting by David Hockney beaten in November 2018 for $90.3 million, surpassed a few months later by a stainless steel rabbit sculpture created by Jeff Koons, sold for $91.1 million in May 2019. Both were also sold at Christie's.

In just a few months, the NFT landscape has gone from a niche corner of the cryptoverse to the mainstream with a speed never before seen in the cryptocurrency ecosystem. It is enough to think that a year ago Rarible's platform, among the most famous, did not exist. While OpenSea's monthly trading volumes did not exceed $1 million.

It is not only the art industry that is involved but also the world of online games, collectable items and sports. For these other sectors, there has been an increase in volume of over 400% in the last thirty days.

However, such rapid growth in interest and capital may also attract many scams. Many believe that NFTs will transform many industries, from finance and gaming up to fashion, events and luxury goods.

For those who downplay this as a passing fad, we give a strong warning: "Now is the time. The iron has never been so hot".

The digital cultural revolution has just begun. Get ready.

Decentralized Finance

With $14 billion traded over the past seven days, trading volumes on Decentralized Exchanges exceed those of last week.

The pace in these early days of March does not replicate the trades recorded in February, but the average remains well above that of the last quarter of 2020. This is a positive sign that confirms the use of DEXs despite the gas fees required to execute smart contracts across the pools of the various financial projects.

DEXes Volume Last 7 Days

The leader remains Uniswap with a total weekly volume of $7.6 billion, an increase of over $2 billion and a market share that recovers over 7 percentage points, from 47 to 54.5%. There was also a notable increase in the number of unique user addresses (+39,000) that used the Uniswap DEX, which rose to over 160,000 last week. These numbers also boosted the price of the UNI token, which for the first time this week rose above $35, a new all-time record and an increase of 530% since the beginning of the year as well as 45% in the last 30 days. SushiSwap follows, with $2.1 billion traded and market share down to 12 percent from 15 percent. Despite a halt in trading, Sushi's token also updated its record in last hours, rising above $22 for the first time. Since the beginning of the year, the SUSHI token has seen its value multiply 7x.

The rise in the prices of both Bitcoin and Ethereum is helping to push the total value locked up in decentralised finance projects back above $43 billion.

Total Value Locked in DeFi

Maker's lending protocol retains the lead

Followed by Compound and Aave.

There is a head-to-head for fourth overall and first place among DEX projects between Uniswap, the vampire project SushiSwap and Curve, all three with just over $4 billion locked.

Since last week, the total number of ETH locked on the projects has risen to over 8,9 million, while the haemorrhage of BTC continues, falling below 32,000 units, the lowest point since mid-January.

5 hottest DeFi news of the week

Polkadot to have new parachains

NFTs are now a trend on Instagram too

Technical Analysis

Bitcoin (BTC)

Surprisingly, the price of Bitcoin climbs back above 60,000 USD, the new all-time high .

BTC New ATH 60,000 USD

The ascent continues not to be accompanied by satisfactory volumes, a condition that at the moment does not jeopardize the closing of the week, which was the second time the market had turned positive, and which cancelled out all the losses accumulated in the last week of February, which had dangerously pushed prices back below 45,000 USD (1).

The holding of 54,000 USD (2) not only for the weekend but also for the next days few of the central week of March, will lay the groundwork for new extensions. It is necessary the support of the volumes that although they remain tonic and in the upper range of the average of the last two months, are half of the volumes recorded in mid-February that accompanied the previous rise, at the moment much more tonic than the current one.

