Bitcoin is not Stopping

The focus is still on Bitcoin. The new rises increase the gap with other financial assets. Despite the drop in interest, DeFi is setting new TVL records.

This week the spotlight continues to be on Bitcoin. With the fifth consecutive weekly session on the rise, the performance exceeds the best uninterrupted series of seven positive weeks in the last year between mid-March and the end of April.

At that time the price of Bitcoin gained just over $5,000 from $4,435 to $9,485 in 48 days. To date, Saturday, November 14th, in 36 days, the price has risen by $6,000 to almost 16,500 USD, a level not seen since January 7th, 2018. The strength of this rise, which began in early September, began to overshadow the rest of the altcoins. Since that time, Bitcoin's performance has been close to a 50% gain, the best among the first 40 cryptocurrencies with the highest capitalization.

The decentralized finance tokens also feel the return of the strength of the queen of cryptocurrencies. The DeFi Pulse index, which lists the 25 most famous tokens in the DeFi universe, has fallen by 30% since its launch on September 9th. Following the euphoria that erupted during the summer, the turmoil around tokens linked to decentralized finance applications, which are used to trade, lend and borrow various digital assets, offering double and triple-digit returns, seems to have subsided.

DeFi Pulse Index

Some protocols had vulnerabilities in the design, attracting the criminal intentions of hackers who have exploited bugs on several occasions, driving away some operators who have returned to prefer the security of Bitcoin. A recent report by CipherTrace reveals that during the second half of the year, DeFi projects were the victim of 50% of all thefts and hacks suffered in the crypto sector, amounting to 14%. This percentage increases to 50% when the theft suffered by the KuCoin centralized exchange at the beginning of October is excluded, for a total of approximately $281 million. Overall, the total theft suffered by decentralized exchanges since the beginning of the year is around $100 million, 21% of the volume of hacks and thefts suffered in the crypto sector since the beginning of the year.

DeFi is a revolution that has just begun, attracting the attention not only of hackers but also of speculators who often lack financial experience and the ability to evaluate projects. Like all major developments, DeFi will have to overcome critical moments in order to find the right countermeasures against hackers and increase levels of user security.

DeFi - Decentralized Finance

Although with less intensity than spot trading (CEX) and derivatives, with the latter recording the historical record of open interest (contracts open beyond the operating day), the weekly volume for decentralized exchanges (DEX) is also rising again. With over $3.1 billion traded over the last seven days, the increase in volumes is 12%.

DEXes Volume Last 7 Days

This is attributable to the DEX Uniswap, which, with over $2 billion of volumes, has regained more than 63% of the entire sector.

Interest for Curve drops (12%) while the SushiSwap project gains market share (8.5%).

The latter, launched at the end of August as a clone of the Uniswap protocol and linked to the Sushi yield token, attracted over $1.4 billion in cash in a few days, followed by a quick flight that brought liquidity back to about $280 million since the beginning of October.

The rise in the prices of tokens and cryptocurrencies contributed to an increase in total value locked (TVL) on decentralized finance projects, setting a new record above $13.8 billion. After hitting its lowest level in the last month with just over 8.3 million ETH, the number of locked Ethereum is again rising to over 8.9 million.

The growth of collateralized Bitcoin continues, reaching a record 174,931 BTC. Of these, more than 70% is generated by the WBTC project, which for the first time exceeds the $2 billion threshold in value, placing it in third position in the ranking of the projects with the largest locked collateral. This ranking sees Uniswap as the undisputed leader, breaking the $3 billion barrier of locked value. Maker is second in the ranking with $2.3 billion.

Total Value Locked in DeFi

1) Uniswap (3,03B)

2) Maker (2,35B)

3) WBTC (1,99B)

5 Hottest DeFi News of the week

DeFi: 100 million stolen by hackers in 2020

DeFi: 13 billion dollars in TVL: it’s a record

Volumes on DEXs increased 12 times

Zapper Snags New Funding From Delphi and Coinbase Ventures

Technical Analysis

Bitcoin (BTC)

The price increase that bitcoin is achieving again this week is showing a divergence of correlation with both gold and the Standard & Poor 500 stock index. Since last March, it is the first time that Bitcoin has diverged so sharply from movements with both of these assets.

