Ethereum Towards New Highs

Technical structure and traders' strategies in favor of new highs for the queen of altcoins

"With e-currency based on cryptographic proof, without the need to trust a third party middleman, money can be secure and transactions effortless."

Satoshi Nakamoto

Non Fungible Token

In the latest report, "The metaverse Web 3.0 Virtual Cloud Economies" from investment firm Grayscale, the opportunities that will arise with the metaverse world are examined. These opportunities are difficult to assess even in their exponential application, as the current technology can speed up processes that took slower in the development of previous technologies. That's also due to the different needs of users that only a few years ago were destined for a few people accustomed to technology and with computer systems lacking applications that acted as a bridge between development and application.

Without going back again to topics already discussed and anticipated in this newsletter, we state that the world of Metaverse will assume an increasingly important and, in some ways, 'intrusive' role in our reality. This aspect will continuously fuse the real world to the virtual one through augmented reality.

For many, it may seem like a distortion, while, instead, it will be an extension of what we are used to experiencing today. Many years ago, the first experiments in 'digital life' such as Second Life offered the possibility of creating a parallel identity, living in a world relegated exclusively to that context and without the possibility of interacting with other platforms.

In the near future, now already underway, avatars will be interoperable between the various virtual worlds, which will necessarily have to distinguish themselves rather than offering similar solutions, risking creating confusion among users. And not only. Today, the first traffic problems are beginning to be encountered with the need to implement the software aspect and the hardware aspect to allow the network to withstand data processing.

This challenge is already underway and is leading companies specialized in components such as Nvidia, the leader in graphic processors for the gaming market, to dedicate new solutions to study and development sectors. To understand the sector's potential growth linked to the Metaverse, it's enough to observe how investors - not only in the crypto sector - are observing and betting on the ecosystem that, as in the case of Nvidia, embraces historical companies in gaming.

Since the beginning of the year, the shares of the fintech giant, with a rise of over 140% and an appreciation of over 220 USD, going from 120 to over 340 USD in just 11 months, are recording their best year since 1999, the year of listing on the American Nasdaq list.

In particular, the rise has been concentrated over the last two months. From the beginning of October, when the quotation was just under 200 USD, the recent ascent has led prices to exceed 346 USD, setting an all-time record. A period where the word Metaverse has risen to prominence, thanks in part to Mark Zuckerberg's announcement.

Investments, both indirect by financial operators and traders and direct to implement the production, will be increasingly massive. Giants such as the former Facebook, in short Meta, will try to take a leading role in the change already underway. But the real challenge will be played on blockchain and decentralized protocols. And the signs are already evident.

After last week's success of the exhibition "Lugano NFT: Non-Fungible Tangible," which registered a success in terms of attendance higher than any best expectation with the issuance of the first NFT by the Swiss Municipality of Lugano, this week is repeated with another exhibition: DART - Dynamic Art Museum - Crypto Art is Now, at the Museo della Permanente in Milan (Italy) opened from November 23 until February 6, 2022.

An innovative museum project, conceived by Piergiulio Lanza and Arch. Riccardo Manfrin, in collaboration with Wrong Theory and Alessandro Brunello, Alan Tonetti, and Serena Tabacchi. The exhibition consists of two areas. The first one is dedicated to "Masterpieces from Private Collections," with a careful selection of iconic works by Masters of all times, coming exclusively from private collections and foundations. The other will host "2121", the first museum exhibition in Italy dedicated to Crypto Art, an exhibition based on the interaction between human beings and the digital world. There will be 72 international artists, from Beeple to Hackatao, from Federico Clapis to Giovanni Motta, from XCopy to Pak, and many other famous artists such as Sinclair, Fabio Gianpietro, Raphael Lacoste, Skygolpe, Dangiuz or collections such as those of RarePepe, CryptoPunks, and Bored Ape Yacht Club.

It is possible to consult the program with the proposed events at the link: www.dartmilano.com.

