I think this is the first time we're trying a decentralized, non-trust-based system

Satoshi Nakamoto

The testbed of technology has always been represented by two sectors in particular, gaming and video. At the turn of the new millennium, the first evolution of the Internet was undoubtedly characterized by users' growing need concerning a possible and more significant expansion to be achieved to overcome those aspects related to the old technological system. Participating in game sharing has consequently allowed an adjustment both of the network and the codes to understand what was usable and what was not. The video and audio streaming have been, since the beginning, the test to understand the tightness and the management of the network infrastructure. At the same time, the management of shared gaming through competitions between users using the Internet. The mix of these different realities led to the birth of the first online casinos, parallel management to the classic theme of the game that forced the platforms' owners to manage the fluidity of the data load to allow all users/players connected playability without interruptions. In 2010 the first casinos began to connect online to the active physical realities of the casinos in presence, and this was a further step that was always a consequence of gaming. The possibility of exploiting the network for players right from the start was aimed at a new need for interaction until we reached the maximum awareness we have today. Making parallelism with what happened in the blockchain sphere, we started to discover at the end of 2017 when the thousands of transactions with the Cryptokytties game put a strain on the Ethereum network, causing a block validation and an explosion of transaction fees. The difficulty for many was a reason for the inefficiency of a structure that, instead, should have guaranteed greater security and effectiveness.

However, what was not yet prepared to do was a sudden intervention to support such a critical situation.

Today, those who focus on cryptocurrencies mainly monitor the acceleration of prices or the flow of declines. Still, in reality, one of the cornerstones of the moment that captures the interest of many is precisely the return of gaming, which changes the size of transactions and accelerates a whole other series of processes.

What we are witnessing and what is happening in these days is just an increase in prices, despite the particular moment of cryptocurrencies, and this is due precisely to this renewed presence of games, such as the one created by Ashton Kutcher and his wife Mila Kunis, Stoner Cats, which is having a very well supported success (thousands of transactions in the first forty minutes after being put on the net) and with a robust return of the volume of commissions.

Usually, these passages have a reason to have to evidence those of the processes that must happen with a logic and a consequence of that one that is the evolution and improvement of the technological revolutions that happens just during the moments of crisis. Knowing the limits of a technological process forces the developers to find a solution that allows them to overcome these difficulties to carry on a process of evolution respecting the users' needs, often, even in an unconscious way, activate these phases of efficiency.

A process that in the following years will be exploited in other areas, replicating what happened in the past. What is happening today with the new euphoria of the NFT (Non-fungible-token) with the gaming protocols will be the test bench for the effectiveness of the network also passing through the blocks and the increase of the fees. The solution to these problems will be helpful in other sectors ready to replicate the protocol in other products like the financial one.

For this reason, an efficient system can only be considered if it knows several critical phases during its growth.

