Bitcoin Superstar

Unlike what happened in March, fears of a worsening of the economic crisis due to the second wave of the Covid pandemic caused all the world's financial assets to fall, except the price of Bitcoin...

Image Source: Fee

Bitcoin is about to close the month of October with the highest monthly closing since December 2017. Even on a weekly basis, if Bitcoin maintains its current levels around $13,800, the king of cryptocurrencies will be the only one among the big coins to finish above parity with a gain of about 6%.

In percentage terms (+28%) this is the second best month since the beginning of the year, whereas in value terms, the gain of over $3,100 since the beginning of the month marks the strongest increase since May 2019 when Bitcoin earned little more $3,200.

The second wave of the Covid19 pandemic is showing a different development between the Bitcoin price trend and the rest of the assets. Unlike what happened last March when the collapse of the financial markets dragged down also the prices of Bitcoin, this period is showing a different pattern between Bitcoin and the rest of the world. Not only the Altcoins are struggling to keep pace, but also the main assets, showing a clear difference in the movements. Since the beginning of September, Bitcoin has gained more than 16%, while Gold is losing 5.5% and Silver is falling more than 17%.

The difference is heavier with the US equity indices of the S&P500 (-7.2%) and the European indices of the Eurostoxx50 (-10%). The recent countertrend also caused the correlation between Bitcoin and Gold to collapse. A few weeks after the historical peak reached on September 15th, the daily trend between the prices of Bitcoin and gold has become increasingly divergent with bitcoin continuing to rise to the highest peak in the last two years, Wednesday October 28th at 13,840 USD, while gold from the historical high of August 7th (2,015 USD per ounce) continues to slide to the recent period lows at 1860 USD on Thursday October 29th. The correlation between bitcoin and S&P500 also collapsed in a few days, dropping to 0% (zero), the lowest level since last June.

The global pandemic is proving to be a decisive factor for Bitcoin, not just the price. But this will be examined in next week's report.

DeFi - Decentralized Finance

Trading volumes on DEXs (decentralized exchanges) are growing again. Since last Friday, the weekly increase is 170% for a total of over $7.7 billion. October, with around $19 billion, is about to close the second month with the highest volume ever.

DEXes Volume

More than 94 thousand traders have used the Uniswap DEX this week, which confirms its leadership in terms of trading volume with $3.9 billion. But it is Curve's DEX that captures the spotlight. With over $3.3 billion, in just seven days it tripled its turnover and gained 42% of the market share, twice as much as last week, reducing Uniswap's dominance from 55% to 50%.

After three weeks, the total value locked (TVL) on decentralized finance protocols falls below $11 billion. This is attributable to the theft that exploited a flaw in the code of the Harvest Finance project, which in just seven minutes created the possibility for the skilled hacker to collect a total of $34 million. It wasn't a direct theft of deposits locked on Harvest's DeFi protocol, but an attack that used flash loans to manipulate the prices of some stablecoins, exploiting the possibility of arbitrage during the numerous buying and selling transactions. Although it wasn't considered a real hack against the protocol, the Harvest team admitted that this was possible due to a design flaw, placing a $1 million bounty on the attacker's head.

The theft has created tensions among DeFi investors, not only because of the value of the tokens of major projects. Many investors have preferred to withdraw their deposits even though so far everything appears to be in order.

Total Value Locked in DeFi

5 Hottest DeFi News of the week

Maker Dao has issue with its governance

DefiDollar Raises $1.2M to Be the Risk-Insured Stablecoin Layer for DeFi

Aave hands over governance keys to DeFi community

Technical Analysis

Bitcoin (BTC)

Positive closure for the fourth consecutive week. Something that has already occurred twice since the beginning of the year (seven times between March-April and four times between July and August). But this time it is the highest weekly closure since mid-January 2018. This is an important technical signal that has now restored investor confidence to the levels of the summer, and from next week it could change long-term positions for automated strategies by the algorithms of many cryptocurrency investment companies. For this last reason, it will be important to understand price trends as early as next week. A decisive confirmation will be with the holding of 13,000 USD. The rapid climb of the last ten days has not built valid supports leaving space for rapid descents down to the 12,000 USD area without affecting the upward trend built by the lows of September. Upwards, on the other hand, the break of 14,000 USD opens up space to continue the recovery of 15,500 USD, a level that coincides with 75% of the Fibonacci retracement between the references of the historical highs of December 2017 and the lows of mid-December 2018.

After the clearing of upward hedges, operators in options derivatives are back to setting new strategies. Over the last week, the value of total open interest (the number of contracts remaining open overnight) exceeded $2.7 billion, the highest level ever, confirming the growth of professional and experienced investors, who have always been accustomed to using this derivative instrument to hedge risk in traditional markets.

Recent period highs are starting to be the first reference levels where new hedges start to open, reaching as high as 14,150 USD. A rise above this level would open up space to rise above 15,000 USD without finding resistance. Conversely, a change of direction still sees the 10,500 USD area as the first real support to protect against a fall. Unless there is a violent downturn, positions will begin to move into strengthening the 12,700-12,100 USD area.

