Bitcoin and Ethereum to the Moon

Ethereum's all-time highs drag the altcoins along and even bitcoin is now hitting new all-time highs

Staring at the screen all day and following every little market movement causes a hypnotic form of mental confusion.

(Anonymous)

From Wednesday, April 14th, Coinbase shares will be able to be traded publicly on the Nasdaq market. With only a few days to go before the release of the first US exchange's financial data, expectations seem to be rising. Unlike a few weeks ago, when the implied $100 billion price tag seemed to be exaggerated, reading the numbers published in Coinbase's official document seems to even underestimate the above-mentioned valuation. Wednesday's event is eagerly awaited by many operators to understand and assess the real potential of a sector that seems to offer opportunities for stellar gains. If the trend were to continue in the coming months, as well as increasing user demand, there would be an exponential increase in earnings for the entire sector. However, this should not only apply to the market of centralized exchanges, but also to that of decentralized ones. If we make a simple comparison between the two sectors, at the moment, the numbers are merciless for DEXs. With over 56 million registered users, $223 billion in assets on the platform and $335 billion in volume traded on Coinbase, Uniswap's decentralized exchange seems to be a market for a select few. There are just over 1.25 million users on the main DEX platform, and the total value of collateral held there is currently around $6 billion for a total of $92 billion. Coinbase's reported net income is approximately $800 million and Uniswap's calculated net income is $276 million. If today Coinbase's valuation, following the published numbers, appears to be underestimated, in comparison, that of the decentralized exchanges is even more so. It seems as if the financial world has not yet realized the value of decentralized products. But this is not the case.

What is happening in the area of non-fungible tokens, abbreviated to NFTs, should probably serve as an example. In the first quarter of 2021, with more than $250 million in trades, the entire volume of 2020 was quadrupled. The hype over the record-breaking numbers of the major cryptocurrencies since the beginning of the year (YTD: Bitcoin +120% - Ethereum +200%) pales in comparison to the growth that NFTs are experiencing in the last couple of months. Just five months after launching its beta version, the NBA Top Shot platform is handling more than 3 million transactions worth over $460 million. It is meeting, on the one hand, the interest of collectors, while on the other, the curiosity of crypto enthusiasts who, it seems, have regained the euphoria already seen in 2017 for ICOs. Vancouver-based Dapper Labs, the company behind NBA Top Shot and the Flow blockchain now officially competing with Ethereum, with a recent funding round, increased its capital from $52 million to $357 million, estimating its valuation at $2.6 billion. Founder and CEO Roham Gharegoslou said it was a major bet for the leading non-fungible token platform.

Since the beginning of the year, the aggregate capitalization of the entire market has increased by 1,785%. The explosive trend is currently involving blockchain projects focused on NFT games, such as those of Theta Network, Enjin, The Sandbox and Axie Infinity, so much so that the tokens linked to these projects are recording four-digit gains since the beginning of the year. Other important NFT markets, such as Rarible and OpenSea, have also seen sales increase by 50 to 100 times over the past three months. In the first week of January 2021, OpenSea's marketplace reported total sales of $5 million and since then, until the end of March, total cumulative sales on OpenSea have risen by more than $100 million.

When different worlds meet, incredible progress often occurs. And when this happens, with the complicity of technology, speed leaves many behind.

Decentralized Finance

For the third consecutive week, total trading volume remains just above $12 billion. The sharp decline in the top two most widely used decentralized trading protocols - Uniswap and Sushiswap - is being offset by increased trading for all other smaller projects.

With $7 billion traded in the last seven days, 8% less than last week, Uniswap's market share drops below 60%. Users of the leading project also fell from 170,000 to 166,000 unique users in the last week.

Total trading value of the Curve DEX project climbed over $1.2 billion, with dominance increasing from 8% to 10%.

In recent days, the team behind the 1inch decentralized finance platform aggregator announced the rebrand to "1inch Network'' anticipating future multichain projects. In addition to the Ethereum network in recent days, the project has also been deployed on the Binance Smart Chain and is considering joining Polkadot's sidechain. Over the past week, the price of the 1inch token has risen by more than 26%, with the most important rises being led by PancakeSwap, which is flying again with a weekly performance of more than 50%.

Overall, the week saw a preponderance of positive balances for the tokens representing the benchmark projects.

Following 1inch and PancakeSwap (CAKE) is Compound (COMP) which has gained 33% since last week's levels. UMA also did well, up 17% and ThorChain is up 36%. Among the major DEXs, only Uniswap's UNI token managed to make a respectable gain of over 11%, trying to climb above the $32 resistance which has repelled any attempt to climb since the beginning of the month. Meanwhile, Sushiswap (SUSHI) and Curve (CRV) reversed course with double-digit declines.