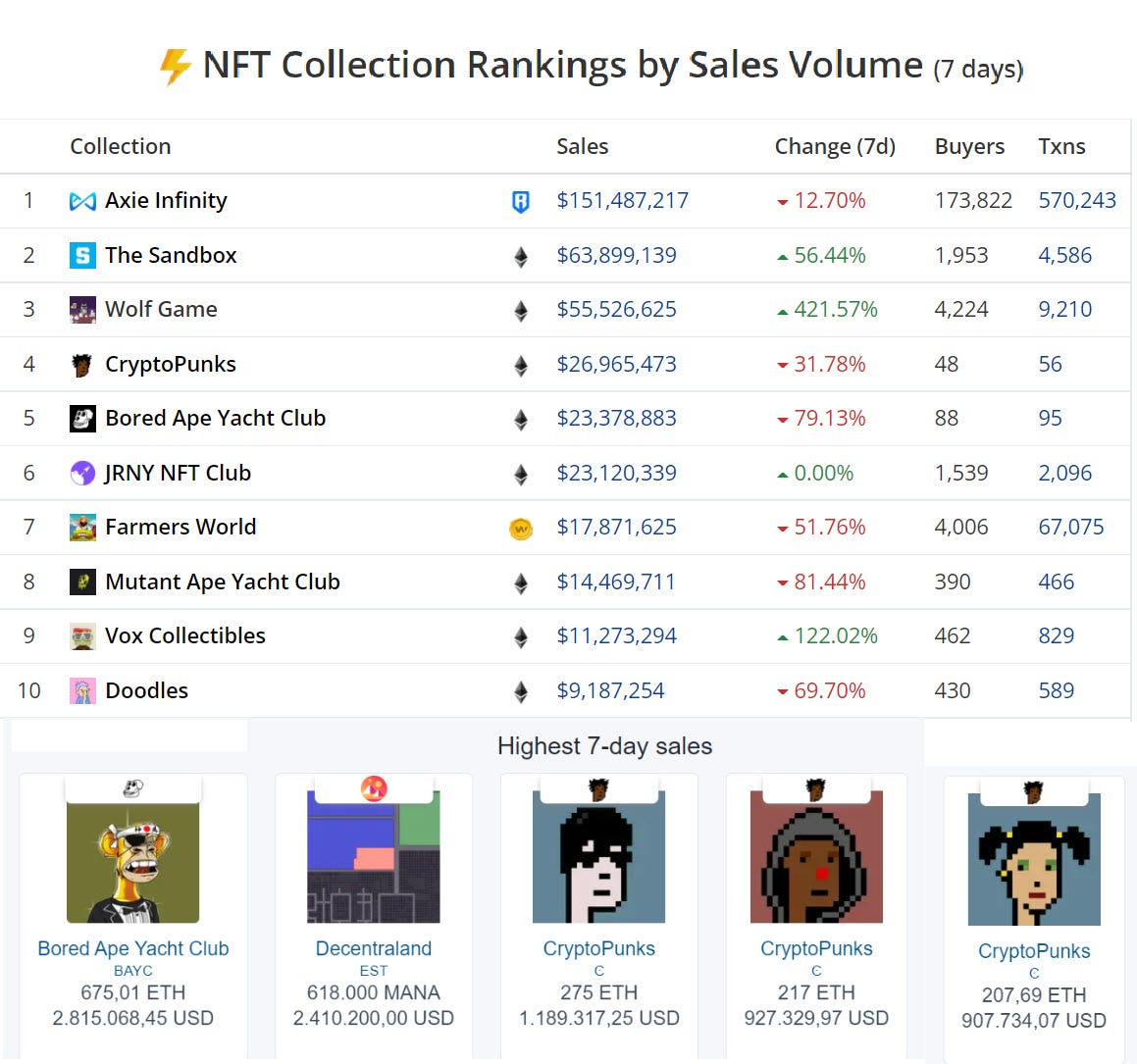

The week has been feverish for the record volumes traded on platforms related to the world of Metaverse. The Sandbox, with more than $64 million traded in the last 7 days, takes second place in the ranking, behind Axie Infinity that, despite a cooling down of trades by 10% to $151 million, maintains the undisputed leadership. For The Sandbox, this is the highest volume ever, with the peak reached on the record day of November 23, where in just 24 hours were traded over $ 12.4 million.

