Bitcoin and the muscles of the Federal Reserve

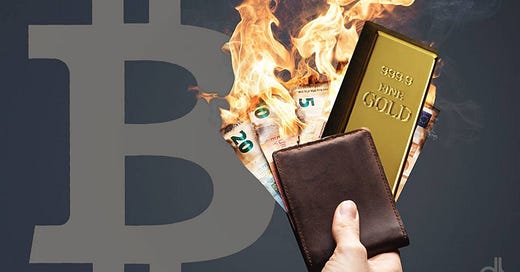

Rising US bond yields shake financial markets. The Bitcoin price is poised to strengthen as a true alternative asset to hedge against the increasingly threatening winds of inflation and uncertainty.

"Inflation is a form of taxation that can be imposed without legislation."

Milton Friedman

The cryptocurrency market has changed. Over the past year, and more so in recent weeks, the massive entry of institutional investors and large US corporations has been reflected in the flight of Bitcoin prices, and subsequently cascading into all other alts, shaping a different and in many ways more mature sector. Bitcoin has become to all intents and purposes an alternative financial asset and this makes it a hedging tool for the strategies that professional investors and financial bigwigs implement to protect their portfolio decisions. I do not see this as a negative aspect, but rather as a consequence of the expansion of the sector, which even indirectly adapts to the choices of traditional finance and macroeconomic policies. Not only traders, but also historical fans or sympathizers of Bitcoin and its grandchildren, the altcoins, need to start considering the macroeconomic aspects as well.

Those who read these pages should also find useful indications for the future in the coming months and not only for the short term. Those who have been reading me or following my video interventions for a long time will remember how I was one of the few to anticipate the main phases of price correction at the beginning of 2018, the recovery at the beginning of 2019, or to comment on the delicate period of last March 2020, announcing the maturation phase of Bitcoin and how the crisis would have been the right occasion to show its value, as eventually happened.

To understand these phases it is not necessary to rely only on a crystal ball (!), but it is also necessary to have a lens that allows reading a context that goes beyond the analysis of a single sector. It is necessary to understand the dynamics of the economy and monetary policies. From what I understand, the readers who receive this newsletter are mostly cryptocurrency enthusiasts with little knowledge of economics. Therefore it is necessary to make them understand what is happening in this crucial period for the world economy, the monetary policies of central banks, primarily the Fed, which are reflected on all assets and cascade on the cost of the dollar and consequently also on the price of Bitcoin. As I explained recently during a conversation on Clubhouse, central bank policies and financial market expectations have contributed to the halt of the bullish price run which a fortnight ago recorded all-time highs for Bitcoin (58,300 USD), Ethereum (2,000 USD) and many other of the blue chip altcoins.

The current short-term pause for Bitcoin and the entire cryptocurrency sector needs to be analyzed carefully with central bank policies necessarily in mind. To understand better, we need to take a step back a few weeks to understand the reasons why the global financial markets are getting nervous, not only reflecting on the most reactive equity markets, but also on commodities and foreign exchange markets. Unlike the Old Continent, which is facing a more serious health and economic situation, in the United States the vaccination programme is proceeding rapidly and, as indicated in recent days by the new President John Biden, by May all American citizens will have received the vaccine. Overcoming the pandemic crisis will be reflected in the US economy, which will return to growth. Experts and institutional investors expect an economic recovery from the second half of the year. The return of consumption causes an increase in prices by decreasing people's purchasing power, thus creating inflation. The item I buy today at $10, because of inflation I will have to spend more to get it. Unlike the current inflation, which is considered unhealthy inflation and is not the result of economic recovery but caused by the distortion due to the adjustment of prices in international trade, in particular the increase in the cost of imports from China, 'healthy' inflation is controlled by the policies of central banks which, in order to calm consumption and the increase in prices, decide to increase the cost of money by operating on interest rates. This is what is happening on the US bond markets, which in recent weeks have seen yields rise to over 1.6%, the highest level for a year. This happens when the markets anticipate the central bank's moves, but yesterday the central bank made it clear that it is going against expectations and is capable of managing current inflation. In yesterday's speech, Fed Chairman Jerome Powell flexed his muscles against market expectations of hawkish decisions, reacting with sharp falls across the board in equity indices and a strengthening of the US dollar, which in recent hours has fallen to within a whisker of $1.19 against the euro, its lowest level since last November. The bearish movement of gold prices has strengthened, returning to hit $1,680 an ounce, the lowest level since last June. In the immediate term, the strengthening of the dollar is reflected in Bitcoin prices, which are weakening again. If the Fed's choices do not turn out to be right and the control of inflation gets out of hand, the situation will become even worse. The next few months will be marked by economic uncertainty, and a further drop in gold prices will increase attention to, and purchases of, Bitcoin, which has always been recognized by experts and is now also appreciated by American corporate companies, as the most important anti-inflation tool for defending purchasing power.

