DeFi Takes back the Scene

Ethereum's new records are not a surprise. Decentralized Finance continues to grow as interest in NFTs focuses on the Metaverse

Know that folks also were skeptical when paper money displaced gold

Lloyd Blankfein - CEO Goldman Sachs

While the most turbulent week since the beginning of the year for Bitcoin (and the entire crypto sector) was moving vertiginously on a rollercoaster, news continued to arrive that reinforced its growth. On the financial side, two important points so far confirm how the adoption of Bitcoin is increasingly passing also through traditional channels. JPMorgan Chase is back in the news. Despite the disdain of its CEO Jamie Dimon, who in 2017 called Bitcoin a fraud, last February the co-president, Daniel Punto, warned that the growth in customer interest and demand could also force the institution to change strategies. Just two months later, informed rumours suggest that the US banking giant will launch a directly managed custody fund next summer to allow certain customers to invest in the queen of cryptocurrencies. Unlike other similar financial services, for example, Morgan Stanley has offered the possibility, through a third party, of an investment division of JPMorgan that will be managed in this way, while also allowing for greater earnings from fees. Meanwhile, America's leading investment bank has confirmed a partnership with Singapore's largest bank, DBS, and state-owned investment firm Temasek, which is close to launching the Partior interbank platform, which will enable the instant settlement of payments between those banks using the circuit in both US and Singapore dollars and in digital format.

In a recent interview, the CEO of Paypal, Dan Shulman, said he was amazed by the high demand received from users after the announcement of the cryptocurrency service offering, which far exceeded expectations. He added that the increasing use of new forms of payment in the next five to ten years will lead to significant changes in the financial system, with a greater impact than in the last two decades. Current forms of payment, including credit cards, are likely to be replaced by the use of mobile phones.

Despite another down week for trading volumes in the world of NFTs - Non Fungible Tokens - there was another major event made official by one of the major auction houses. After Christie's and Sotheby's, the art auction house Phillips de Pury joined the list. The sale, which ended on Thursday 22 April, put up for auction a single work by the artist Michah Dowbak, known by the nickname Mad Dog Jones. Called 'Replicator', the original digital work, linked to the NFT, has the ability to reproduce itself over time. Using the process of a photocopier, six more different images are generated from the original image and linked to other NFTs which, in turn, can produce up to five, each unit decreasing the replication of other images and so on, until it stops at the seventh generation. Phillips estimated that the entire cycle will produce about 220 unique NFTs. The metadata code programmed into Replicator's NFT includes a 10% commission on secondary market sales, which Dowbak will receive back automatically. The auction started on 12 April at $100 and reached a high of $2.4 million the next day, involving around 200 people and a total of 67 bids. As is often the case, this time the bids increased half an hour before the official closing time, from $3.4 million to $4.1 million, the final price calculated at the set price of $2,338 per Ether. Six days later, the value per Ether has risen by 15%, with the value of the work increasing as a result.

We are living through one of the hottest periods in the history of the entire cryptocurrency world which, unlike in the past, does not only embrace experts or insiders. When programmers, developers, engineers, innovators, artists, entrepreneurs, all with different talents, timeframes and approaches begin to converge in the same movement of intellectual capital, progress is bound to unfold with incredible results. It is not to be excluded that the transitions may suffer delays and disappointments as well as others accompanied by periods of euphoria and fast pace. But when this happens, and it is happening, the future will have already begun.

Decentralized Finance

The last week confirms a strong trading activity on decentralized exchanges with a total volume of about $18 billion, close to the records of the end of February ($18.5 billion).

The most popular DEX is Uniswap with over 223,000 unique trades over the past seven days, more than 20 times the trades on Sushiswap which remains the most popular alternative for decentralized trading. Although up about $17 million from $9.031b to $9.048b, the weekly volume traded on Uniswap was in line with last week, gaining one point in market share to 54.9%. On the other hand, Sushiswap's volume increased by around 200 million to $3.244b, gaining over three points from 16.7% to 19.3% of market share. The Uniswap and Sushiswap protocols together trade ⅔ of all decentralized trading volumes.

The growth of Uniswap's users and business volume is reflected in the price of the token, which in recent days has reached new records at $44 per token, entering the Top 10 of the most highly capitalized tokens, rising above $21 billion for the first time, bypassing the capitalization of the more emblazoned Litecoin and BitcoinCash.

With just a few hours to go before the end of the month, April's approximately $77 billion in traded volume ranks second in total monthly volume traded on decentralized trading platforms. About half of the volume with $36 billion was transferred to Uniswap, followed at a distance by Sushiswap with $11 billion in the last 30 days.