Decentralized Finance

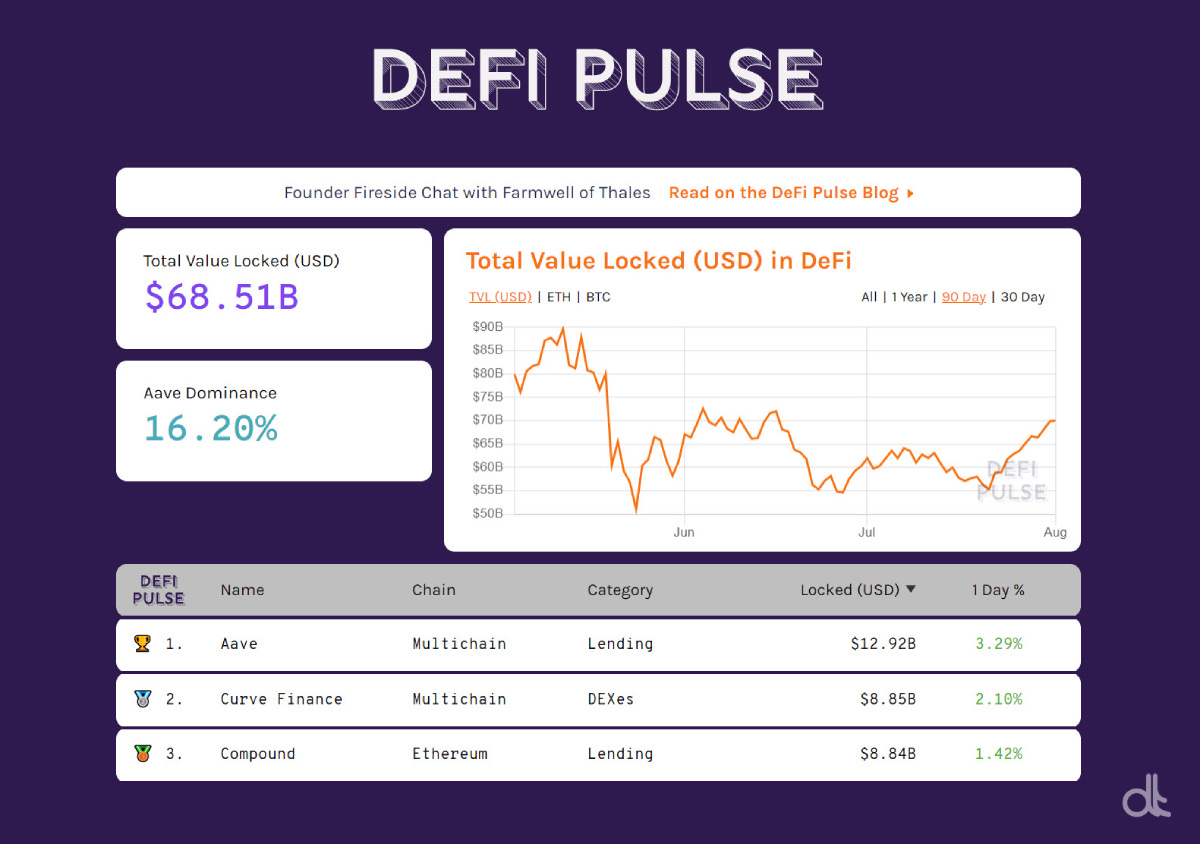

Since the last posting, the Total Value Locked (TVL) has increased by $8 billion, boosting growth by over $14 billion from the lowest point reached on July 21. A reversal that coincides with the prices of the main assets. For Ethereum, with around 9.7 million ETH, the number blocked on the various decentralized protocols remains stable since last week. While for Bitcoin, the number rises above 191 thousand BTC, the highest value ever, indicating how users who own Bitcoin prefer to use it as collateral to obtain a loan instead of selling it for cash. An advantage offered by lending services that are increasingly appreciated and used.

The reason that is also supporting the growth of Aave's decentralized multichain lending project that returns above $13 billion TVL for the first time since the beginning of June, consolidating the leadership gained several weeks ago.

In the second place, Curve Finance, the DEX designed stablecoin exchange, raises over $8 billion.

Compound follows, a close third but tied with $8 billion locked up in collateral.

The head of Compound's legal department these days has expressed his disappointment on the proposed law in the colossal spending maneuver of $550 billion where a rule has been inserted that imposes on the subject responsible for the provision of services necessary for the transfer of digital assets, the obligation to transmit to the U.S. IRS the names complete with tax code. Being a norm that does not clarify specifically, these subjects also include managers active in the DeFi markets. This procedure is impossible to apply to anonymous entities such as liquidators or governance token holders who use DeFi systems without the need for KYC.

