Bitcoin's week will make History

In just a few days there has been a lot of explosive news for Bitcoin confirming that the best rise ever is not a flash in the pan. Altcoins have also done very well.

"It's a Zero Sum game - somebody wins, somebody loses. Money itself isn't lost or made, it's simply transferred - from one perception to another. Like magic". Gordon Gekko

Since the last report of last week, there would be a lot of useful news to be discussed in this issue. In the report of October 23rd, I commented on the news of PayPal that in those days made official the opening to the use of the main cryptocurrencies for its customers. This news ignited the crypto markets, causing the prices to explode from $13,000 at the time to a step of $50,000 these days. In that report I wrote: "What is happening in these hours will result in a cascading process that will force other payment giants not to lose precious ground". And today I am commenting on a similar event. The credit card payments giant Mastercard, in an official post has declared that it is ready to offer its customers the possibility to use cryptocurrencies as a means of payment. In the first paragraph of the post, the words sound like succumbing to the need to offer the payment service to its customers and merchants. But this is not the case for those who know and remember the events of recent years. It is a decision destined to change a market that is always adapting to payment services, that in cryptocurrencies, until recently opposed. The Mastercard circuit has long offered its payment network to circuits such as Wirex, Uphold and Bitpay for debit card services. These services make it possible to convert cryptocurrencies into fiat currency in just a few steps, load credit onto the card and use it at any merchant. Although the details are not yet known, I think Mastercard's direct engagement could facilitate conversion to fiat currency or direct payment in cryptocurrencies on the part of the customer. This would make it easier for the end user to use cryptocurrencies on a day-to-day basis, without having to go through some technicalities that are easy for some but still difficult for many who are unfamiliar with the technology or afraid to perform foreign exchange transactions.

The giant Mastercard began exploring the cryptocurrency sector in 2013 by filing a patent for Bitcoin payments. A project abandoned two years later, presumably in the wake of the Mt.Gox scandal. It is very likely that the study team is composed of people who know the industry, because in recent years the foundations have been laid for the construction of a structure that today can make a difference with all competitors. Eighty-nine patents based on blockchain technology have already been approved, and another 285 are waiting to be approved worldwide. Among the documents already approved in the United States, we read that they concern the possibility of keeping cryptographic transactions private, the verification of card payments directly on-chain, instant processing on blockchain and the possibility of managing refunds. Not only that, in the same post launched online on the company's website, it is indicated that a platform offering the possibility to test digital currencies issued by central banks is at an advanced stage.

Those who in the past, even more recently, thought that cryptocurrencies were a means of payment destined to fail or to remain confined to a few people, today must take note that the change is not only at an advanced stage but has now become irreversible. In the very near future institutional adoption will pass through tokenization of assets, then to decentralized finance. Any doubts about this? See you again in a very, very short time.

Decentralized Finance

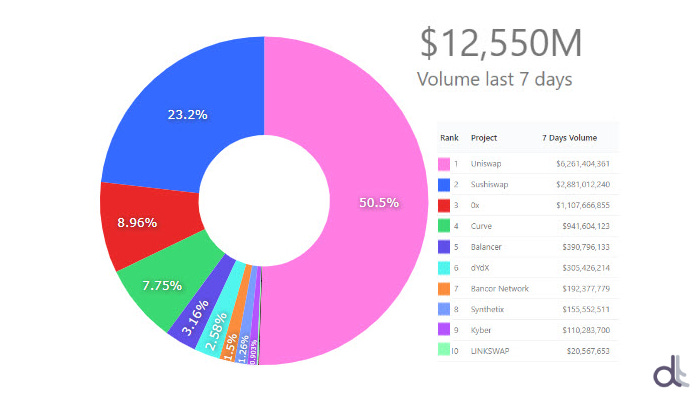

Decentralized trading on DEX protocols is progressing at a rapid pace. This week's volumes of over $12.5 billion remain in line with those traded last week. Since the beginning of February, over $23 billion has been traded in just 12 days, almost as much as the volume achieved in the entire month of December 2020, which was the second-highest volume month ever until January.

Among decentralized exchanges, Uniswap remains the clear leader with over $6.2 billion traded in the last week, representing 50% of the entire market.

SushiSwap follows with $2.8 billion, or 23%, both of which are in line with last week's figures.

While 0x trades over $1.1 billion for the first time, up about 10% from last week and its market share is up one point to 9%.

DEXs Volume last 7 days

Uniswap also remains the leading DEX platform in terms of weekly trades despite a drop in the number of weekly traders to 128,000. It is possible that the increase in gas commissions has discouraged many small trades from being executed. Numbers also fell for the 1inch protocol which allows the aggregation of some DEXs and the advantage of saving on commissions. Just under 15,000 total weekly traders compared to over 17,000 last week.

