Ethereum is Unstoppable

Massive increase in purchase volumes drive Ethereum to record new highs. Record-breaking debut for Meebits with NFTs.

Every informed person needs to know about Bitcoin because it might be one of the world’s most important developments.

Leon Luow - Nobel Peace Prize 1951

What is happening in the crypto world in these early months of the year seems to consign the past to another era. Today's numbers not only make those of 2017's best glories pale into insignificance, but they are starting to write a new era that, although it may seem slow, is beginning to unite the traditional financial world with what we can call cryptocurrencies.

Even the famous saying 'Sell in May and go away' seems to be out of tune with what is happening in these last few weeks that are increasingly in a state of fibrillation, both for the news that awaits us in the coming months and for the numbers that continue to grow at a rate that multiplies exponentially.

We are living through a historic phase that has never happened before. A year after the start of the crisis, caused by Covid-19, the world's central banks are making decisions based on projections that have no parallel in the past. Officially, we are in an abnormal recession (reduction in productive activity and contraction of gross domestic product), with household disposable income rising - rather than falling, as has always been the case in economic downturns - caused by the distribution of government subsidies with an action and power never seen before. These decisions are creating inflation (a reduction in purchasing power) that is difficult to interpret in future developments. The US Federal Reserve considers the current inflationary phase to be contingent, as it is caused by the ever-increasing increase in raw materials, while the markets are suggesting that prices will rise in the coming months due to the massive injection of liquidity. The subsidies showered on American households seem to be partly the cause of the rise in US stock markets. Liquidity in people's hands leads to consumer spending but also to investments in the stock markets. Not only that, but this time part of it is being used to buy cryptocurrencies, particularly bitcoin, which is increasingly seen as an asset to protect against inflation and loss of purchasing power.

Not only retail, but also American and investment companies are increasingly trusting digital gold, which is intended to diversify the cash available in their coffers and protect against a subsequent devaluation of the fiat currency.

In recent weeks, Ethereum has also begun to diversify in the eyes of investors. The growth in trading on the derivatives market has highlighted the interest of institutional investors. Less than two months after the introduction of the update to EIP-1559, which will change the mechanism of fees paid to miners, the percentage of distribution of the new issuance (which will partly be destroyed), is causing real deflation. Although different, it is similar to the principle governing Bitcoin's monetary policy, which tends to cut new issuance in half every four years.

Unlike past crises, investors today have access to easier and more immediate ways to protect purchasing power, but not everyone feels ready to embrace technology and the fear of making mistakes and losing access keys, or more importantly, not knowing how to adequately protect their data, is driving many companies to rush into offering proper custody products, thus providing access to those who do not yet feel ready to become independent.

In recent days, Patrick Sells, head of banking solutions at cryptocurrency custody firm New York Digital Investment Group LLC (NYDIG), which already works with cryptocurrency giant Fidelity, and which recently started backing JP Morgan Chase's fund, said that hundreds of US banks have already signed up for their Bitcoin buying, selling and holding programme through banking relationships and are ready to launch their own services in the coming months.

For many Bitcoin fans, this moment was long overdue, while for others, it remains at a stage of quiet indifference, for many it is just the beginning. It doesn't matter what stage you are in, the important thing for you is to accept that the new dimension has already begun. Those who don't, will find themselves having to chase the change, as has happened with every epoch-making technological breakthrough, initially intended for a few and then quickly becoming an indispensable objective for the masses.

Decentralized Finance

With over $19 billion traded in the last seven days, it is a new weekly volume record. The launch of the new V3 version of Uniswap contributed to this, with over $96 million traded on the first day. The leading decentralized exchange platform (DEX) for the first time surpasses $10.2 billion in volume over the past seven days for over 253,000 unique trades, maintaining over half (Dominance: 54.7%) of the entire DEX market share. Investors are taking advantage of this to take profits. In the hours of the launch of the new platform on Wednesday, 5 May, the price of the UNI token of Uniswap touched 45 USD, the historical record set two days earlier, where profit-taking began to prevail and in the last few hours lost 15% from the highs, bringing the quotations back to test the previous resistance, now become support, in the 38 USD area.

SushiSwap is also on the rise with $3.2 billion, the second most used platform by traders and occupying 17% of the entire DEX market.

Should the trading trend continue in the coming weeks, the month of May will project new all-time highs in DEX trading after the recent record high in April which, thanks to momentum in the final days of the month, pushed the total volume traded on DEXs to $77.4 billion, surpassing the previous record of February 2021 by over $300 million.

Total Locked Value (TVL) on the decentralized finance platforms broke new all-time highs as it climbed over $78 billion. The number of locked ETH fell by around 300,000 units to 10.3 million, the lowest level in the last month, while the number of tokenized bitcoin rose above 166,000 BTC. This is the highest peak since the end of February.

