Ethereum is on Fire

A week of upturns with Ethereum that continues to take over the scene by setting new records. Bitcoin becoming increasingly digital gold.

The training of those who, over the last few years, have approached Bitcoin, as well as the main cryptocurrencies, has been more unbalanced towards technical and IT expertise rather than financial expertise.

Image Source: Kindersley Social

What happened in 2017 during the ICO bubble, the proliferation of new projects that promised IT and social revolutions that would give goosebumps to the cat and the fox of Pinocchio's fairy tale, the two most famous creators of false financial illusions in history, managed to raise hundreds, sometimes even millions, of dollars by exploiting the incompetence of reckless investors.

The recent unfolding of the events we have been witnessing in recent months, particularly since the outbreak of the Covid19 crisis in mid-March, which has affected all global financial markets without exception, including those of cryptocurrencies, is attracting more and more people who want to try to understand the reasons that in the coming months, or perhaps years, will drive central banks in their decisions to support the economy and financial markets traditions.

These decisions are reflected in both professional and independent investors, who want to make increasingly conscious choices and are therefore looking for new financial instruments and assets.

Unlike the previous financial crisis of 2008-2011, which broke out with the bankruptcy of Lehman Brothers, considered the most dramatic event in history for a financial institution, this time there is also Bitcoin, alongside the undisputed gold and silver, considered the most useful instruments to protect purchasing power and the increasingly aggressive inflation caused by the action of the world's central banks whose main objective is to avert a dramatic recession.

This particular interest of investors and speculators in cryptocurrencies and monetary policy could also be seen on Wednesday, a few hours before the conference of Jerome Powell, President of the FED. On a day that was particularly shaky and coloured red, among the few positive signs was the bright green of Bitcoin, which after two weeks put its head back above $11,000.

This rise was then slightly deflated in the following hours by the reassuring words of Powell directed at economists and businessmen. This event had gone almost unnoticed, if not overlooked, by most cryptocurrency investors and market participants until a few months ago. Today, however, it is increasingly an event to follow.

DeFi

After last week's collapse in the total value locked in decentralized finance protocols, the recovery of the TVL calculated in US dollars (USD) continues despite the fact that the price of Ethereum has 'only' risen 2% from last week's levels.

Capitalization is approaching $9 billion again. The merit is due to the increase of Ethereum and Bitcoin locked on the various dApps. More than 7,5 million, a new record, are the Ether locked in decentralized lending, trading and insurance protocols. New record with over 107,000 Bitcoin tokenized using the ERC20 standard, surpassing for the first time a value of $1.1 billion in USD.

Total Value Locked in DeFi

The use of decentralized exchanges (DEX) continues to grow exponentially, raising above $14 billion in 15 days. The previous record set in August was $11.6 billion. A 150% growth on a monthly basis.

DEXes Volume

Despite replication and fork attempts:

the Uniswap DEX remains the undisputed leader, generating over 60% of daily exchanges;

followed by Curve (25%);

and Balancer (7%).

Market Share DEX Volume

5 hottest DeFi News of the week

Total value of DeFi grows of 40% in 5 days

Polkadot established a fund for projects that give traction to the network

Bitcoin supply on Ethereum tops 1 billion

Analysis and Operation

by Federico Izzi

Bitcoin (BTC)

The queen of cryptocurrencies is showing strength again. On a weekly basis, calculated from last Friday's levels, September 11th, Bitcoin achieved one of the best rises and returned to test the 11,000 USD, a level that had not been recorded since the sinking of September 3rd.

In the previous weekly update, I pointed out that recent attempts to break the technical and psychological support of the 10,000 USD were not supported by sellers. In fact, I wrote: "The technical analysis rule indicates that rejecting a test repeated more times in few days of the same level of prices, as happened in this week, indicates the exhaustion of the trend and the intention of inversion of the operators. It seems that this is taking place".

What happened in the last week confirms the rule. The return of the prices over the 11.000 USD is a clear signal that the bearish force did not have more strength.