Decentralized Finance

February set a new record for monthly trading volumes on decentralized exchanges, closing with more than $74.8 billion. This is three times the volume recorded last December.

DEXes Monthly Volume

Since Friday, February 26th, trading volumes have halved, falling from $18.5 billion to $11 billion. The halt coincides with the collapse of volumes on centralized trading services as well. The aggregate volume of trades made in the last 24 hours on decentralized trading protocols is $1.1 billion. The same volume was recorded last week for three consecutive days on Uniswap, the main DEX.

DEXes Volume Last 7 Days

Uniswap's dominance at the top of the podium remains unchanged, with half of last week's volumes being recorded, but with over 121,000 unique addresses executing at least one trade. The 1inch aggregator allowed over 15,000 users to transfer just under $2 billion in trades by selecting the best match between supply and demand for decentralized protocols.

Despite the general weakness of prices, the value of decentralized finance projects has risen to over $39 billion. This is thanks to the increase in locked Ethereum which has risen to over 8.8 million units, the highest peak since mid-November. On the other hand, the number of bitcoin tokenized fell to 44.9 thousand, the lowest level since early February.

Total Value Locked in DeFi

On the podium of the protocols with the highest deposits are the three lending and financing projects of Maker with over $6 billion as well as

Compound and Aave both with around $5 billion.

Next up with $4 billion is Curve, the DEX project with the highest total value locked, about $400 million more than Uniswap.

5 hottest DeFi news of the week

Sorare: One Shot League fantasy football game coming soon

Animoca Brands to invest in a loan platform

DEX and DeFi volumes decline

Wall Street Jim Bianco supports DeFi

Insurance Giant Aon to test DeFi

Technical Analysis

Bitcoin (BTC)

In the previous update I indicated that I was expecting a price rebound to figure out the extent of the new weekly sub-cycle. The rebound happened exactly as I hypothesized, with prices back above USD 52,000 , but without giving confirmation of the recovery. On Wednesday, March 3rd, the climb pushed prices just above USD 52,500 intraday (1), failing to confirm at the close of the day and ending just above USD 50,000. This trend indicates that the upward movement was more impulsive than the result of a real rise. Looking at the price movement with the volumes traded in those hours, the climb that brought the prices from 49,700 to 51,700 USD saw volumes decrease, a signal that does not indicate a strong rise. The subsequent run from USD 51,700 to USD 52,500 in the following minutes saw a significant increase in volumes due to closures of bearish positions with stop-losses above USD 52,000. In the following hours, the return of prices below this threshold occurred with contracting volumes. If there had been new purchases the price would have continued to rise, instead, the subsequent descent and return to the original price indicates a lack of new upward positions.

The weekly cycle that began with the minimum of Sunday, February 28th at the moment indicates a good holding. It is worth recalling that prices are in the closing phase of the two-month cycle that began with the double minimum at the end of January. A closure that, as already written previously, I have assumed to take place in the second part of March. Therefore the price is situated in a critical phase where the weakness prevails and it would not come as a surprise if prices were to resume falling. In this phase, it is necessary to have the confirmations of the maintenance of the supports, instead of trying to anticipate the return to the rise. Only a return above the highs of the week (52,500 USD) and confirmations at the close of the day above this level, would provide the first signal of a possible breakout and anticipation of cycle closure. On the downside continue to monitor the support of 44,000 USD (2). A break downwards does not exclude a visit to the technical and psychological support of 40,000 USD (3).

BTC Chart

Options

The operations of professionals in options derivatives reinforce the technical hypotheses I have developed. In fact, downside risk hedging strategies prevail with an increase in Call options positions (upside). Only rises above 51,600 USD (A) would begin to trigger the coverage of open selling positions and the possibility of extensions up to the 54,000 USD area where purchases would begin to intervene and there would be a change of positions from bearish to bullish. On the downside, the holding of 44,000 USD (B) remains crucial, which is where the more protection of the most important supports is located.