With another high jump yesterday the prices approach 16,500 USD. The rise is also accompanied by the return of confidence to 90 points, a figure that had not been recorded for over a year (June 2019). The period of glory for Bitcoin is further enhanced by the trading volumes. After the previous week's record for aggregate volume on future derivatives, this week Open Interest sets a record for future derivatives at over $6.1 billion. An index that an increasing number of traders are choosing to continue their bullish exposure overnight.

BTC Chart

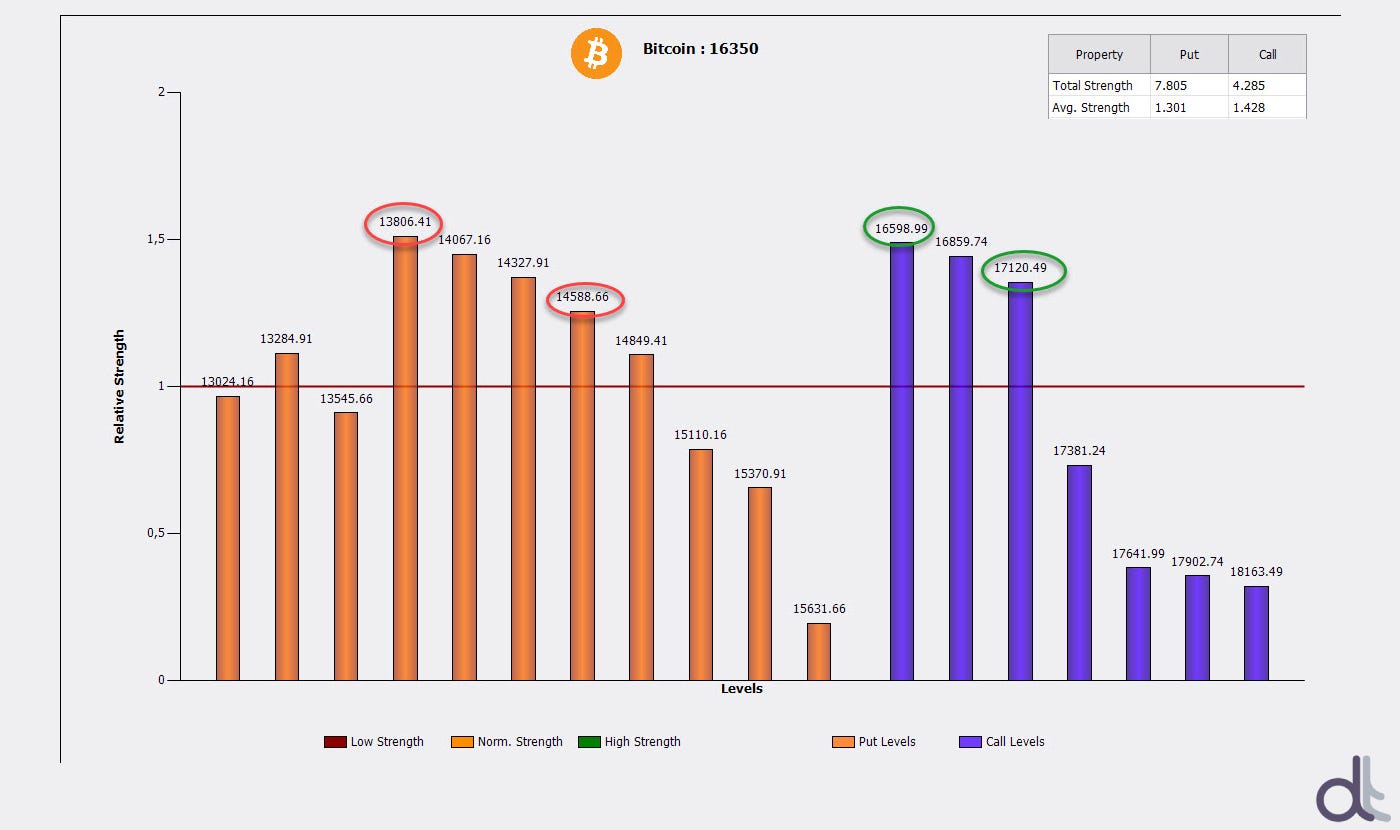

The increase in long positions left open increases risk. This is why derivatives traders are choosing to hedge against the danger of a reversal of the trend by increasing Call options hedges from last week's levels. Any triggering of strikes between 16,600 and 17,100 will increase the likelihood that the absolute historical highs of $20,000 will be revisited in a short time. Conversely, a rejection of the current highs would open up room for a healthy price decline useful to form a solid support base from which to restart. At the moment, options operators are identifying the 14,600 and 13,800 range as an area of support where prices can return to fall without causing tensions. Only a fall below $12,500-12,000 could begin to undermine the structure of the current annual cycle that began with the mid-March low and is firmly set to rise.

BTC Options

Ethereum (ETH)

After last week's rally, which saw the prices of Ethereum recover the ground lost previously to the Bitcoin upturn, the current week is coming to a positive end but with much less intensity than the previous week. The rise of the last 3 days has found the strength to go back to the highs of early September. The volumes that accompanied the recent rise are good, although not at mid-October levels, with the average daily trading in the last week being above the intermediate value since the beginning of the month. This is a good sign that gives hope for a continuation of the uptrend in the coming days, though it is necessary to confirm the breaking of the recent highs set in the last few hours just below USD 480. This level, the highest since the annual top recorded at the beginning of September, which now coincides with the first strike used for Call options, must necessarily be exceeded as soon as possible otherwise there is a risk of a dangerous double technical maximum.

ETH Chart

