For Bitcoin all the eyes are pointed on the technical expirations

After hectic days on DEFI now everyone is focusing on the technical expirations for Bitcoin and Ethereum

The only way to discover the limits of the possible is to go beyond them into the impossible.

Arthur C. Clarke

In the world, 900 BTC are mined every day, three hundred and twenty-eight thousand a year, and this process, known as 'mining' in technical jargon, requires very powerful computers that use a great deal of energy and consequently pollute enormously. However, after the recent events, BTC is now ready to face new challenges, namely to open up to renewable energy sources.

If we take China as an example, we know that in the past it became so important in mining because it had a surplus of hydroelectric energy that had no real use in the industrial dimension. This led to an absorption and consequently a subsequent monetisation, in line with the construction of various infrastructures and the development of a blockchain network that has been active for several decades now. The operation that the Chinese government then did, and invested in, was to push exchanges out of the borders to increase its interests and business volumes.

The history of Bitcoin in China owes much to an earthquake that shook the southwestern province of Sichuan in 2013. Among the millions of donations that flowed into charities, some made in bitcoin to a foundation promoted by action movie star Jet Li stood out.

The ensuing buzz about bitcoin then intrigued an employee of a Shanghai telephone company, Jiang Zhuoer, who that winter decided to buy two computers and start mining from home. In an interview, Zhuoer said that the business had started to generate between $500 and $700 a month and that the energy produced by the devices was used to heat the entire flat.

That same year, a team of technology enthusiasts in Beijing began designing computers specifically created to generate new bitcoins, founding Bitmain Technologies Ltd., which has now become the world's leading manufacturer of microchips optimised for bitcoin mining. The trade in machines and the direct mining activity have made Bitmain a giant that for several years has been earning more than Nvidia, the US company that invented the GPU, the graphics cards installed in millions of technological devices.

Now the government of China would like to close it down because the demand for green energy is increasingly pressing due to its cost and high pollution. The opportunity that the use of solar and wind energy brings to the table leads to a price analysis that is much lower than the coal and natural gas used until now (with an even more interesting comparison regarding hydroelectric and geothermal energy, which are inexpensive even if geographically limited).

Even Elon Musk, CEO of Tesla, recently stated that the company will stop accepting payments in Bitcoin precisely because it is concerned about environmental damage. For this kind of business they are currently trying to reduce pollution emissions and increase incentives. In the near future there will be more and more attempts to talk about a green bitcoin that will be 50-70% sourced from renewable energy sources.

In the world, both America and China have an excessive production of hydropower, which is partly absorbed by miners, especially at night when other industries do not have a real and volumetric need for it. This energy, which is fed into the grid, would surely be wasted by remaining unused, which is why the miners absorb it and make it possible to monetise it. The miner represents a unique energy buyer in the world, which could allow energy companies to implement their capacity to generate solar and wind energy. This implementation, together with energy storage, could facilitate the transition to a cleaner electricity grid.

BTC mining is an economy on a very particular scale because it stems from the profit that comes from the use of safe wastes and excesses of free and free energy and, right now, we know that it is becoming an investment- and cashflow-intensive market. These are the reasons why the price of hardware to mine bitcoins has increased so much from the base price. The bitcoin business is mainly starting to be entered by very large investment groups and even listed companies.

In the next five years the financial markets will focus their interest on the mining sector, and this would lead to a twofold investment, both with cryptocurrencies becoming green and giving a boost to the emergence of projects and real renewable energy financing. In short, Bitcoins could become the main drivers of the energy transition.

Decentralized Finance

The latest exploit of Iron Finance, a project which developed a native algorithmic stablecoin on Polygon and Binance Smart Chain (considered among the most eligible competitors of Maker's DAI), has suffered an attack on the protocol architecture, causing the price of Titan (his native token) to collapse to ‘zero’. Few hours before the attack, the Iron Finance project was seeing more than 120% growth of active portfolios in less than a week. The collapse occurred within hours, setting the record for the fastest implosion in DeFi history.