BTC Options

Ethereum (ETH)

Throughout the week the prices of Ethereum have fluctuated between 1,300 and 1,650 USD, within the range of Fibonacci retracement levels of 25% (1,650)(1) and 50% (1,300)(2).

The rebound in prices that began from the low of Sunday, February 28th has managed to bring prices back to test the 1,650 USD, resistance area that I indicated as important in the previous report.

As with Bitcoin, there was a lack of support for the new purchases needed to push prices to close the day above this resistance level. At the same time, however, the holding of 1,300 USD becomes important for the stability of a critical level in the quarterly cycle which began in late December. Despite the different cycle setup between Bitcoin (2 months) and Ethereum (3 months), both hypotheses find the same point of closure expected in the second part of March. For Ethereum too, it becomes important to follow the trend in the coming days.

The passage of time without particular bearish movements, in a phase where sales prevail, would strengthen the next restart of the new quarterly cycle. But it is still too early to push too far. It remains important to follow the price trend over the next few days for further confirmation of the 1,300 USD (2) holding. A break to the downside would increase the chances of seeing the 1,000 USD again. On the contrary, a daily close above 1,650 USD (1) would begin to give the first sign of restarting the new quarterly cycle.

ETH Chart

Options

Traders in options continue to remain cautious, preferring to hedge the risk of a return of sales. The ratio between Put (down) and Call (up) options remains in favour of the latter with a ratio of 1:2 although with less margin than last week when the ratio was 1:8. The 1,650 USD (A) area remains a hedging area even though the most important positions have moved just above 1,725 USD (B) in order to widen margins in case of a return of purchases. Next week we officially enter the most critical phase of the current quarterly cycle. It becomes important for options traders not to make any missteps and protect against a possible increase in volatility. A plunge below 1,400 USD (C) could cause a rise in tension and price movements with strong excursions even within the same trading day.

ETH Options

Interview with Claudia Lagorio, COO of Bitfinex and Tether

We talked about smart working, DeFi and diversity with Claudia Lagorio, COO of Bitfinex and Tether.

- How is it to work in a male industry? I suppose you are also the only woman in Bitfinex…

I wouldn’t define it as a male industry, many women are involved in its development, supporting the crypto revolution in many ways and their contribution shouldn’t go unnoticed.

For example, in Bitfinex and Tether, women are covering various roles, including technical and leadership positions.

Having a diverse and well-balanced team is part of our strength. Everyone contributes with their talents, personality, and background to the development of our products and, more generally, to the crypto community's growth.

- How do you manage your company working only remotely? This way covid-19 didn't touch you at all, right?

Managing a completely remote and distributed company requires both strong organisation and good adaptability. Efficient communication is the key, and finding the right tools is the first step to achieve it. Your needs go from just sending a quick message to a colleague to collaborating and developing complex projects that involve multiple departments.

Our industry, and the world around us, are continually evolving and we face new challenges every day.

Even though Covid-19 has touched everyone from a personal perspective, working remotely and from various locations has demonstrated once again to be a winning choice. Our unique setup allows us to be resilient and to always provide a consistent and outstanding service with the peace of mind of working from a safe environment.

- What do you think about DeFi ?

DeFi has the chance to set the standard for a more transparent ecosystem of financial services.

Both Bitfinex and Tether are following the DeFi space closely as it continues to evolve. We are collaborating with projects or funding or integrating them in our suite of products. In particular, we are supportive of initiatives that are building financial products that aim to enhance levels of financial inclusion. These projects serve those who have difficulty obtaining access to standard banking services. Another important aspect for us is the focus on the adoption of layer 2 scalability solutions to make the DeFi space ready for the next 100 million users.

- NFT is one of the great trends of 2021, any future news about it at Bitfinex?

We have seen NFT interest growing rapidly since the beginning of 2021. At the moment we are closely looking at the ecosystem without direct involvement. While having the potential to improve and solve many complexities of the digital property industry, we urge users to carefully evaluate before investing in the ownership of NFTs.

- What do you expect from 2021 after the great news of the end of the dispute with the NYAG?

We can finally focus our energies towards what we do best: the development of ground breaking products. Keep an eye on our social media channels because something big is coming.

- How do you see Bitcoin in 5 years? And the industry in general?

We are witnessing big players entering the crypto space right now and I expect crypto will reach hundreds of millions of people. Bitcoin based-products will mature and become more accessible to the average user. Concepts like the circular economy and living on crypto will become more sustainable, while bitcoin will grow to become the first unstoppable Internet currency.