The Total Value Locked (TVL) of all decentralized finance projects continues to set new records. It has now risen for the first time above $40 billion. That's 20% growth on a weekly basis and 160% (!!) since the beginning of the year. This is due to the number of ETH and BTC that have returned to be locked in the various protocols in order to obtain returns on loans or to provide liquidity to trading or market making protocols. The numbers are back to mid-November levels for both Ethereum and Bitcoin.

Total Value Locked in DeFi

The protocol with the largest amount of locked collateral is Maker, which rose to $6.5 billion for the first time.

Aave followed with $5.9 billion, an increase of more than $2 billion since the beginning of the month.

Compound follows with $4.5 billion.

All three are decentralized lending platforms. In fourth place for the first time is Curve Finance, with $4.1 billion, overtaking Uniswap's project for the first time. Curve.fi's DEX is particularly used for the exchange of stablecoins, which is more advantageous than the competition in terms of the fees charged.

5 hottest DeFi news of the week

A new All time high for DeFi

St Louis FED supports DeFi

Grayscale ready to invest in DeFi projects?

Curve Finance ready to be on Polkadot

Avalache is now connected with Ethereum

Technical Analysis

Bitcoin (BTC)

If the price of bitcoin were to close Sunday's session above $45,000 it would end the week with the highest weekly gain in the history of the king of cryptocurrencies. In recent hours, the price has been close to $49,000. Considering the opening set at 12:00 PM (CET) on Monday, February 8th at $38,840, this is a climb of more than $10,000 in one week with a percentage gain of more than 25%, three of the best weekly gains in the last four years. But unlike the others, the gain per unit, i.e. price, is by far the highest ever. The weeks that will go down in Bitcoin history are becoming more and more numerous, and this is certainly one of them. Starting with the news of Tesla and moving on to the announcement of Mastercard and BNY Mellon - the oldest US bank that will offer cryptocurrency custody services for its customers - it ends with a double announcement that adds up to many others that seem to be starting to become part of the norm. The city of Miami, Florida's second-largest city, has approved Mayor Suarez's proposal to be able to pay part or all of its employees' salaries in Bitcoin. A few kilometres away, in another country, the securities regulator of Ontario, Canada, approved an alternative mutual fund. The first ETF where Gemini, a company founded by the Winklevoss brothers, has a stake.

News that supports the price of Bitcoin on highs that only 5-6 months ago seemed unattainable, at least in the medium term. This is why we should not be surprised if in the next few days the price breaks through the psychological barrier of $50,000 USD, which is now within reach.

The overcoming of the resistance of $39,000 USD (1) - a level which in the previous report I indicated as a crucial barrier corresponding to 75% of the long-term Fibonacci retracement - once again takes Bitcoin prices into uncharted territory. For this reason, the only useful technical analysis tools in this case are Fibonacci extensions, which identify the next target above $51,000. This is an extension that takes as reference the period March-July 2020 which I consider a crucial moment in the history of Bitcoin. The price holding in the range between $4,000 and $9,000 for almost five months has allowed building a solid base from which to move forward in the long term.

From these levels, it is necessary to identify support areas useful for weekly operations. Last Monday's green candle, which exploded with a rise that disintegrated the previous record of the beginning of January, left no traces of useful support in the short and medium-term, except for the previous record which has now become support: precisely $41,970 (2). These levels are about 15% away from the records of recent hours. For those familiar with the sector and the history of Bitcoin, they will know that these are fluctuations that can also be the order of the day. Any bearish movement of this magnitude would not compromise the short-term bullish structure that has accompanied the rise since the end of January. For the medium term, on the other hand, we must look below $30,000 (3). This level is 50% away from current prices.