The failure of Iron Finance overshadowed the hacking of other projects such as KetchupSwap, Lokum, YBear, Piggy, CaramelSwap, GoCerberus and Garuda which saw all their native tokens plummeting to $ 0. The concert failures of these projects, which allowed the hackers to get away with it, is due to a bug in the system they were all built on. The Cerberus and Garuda teams have initiated the Thoreum Finance initiative which introduces improved smart contracts allowing the holders of these tokens to obtain compensations.

These are very busy days for decentralized finance, trading volumes on exchanges continue to decrease. In the last week, the total traded volume was just over $14 billions. A trend that brings numbers back to the average of the first four months of the year.

Uniswap's DEX remains unchallenged by trading $ 8.7 billion over the past seven days, accounting for 65% of the entire trading volume on all exchanges. Uniswap's market shares grow at the expense of the other DEXs, with

Sushiswap at 11% and

0x Native at 7%.

The Total Value Locked (TVL) of fixed assets on decentralized finance projects returns to $ 54 billion, the lowest level since the end of May. Blame the falling prices and the total number of Ethereum and Bitcoin blocked in the various DeFi lending, financing and trading protocols. While the number of ETHs returns to the levels of the end of May (about 8.6 million ETH), Bitcoin collapses back to the levels of April 21th (152,600 BTC). For the first time, the total number of BTCs issued in ERC-20 tokens exceeds 242 thousand, with an equivalent value of less than $ 10 billion due to prices below 37,000 USD.

After three weeks, Aave's project drops below double digits at $ 8.5 billion, followed by

Curve at $ 7.4B for the first time on the second step of the podium, and

Maker just below with $ 7.2B.

Not Fungible Token

Republic Realm, is a company which offers professional management of digital real estate portfolios, focused on real estate in both the physical and metaverse worlds, it has been awarded 259 plots of land for 1,295,000 MANA, equal to $ 913,228. The sale took place on the Decentraland platform and it's been the most expensive purchase in the virtual real estate world. The purchase returns an average price of 3,800 USD per single plot, despite the total payment just under almost a million dollars, this can be considered a bargain if previous sales are calculated equal to a price that has always fluctuated between 5,000 and USD 10,000.

Unlike other similar metaverse projects, such as Sandbox, Somnium Space or OVR (read the exclusive interview with their COO here), the land on Decentraland has all been sold, positioning itself as the leader in the virtual real estate sector.

5 hottest DeFi news of the week

Technical Analysis

Bitcoin (BTC)

Despite the ups and downs of the last few days, the price has continued to move in a range between 32,000 and 42,000 USD for about a month. The rise in price at the beginning of the week initially seemed to have pushed prices beyond the resistance of 42,000 USD (1), but BTC did not manage to find the hoped support making his price to return to the levels of last week which would interrupt the positive period made by three consecutive weeks which had not happened since last February.

The next few days will be crucial to understand whether the indecision of the last few days has been an opportunity to accumulate more BTC or just a pause before resuming the descent. However, the end of the intra cycle that began on Tuesday 8 June is expected and it should be ending by next week. In a technical context that has not yet decreed the exit from the bear phase, the period still remains delicate and uncertain. For these reasons it becomes necessary to continue to monitor the price trend following the weekly dynamics.

BTC Options

We are just a few days away from the important quarterly expiration of futures and options (Friday 25 June) that many have been awaiting with concerns but which, as often happens, could pass without affecting the movement of prices. In the last week posting of Options Call has grown (upward) with the prevalence of strikes between USD 41,700 and 43,700, indicating that professional traders prefer to protect themselves from possible bullish pulls above the recent highs. On the downside, however, hedges in the USD 32,000 area are strengthened, highlighting the importance of technical support which in the last month has repeatedly proved to be at a crucial level that must be protected in order to not risk seeing prices revisiting the January lows.