The Sandbox is an augmented virtual reality game created on the Ethereum Blockchain. The platform allows users to create, build, buy and sell digital assets in the form of content and applications, allowing them to combine Non-Fungible Tokens with the Decentralized Anonymous Organization. In this virtual reality, referred to as the "Metaverse," users can purchase plots that they can browse, build, and monetize. These plots are basically 96×96 meter (virtual) plots of land each.

The SAND utility token is used to acquire NFT in the platform's Metaverse or to purchase equipment, customize one's character, play special video games, and more.

Since the beginning of the year, the price of SAND has been rising more than 18,000%, among the top five tokens of 2021. On November 25, SAND's price hit an all-time high at 8.48 USD.

Among the 5 highest auctions of the week in second place is that of plot #4339 located in Fashion Street. That's the first sale of this plot for 618,000 MANA - the utility token of the Decentraland project - or $2,410,200.00 setting an all-time record for this decentralized 3D virtual reality platform consisting of 90,601 plots of land. Decentraland is defined as a virtual reality platform created on the Ethereum Blockchain that allows users to purchase virtual pieces of land where they can navigate, create, experiment, and monetize content and applications.

With a rise of 6,000% since the beginning of the year, the MANA token enters the top 10 best of 2021. Over the past week, MANA set its all-time high at $6.1 on Thursday, November 25.

The top spot for the highest sale of an NFT in the last week goes to the rare image #544 of Bored Ape Yacht Club's Sushi Chef Headband with the sought-after "Solid Gold" fur trait, awarded for 675.01 ETH or $2,947,231.50. That's the second-largest sale for a "Solid Gold" monkey from the BAYC series, awarded by Twitter user 'SaintBayview.' The buyer expressed his happiness in a tweet immediately after his purchase.

The BAYC monkey series is stimulating more and more buzz and interest with new participants since several rumors are increasingly taking for granted the launch of the native APE token early next year.

The Paris Saint-Germain Fan Token returns to increase trading volumes despite the recent disappointment in the French club's Champions League match. The trades for the fan token of the Turkish club Trabzonspor rose by 80% with over $86 million, dragging up the price of the token that on November 21 touched an all-time high of over 7 USD. Of the Italian football clubs that had occupied the ranking in the last two months, only AC Milan manages to remain in the top five. In the last week, $56 million was traded, and an increase of 20% was recorded, with the price of the token just above 6 USD, the lowest level since last June.

Decentralized Finance

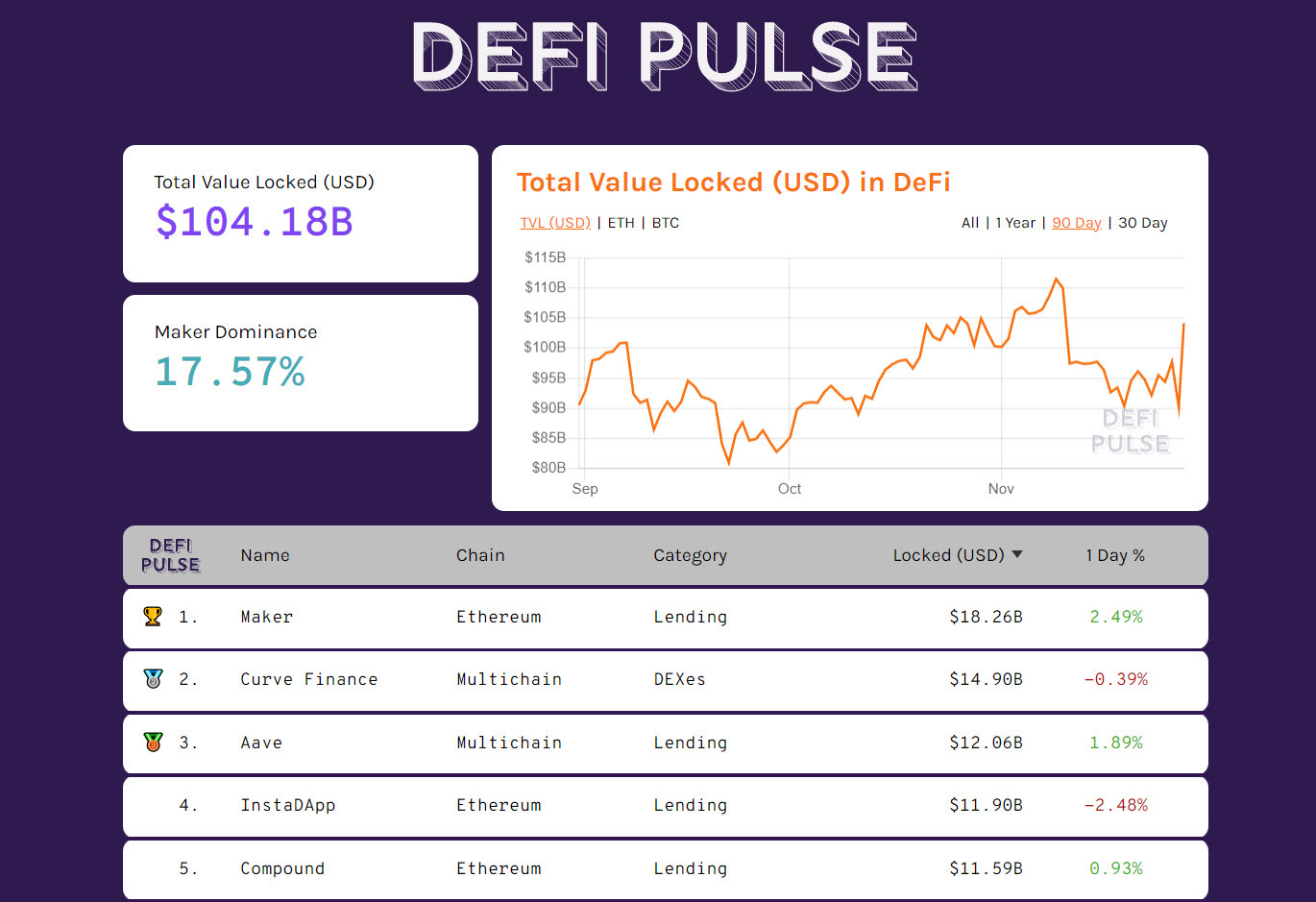

Despite markets continuing to slide for the second week in a row, the value of capital locked up on Decentralized Finance 1.0 protocols remains above $100 billion. Evidence that the sector remains robust, confirmed by the number of ETHs above 9.7 million, the highest peak since November.

The number of Bitcoins tokenized on the Ethereum network also rises, increasing to 226,971 BTC for the first time. Maker's Project regains the top spot with $18.2 billion, followed by Curve Finance at $14.9 billion and Aave at $12 billion. The longest-running decentralized credit platform, MakerDAO, the first to create and support DAI, the digital stablecoin whose value is pegged to the USD, during the week recorded a TVL above $19 billion; the highest value locked ever.

The Total Value Locked of the decentralized protocols of DeFi 2.0 also rises to $88 billion over wrapped BTCs the total value returns to $258 billion, as certified by DefiLlama.

The weekly volume traded on DEX 1.0 rises to a value above $28 billion. As predicted in recent weeks, average trading remained high even in the second half of the month, just hours before the close, with the volume traded in November exceeding $126 billion. That's the second-highest volume spike ever, lower only than last May's record high of $174 billion.

The stablecoin market continues to swell, with a total capitalization exceeding $130 billion for the first time. Even if Tether continues to maintain the dominant position in the sector, capitalizing over $74 billion or 49% of the entire market, the exponential growth of USDCoin continues, which in the last few hours rises for the first time over $38 billion in capitalization.

A growth that since the beginning of the year marks an increase in capitalization of about 10 times. The topic of stablecoins remains hot for central banks and governments in an attempt to understand more and more how they are used and how they work. With the growth of capitalization also increases the importance of identifying possible threats to the U.S. dollar and the need to evaluate the regulation of these new technologies without interfering in the choices of users who, more and more, use the new payment systems. These days, U.S. regulators have already set the timetable for 2022 to deepen and define the regulatory parameters to protect consumers.

The NFT Magazine: second drop with Coldie on the cover on sale on December 2nd

The NFT Magazine, a new project created by The Cryptonomist and the Italian company ArtRights, will launch its public sale for the magazine's second issue on December 2nd on OpenSea.

The artist who has the design for the cover this time is Coldie, who was voted onto the Readers Club by the readers of The NFT Magazine. In fact, NFT Magazine holders have access to a special section where they can vote and decide the project's future.

During the public sale that will take place on December 2nd on OpenSea, each copy will be sold for 0.05 ETH.

The NFT Magazine organized a private sale for the Readers Club members in the past few days, which sold out with about 200 copies, so now about 500 copies are left for the public sale.

The NFT Magazine first issue with Hackatao

The first issue of The NFT Magazine was sold on November 2nd in less than 24 hours, selling 500 copies.

The first issue had Hackatao cover with a pre-sale of 0.03 ETH and a public sale at 0.05 ETH. The price on the secondary market is growing fast, and it is now at 0.138 ETH, with a spike that arrived at 0.149 ETH.

Cryppo airdrop for magazine holders

Those who have bought the first two issues of The NFT Magazine will then benefit from having a free mint of the NFT of Cryppo, which is a series of collectibles that depicts the mascot of The Cryptonomist in 7,777 pieces and over 90 different traits.

The team explained in the roadmap that a DAO would arrive in the next future, with a governance token to be released for votes.

NFT Magazine details

A few days ago, the contents that readers will find inside the magazine were also revealed: not only the cover and an exclusive interview with Coldie, but also an analysis of trends in collectibles; a top 25 of the best projects, a top 10 of the best collectors and their interviews and much more.

While the first drop of the magazine had a limited edition of only 500 copies, this second edition will be in 700 copies. Unsold copies will be burned to ensure the rarity of the NFTs.

How to buy The NFT Magazine

As is common with the NFT world, The NFT Magazine (but also Cryppo) will be on sale on Opensea. To buy these non-fungible tokens, you will need to have Metamask or another wallet compatible with Wallet connect (e.g. Eidoo) and some Ethereum to spend. Please consider that The NFT Magazine price is 0.05 ETH, but you will also need to pay gas fees.

Moreover, both NFT Magazine and Cryppo will be sold for a fixed price (no auction).

5 hottest DeFi news of the week

1) “2121”, Italy’s first museum exhibition on Crypto Art opens alongside masterpieces from the past

2) The NFT Magazine: 2 December drop with Coldie on cover

3) Giovanni Motta and his success in the NFT world

4) DeFi TVL hits new highs while Metaverse tokens show signs of exhaustion

5) DeFi privacy project Panther raises $22M in 1.5-hour public sale

Technical Analysis

Bitcoin (BTC)

The price trend in the second half of the month perfectly confirms the assumptions developed in the updates of the last three weeks. With the latest downward movement that developed over the weekend, the price of Bitcoin extended just below the area of 54,000 USD (1), the target level identified in the last analysis.

Despite the lower trading volume that characterized the weekend, compared to those traded in the previous days, the increase in purchases recorded as prices tested the 54,000 USD (1) area is currently making prices bounce upwards with the recovery close to 10%.

At the moment, it is too early to understand if, with the recent lows (1), the closure of the 1 and 2-month cycles identified in recent weeks has been realized. If so, it could be defined perfect, in the timing! But for more confirmations, it is better to wait for the following hours. To follow the updates, we suggest subscribing to the free telegram channel of DeFiToday.

Levels to monitor next week:

° Upside: resistance areas can be monitored again. The overcoming of 59k first and then 60k (2) would provide the first signal of the beginning of the new monthly cycle. If this movement were to occur, then it will be necessary to recover the 61k USD (3) and begin developing all the hypotheses of the new monthly cycle to understand strength and intensity.

° Downside: a return below 53,500 USD (4), the area of double minimum marked in the last 72 hours, would indicate that the monthly cycle is not over, once again raising the hypothesis of a return of prices to test the crucial medium-long term support positioned between 49k and 52k USD. It is important to remember that despite the decline of the last two weeks that has caused prices to slide more than 20% from the tops of early November, the medium to long-term technical structure still remains solidly set to the upside.

BTC Options

The recent price lows coinciding with the expiration of monthly derivatives have once again caused operators to reposition their strategies. They have returned to buy Put options providing the first signs of a trend reversal that in the last 24 hours has timidly returned with a price rebound. The ratio between Put and Call has risen to 1:2, confirming that the 56k USD area continues to be particularly attentive. In fact, despite the slide just below 54k USD, positions covering 56k USD continue to be the most used by operators. On the upside, operational strategies are spread between 63k and 68k USD. That's the wide-area to be broken down in order to go back to new highs.

Ethereum (ETH)

The technical picture of the queen of altcoins turns out to be better. The decline of the last few days brakes the loss to -19% while Bitcoin extends over 22% and the holding of the levels of the last 30 days (1), while for Bitcoin, the lows of the beginning of October have been revisited.

The reaction of the last few hours also draws a double minimum, creating buying opportunities and rebounding quotations over 11%, recovering in a few hours the descent of the weekend.

Better technical structure also in the medium-long term. Considering the last two-month cycle started with the double minimum of late September (2), the recent decline has not gone beyond 40% of the Fibonacci retracement. Instead, taking as reference the minimum of last July, the beginning of the current six-month cycle, the Bear's scratch stops at 25%. That's a clear sign of an excellent long-term bullish trend, confirmed by overcoming the relative highs of last week in the area of 4,550 USD (3). A technical indicator that shows the beginning of a new monthly cycle.

Levels to be monitored next week:

° Upside: breaking the previous relative high (3) projects quotations to the 4,800 USD area. A landing with the support of new buying volumes increases the probability of updating the historic highs reached in the first ten days of November. If the realization of this technical hypothesis occurs in the coming days, the new monthly cycle will see the first bullish target in the 5,000 USD area (4).

° Downside: unlike last week, the current setting drives away the bearish clouds, raising the levels of attention in the 4,000 USD area that coincides with the area of the recent double minimum (5) made in recent days. Only a return below this level will bring back the fears in favor of new declines.

ETH Options

The protection of the support levels with the Put Options positions indicated last week had repelled the decline, triggering a rebound that has brought the quotations back to a step away from the absolute records. The upward movement that started from Sunday's minimum has definitely changed the strategies of the derivative operators that now are decidedly supporting the upward movement, with a ratio between Put and Call of 2.2:1. Analyzing the strikes on the downside, we have confirmation of the importance of holding the support at 4K USD, while on the upside, the overcoming of 4,750 USD at the moment finds no other useful barriers to prevent prices from rising towards new records.

Disclaimer

The analysis presented exclusively reflects the author's point of view and does not represent operational advice or a trading signal and should not be seen in any way as a service of financial advice or solicitation of public savings and should not be taken in any way as a service on which to base investment decisions.