Boomerang Bitcoin

An increasing number of financial companies are becoming interested in Bitcoin. Now it's the turn of MassMutual, which invested 0.04% of its assets. This is the time for JPMorgan to make a mea culpa.

The uptrend of recent weeks for digital gold, currently culminating in a record-breaking Bitcoin price of $19,955 last week, has once again attracted the attention of mainstream media and small and large investors. In contrast to the 2017 rally driven by the proliferation of new ICOs attracting new capital especially among 'insiders' i.e. people already active and present or already aware of this new financial sector, this time the reasons that are attracting new money are largely supported by investors and financial companies that can be considered part of the traditional legal financial system.

The online version of the Wall Street Journal yesterday reported that Massachusetts-based MassMutual Life Insurance Co., a leading US insurance company, purchased 5,500 bitcoin for $100 million at current exchange rates. The company confirmed the investment by explaining that the strategy has a "measured yet meaningful exposure to a growing economic aspect of our increasingly digital world". The investment represents 0.04% of the total company's assets worth $235 billion.

But it doesn't end there. In a recent Bloomberg report of December 9th, the analysis of investments made by the Grayscale Bitcoin Trust claims that around $2 billion have been invested since October. Over the same period, more than $7 billion has come out of gold-backed exchange-traded funds. This countertrend suggests that some of the outgoing transfers from gold investments have been flowing into Bitcoin funds. This assumption was reinforced by JPMorgan Chase & Co.'s chief analyst Nikolaos Panigirtzoglou, who said: "the adoption of bitcoin by institutional investors has only just begun".

In September 2017, three months before Bitcoin reached an all-time high of $20,000, JPMorgan Chase President and CEO - Jamie Dimon - called Bitcoin "a 'fraud' that will eventually blow up. It's worse than tulip bulbs. It won't end well", resulting in the raising of shields among cryptocurrency experts. After "only" three years these words are submerged by facts coupled with self-condemnation for those who uttered them.

DeFi - Decentralized Finance

After a start of the month with low volumes, trading on decentralized exchanges (DEX) rose again to over $4 billion, an 8% increase on a weekly basis.

Uniswap remains the growing DEX leader in terms of trading volume with around $2.6 billion and 63% market share.

In contrast, trading on SushiSwap fell by $18 million to $513 million.

0x climbs to third position overtaking Curve.

The ranking is reversed in terms of average of a single trade. For Uniswap the average of each single trade is $24. That of SushiSwap is six times higher with an average of $120. A little over a week after the announcement of the merger with Yearn.Finance, the value of the SushiSwap token rose by over 75% from USD 1.5 to just under USD 2.5. The average of 0x rises even higher with $418 per trade.

