Bitcoin takes a break as NFTs keep exploding

As the king of cryptocurrencies takes a breather, the digital art world heats up even more. However, the NFT world isn't just about art, it's so much more.

"I can calculate the motion of heavenly bodies, but not the madness of people."

Isaac Newton

The auction of Beeple's digital artwork for $69.3 million at Christie's and the impact of the news on all the world's major media have aroused interest not only in the traditional art world, already in turmoil in recent weeks, but also and above all among auction houses, galleries and collectors.

The upheaval in the sector is due to the possibility of creating digital works of art accompanied by a certificate that makes them unique, guaranteeing ownership and the possibility of being tracked at every step, as well as reserving the return of royalties on every purchase. This was unthinkable until recently.

The growing interest in this new method of creation and presentation to the public for the purpose of sale opens up new scenarios for intermediaries who must now find new alternatives to offer in order not to risk being cut off from a multi-million dollar business. The CEO of Christie's recently declared that "after the auction of Mike Winkelmann - Beeple's real name - his phone started ringing non-stop with the curiosity of those who realised they were facing a new dimensional discovery of art. The oldest auction house does not want to miss this golden moment and is capitalizing on the momentum it has gained by organising a series of auction sales of artworks (including an early 20th century Monet) this May, accepting payment in cryptocurrency and accompanying the sale with an NFT token guaranteeing authenticity and ownership.

If the art world is buzzing, so is the world of sports clips, which has seen unprecedented growth in turnover over the past month. The officially licensed NBA platform, Top Shot, which collects the highlights of every American league game, is captivating NBA fans and blockchain evangelists alike. In the past month, more than 185,000 buyers have recorded over $300 million worth of transactions, accounting for 80% of the total turnover since the platform was first launched.

For many, it is difficult to understand the motivations behind this craze of buying digital video clips for millions of dollars. For others, however, it seems to herald a new era of collectables on a par with works of art. Michael Levy, one of the first investors in the NBA Top Shot platform, a few months ago bought hundreds of frames of some of the most salient moments of the games, for about $175,000 and today they are valued at more than $20 million, in a note he declared "It's the story, the scarcity, the joy you get as a collector,” Levy said. “It's not the ability to hold it in your hand".

This is the beginning of a period of disruption that marks the birth of a new artistic movement. Just as the advent of rap music in the 1970s was seen as a passing event, but one that was destined to establish itself and remain, so it is now happening with art. After the transition from classical to contemporary art, we have finally entered digital art.

Decentralized Finance

A modest slowdown in trading on decentralized exchanges (DEXs). Over the past 7 days, total volume has dropped to $12bn from $14bn last week.

Uniswap is the undisputed leader with around $7bn or 60% of all trading volume. Despite the decrease in the amount traded, the number of trades rose to over 188,000, a new all-time high. The UNI governance token has been trying unsuccessfully to get back above $32 all week. Despite this, the value of UNI remains close to the all-time highs recorded at the beginning of last week. Since the beginning of the year, the token has multiplied 7x its value and over 100x since its launch in mid-September 2020, for many an airdrop of 400 tokens that the Uniswap team had decided to give away as a surprise gift to all users who had used DEX before the listing.

The second most-used DEX protocol SushiSwap, which started out as a clone of Uniswap, retains its second position as the most-used project by traders. In the last week, the number of trades fell to 9,350 and the value traded from $2.2 to $1.7, keeping the market share at 15%. Three days ago, the open-source decentralized applications platform Avalanche tweeted that it had integrated SushiSwap's AMM (automated market maker) protocol, increasing competition for the Ethereum ecosystem, which is increasingly threatened by the cost of gas fees, which in the past week have risen again to over 193 Gwei.

Since the beginning of the month, the total volume traded on DEXs has exceeded $40 billion, in line with the average volumes since the beginning of the year. More than $180 billion have been traded in less than 3 months, 65% of the volume recorded in the last 12 months, for a total volume of around $300 billion.

For the DeFi lending, financing and trading protocols, Total Value Locked recovered to $44.5 billion, less than $800 million from the record high reached on February 21st. The number of Ethereum tokens locked above 9.2 million is the highest value since early November. Tokenized bitcoin also returned to grow, rising above 34,000 BTC after falling to 25,000 last weekend, the lowest level in seven months.