Ethereum (ETH)

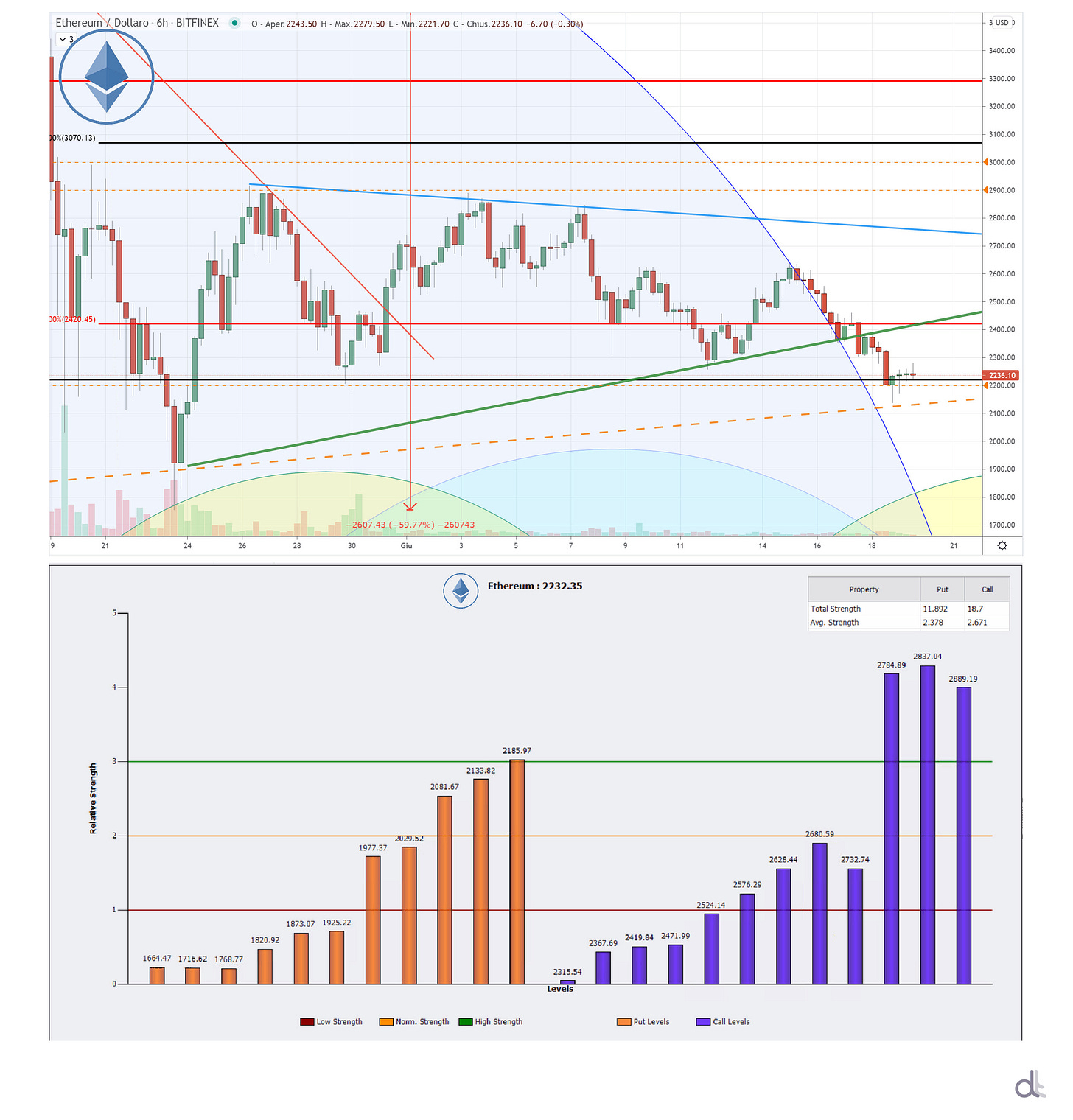

Critical phase for Ethereum prices which returns to highlight a more pronounced weakness and which in recent days has brought prices back to test the dynamic support that since the end of December 20 has been able to support the long-term positive trend. The return of prices on the USD 2,200 area brings the bar back to a possible test of the 50% Fibonacci retracement calculated by taking the lows and highs of the last 15 months as references. Failure to hold on to these levels would open room to revisit the lows signed at the end of May in the USD 1,800 area. If on Sunday, June 20, prices are going to close below USD 2,500, it would result as the second consecutive week having a downward trend . This event has already happened twice since the beginning of the year.