Now, however, the same is true for the breaking of the USD 11,000 resistance. If attempts to climb above this level in the coming days will not be accompanied by volumes, it will be better to postpone ambitions to review the USD 11,600.

BTC Chart

The upwards hedges remain solid, positioned between 11,650 and 12,420 USD.

The strength of the strike Call 11,900 increases, indicating a barrier to be broken in order to reverse the medium-term (monthly) trend from bearish to bullish. These levels are still worth continuing to monitor.

One week later, the positions to protect against bearish movements increase, even though the ratio between Put and Call options remains 1:3. It is important not to return below USD 10,450-10,500 in order not to reawaken downward speculation.

Ethereum (ETH)

For the queen of altcoins, the signs of a possible recovery were even more evident. In last week's update, I wrote: "These signals reinforce the conditions of being close to bullish reaction levels".

In the last few hours, prices have been trying to recover from the recent highs in the 390-400 USD area, levels revised during the previous weekend. These are attempts devoid of the push of volumes that, instead, were present during the weekend. The 400 USD area, in addition to being a psychological area, is also a very important technical level, having been a support in August, which had repeatedly rejected any attempt to fall, causing a sharp jump up at the beginning of the month.

ETH Chart

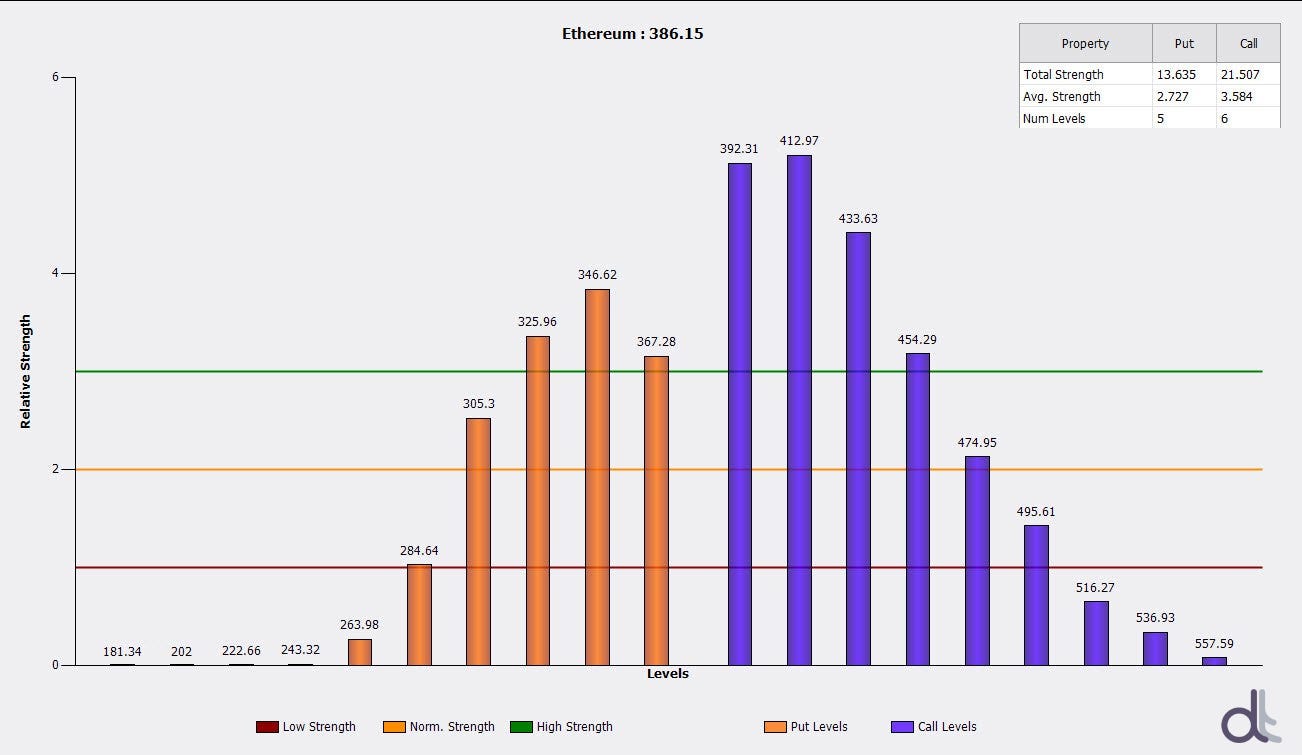

Sunday's rise hits the 395 USD resistance, the first level of coverage of professionals in options indicated in the previous update, quoting: "analyzing the bullish strikes, a first sign of strength will come with the break of the 395 USD area".

These protections have shifted to higher levels in the last few days, in the 405 USD area, which is being strengthened, reaching the highest level.

Analyzing the strikes in the most popular Put options, it remains crucial that the minimums at the beginning of the month, in the 315 USD area, are maintained. A break-down could detonate dangerous volatility.

Conversely, exceeding USD 405 would most likely result in the test of the USD 455 area in the following days.

Maker DAO: “the foundation will be dissolved at some point”

An insightful interview with the Maker DAO team to speak about stablecoins, Ethereum gas and DeFi, of course.

Why do you use centralized stablecoins to create a decentralized one?

The Maker community chose to include centralized stablecoins in the collateral portfolio with risk parameters reflecting the nature of the collateral by measuring community sentiment through forum polling and executive vote.

Some voices spoke against reliance on centralized coins as an affront to the decentralized nature of the protocol but the others countered that including new sources of liquidity had become a necessity for the protocol.