Non-Fungible Token

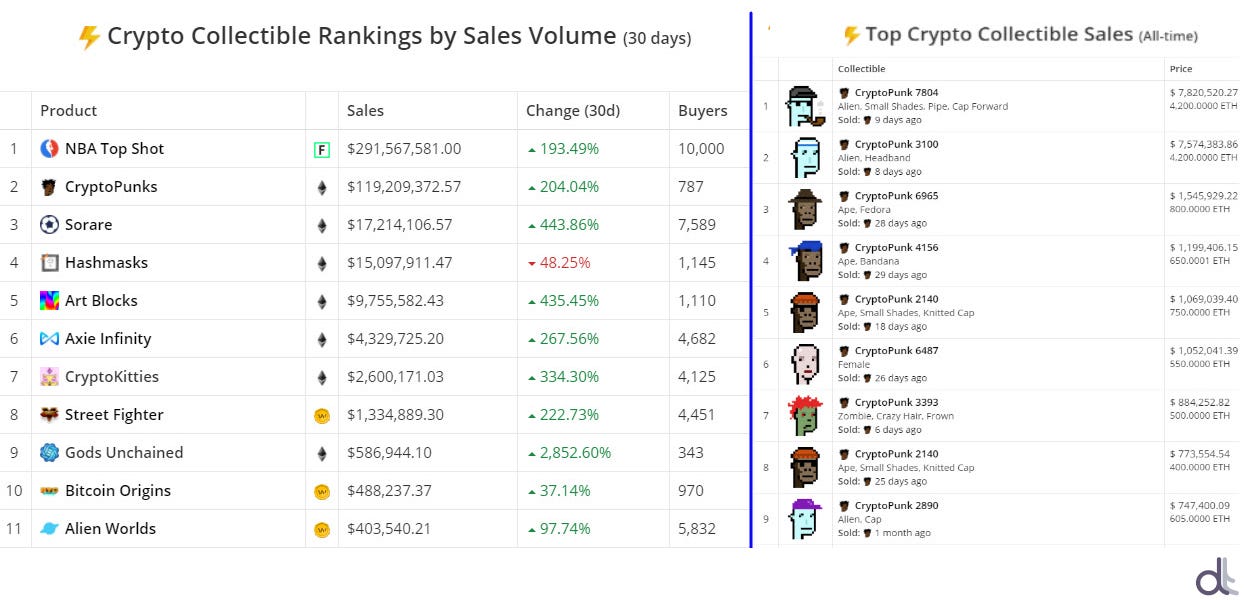

Google searches for NFTs increased in 2021. This suggests that awareness and interest in the retail space are growing. The long-standing collectible game CryptoKitties built on the Ethereum blockchain is back with strong numbers. Although a far cry from 2017's records in terms of the number of users, the turnover traded in the last month is 8% of the total calculated from November 2017. NBA Top Shot is the collectibles project with the most active users (10,000 in the last 30 days) and exchanges (>$292,200,000). Among the collectible tokens sold in the last week was the CryptoPunk 7804 sold for 4,200 ETH equivalent to $7.8 million (you can verify the transaction hash here).

This is the highest ever auction of CryptoPunk - the first collectible NFT project launched in June 2017 on the Ethereum blockchain. These are uniquely generated characters in the form of low-quality 24x24 pixel images. Initially, they could be claimed for free by anyone with an Ethereum wallet. Some of them in the last month have been sold for prices in excess of $500,000.

Over the past week, there have been more than 236 active sellers on the CryptoPunks platform with approximately 400 transactions. NBA Top Shot also recorded a 7% decrease in turnover during the second week of the month. Sorare, on the other hand, saw an increase of 6%, thanks in part to the unique Cristiano Ronaldo digital figurine, which sold for $290,000. In the sports sector, this was the highest auction, exceeding the previous record of $208,000 set a few days ago, for a video of Lebron James during a game in the major US basketball league.

These staggering figures highlight the feverish period that is causing an explosion not only in prices but also in the number of searches.

5 hottest DeFi news of the week

47% of accredited investors are very likely to invest in DeFi

Mintable to sell a Baranoff Rossine NFT

The first NFT arrives on the Cardano mainnet

Bank of America sees DeFi more disruptive than Bitcoin

Technical Analysis

Bitcoin (BTC)

After the new all-time high on Saturday, March 13th, with the price of bitcoin rising above $61,600 for the first time (1), the start of the week was difficult. The decline that unfolded over the next 48 hours saw prices lose 13% from the weekend's tops. In terms of intensity, it was the sixth-worst decline since the beginning of the year. From the Tuesday low, prices found good support in the $53,550 area (2) where volumes returned alongside the price rebound. The upward price trend since the beginning of the month is positive and cancels the hypothesis developed in recent weeks in line with a continuation of weakness at the end of the two-month cycle that began with the lows of late January. In this phase, it will be necessary to follow the evolution of the prices in the next few days following the trend on a weekly basis. A new bullish extension over the highs of last weekend will give definitive confirmation of the anticipated start of the new monthly cycle and perhaps even a new bi-monthly cycle. Conversely, a descent below Tuesday's lows will still keep open the possibility of the return of weakness, although it will be necessary to identify the new temporal phase to understand the structure of the upper cycle (3-6 months).