DEXes Volume Last 7 Days

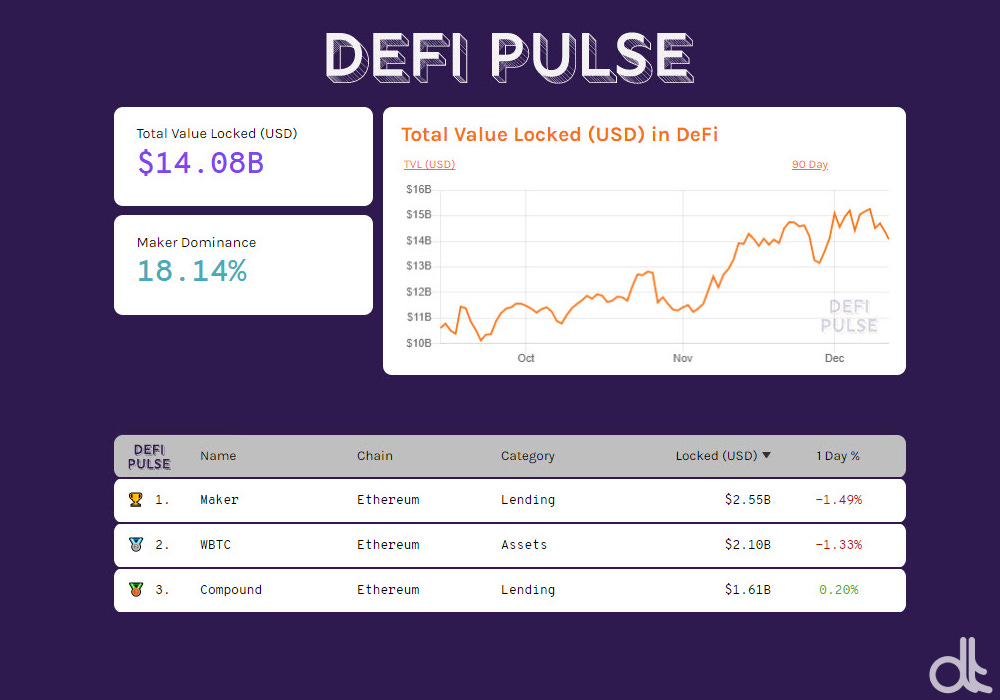

Despite the difficulties of the last week with the value of the tokens falling, the total value locked (TVL) grows and reaches a new record during the week with over $15 billion for the first time. An increasingly sustained growth that since the beginning of the year sees the value locked in decentralized finance projects multiply more than 15x times.

The number of locked ETH is rising again with a weekly increase of 200,000 ETH for a total of 6.9 million ETH. For the fourth week in a row, tokenized Bitcoin decrease, today just over 162,000 BTC on the Ethereum network for a total value of about $3 billion at current prices.

Maker consolidates first place with over $2.5 billion collateral locked.

WBTC and Compound follow, the latter with $1.6 billion, almost on a par with Aave.

Total Value Locked in DeFi

This week, during the CryptoFocus episode, there were two leading representatives from DeFi: Maria Magenes from the Maker Dao Foundation and Emilio Frangella from Aave who unveiled the latest news.

5 hottest DeFi news of the week

Mass Mutual bought 100 million bitcoins

Yearn Finance reveal its revenue report

Curv Partners With MetaMask for institutional market

Yield raises $5M to simplify DeFi

Liquid launches crypto ledger book for Singapore stablecoin

Technical Analysis

Bitcoin (BTC)

A stop for Bitcoin prices that slide more than $1400 from Monday's opening (00:00 CEST) to Friday night's levels with prices back to testing again the $18,000. If prices were to maintain these levels, or fall again until closing on Sunday, this would be the second-worst week since mid-March in terms of both numbers and weekly performance.

Technically, the downturn of the last few hours has pushed prices below dynamic support at $18,200 (1), parallel to the trendline, which has been joining the rising lows since mid-October. The break downwards indicates a weakening of the uptrend that has characterized the trend of the last two months with an increase of the price of 90% from the lows of the beginning of October from 10.500 (A) to 19.950 USD of December 1st (B).

The decrease started from the highs of the first day of December sees the red sign prevail 6 times in 11 days, showing a controlled descent with a loss of about 10% without particular tensions. The beginning of the weakness confirms the hypothesis of a quarterly cycle started between the end of September and the beginning of October which, if it confirms the structure of the previous 3-month cycles, will end by mid-January. For prices, it is important to maintain the highest levels of support so as not to compromise the rise that began in early October.