New records for Total Value Locked (TVL) rose to over $66 billion in the last few hours, showing value growth of over 450% since the beginning of the year and 50% since the end of March. Much of the growth has been driven by Ethereum, which is not only growing in value but also as the most widely used collateral with over 11 million ETH locked on various decentralized finance projects. The number of Bitcoin tokenized as ERC-20 also rose above 157,000 BTC, the levels of early March.

Maker is the lending protocol that has the highest capitalization. After Compound, it is the second DeFi protocol to surpass $10 billion in locked collateral, making it the leader among decentralized finance projects, bypassing Compound which slips into third place. In the last 48 hours, the value of Aave has increased from 5 billion to 9 billion USD, making it the second-largest collateralized project. The launch of the new liquidity extraction programme on 27 April, with the transition from version 1 to V2, is increasing the activity of users to immobilise collateral to be used in loans and financing, enabling the extraction of around $1 million per day of liquidity (at the current price of the Aave token of $430), which will be distributed equally between lenders and borrowers. The current programme will run until July.

Non-Fungible Tokens

After the euphoria of March, the entire Non-Fungible-Token sector returned to stabilize on February's volumes. After the first auction launched by Christie's in March, which held the highest ever sale of a digital work ($69.7 billion), April saw two other historic auction houses launch the sale of other NFT-related digital works. In mid-March, that of artist Pak (click here to read the dedicated newsletter) for around $17bn, and last week with artist Dowbak closed at $4.1bn (read the email opening).

Earlier this month, on 6 April, the sale of the first Italian music NFT called 'Premessa della premessa' by one of the most famous and groundbreaking artists Morgan, aka Marco Castoldi, closed on OpenSea for 10ETH from the Swiss group Poseidon Capital. The auction was announced by the artist himself at the end of March on ClubHouse and saw Morgan's direct and almost daily participation, delighting his fans with content and comments on the piece produced exclusively for this event.

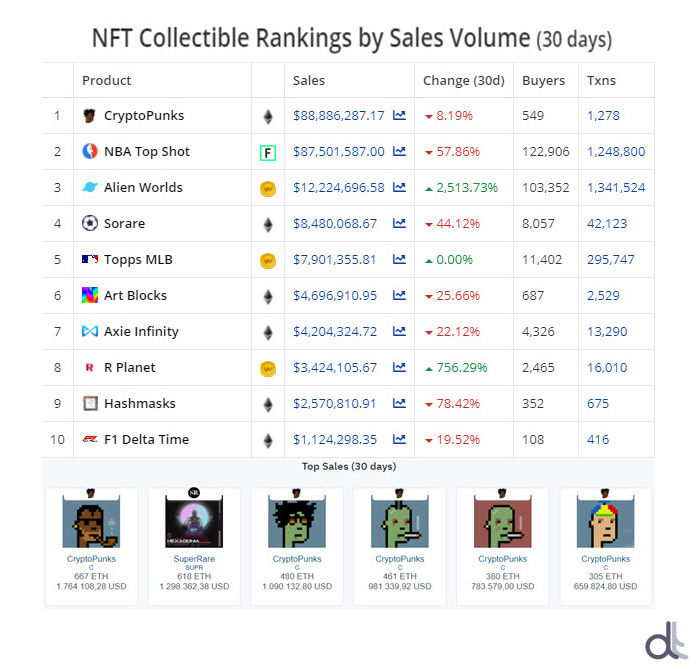

The last two weeks have seen a particular increase in volumes for non-fungible tokens issued on virtual reality worlds called Metaverse. One of the most successful tokens in the past month has been Alien Worlds, which was launched a few weeks ago on the WAX blockchain in collaboration with Binance, which listed the token on its pool, raising over $12 billion in trades. The third-largest project in terms of turnover. The leading NFT projects, CryptoPunks and NBA Top Shot, both did better, with over $88 billion traded, albeit down from March's monthly volumes. For NBA Top Shot, this is a 57% drop despite the high number of users (123k) with over 1.2 million transactions, lower only than Alien Worlds. Cryptopunks remain the digital collectibles with the highest value traded over the past month. Nineteen of the twenty highest priced auctions are Cryptopunks. In first place was CryptoPunk No. 3011 with the pipe, which fetched 667ETH for an exchange price of $1,684,881. This is the third-highest sale ever for these low-resolution digital images. The previous owner of CryptoPunk 3011 bought it in mid-March for 400ETH. In just over a month, the rare image of the man with the pipe has appreciated by 66% calculated in Ether, and 144% calculated at the exchange rate in US dollars.