BTC Chart

Options

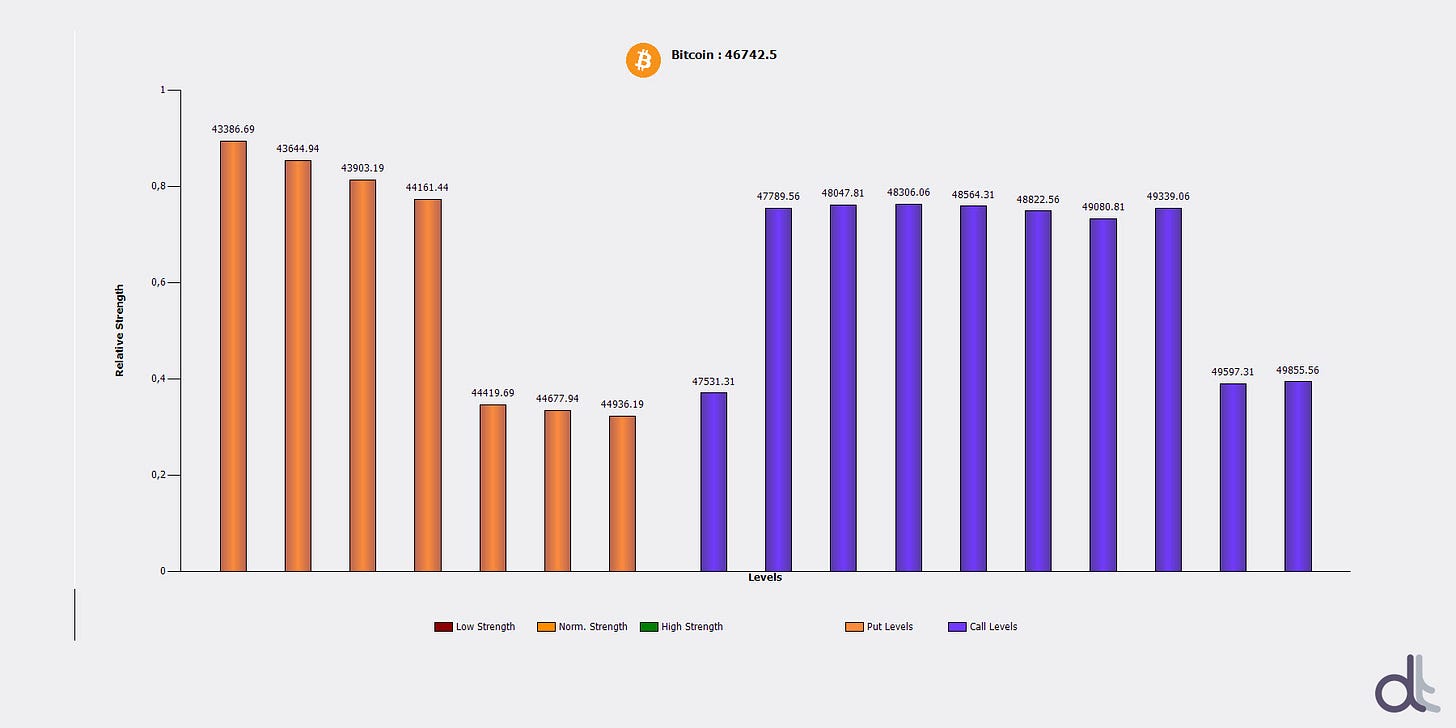

The operational indications developed last week as a result of the study of strategies applied to options, highlighted the growth of Put options indicating the change in sentiment of traders. The crossing of the threshold of $40,000-40,300 - protection on the upside - forced Call options hedgers to quickly open futures derivatives or to close their uncovered positions, fuelling the rise which has led in these hours to touch the $49,000.

With only a few hours to go before new all-time highs and against a backdrop of solid double-digit rises, this backdrop does not allow for useful options analysis to be carried out to identify useful operating levels for the coming week. It is necessary to wait for a base of price consolidation to allow professional traders to start setting new operational strategies.

BTC Options

Ethereum (ETH)

Ethereum is also on track to end the week on a positive note, posting new all-time highs. Although this is not the best week of the year for Ethereum in terms of percentage gains, it consolidates the bullish trend that began last fall. Since the beginning of the year, Ethereum has gained over 140%, double the performance of Bitcoin which stops at "only" +70%. I have to reiterate again this week that Ethereum's bullish trend remains above the dynamic supports since late December, confirming the strength of the bullish structure. Technically there is not much to add to what has already been written in previous reports. With the rise, the support levels to be taken as an operational reference are raised. The trendline that joins the rising lows from the end of December identifies the first dynamic support level to be taken as a reference: the $1,500 area. The distance from current levels allows an operating margin of over 15%, attracting speculation. It may seem like a wide margin of oscillation but this should not be misleading if we consider that since the end of December, within the current trend that has made Ethereum gain over 220%, there have been four movements with an intensity equal to or greater than 15%. Declines that have not compromised the bullish structure.

ETH Chart

Options

The rises of the last few days increase the strength of Put options by reinforcing the protections between $1,580 and $1,630. Upwards, strategies are starting to be built in the $1,850 area. Operationally, this means that the main sentiment continues to remain positive. The first signs of weakness only come with a return below $1,550 for more than two days in a row, which would make people start increasing the positions of sold Call options.