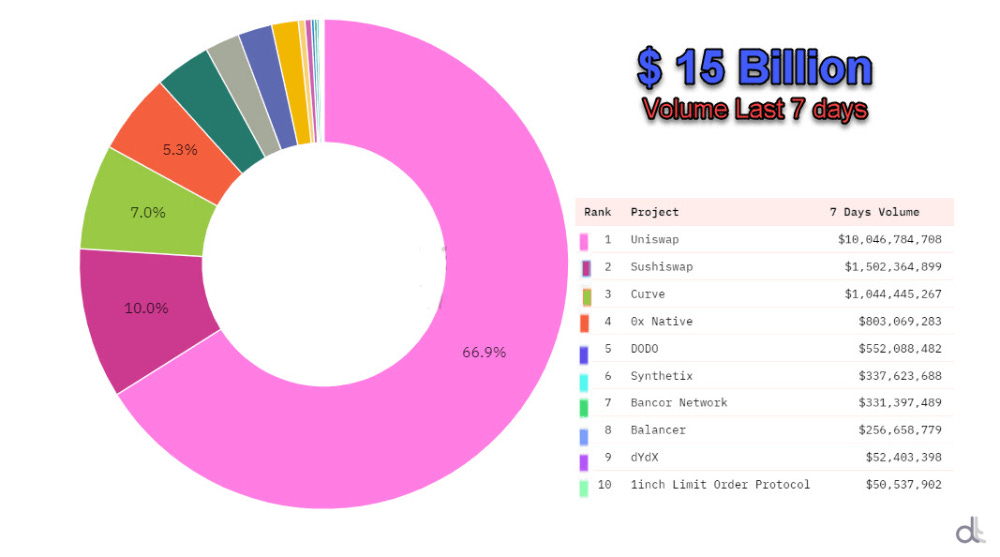

With an increase of 13% since last week, the weekly trading volume recorded on the Decentralized Exchanges is back above $15 billion.

Uniswap is still the leader and, after three weeks, is back to trade over $10 billion, gaining again 67% of the market share

Followed by the DEX vampire Sushiswap with $1.5 billion, equal to 10% of dominance.

At a distance is Curve with over $1 billion traded since last Sunday, 7% of the total volume traded.

Over the past week, the Uniswap case has garnered attention for its decision to arbitrarily remove 100 tokens from being able to trade on its decentralized exchange. The exchange took the decision without involving users or proposed voting. The delisting of these tokens, resulting from regulatory issues, was done by the front-end procedure of Uniswap's webApp without directly involving the protocol. This procedure allowed Uniswap Labs to make the necessary changes to comply with the regulation that highlights the mechanisms of DEX protocols while continuing to leave complete operational freedom to users. In fact, the change was made on the application's web interface, leaving the protocol unchanged, allowing users to continue to exchange the tokens removed without going through app.uniswap.org. A procedure that relieves the company Uniswap Labs of any legal responsibility. A clear example of how the platform, while continuing to remain decentralized and open-source, continues to ensure the anonymity of users by ensuring compliance with regulations.

The month of July closes with a total of $72.2 billion traded on DEX. Since the beginning of the year, only the month of January totaled a lower volume with $67.9 billion. However, the signal remains positive for having recorded a modest decrease of 15% MTD despite an uncertain market phase with low volumes traded across the board, including centralized exchanges which, except for the last few days, have recorded daily trades below the average calculated since the beginning of the year.

Non Fungile Token (NFT)

These last days of July have been hot. Unlike last quarter, this time, it wasn't the art-related projects that attracted the interest of users but those of gaming or cards related to collecting. The NFT project of Stoner Cats, supported by Hollywood stars Ashton Kutcher and Mila Kunis and the involvement of Vitalik Buterin hired to dub one of the characters of the series of animated shorts, has collected a strong expectation among fans and insiders. The drop of the kittens that occurred on July 27 exploded the demand by exhausting all 10k NFT remained available at the base price of 0.35ETH each for a few minutes by collecting a total of 3,650 ETH equal to a value of $ 8.2 million, in just 40 minutes.

In the euphoria, there was no lack of discontent on the part of many users who tried to mint Stoner Cats using the automatic gas limit procedure (the unit that measures the cost of commissions). Problem partly overcome by those who, instead, manually selected this limit. The project team announced that after the initial unforeseen debacle, they are now planning some "fun things" to ensure that no users are left unhappy.