BTC Chart

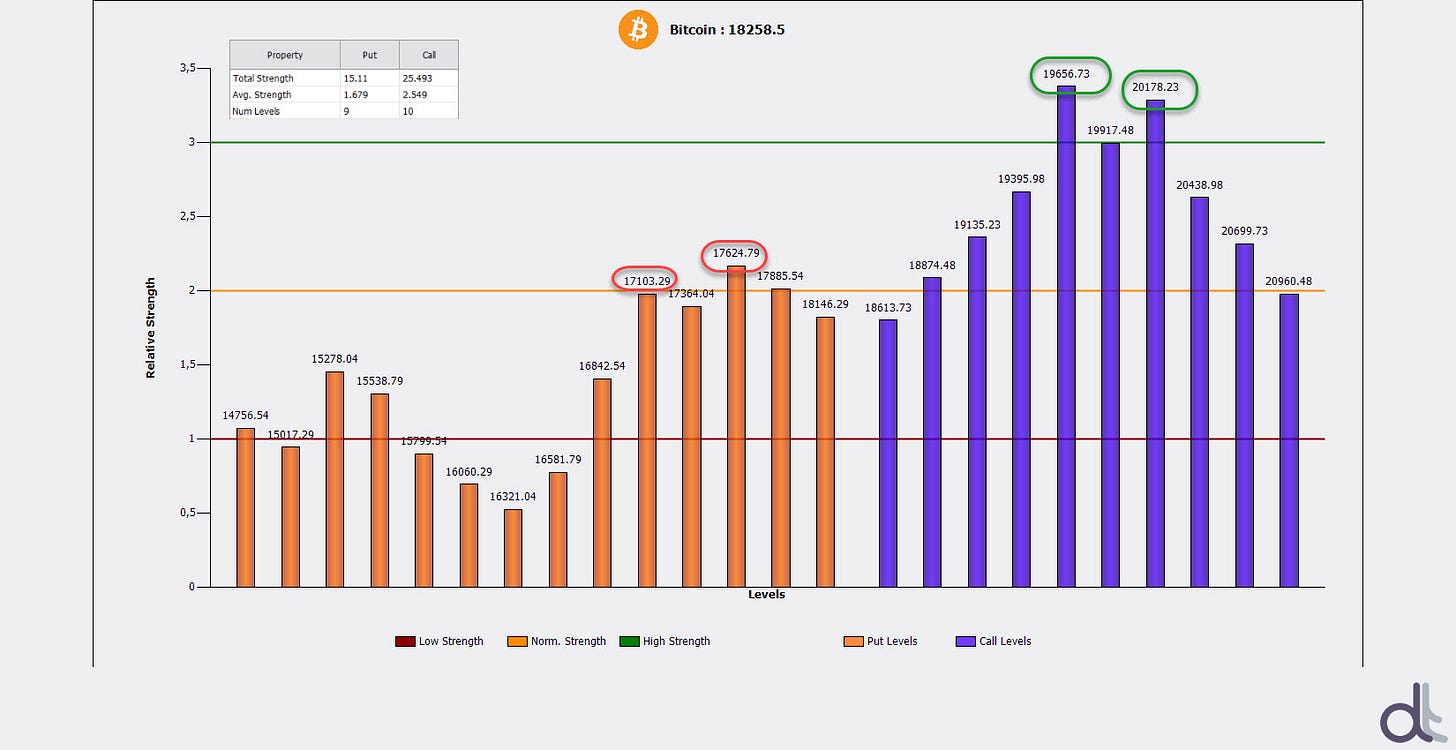

Strong increase in the strength of options on both sides even if Call options remain higher. An indication that professional operators expect a continuation of the weakness and prefer to protect themselves against a possible return of strength. The resistance protection of 19,650 USD remains well set. Since last week, the other defences have changed higher, moving above 20,180 USD. Downwards the defences of the supports between 17,100 and 17,620 USD are rising, the latter is the level that in these hours is trying to repel the intraday weakness.

BTC Options

Ethereum (ETH)

Ethereum also suffers from weakness, with a drop of more than 15% to the current levels from the peak reached on December 1st at 636 USD (A). Unlike Bitcoin, the downward movement of Ethereum finds the possibility of further room for manoeuvre downwards without compromising the upward trend that from the mid-September quotations to the highs at the beginning of December sees the value of Ethereum almost double. In the short term, it is important to contain the further lengthening of the descent above 475 USD (B), the former resistance that rejected the previous upward attack at the beginning of September.

ETH Chart

Technically, the quarterly cycle has a similar structure to Bitcoin. Started between the end of September and the beginning of October, after the minimum of November 26th (1) it entered the second part immediately marking a new maximum (636 USD on December 1st - A) and a reversal occurred immediately in the following days. An indication that it is not good to hope for a continuation of the increase. But before confirming the reversal it is necessary not to sink below 475 USD (B) in the next few days. Holding this level will strengthen the current bullish structure. On the contrary, it is necessary not to extend the decline below the trendline joining the rising lows since mid-March (425 USD current value).

In contrast to last week, the strength of the Call options increases to protect against a sudden upward reversal. The area 620-635 USD is the protection of resistance levels. Downwards the protections are spread between 535 and 410 USD with similar relative strength. An indication highlighting the operators' possibilist approach in favour of a continuation of the weakness for the coming days.