BTC Chart

Options

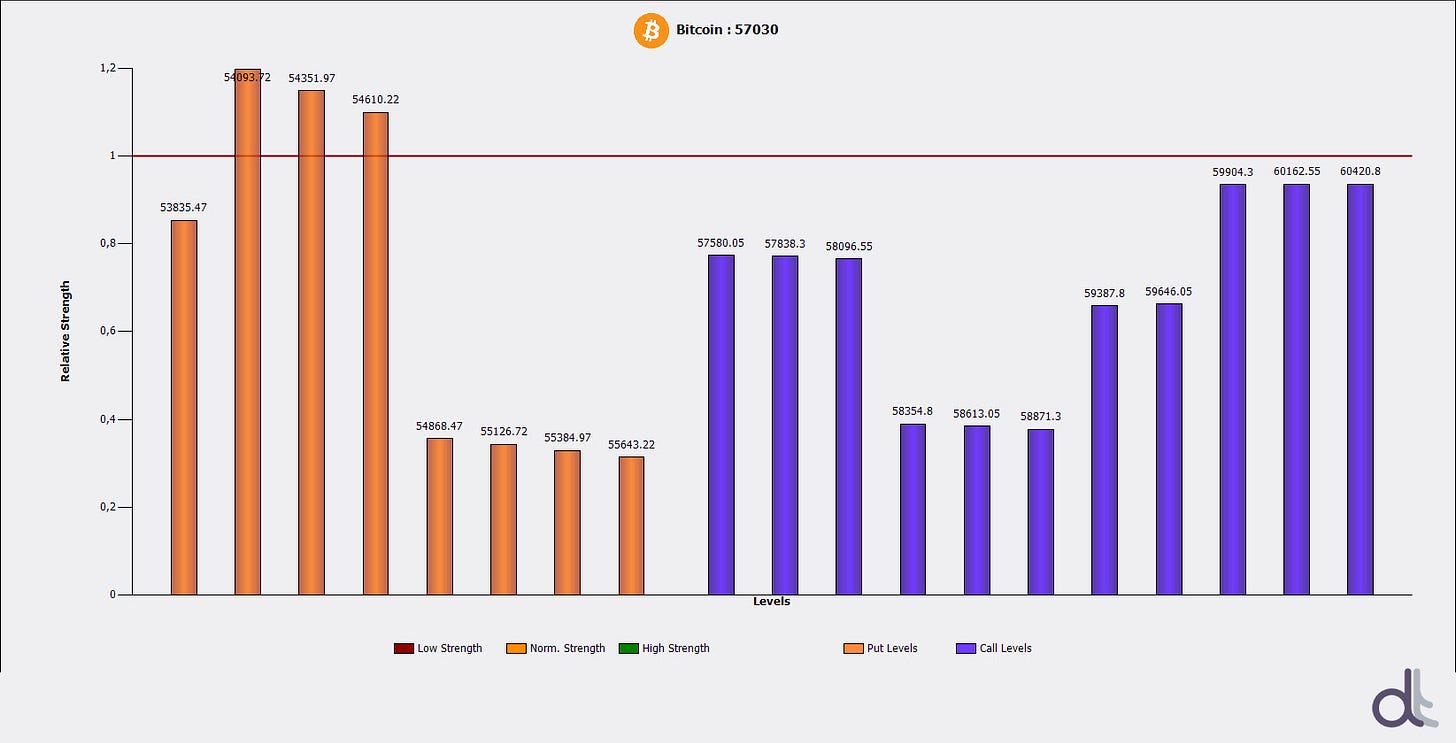

The rise above 54,000 USD between Tuesday and Wednesday - the level indicated in last week's report - triggered call option covers which accompanied the rise above 58,000 USD over the next 48 hours. The strategies of derivatives traders continue to remain unclear on the upside, despite the fact that aggregate open interest data on futures recorded an all-time high of over $20 billion between Thursday and Friday. Current data indicates that traders prefer to hedge risk for any declines below 54,000 USD where put options would start to kick in with 54,000-54,600 USD as the barrier to protect in the event of a drop. It seems that in the last week professional traders have bought long futures hedging the risk with Put options. It will be interesting to follow the evolution of the price in the coming days. It seems that an exit above the historical maximum or a return below 54,000 USD will be required to move volatility.

BTC Options

Ethereum (ETH)

Unlike Bitcoin, Ethereum prices replicate the rise by remaining in a technical rebound context. In fact, the rise stopped below 1,900 USD (1) indicating lower intensity. If we take the highs of February 20th and the relative lows of February 28th as a reference, the price recovers 75% of the decline. This signal indicates a good rebound that has the characteristics of wanting to become bullish. But it is necessary to overcome the highs of Thursday as soon as possible, otherwise there are risks of corrections in the coming days. It is necessary to remember that the price is still in the final phase of the quarterly cycle that began at the end of December. Only a rise above 2,000 USD (2) in the coming days, would decree the beginning of the new 3-month cycle. It is necessary to have the support of the volumes that in this week trades 1/3 lower than the highs recorded in the second part of February.

ETH Chart

Options

The analysis of traders' strategies in options confirms the prevalence of hedging the risk of possible rises above 2,000 USD. Call options positions (on the upside) prevail, albeit slightly and lower than last week's report. Conversely, on the downside, the first protections are appearing in the 1630 USD area, although the real bulwark to be knocked down in the event of a fall continues to be 1400 USD.