ETH Options

The options strategies recorded an increase in the hedging of Put positions (downward) decreasing the Put: Call ratio to 1: 1.7, a sign that professional traders are not intimidated by the weakness that is characterizing the trend during the last days. On the upside, however, 90% of medium-term Call option hedges are concentrated in a strike range between USD 2,700 and USD 2,900.

Art on Decentraland

The three-dimensional navigable world where you can buy "Land" it welcomes artists, art galleries and auction houses.

Art exhibitions on NFTs are increasingly gaining ground among the protagonists of the physical world, galleries, artists and auction houses do not miss the opportunity to be digital pioneers in a sector that still struggles to understand what a non-fungible token is or questions about the possible speculative bubble.

And if the sales platforms are crowded , others are welcoming the first exhibitions.

Between these , there is Decentraland, a platform based on the Ethereum blockchain which is been developed aiming to create a virtual world where users can have complete control over the content they create and share, giving them all the tools to autonomously monetize the work they have done.

The platform is represented as a three-dimensional world that can be navigated by users using the browser or through the virtual reality viewers.

The world is divided into 90,000 Lands , which represent the digital spaces that users can buy, sell or rent to share their contents.

All interactions within the platform are mediated through a token called MANA, whose value has grown by more than 180%.

Among the first to arrive and build on Decentraland is the famous physical gallery ‘’König Galerie’’ which has reproposed his structure in St. Agnes (Berlin) hosting the collective exhibition “The Artist is Online. PITTURA E SCULTURA NELL’ERA POSTDIGITALE "curated by Anika Meier and Johann König with over 50 young artists, who work daily on physical media, managing the new digital experimentation in the form of NFT.

"For us it is important to demonstrate that digital art is something that has the same qualities as painting and sculpting" said Anika Meier, curator of the German gallery, who took care of the project.

Even the Sotheby's auction house did wasted no time and few days ago they inaugurated their own metaverse, replicating the physical headquarters of New Bond Street in London.

The virtual gallery is located in the Voltaire Art District of Decentraland and can be found using the map coordinates 52,83; the building has five spaces on the ground floor to display the works, and it has as well as a digital avatar of their London commissioner Hans Lomulder who greets visitors at the door.

"We see spaces like Decentraland as the next frontier for digital art where artists, collectors and viewers can interact with each other from anywhere in the world and showcase art that is fundamentally rare and unique, but at the same time accessible to anyone who wants to discover it" he says. Michael Bouhanna, head of sales at Sotheby’s.

While the MoCDA - Museum of Contemporary Digital Art has just inaugurated the personal exhibition of the digital artist Marja Moghaddam “Digital Embodiments and interventions” curated by Filippo Lorenzin.

The artist, who has been working in the field of digital art since the 1980s, after winning the Art Rights Prize for the Digital Art category, was selected by Serena Tabacchi Director of MoCDA to present a selection of works that explore creative potential of 3D Computer Graphics, motion capture, Augmented Reality and Virtual Reality, just to name a few.

Exclusive interview with TokenAngels, a leading collector of NFT and crypto art

1) When did you start getting interested in NFTs and why?

In 2019, one year after the start of the crypto bear market, I asked myself which sectors potentially could have contribute to the growth of Crypto and I immediately thought about gaming, so I began to participate in some conferences in London & Honk Kong (mainly dedicated to blockchain gaming ) ,during which I had the possibility to meet the pioneers of this industry , platforms such as OpenSea, NonFungible, SandBox and their slogan was “it’s been love at first sight".

I even remember that on the return flight from HK I saw Ready Player One, and between one gin and tonic and the next I really think I had an enlightenment, it must have been the effect of the juniper or the closeness to God …

2) Can you tell us your favourite projects and artists that you have invested in?