For more information, please see the Governance and Risk Call from April 23rd, 2020. Discussion regarding wBTC as a collateral type starts at ~22:30.

“Fiat, USD if you live in the US, is perceived as less volatile, since products and services in the US are paid for in USD, and those prices in USD remain semi-constant over time. Which means, USD has utility, there is a need for time-stable value (remittances, bounties, etc.). The utility of a decentralized one, with how MakerDAO creates DAI, is that it’s transparent (we know how it’s made, and if the value is backed), without also infringing on potential legal boundaries.”

For more discussion, please see:

● What’s the point of adding stablecoins as collateral?

● -ve DSR vs centralized stable coins as collaterals!

● Idea to significantly lower centralized stablecoins risks as collaterals while scaling DAI

There have been several problems with this protocol in the past, have you integrated any form of insurance?

The MKR token acts as insurance in the event the protocol becomes undercollateralized.

The cost of gas is becoming a problem, how do you intend to deal with it?

Some community members have demonstrated concern that high gas can limit incentive to vote. There is discussion of using proxy contracts to call poll vote functions in one transaction to record votes on all the selected polls rather than requiring one transaction per vote.

See discussion in the MakerDAO Governance Audit Report

At the moment there does not seem to be consensus on ways for makerDAO to deal with this issue. However lots of projects are trying to move to layer 2 solutions which greatly reduce transaction fees. While the discussion is ongoing, the community has not reached a consensus on how to approach the issue.

What do you think about bitcoin on the Ethereum network?

Bitcoiners currently do not have a permissionless way to leverage BTC. As soon as ethereum builds out permissionless bridges (like tBTC and renBTC), and they are integrated with DeFi protocols, like MakerDAO, there is an opportunity for a huge flood of value to enter into the ecosystem. Bitcoin is over 30x the size of total volume locked in DeFi. Some of that capital is going to want to play!

What tokens are you thinking of adding to MakerDAO next?

The Maker community has developed a process for onboarding new collateral that includes making an application, getting that application evaluated by teams responsible for assessing the risk associated with accepting new collateral, and putting the application to a vote.

Please see our Collateral Status Index for the latest updates on proposed collateral types and this post for more information on the process.

What do you think about banks issuing cryptocurrencies?

The community recognizes that banks are interested in issuing cryptocurrencies and using distributed ledger technology but has not come to a consensus regarding the value of such projects.