ETH Options

CrescoFin: interview with founder Robert Sharratt

A new project with Aave and Chainlink as partners

A new project is emerging during these days: CrescoFin, which caught our interest because of its interesting partnerships with world-famous companies like Aave and Chainlink.

Why did you choose an IDO (Initial DEX Offering) rather than an ICO (Initial Coin Offering)?

We wanted to build a strong community and also establish a liquid market for our token holders. We are excited to be the first regulated company to offer real equity in tokenized form in crypto. By starting on DODO and then moving to Balancer we were able to distribute a good number of tokens at a low price, much lower than if we had offered the tokens on Uniswap, as the curves are more beneficial to the community.

Why did you choose the Ethereum blockchain?

We chose Ethereum so that we can interact with other great projects that are also building on Ethereum. For example, we have a partnership with Aave to build a money market for our insured collateral.

What is the wCRES equity token?

The wCRES token is an ERC20 token that can be exchangeable into CRES tokens. The CRES token is also an ERC20 and it represents real equity in a Swiss regulated company.

The tokens are protected by Swiss law and there is an absolute maximum number of tokens that can be minted (12 million, of which 10 million are in existence). There is no advance requirement to purchase the tokens; anyone can buy them. This exactly matches Swiss law: anyone can buy shares of Swiss companies, like Nestle. However, to register to vote, you need to inform the company and do a simple identity process. If you are not on a Swiss government sanctions list then you are automatically accepted. Then, it is also easy to switch back to wCRES for trading if people want.

Why did you create 2 separate tokens, CRES and wCRES?

There is one equity share “unit” in the company, which can be held via two related ERC20 tokens, at the choice of the token holder This facilitates low-gas-cost trading and reflects Swiss law.

wCRES Represents unregistered equity in the company. It is a simple token designed for easy trading on Uniswap and DODO Exchange with low gas usage.

CRES Represents an equity shareholder interest registered with the company. This token contains voting and other functionality and uses more gas than the wCRES token.

A token holder can easily swap wCRES tokens for CRES tokens, and vice versa. To swap to CRES tokens, the token holder has to provide basic KYC information to the company

In which macro category of DeFi do you operate?

The company is not pure DeFi, since we bridge the traditional and crypto world. Since we operate in the real economy, there is an element of centralization that cannot be avoided.

We don’t fit easily into existing DeFi categories. We are really the first technology alternative to a bank account and we compete with commercial banks. Our view is that crypto will eventually lead to more and more people having their savings on-chain and this is the market we want to capture. We also intend to bring our institutional users to crypto.

DeFi implies that there is no interaction with the traditional world, not even KYC, which you are using, wouldn't it be better to say you are CeFi?

The company differs from centralized entities like banks by being built on Ethereum. So, we don’t have our own in-house black box databases. However, while CrescoFin is non-custodial, it is permissioned, since we are regulated. Swiss law is quite clear about crypto and KYC and we feel that Switzerland is one of the best countries in which to be operating a crypto project. Our view is that KYC and regulation is inevitable if you are creating financial products. For attracting institutional users, dealing with a regulated entity is a requirement.

What problems have you encountered with Swiss legislation?

Swiss legislation has been very clear about crypto for some time and it is a supportive environment in Switzerland. The country itself has a decentralized political model that perhaps has encouraged crypto adoption. Swiss legislation continues to evolve in a positive direction, including recognizing on-chain transactions as legally valid. Swisscom runs a blockchain integrated KYC process. A number of canton governments have even put their company registry on-chain.

Who is the target of your product and why was it made using blockchain?

We offer an insured savings account with much higher rates of interest than in a bank. We operate in fiat and are developing our offer in stablecoins. We operate on a blockchain tech stack to be composable with DeFi protocols and it is also how our financing operations work, to enable us to offer an attractive rate of interest to depositors.

What is your business model like?

We combine matched funding + blockchain technology + insurance to offer a better rate of return to savers than in a bank. Our view is that insurance is necessary to neutralize the advantage that banks have: a feeling of security. With us, everything is 100% insured.

There is a lot of competition in the crypto sector, have you adopted any particular marketing strategy?

We are focused on bringing new users to crypto and encouraging mass adoption. Our offer is simple: we make your money work harder for you than in a bank.

When will the project be launched?

We are in operation now, with institutional users. We expect to launch for retail users worldwide in 2021.