After the hype of the first day, the total turnover traded on Stoner Cats has been decreasing while still maintaining the sixth position in the overall weekly volume ranking, where it continues to be led by Axie Infinity's project with over $168 million traded in the last seven days. It is followed by CryptoPunks, which increased volumes by 1.180% on a weekly basis trading $104 million 'only' with 856 transactions. The resurgence of interest in these 32bit images rewards some of the rarer CryptoPunks to occupy the top five spots for the highest sales of the week. The first two auctions feature a monkey wearing a hat (#5217 awarded for 2,250 ETH = $5,500,597.50; and #2140 awarded for 1,600 ETH = $3,764,528.00) also capture the respective first and second places for July.

In third place with 19k tx and $64 million traded and a weekly volume increase of 459% is the Art Blocks project, a generative art project already known to readers of this newsletter.

Also, this week there is an increase in volumes for NFTs related to soccer, where the French club Paris Saint-Germain jumps to first place with $225k traded. Slipping to second place the Spanish club FC Barcelona that halves the weekly income to $122k. In third place, the Italian club Juventus with $108k.

5 hottest DeFi news of the week

pNetwork leads the way for blockchain bridges

Curve Finance now supports Tether Euro

Shopify now sells NFTs

Axie Infinity high performances

Technical Analysis

Bitcoin (BTC)

The last ten years had never seen ten consecutive upward days for the price of Bitcoin. On July 20, after touching the lowest point since the beginning of the year with prices touching the support of 29,300 USD (2) for the third time in two months, the return of purchases reversed the trend that in these hours has brought quotations back to exceed 42,500 USD (2) for the first time since the beginning of May (3). A reversal that has swept all the hesitations of the last two months with price courses that have dangerously oscillated in the 30,000 USD area making many fear for several times the possibility of falling to revisit the previous historical highs of late 2017 at 20,000 USD. A danger that at the moment seems to have been relegated to the unfounded fears area. As written and reiterated several times in the analyses of this newsletter, the holding of the technical support protected by the options hedge in the 28,000 USD (1) area has always remained crucial to understand the intentions of professional traders. An hold that, in fact, triggered the current price run, reversing the trend from bearish/neutral to bullish and recovering 40% in a few days. A tailwind in the final part of the month that allows us to close the month of July with a positive gain of 18% per month and interrupt the negative series of three months in red.

Statistically, August is not characterized as a favorable month for the bulls, with five closings in the red and three in the green. The performance of 2017 stands out where the month closed with +65%, the best monthly performance in the last seven years. For the years where the month of July closed in positive only twice, in 2015 and 2018, August closed with the opposite sign. Data that bode well for a positive continuation even for the hottest summer month of the year.

For the week just beginning, it will be essential to monitor:

On the downside: the holding of the medium and short term support of 36,000 USD (4). In case of breakage, the recovery of these days would be frustrated.

On the upside: overcoming the recent weekly highs of 42,500 USD (2) would open space to test 45,500-46,000 USD (5). An area that coincides with the 50% of the retracement of Fibonacci calculated taking as reference the highs of April and the lows of July. A return of prices to the resistance of 45,500-46,000 USD area will be followed with attention to begin to evaluate the end of the bear market that started from the top of mid-April.

BTC Options

As hypothesized and written in the last update, the overcoming of 35,500 USD did not find particular resistance, causing prices to rise above 42,000 USD without finding bearish resistance. The rise of the last few days has also blown up the fragile downside protections that remained, bringing the ratio between Put and Call options 1:8, highlighting how operators choose to maintain Put positions to protect themselves from possible downward reversals and at the same time see room for further stretching.

Significant positions placed for the $50,000 strike stand out. Of the approximately 12,000 total BTC, more than 90% are Call options, indicating that this level will be the barrier to break down in case of further price increases and the reference level for the entire month of August. In fact, integrating all the data available and reported above, a break of 50,000 USD would provoke a substantial repositioning by operators that, as in these cases, would cause a strong price excursion.

Ethereum (ETH)

For the queen of Altcoins, the series of consecutive up days rises to twelve, an all-time record that has allowed the price to recover more than 50% and push itself back above 2,600 USD (1), the highest level since the beginning of last June.

Since the start of the year, the performance of Ethereum exceeds 250%, more than six times that of Bitcoin, highlighting the first half of 2021 as one of the best periods in the history of Ethereum.

In recent weeks, signs of a possible upward price recovery were evident, as was realized during the week just ended. Despite the distrust and difficulties due to reflections of the geopolitical tensions that have mostly affected the Bitcoin trend, the data on the Ethereum network and the holding of technical supports gave hope for a recovery of the quotations, as is happening.

For the first week of August, prices must confirm the holding of 2,300 USD or at least not close the day below 2,200-2,150 (2). In this case, it would question what has been done in these last two weeks of July.

Monitor:

On the upside: 2,700 USD (3) important resistance - 3,000 (4) the barrier to break down

On the downside: 2,200 (2) important support not to be violated with daily closure

ETH Options

The strategies in options built by professional operators and analyzed in these pages in the last weeks have suggested the possibility of upward extensions. The ascent of the price above 2,300 USD triggered a mini-rally that in these hours has brought the quotations back to within a step of 2,700 USD. The hedging strategies on the upside concentrate more than half of the total positions in Call options, all in the area between 2,600 and 2,700 USD. The overcoming of this last level creates spaces to rise to the 3,000 area in the following days.

The ratio between Put and Call options is 2:1, providing a sign of confidence for a continuation of the upward trend or a consolidation of the recent lows.

Promising Altcoin Projects #001

Idle Finance - The best Yield without any effort

Idle Finance is a DeFi project born in 2019, thanks to the victory of an important hackathon organized by Consensys Relay. Founder Matteo Pandolfi, William Bergamo, and Samuele Cester, already active in the crypto sector with some bots, decided to create a product that could ensure a passive yield, giving birth precisely to Idle. Unlike most crypto startups, Idle Finance first launched its product and then, after reaching a significant number of users and a respectable TVL, in December 2020, the governance token $IDLE.

But how does Idle Finance work?

To earn yield passively, you just need to access the Dashboard and connect an Ethereum Web3 Wallet as a MetaMask. Then you can choose your preferred strategy between the two available so far: Best-Yield and Risk-Adjusted. The first is a higher risk strategy that always offers the best yield, while the other is designed for those who want to earn from their stablecoins without taking unnecessary risks. In both strategies, you can deposit DAI, USDC, and USDT, but in the first one, there are also other options such as sUSD, tUSD, wETH (wrapped Ethereum), wBTC (wrapped Bitcoin).

From the dashboard, it is possible to check several statistics for each currency used in the two strategies, such as the size of the Pool, the current APY, a grade assigned by IDLE, and the weekly APR trend. The total value locked in IDLE Finance is about 173 million dollars. A few months ago, it had touched $500M, but price corrections on DeFi's tokens drove away some capital, and all DeFi products suffered. To combat this somewhat delicate period in the crypto world, Idle Finance has decided to enhance the value of its tokens with Staking, a program designed for investors who have long-term goals. It is possible to earn protocol fees and further lower the entry price since for each IDLE put in Stake, you get $stkIDLE.

IDLE Staking

The gain will be $0.25 $stkIDLE for every single IDLE by staking IDLE tokens for one year. While Staking two years will give instead 0.5 $stkIDLE for each IDLE. The best option is the four-year Staking, in which you will have 1 $stkIDLE for each IDLE.

IDLE Token

The maximum supply, which will be reached only after four years from the official launch of the token (so in December 2024), is 13 million units. The circulating supply right now is 1.75 million tokens. IDLE had an ATL price of 0.78 cents (on December 20, 2020, i.e., on the official launch day) and an ATH price of a whopping $30.65 (on February 13, 2021, during the last bull-run of DeFi tokens). Today's price is $4.94, or a market cap of only $8 million and a fully diluted valuation of less than $65 million. These numbers are very low for such an important DeFi project, so we could likely see some significant rises in the next bull-run.

Remember that the Idle Finance project has been tested by Quantstamp and passed the audit without any problem, having on its side significant investors such as Consensys Lab, Gumi Cryptos, and the Lao. The projects that IDLE uses to achieve considerable yields are first-class projects such as Compound, AAVE, Maker, and dYdX. In addition, Idle is a DAO open to proposals from its token holders that can be published, analyzed, or discussed on their official forum.