Ethereum (ETH)

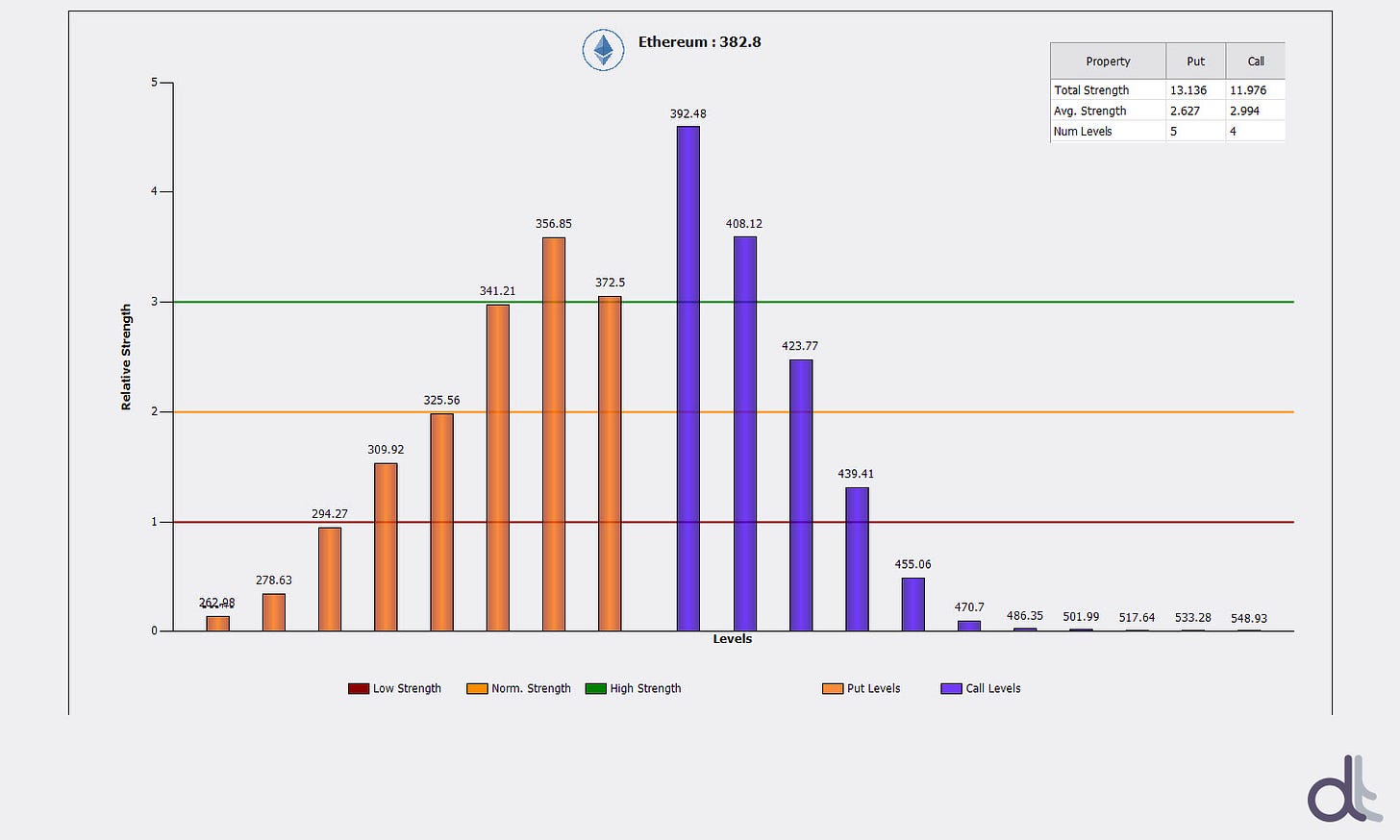

The rise in prices stops at 415-420 USD, an area of technical resistance for several weeks, strongly protected by operators in options. This has helped to repel the bullish attack by bringing prices back below 390 USD. It becomes important to brake the fall above the bullish trendline of 355 USD. A break-down of this dynamic support will begin to give the first sign of trend reversal. The trendline has been accompanying the uptrend for over seven months.

The strength of the positions to protect the elevations increases. After protecting and repelling the rise above 415-420 USD the strategies lower the protection to 390 USD, which was already a resistance level then became support and now resistance again. Downward protection is confirmed with open put options between 365 and 350 USD.

New gaming NTFs to earn money while playing

The gaming sector is one of the best use cases for non-fungible tokens (NFT) after DeFi.

Yesterday night with an explosive video, YouTuber PewDiePie officially announced its collaboration with Wallem, a free game available on both iOS and Android.

This video game is based on a 3D map and on an ultimate Augmented Reality engine, capable of controlling users’ real-time actions like in the most famous game Pokémon GO.

By navigating on the worldwide 3D map, users will be able to join events, catch brand points and use them to buy different goods and services.

The first two events are with big Italian names such as Armani and Motta to win a watch and/or 50€ in PlayStation’s games.

Also, tomorrow a new Halloween event will be launched on the application and catching 12 pumpkins people will be able to win an iPhone 12.

Wallem and the Pteria DAO

The brand points collected aren’t just normal gaming credits but a token based on the Ethereum blockchain called Pteria (PTERIA).

In fact, these tokens are issued by a third party, a DAO (decentralized autonomous organization) called Pteria, that created these tokens independently as utility tokens to be functional in gaming platforms.

Wallem will be the first gaming app to be allowed to use PTE, but more will be announced in the future.

Pteria and NFTs

The Pteria DAO has also issued a limited number of NFTs representing skins that can be used within the Wallem app, a mobile game where users access exclusive augmented reality events using different skins.

As first mint the Pteria DAO will issue 6 different NFTs.

Basically, all the skins in Wallem are real NFTs based on Ethereum standard ERC721 and people who decide to buy them will earn 10% of all the gamers’ activities in the game.