My name suggests that I am an angel investor, in fact I have invested in about ten NFT projects but for confidentiality I always prefer not to make them public.

My NFTs investment are obviously visible on the blockchain, just check my wallet.

Let's say that I am mainly interested in art and collectibles. A little less for the moment in VR and gaming.

I mainly focus on those projects and artists which founded the CryptoArt niche , which according to me it goes from about the year 2016 to the end of 2019.

Above all I am proud to have collected 4 of the 7 unique RarePepe, including the Famous HomerPepe, many CryptoPunks, among these I have 1 of the 8 zero traits, 1 of the 24 Apes and 1 of the 11 six traits (which among other things is the CryptoPunk with more hidden traits). As for the artists, I have a particular passion for Matt Kane, with whom I have launched the project

Volatility.art , which is a programmable work that changes daily depending on the Bitcoin price and it will mint 210 NFTs over the next 10 years . You can visit the 3D installation on CryptoVoxels. Of course I can't fail to mention Sarah Zucker, Xcopy, OficinasTK, Max Osiris, MLO, Joy.

And for what is concerning Italy, which has made and continues to make a fundamental contribution to this industry and to NFTland in general, in recent years I have collected works by Mattia Cuttini, Hackatao, hex6c, Federico Solmi, Paola, Pinna, Ablu, etc.

But there are many other talented artists that I have not yet had the opportunity to collect , that’s why I indeed invite you to follow them on their social media as Twitter (yes, because this is where CryptoArt communicates), Instagram and if you have Telegram, follow the numerous channels including R.I.O.T.

3) What do you think of the boom that NFTs are having now? Are we in a bubble?

I strongly believe in the tokenization of assets, both digital and physical, so I am very confident about the future of NFTs in general.

The NFTs , especially with regard to art, have given artists the opportunity to make themselves known around the world and have brought many people closer to art. In fact, collectors in addition to acquiring a certain "status"they can also interact with artists and become real patrons as well as creating friendships which lead to collaborate on new projects all together.

Obviously I would say that 90% of the money spent on NFTs comes from earnings made in crypto , so even in the NFTs space you can find projects developed exclusively to raise quick funds and run …those projects sometimes are just pure hype becoming bubbles and bursting truly quickly .

There are many influencers in this space which are promoting projects just for raise funds, which allows them to allocate fresh cash in other new projects with the only idea to dump on new investors (rinse & repeat ).

That’s why I focus solely on OG projects as RarePepe, Punks, Autoglyphs . Nobody can change the history… So ... watch out for pinball machines

4) Since you have been in the industry from the very beginning, what did you think when you heard about the investment of almost 70 milliondollars in Beeple?

Well, let's say I would have liked to see a CryptoArt founder as first artist in a house

auction. Fortunately, this is happening this week on Sotheby's.

The record selling has certainly caused NFTs to be spoken about all over the world but it has also alienated the traditional collectors who considered it a joke.

What I am expecting to see is that retail investors which has never been involved in crypto will start purchasing and endorsing NFTs ,it would substantially speed up adoption and awareness on this new form of Art.

5) how do you see the future of NFTs 5 or 10 years from now?

I believe that NFTs can become one of the most important asset classes in the entire world , it can and it will fit perfectly in the virtual world economy togheter with the regular economy.

I hope NFTs will become smarter, that they will communicate with each other and that they will be used in more ways but above all reasons I hope NFTs will allow anyone to feel part of the community and to express their own creativity.

We know that Italy has given so much to the development of civilization, so I hope also in this case each of us will give his contribution for the future digital world that will come , because at the end Metaverse without a touch of Italianity would not be absolutely the same.

Let’s Connect

DeFiToday is A FREE weekly newsletter covering all the top stories in DeFi:

Bitcoin, Ethereum and DeFi Charts

Esclusive Interviews

Curated content from industry leaders

Join our Telegram Channel - Follow us on Twitter - Subscribe