Are there any plans and projects to encourage the integration of MakerDAO into other protocols?

The DAO itself is looking to onboard Real-World Assets.

See discussion in the Forum: Initial Thoughts and Questions for Including Real World Assets in the Maker Protocol

What is your opinion on centralized stablecoins, do they have a future?

Given the community’s optimism and enthusiasm for experimentation, we expect there to be a full spectrum of stablecoins expressing varying degrees of centralization or decentralization with regard to governance and monetary policy.

It’s hard to know what happens once cryptocurrencies become large enough to compete with national currencies.

Can DAI realistically become a tool to spend bitcoin?

Yes, it’s already happening with the ability to Wrap Bitcoin and use it to mint DAI on Ethereum. As an example, as a Tanzanian citizen who owns a small percentage of bitcoin, I can choose to use their bitcoin as leverage to borrow DAI. Or, if you rather have exposure to the U.S. Dollar, you can convert into DAI. The advantage of using bitcoin as leverage, I get to still own it, and I get to borrow DAI at a very low APY. In fact, right now the APY is 0%.

How much can the risk that an algorithmic stablecoin like DAI can become volatile in certain critical moments be quantified in percentage?

Dai is not an algorithmic stablecoin. Instead of relying on collateralization, algorithmic stablecoins use algorithms that grow or shrink the token supply in response to supply and demand to try and maintain a stable value relative to other assets.

This one’s tough as market conditions are largely unpredictable. I guess the best way is just to look at previous crisis events, like Black Thursday, and find safeguards and improvements to counteract that kind of volatility.

Can the governance of DAI ever be totally and completely decentralized?

There’s been a gradual transfer of responsibilities from the Foundation to the MakerDAO community. This is really more about finding ways to organize and collaborate on complex tasks that are typically done in the format of a centralized top down organization. I do believe we will get there and the Foundation will be dissolved at some point.

It is going to take time, but time is on our side. More importantly, we have some awesome community members and Foundation members that are simply outstanding. The strength of this community is unstoppable.

The Pump & Dump of the SAFE token

The SAFE token from yieldfarming.insure has been the protagonist of a remarkable pump&dump in these days. On the morning of September 14th, it made its debut on the crypto markets with a price just under $500. In the evening it reached an incredible peak of $4,236, which is almost ten times as much as the debut price a few hours earlier.

At that point, the bubble burst, so much so that the next day it had already fallen below $1,000, and today it has also fallen below $300, which is well below the initial price. How is it possible that it gained 752% in one day, only to lose 93% of its value since the peak, in just two days?

The story of yieldfarming.insure comes from an anonymous developer who distributed these SAFE governance tokens to users who locked crypto assets using Nexus Mutual's wNXM tokens, for example.

At first, information was spread that the project was closely related to other projects such as Nexus Mutual or yearn.finance. In fact, all the insurance-related assets on the yieldfarming.insure platform were endorsed by Nexus Mutual and the anonymous developer of the same Chef Insurance platform.

In particular, Chef Insurance stated that he received a $25,000 grant from yearn founder Andre Cronje.

There were rumours and speculation on Twitter that SAFE could have been used to create innovative insurance products that could compete with yearn.finance itself, and this quickly raised the price, considering what has happened in recent weeks with the YFI token, which rose from $850 to $42,000 in less than two months.

However, a subsequent tweet from Chef Insurance spread panic in the markets, and triggered the collapse of the SAFE token price.

Chef Insurance accused the investor, Azeem Ahmed, of unethical behaviour and said he had been manipulated by Azeem himself, whose aim was to maximize profits at the expense of the community. On the other hand, Azeem argues that Chef Insurance is too inexperienced, and for this reason would have ended the collaboration.

In the face of difficulties, Chef Insurance launched a survey asking how he should proceed, effectively promising a new token and migration. So the story is not yet over, but rightfully belongs among the increasing number of DeFi projects born and dead in a few days.

Update: