Bitcoin between Innovation and Revolution

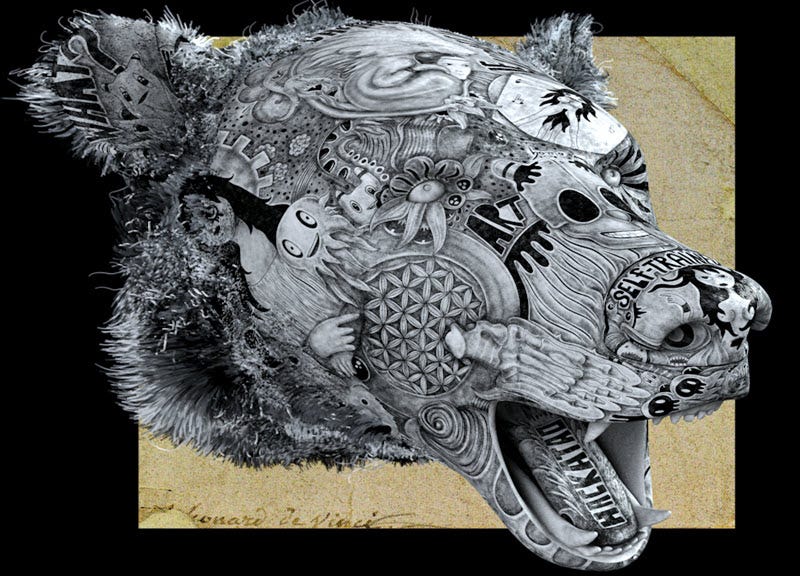

Rumors after M. Saylor's statements fuel expectations as Leonardo's classic art meets the digital

If you don't believe me or don't get it, I don't have time to try to convince you, sorry

Satoshi Nakamoto

If anyone had fallen for any reason into some kind of lethargy, numbness, lasted a few years, and today waking up he would suddenly realize of what has happened and is happening to the digital world, he would find it completely revolutionized.

Until a few years ago, who could have ever imagined that a virtual currency would one day be able to place itself on the podium as a real financial asset in all regards?!

March 2020 has signed during a pandemic, a revolution in the global financial industry. Slowly, but upon careful observation, we can see that important historical changes are taking place over a long-range time parameter , those changes will not just impact the world, but especially the entire financial system will be radically different than the previous one. And Bitcoin, the new era of future finance, it's becoming a legal reality supported by a value that can be calculated through not only the intrinsic value of it (which had to be justified by various factors such as cost energy of its emission), but from a choice made by international institutional investors adopting Bitcoin as a monetary solution.

After the acceptance by the state of El Salvador as a legal tender payment instrument, we can now talk about a genuine change even if it's still structured in a small dimension. If this nation, however, would be giving the start to a new financial perspective, there would be all the preconditions for a slow but effective global revolution. Another step at the moment is to interpret, valorazing, the new figure of Bitcoin, and it can also take place through observing the price it has had over the last few years (ascent and descent) that increasingly positions BTC as a “Safe haven” asset that protects purchasing power.

During the last few days, Michael Saylor, CEO of MicroStrategy, Bitcoin evangelist, has intervened again, with his statements he has definitely made a point giving a very strong signal. He stated that the reasons that prompted his company to invest in Bitcoin were precisely to enhance their cash reserves which were subject to inflation caused by the continuous fluctuation of the monetary policies decided by the American central bank.

The reason that brought him to buy another 500 million dollars in Bitcoin was based on a strategy which intends to continue investing to preserve purchasing power . The reason that will lead many other global companies to take this same step will be the active response to this very change.

Decentralized Finance

The Uniswap project that saw the light in 2018, but started to take off last fall 2020, is currently in continuous evolution mainly due to the development work that the team of experts of this reality has brought. We can see in concrete how it has now established itself as a leading project in decentralized exchanges.

Although the total volumes are around 11 billion USD weekly, this, in particular, contributes to a real breakthrough of the critical factors with the launch of the DEX's v3 that, in the last few days, has seen overtake, if not double, the volumes between the previous version (v2) and the current version (v3). In the last 24 hours, v3 has traded a counter value of over 800 million USD while v2 is around 360 million USD, and this is a turning point that will make all the other projects grow, as usually happens in this sector.

At the moment, Uniswap's DEX almost cannibalized the entire industry in the last seven days with 11.3 billion USD, equal to more than 71% of the market share.

Followed by Sushiswap that had copied the previous version of Uniswap but still holding a position of 1.3 billion USD traded in the last week, which is, in addition to a tenth of the giant Uniswap, just over 8.7%.

A bit further away is 0x's third project, Native, with 838 million USD traded in the last seven days, or 5.3%.

The month of June ended with a trading volume of 85.7 billion USD traded. That stands as the second-highest trading volume month on record, although far from the historical record peaks of May, which had seen a close of over 173.1 billion USD.

In the last week, the total trading volume is just over 16 billion USD with a slight decrease of about 10% weekly; while all trading volumes fall, Uniswap instead keeps its record intact.

As indicated by the Defipulse.com website, the total TVL (Total Value Locked) on Decentralized Finance projects remains below $55 billion, with:

Aave returning above $10 billion after two weeks;

For the first time, Curve's DEX, the liquidity pool designed for stablecoin trading, rises to second place overall with $7.9 billion;

In third position slides Maker with a total locked of $6.4 billion.

Non Fungible Token

Despite a slight perception of cooling in the NFT market, however, the ferment in this sector continues. In the last few days, a series A funding round has been concluded, which closed with a collection of 13 million dollars for the marketplace Mintable, whose investors include Ripple, Metapurse, the investment fund supported by Metakovan, Expedia Group, and Spark Digital Capital. And it is precisely this marketplace that ranks among the most popular, along with OpenSea and Raribile, the most popular.

Singer Katy Perry recently launched her collection of NFTs on Tetha.Network's blockchain-managed marketplace.

The NFT of the WWW, the first source code created by Tim Berners-Lee in 1989, has been transformed into NFT and auctioned for $ 5.4 million. A significant result that, by importance, positions together with the first Tweet awarded for 3 million USD last March. Berners-Lee and his wife will donate the proceeds of this successful auction to help important causes related to their associations.

However, the week sees the affirmation of the Axie Infinity project - the replica of a virtual farm where users can breed, trade, and have pets fight each other - which rises weekly by over 60%, with over $45 million traded.

Another significant growth comes from Bored Ape Kennel Club, which increases its turnover by over 155% in seven days, with just under $8 million and about 2,000 transactions.

In the last week, four of the top five most significant trades belong to CryptoPunks. The first one was awarded for 109 ETH, equal to 232,730.26 USD, a female image characterized by red hair and bright red lipstick. It was a sale as the previous owner had bought it last March for 155 ETH, at the time equal to a counter value of 333,614.25 USD. Among the top five auction positions of Non-Fungible-Token also includes the virtual world dimension of Decentraland with a plot of land awarded for 275,000 Mana, equal to 152,584.85 USD.

5 hottest DeFi news of the week

Technical Analysis

Bitcoin (BTC)

June marked the end of the third consecutive month of decline, the longest time series since 2019 (July-September), which does not undermine the performance that has seen it record a rise of 15% since the beginning of the year while remaining, however, positive.

The last week was characterized by ups and downs, after reaching the price lows, and since last Friday, June 25, testing the price spike during the May 19 decline, when for the first time in four months, the price of Bitcoin fell to 29,500 USD, the lowest point since the end of January. This recovery developed during the week bringing Bitcoin prices above 36,500 USD (1) without finding the proper confirmations needed in these cases to give a new impetus necessary to sustain the rise. Currently, weak signs of recovery are starting to be seen through the hints of a possible reversal. However, volumes are needed, which have fallen below the average of 10 billion USD of daily trades, unlike last week. However, technically, Bitcoin must get back above the peaks of 36,500 USD (1) recorded last Tuesday, June 29. Otherwise, the situation will continue to be precarious. Instead, an eventual break of the lows below 30,000 USD (Saturday, June 26)(2) could provoke a solid downward movement dictated mainly by strong speculation.

BTC Options

As far as options are concerned, we know instead that they have registered a sharp drop in Open Interest in the last week and this one, also for futures. That could mean that Cash & Carry operations, as far as the speculative activity of professional operators, who use both spot and futures instruments to exploit the price difference between the two underlying, could be in a final phase. This occurrence is undoubtedly a clue indicating the recovery or trend reversal and, in this case, a price that returns to grow again. However, to have further confirmation, we should observe a price continuity not too much oscillating between 32,000 and 30,000 USD. Perhaps this is also the reason for the increase in open protection positions for Put options, which have notably increased in the last seven days, reducing the ratio between Put and Call to 0.8:1. On the upside, instead, the protection positions above 41,000 USD remain spread up to 43,800 USD, and this is the area that professional traders take as an example to indicate a possible reversal of the trend with prices rising again, an essential signal in a medium and long term perspective. With prices below these levels, we can currently state a price distance of over 25% from current levels; it is necessary to continue to be therefore cautious in this sense.

Ethereum (ETH)

Unlike Bitcoin, Ethereum, despite marking the last month in negative, is still mindful of a substantial rise obtained in April and a quarterly closing in positive. That is a sign of strength that sees the sixth consecutive upward quarter since the first of 2020. If we want to parallel, we could say that Ethereum enjoys a more definite upward trend than Bitcoin. Consecutive upward historical series this never happened before.

The uptrend developed at the beginning of this week has pushed after about two months to break the bearish trend line (1) started last May (2). The overcoming of 2000 USD (with a fall in both technical and psychological areas) pushed prices a step away from 2300 USD (3) without finding the necessary confirmations to overcome the barrier and the critical resistance that coincides with the relative lows touched at the end of May and in the middle of last June. That is a level to be followed carefully if one wishes to find confirmations of a solid reversal by the price from the bottom to the top.