BTC Options

Although prices have managed to push above the $58,000 barrier, until last week considered the most important level for derivatives traders to protect, this level seems to remain an important watershed. After the breakthrough that pushed prices over 16,500 USD, prices quickly returned to test 54,000 USD, which in the previous update I indicated as an important support level for downside protection. A week later we are still with prices between these two operational areas. I do not exclude the possibility that this phase of uncertainty could be prolonged until the next few days while waiting for the quarterly expiry of the major options contracts. In the last week, Call options positions have grown considerably to cover possible extensions above 61,000-61,600 USD. The ratio of puts to calls has reversed 1:2, showing that traders remain exposed to the upside and prefer to secure profits by selling call options.

Ethereum (ETH)

After attempting to break through the 1,900 USD mark (1), the Ethereum price has been hovering around the 1,800 USD mark all week without providing any useful operational indications. With the exception of a bullish tick last weekend, the price has been hovering in a narrow range of $100 between $1,750 and $1,850 for the past two weeks. If on the one hand, the holding of 1,700 USD (2) is a good sign of strength in a phase which, if correctly analyzed, indicates a closing quarterly cycle - which began in late December - without the sales that usually characterize the final phase of the cycle, on the other hand, the lack of volumes is a sign of strong indecision. In fact, a sudden increase in volumes caused by even a few players could provoke strong speculative excursions. Over the past week, the average daily trading volume on the main exchanges has been around $4.5 billion, peaking at over $6 billion just twice (on March 13th and 15th), less than half of the record highs set at the end of February with Ethereum trading just above current levels.

ETH Options

Hedging positions for rises above $1,900 have increased, while downside protection has been raised from $1,400 to $1,600. The ratio between Put and Call options has increased to 1:2, indicating the caution of traders who fear a return of weakness, protecting the gains of the long positions that remain open. Over the past week, aggregate open interest in options (a measure of the amount of options remaining open overnight) has remained stable at highs above $3 billion.

DeFi Today interviews Jeff Zhang of Binance Smart Chain

The Binance Smart Chain is the exchange blockchain where developers can build their own dApps. Recently, Binance is pushing this project a lot, allowing companies to use it to develop several different DeFi applications.

The BSC has been launched in September 2020 and it now has 158 DeFi apps, according to DappRadar data.

In the last week, BSC records a turnover of tokens immobilized on the project in excess of $13 billion. Many users choose to use BSC because of the advantage in fees to be paid per exchange.

What do you reply about the accusation that BSC is not really decentralized?

BSC is governed by the 21 validators that are elected every 24 hours. The latest validator set contains prominent community members, such as BNB48, Ankr, Bscscan, Trust Wallet, MathWallet, Certik and many other anonymous ones.

How is it going with BSC?

Actually BSC has completed the initial network effect as a public chain. Everyday we see new projects and new users flow in the Binance Smart Chain. ( The full list can be found in BSCproject.org https://bscproject.org/#/ ). We acquire developers through “Hackathon” “Masterclass” and general users through “Educational content” “Cross-Country collaboration” “Big BSC projects” “Wallet collaborations” We will keep cultivating in these directions and expand rapidly.

Long term plan:

Push hard on BSC to reach 3-4x of ETH Txs with 100 TPS, and ~60-70% of ETH active addresses (1m weekly active users)

Introduce more cross-chain infra to enable “Internet of value”, e.g., All chains to BSC

Start the progressive BSC decentralization (open more validators to trusted partners)

Focus on NFT and Gaming, and build a comprehensive ecosystem including artists (IP), collectables, gaming, social token, and real world assets;

Ethereum partnership (1inch/TheGraph/Gnosis are good start).

Inspire more DeFi 2.0, like Futures, Options, DeFi composition, etc

Can you talk a little bit about pancake swap and why did you decide to support the project ?

Our developer support programs are open to the public. BSC Accelerator Fund has sponsored more than 15 teams; Builder reward program record is released monthly here. MVB program is going to announce the top 10 projects soon.

1. BSC Accelerator Fund (100 Million dollars)

Most Valuable Builder Accelerator (MVB) Program

2. BUIDL Reward Program

3. BSC Hackerlink Grant Application Guidelines ( 50k dollars for round 1)

https://hidorahacks.medium.com/bsc-grant-application-guidelines-e2338abe65dd

4. Binance Hackathon: The Future Is Now | Powered by Gitcoin (February 1-21 )