Since the beginning of the week, the strategies of the operators in options have highlighted their intention to support the upward trend, anticipating what has happened since then. The difference in strength between Put (13) and Call (2.7) options remains clear. Hedging strategies highlight how operators prefer to cover the risk of possible reversals of the upward trend by remaining set to the upside. In fact, the range considered at risk in case of possible falls is between 365 and 340 USD. Areas more than 26% distant from yesterday's daily closing on Friday, November 13th, (476 USD). This area coincides with the bullish trendline that combines the rising lows since mid-March and has accompanied the bullish trend for eight months.

ETH Options

The unintentional hard fork on Ethereum

On November 11th, 2020 an "unintentional" hard fork took place on the Ethereum network. In fact, an update to the Ethereum protocol was implemented, but it was not retro-compatible.

In these cases, despite being hard forks, there are generally no serious problems, because it is sufficient that all nodes are informed that there is a need to update the code after a certain block, and everything is resolved in a simple update.

This time, however, it wasn't like that.

The news of the release of the update was not spread to all nodes, so when it was applied, some nodes had updated the software code, while others had not. Since the new code was not backwards compatible, two different versions were created when block number 11,234,874 of the Ethereum blockchain was mined.

One followed the updated protocol, while the other was only compatible with the old, outdated protocol. This caused a fork in the chain, with some nodes compatible with the new one, and others continuing to support the old one. In fact, a split in the chain was created, i.e. a division that could have created a new cryptocurrency.

Fortunately, however, when they realized the problem, the outdated nodes tried to understand the cause of this split, and once they realized that the cause was an updated version of the protocol they didn't know about, they updated the software so that it was compatible with the new chain.

The old chain soon became obsolete, and all nodes started using only the new one with the updated protocol, abandoning the old chain and avoiding the split. However, this story reveals how problematic it can be to update decentralized protocols if the news about the timing and changes to be made is not well distributed.

The price of ETH, however, has not suffered consequences.