Among these is the audiovisual digital content of the Hexagonia project sold on SuperRare's marketplace for 618ETH, at an exchange rate of $1,298,362.

5 hottest DeFi news of the week

Papel, everything to know about the deflationary token

Zilliqa to enter in the NFT sector with a new project about football

Polygon launches a 100m found to support DeFi adoption

Uranium Finance has lost 50 million dollars

Pancake Swap makes more transactions than Ethereum

Technical Analysis

Bitcoin (BTC)

The month of April saw the widest ever excursion of around 20,000 USD given the lows and highs of the price over the past 30 days. After hitting an all-time high for the Bitcoin price of close to 65,000 USD on 14 April (1), the turnaround in the second half of the month saw the deepest bearish movement since the beginning of the year. In 11 days, the drop was 27%, with the price returning below 50,000 USD (2) for the first time since the beginning of March. This price break triggered the pride of the bulls who came back with sales and sent the price back above 57,500 USD in the last hours of the month (3). This was not only a reaction to the psychological support of 50,000 USD (2) but also the defence of a level where the highest number of puts are positioned among all the available strikes with quarterly expiry in June 2021.

Technically, the break of the bullish trendline (4) that has accompanied the uptrend since the end of January marks the first false step since the beginning of the year. Still nothing compromising for the trend that still remains solid. If my hypothesis is correct and identifies the middle of the current bimonthly cycle (the monthly cycle) started with the recent minimums of 25 April (5), it will be important to understand if in the next few days the bullish push will succeed in bringing prices back to mark new highs. Given the trend of previous cycles, this is the most credited hypothesis with an estimate of 60%. Though above half, this is not a hopeful percentage. This is due to a bimonthly cycle that if properly set (remember that the technical and cyclical setting is subjective applied on the knowledge of the analyst) for the first time. On the contrary, it would be the first bimonthly cycle with the first bearish sub-cycle (monthly) after more than a year. For this reason, it becomes very important to understand and identify the trend of the monthly cycle already in the next few days.

BTC Options

At over 18.8k Bitcoin, the 50,000 USD is the strike most used by professional traders to hedge downside risk. It is very likely that this is the reason why prices have recovered in a few hours above this level. A confirmation of the break-up would have forced many traders to increase their hedges at the next level of 40,000 USD where the next level used to hedge a more pronounced decline emerges. Before the 50,000 USD level, the intermediate strike levels used to control downside risk are positioned in the 53,600-53,800 USD area. While on the downside the hedges have been spread across multiple levels, on the upside a few strong hedges remain in place just above 59,000 USD.

At 17.8k Bitcoin, the 60,000 USD strike is the second most used level by professional traders to hedge risk, in this case of upside.

Ethereum (ETH)

The price of Ethereum continues to set new records. In these early hours of the new month the price has reached 2,800 USD (1), up 280% since the beginning of the year. This performance triples that of Bitcoin, which has gained 'only' 100% since January 1st. In recent weeks I have repeatedly pointed out the strength of the technical structure that accompanies the rise in prices from the lows of late December. The trendline that joins the rising lows of February and March was also affected by the recent mid-April decline, a condition that did not occur for Bitcoin. This is a clear indication that the trend is supported by the strength of the technical analysis signals as well as metrics that in the last week have recorded a marked increase in volumes not only on the spot market but also for the derivative instruments of futures and options that for both set records for Open Interest (positions remaining open overnight).

The achievement of the target in the 3,100 USD area, calculated in March by projecting the Fibonacci extension, now seems a foregone conclusion. It is necessary to evaluate the trend of prices in the coming days to have confirmation of the bullish extension that in the last week has not given any sign of failure even in an intraday perspective. The holding and consolidation of 2,500 USD (2) will propel the climb to target levels. Otherwise we will have to wait for the next weekly cycle.

Options

The steep climb has swept all protection above 2,200 USD, forcing bearish traders to quickly cover their positions, thus contributing to the increase in trading volumes indicated above. To better understand the repositioning, we will have to wait for the next few days and recommend following the updates on DeFiToday's Telegram channel. For the moment, the downside hedges are positioned just above 2,500 USD, the area indicated to obtain confirmation of the consolidation of the current uptrend.

Let’s Connect

DeFiToday is A FREE weekly newsletter covering all the top stories in DeFi:

Bitcoin, Ethereum and DeFi Charts

Esclusive Interviews

Curated content from industry leaders

Join our Telegram Channel - Follow us on Twitter - Subscribe