Maker confirms its leadership among DeFi protocols by climbing above $12 billion in countervalue of collateral held for the first time. This week, another project broke through the $10 billion TVL wall.

Thanks to its new staking and user reward scheme, Aave is now the second-largest decentralized platform.

Compound came in third, just a few million below the $10 billion mark. On 12 April, Compound's protocol was the first to cross the $10 billion barrier of collateral locked in the DeFi project.

Non-Fungible Tokens

In a week that has seen a resurgence in volume for most marketplaces, Meebits has made its debut with more than $45 million in sales in less than a week. The creators of CryptoPunks are creating 20,000 new next-generation 3D human-like avatars created on Ethereum's ERC-721 Blockchain standard, available on any compatible exchange service and in Metaverse applications.

CryptoPunks are the second most traded market of the week with over $33 billion, double last week's volume.

Following in third place is the NBA Top Shot marketplace with $13.5 billion, down in trading volume for the second week in a row.

The week's highest selling CryptoPunk Zombie 2066 sold for 500ETH at an exchange rate of $1.4 million. Meebits' 3D avatars sold for between 395 and 420ETH, equivalent to between $1.3 and $1.4 million.

Sotheby's auction house has announced that it will become the first to accept bitcoin and Ethereum as a means of payment for physical works of art. The debut will feature the famous "Love is in the Air", one of the most iconic works by street artist Banksy, whose identity, like that of Satoshi Nakamoto, remains unknown.

5 hottest DeFi news of the week

Binance NFT marketplace in partnership with Alphonso Davies

Uniswap launched its Version 3 platform

DeFi is more disruptive to banks than Bitcoin, says ING

Wirex to add its token on Ethereum in DeFi push

Goldman Sachs to offer Bitcoin derivatives

Technical Analysis

Bitcoin (BTC)

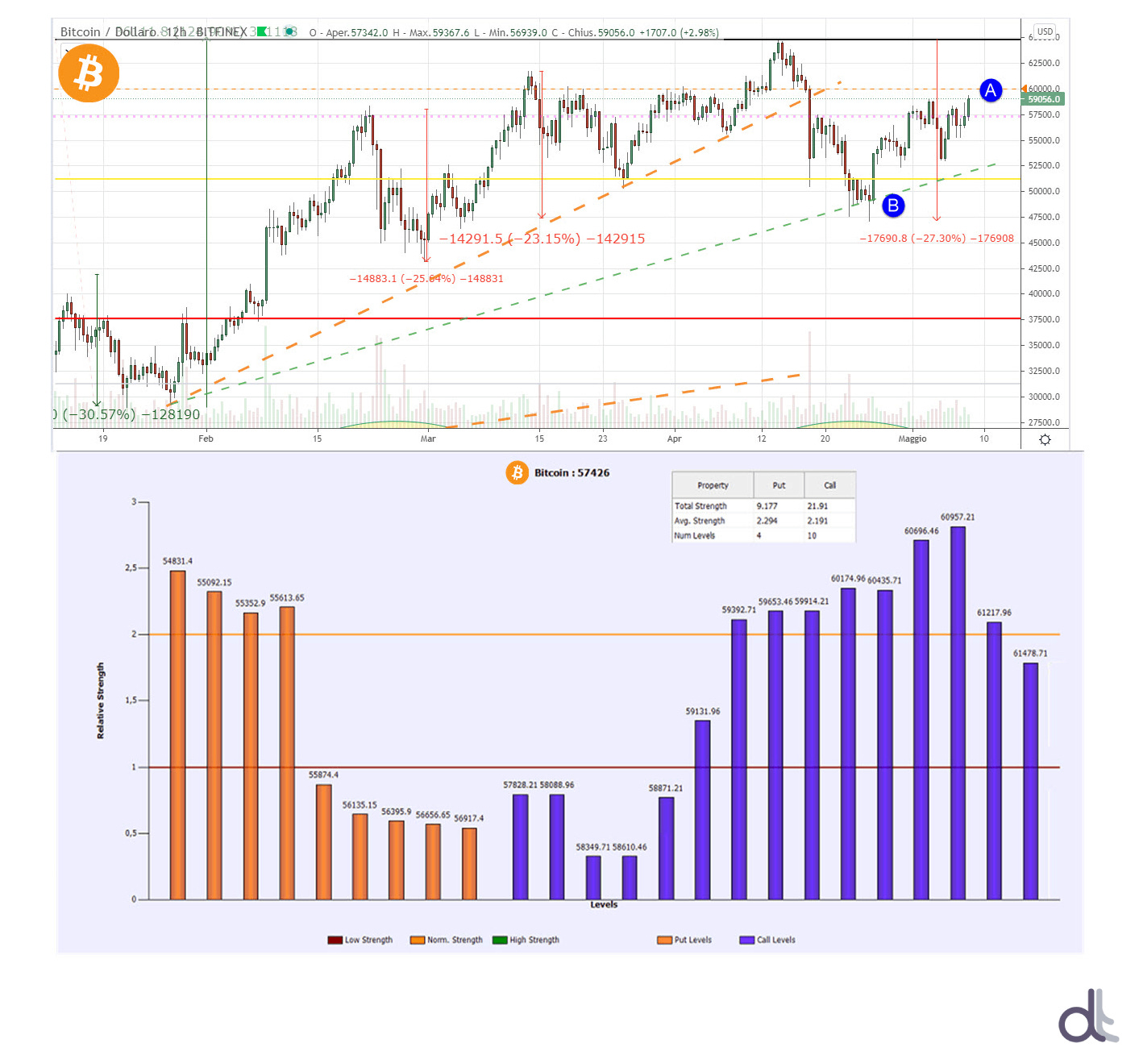

The first week of May is set to close on a positive note, albeit with less intensity than the previous week, which has repaired much of the descent experienced throughout April. The price fluctuations, which have seen prices move within a range of 600 USD (around 10%) throughout the week, keep the technical situation uncertain without providing clear indications useful for understanding future developments. With the exception of a five-day interlude (from 13 to 17 April), the price of Bitcoin has repeatedly tried to break through the psychological, now technical, 60,000 USD (A) mark. A healthy price consolidation is needed before trying again and not risking the low volumes. It is important not to give way to the threshold of 48,000 USD (B), a level tested during the descent that ended on 25 April when purchases returned.

The slide of dominance below 45%, the first time since July 2018, should not be interpreted as a weakness of Bitcoin but a period of strength of the Altcoins that are experiencing a new upward momentum again. In fact, Bitcoin's capitalization continues to remain above the trillion dollar mark. This level was first breached last February.

BTC Options

Volumes continue to fall not only on the spot but also on the derivatives markets with futures open interest down 30% from the mid-April highs and options positions left open overnight down 25%. The strike of 60,000 USD remains the most used barrier to cover a return of bullish force even if positions fall to 14.3 thousand from 17.8 thousand Bitcoin last week. If this signal is confirmed next week, it will show a change in the strategy of professional operators who are less defensive towards a new upward extension. Currently the 1:2 ratio in favor of Call (up) highlights the prevalence of strategies in favor of caution of operators who prefer to take advantage of this period of congestion by using the sale of Call options to cash immediately liquidity to be used in the short term.

The holding of Put positions (downside) of the strike of 50,000 USD remains the barrier to be knocked down in case of price descents below this level. The previous attempt to fall on 25 April highlighted the importance of this technical and operational support.

Ethereum (ETH)

Ethereum's climb continues to show excellent health for the queen of altcoins. Closing positive on the upside for the sixth consecutive week with numbers slightly lower in percentage (+20%) and price (+600 USD) than those recorded last week. In just two weeks, the price of Ether has gained more than 50% or over USD 1,200. This is a performance of unprecedented intensity. Previously, only twice before, both in 2020, did Ethereum show sustained rises for over 6 weeks, albeit with much smaller numbers than today. A moment of glory for the leading Altcoin is also confirmed by the high trading volume in both the spot and derivatives markets.

Since the beginning of May, the daily trading volume on the major trading platforms, calculated in US dollars, has exceeded Bitcoin's volumes. On Tuesday, May 4, daily trading volume on major exchanges exceeded $23 billion for the first time, while aggregate volume on derivatives futures rose to $89 billion. New absolute records for both markets.

Futures Open Interest also rose to over $10 billion and options OI rose to over $6 billion.

Technically, the structure of Ethereum remains solidly set to the upside without any danger signals. In the short term, only a return below 3,200 USD (A) would trigger a first alarm signal, while for the medium-long term the threshold to be monitored remains the 2,500 USD (B) area, the previous resistance that has now become support. This level is 30% away from current prices.

The recent price rally stopped just short of the next Fibonacci extension level, which is in the USD 3,600 area (C). This is a clear signal that secures the recent price rally even if possible corrections should not be ruled out, which in a parabolic phase allow ample room for manoeuvre without compromising the uptrend.

ETH Options

In a strongly bullish phase, there are no particular strategies of the professional operators. The only difference from last week was the shift of the first protection from USD 2,500 to USD 3,200. In fact, the only two strikes particularly traded are those of 3,200 USD on the downside and 5,000 USD on the upside. The latter will be the level to continue to observe for the next few weeks if the uptrend returns.

OVR: a new way to experience NFTs in real life

DeFi Today interviewed the COO of the Italian project OVR.ai, Diego di Tommaso, to discuss its roadmap and recent success in the field of NFTs, featuring an important sale of more than 100k dollars.

When did you start to work on the project? How does OVR work?

We started developing OVR in late 2018, we’ve been building during the whole bear market and finally launched our platform to the public 30 November 2020.

Ovr is the decentralized platform for geolocalized AR/VR experiences. We use NFTs as spatial domains, basically we divided the world in 1.6 trillion 300 sqm hexagons called OVRLands, each one represented by an NFT. Just like in the web, who owns a web domain will control the content over the website, in OVR who owns the NFT representing a geographic location (Spatial Domain) will decide the AR/VR content over there. Some of the major use cases are: gaming, live events, virtual retail, virtual exhibitions, avatars, tourism, real estate showcase, art exhibitions and many more..

What's your biggest achievement so far? Can you tell us some numbers of the app?

We launched our project to the public 4 months ago and we already sold over 250k OVRLands. We have a visualization app for AR/VR experiences downloaded more than 100k times, 5k daily users. On May we launched the beta version of our Builder allowing people to create and connect AR/VR experiences to OVRLands

Recently you sold the Eiffel Tower for $100k, what can the owner do with it?

The owner will be able to connect AR/VR experiences to the Eiffel Tower: tourist experiences, live virtual concerts (OVR allows to create Avatars of artists that can perform live with full body tracking), geolocalized games and all he/she dares to dream creating in AR/VR.

What are your goals for the future?

OVR vision is to enable the Spatial Web, merging the physical and virtual world through geo-localized AR. OVR aims to become a de-facto standard platform to create AR/VR geo-localized AR experiences.

You recently started your art gallery, how is it going?

Our art gallery was a great success, both artists (we inaugurated the gallery with NFT artist Giovanni Motta, Marco Biscardi and Rok Bogataj) and visitors were enthusiastic about being able to browse artworks in a virtual space and being able to interact with each other with their avatars.

One week since the first exposition we already have 20 international artists applying to be featured in our galleries. All of them will be featured in our gallery with a weekly rotation.

Soon artists will be also able to build and publish their own personalized virtual gallery on OVR with our builder. Artists interested to exhibit on OVR galleries can apply with this form: https://www.ovr.ai/live-event/

Binance: “Our goal is to make Binance NFT the largest NFT trading platform in the world”

DeFi Today interviewed the Binance team to understand more about their upcoming NFT platform set to be released in June.

When did you start to work on the NFT platform?

The Binance NFT platform has been part of the Binance strategy blueprint for a period of time. We launched the landing page in April, and the marketplace itself will be launched in June.

What will be the differences of your NFT marketplace compared to the others?

The NFT market in its current form has some shortcomings:

The barriers to entry are still high for the general population.

The NFT transaction fees are high on certain chains like Ethereum.

For some NFT sites, users cannot withdraw their purchased NFTs outside of the platform.

The liquidity for NFTs is low for the majority of the market.

Binance has the largest user base in the crypto world, with users in over 180 countries and regions. Based on the number of users, the Binance NFT platform could attract millions of potential NFT collectors in the world, and Binance will aim to provide the highest liquidity and minimal fees for the users. Binance has the best resources in the crypto world and we have the best technical support to solve such problems.

The transaction fees will be very competitive in the market and at the same time we provide royalty payments for creators so that they get benefit from each subsequent transaction. Users will be able to deposit and withdraw their NFTs freely on our platform, which means they have full ownership. The most critical part is that Binance has the best and largest trading users who will contribute huge liquidity to the Binance NFT marketplace.

Our goal is to make Binance NFT the largest NFT trading platform in the world, in terms of trading volume, user base, and variety of works. Just as importantly, we want creators to experience the best minting, buying and exchanging experience, by leveraging the fastest and cheapest solutions powered by Binance blockchain infrastructure and community.

How many artists will you have in June at the moment of the launch? Will they be exclusive with you?

We will bring onboard many top profile artists upon launch, as we aim to be the largest NFT marketplace. There will be artists collaborating with us at the moment of the launch, and we plan to launch more NFTs which will cover every category. Not all artists are collaborating exclusively with us.

Will it be possible to buy NFTs with credit cards or with all the crypto assets you have on Binance?

Yes, we will support credit cards and more cryptocurrencies to buy NFTs in the future.

Are you working on your own NFTs?

Yes, we are working on our own NFTs.

Join our Telegram Channel - Follow us on Twitter - Subscribe