The prices retracement and lack of confirmation of overcoming the 2300 USD (3) have brought in these hours the prices to test again the psychological threshold of 2000 USD (1) that has now become a short-term support level. Regarding the signals instead, to follow during the next week, it is necessary not to go below 1800 USD (4), price formed at the end of last week. In case of a break down of these levels, we could see the following targets in the 1500 USD area and then the most important one in the 1300 USD area that coincides with the minimum of the end of last February.

ETH Options

As far as options for Ethereum are concerned, positions to protect against a possible reversal of the upward trend are strengthened, and professional traders' positions are confirmed in the area between 2600 and 2750 USD. Here are concentrated the most critical hedging positions with Call options, while on the other hand, on the downside, it is essential to defend the barrier of 1900/2000 USD. In fact, in the case of a failure to hold these levels, the professional and institutional operators that use this type of derivative instrument to hedge the risk indicate the next level to monitor in the 1700 USD area.

Leonardo's classical art meets digital art

In recent months the NFT industry, which stands for Non-Fungible Tokens, the technology that allows a digital code to be made unique, found the height of notoriety when the work of the artist Beeple was sold for nearly $70 billion at Christie's auction house. The third most expensive work sold at auction by a living artist. In the following weeks, other renowned and historic auction houses such as Sotheby's and Phillips accompanied their traditional auctions with digital works, starting to give the first signals between the physical and digital worlds.

And today, this space is beginning to be filled. Once again, Christie's is the revolution's promoter, reviving the emotion of Leonardo Da Vinci, where the drawing "Head of a Bear" is reborn in the metaverse with the genius of the Hackatao, managing to merge the real with the digital, the past that inspires the future, with their work "Hack of a Bear."

A bear head, executed by Leonardo in silverpoint on pale pink paper measuring only 7x7 cm and offered in the catalog with an estimate of up to 12 million, now comes to life with a dynamic work through augmented reality technology.

The work commissioned by Christie's will accompany the drawing's exhibition in the King Street Rooms from July 3-7 and will be auctioned the following day, July 8.

Several NFT works will be created from this work by Hackatao, one of which will be donated to the Museum of Crypto Art (M○C△), and the others will be available on SuperRare.com, one of the first major CryptoArt platforms.

"One can only assume that if Leonardo [...] were living and working now, he would be absolutely fascinated by the rise of NFTs and would probably want to coin his own as well," says Noah Davis, Specialist, Post War, and Contemporary Art, Christie's New York. "This collaboration marks an important moment for crypto-native artists like Hackatao, now that their practice is exploding at the highest level in the international art market."

Italian crypto artist duo Hackatao once again has something to teach us.

The new perspective comes from a project that looks to the future by passing through the bridge that connects all historical eras of humanity: that of universal classical art. And linking a drawing by Leonardo to a unique encrypted code is perhaps the most innovative and audacious current expression imaginable. It almost seems that the uniqueness and rarity of even a single small drawing representing a bear head, produced by the Master, is no longer for a moment dictating the rules but the infinite container of the blockchain world. Tokenizing genius, this was the goal highly achieved by the Hackatao. And at the exact moment when, on July 8, Christie's will auction the original work of Da Vinci, the Italian duo of crypto artists will have already toured the planet with the selection of the digital work.

I couldn't help but interview them.

From Hackatao Tex to Leonardo's Bear's Head, how is the perception of CryptoArt changing?

At the beginning of 2018, when we tokenized our first work with Superrare, the CryptoArt mainly was ignored by the art establishment (gallerists, collectors, and artists included), considered a little game technologically too complicated to have a future. But those who believed in it and sowed the seeds of a paradigm shift working steadily to build this metaverse have been amply rewarded. Today the attention on NFTs and CryptoArt is impressive compared to only three years ago. However, there is still much work to be done both technologically and from a sustainability perspective. Hack of a Bear for us represents a chance to go even further, creating a continuum with Leonardo's art and the new Renaissance 2.0 that we are living and actively building.

We are bringing the new generations closer to the power of art through the playful aspect of the message.

Yes, making art, first of all, is fun, fulfilling, and psychologically resolves a lot of us. Through NFT and CryptoArt, the new generations can express themselves with their native digital languages and have immediate access to an international market without barriers and borders, but above all, decentralized. It is no longer necessary to live in a big city like NYC or to attend a certain entourage to emerge, even if we believe it is essential to participate in the NFT community to make oneself known. And those who enter the crypto-verse intending to build something of value and not for purely speculative purposes will have their playful satisfaction.

Being against contemporary false moral ethics is the new artistic renewal. Is the world of the blockchain?

We don't know if the world will be blockchain, but certainly, those who live and work in this new dimension have a hard time going back to the old logic. Once you understand the creative application power of blockchain and the founding values of cryptocurrencies, everything else seems complicated and obsolete. For this reason, those who are part of this movement have also chosen freedom.

Let’s Connect

DeFiToday is A FREE weekly newsletter covering all the top stories in DeFi:

Bitcoin, Ethereum and DeFi Charts

Esclusive Interviews

Curated content from industry leaders

Join our Telegram Channel - Follow us on Twitter - Subscribe