Total collateralized value in DeFi broke the $51 billion barrier for the first time. This is largely due to Ethereum which, with more than 10 million ETH locked in the various decentralized finance projects, the highest number ever, and a value per unit at an all-time high of $2,200, has tripled the TVL since the beginning of the year. After several weeks, Compound's lending and financing project regains the lead, surpassing the $10 billion mark in locked collateral for the first time ever. Maker dropped to second place, keeping its value above $8 billion, close to its top levels. Uniswap's DEX remains the favourite project of traders, defending its third place overall with a TVL above $5.5 billion, the highest value ever for a decentralized exchange.

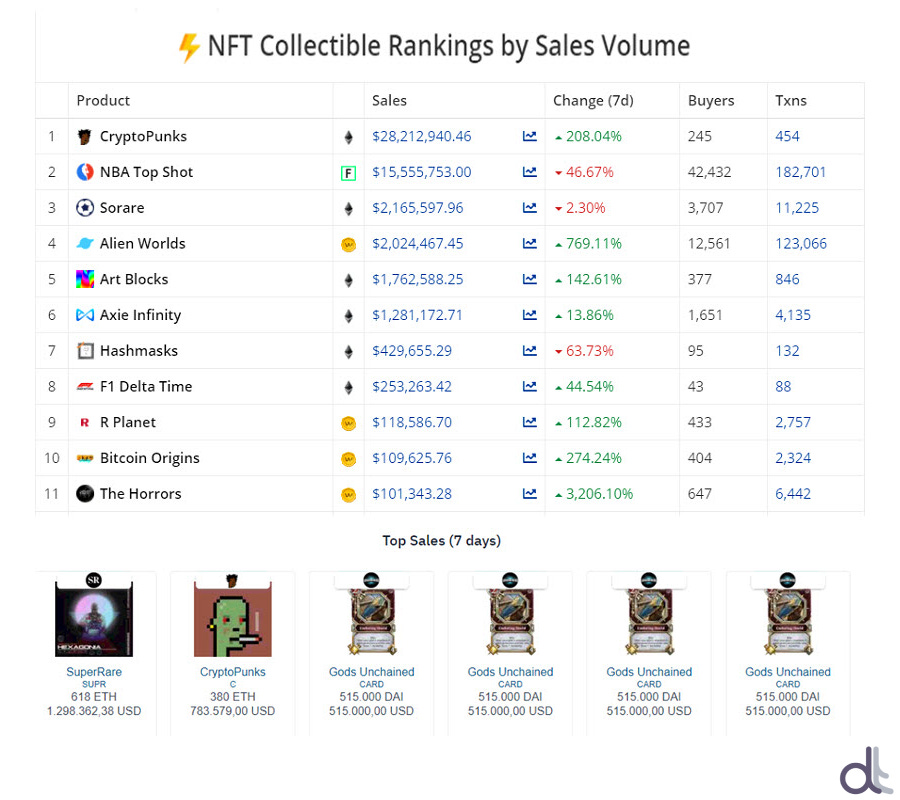

Non-Fungible Token

With the number of active users and therefore the value of trades decreasing further (-48%) for the second week in a row, the NBA Top Shot marketplace was overtaken by CryptoPunks, which had a busy week with an increase in trades of over $28 million, up +200% from the previous week. One of the rare images of smoking zombies sold for 380 ETH (US$783,579.00), the second-highest trade in the last seven days. The former owner had bought it last mid-November for 'only' 35 ETH, or 15,880.55 USD. In less than five months he has made a gain of 4,800%.

The week's highest sale was for Destination Hexagonia's audiovisual trading card, which was bought for 618 ETH (1,298,362.38 USD) on SuperRare's marketplace. The marketplace for GodsUnchained, the trading cards used in the game that combines the classic experience of strategy games such as Magic the Gathering and Hearthstone, with a virtual reality dimension, is also growing. In the last week, the total volume of GodsUnchained exceeded 16 million dollars. The main cards were all sold at a fixed price of 515,000 DAI, the algorithmic stablecoin pegged to the value of the US dollar.

5 hottest DeFi news of the week

Ethereum Layer 2 to have less fees

The top DeFi performances of 2021

Mark Cuban on the future of Ethereum

Binance to invest in DeFi startup Mound

Compound is now the first DeFi project

Technical Analysis

Bitcoin (BTC)

With a surge over the weekend, the price of Bitcoin returned above 60,000 USD. A rise that shows intentions of climbing above the historic highs of mid-March by regaining market share lost to altcoins over the past week. Despite the return below 54% of the entire market - the lowest level of dominance in the last 12 months - Bitcoin is showing good holding of short and medium-term support. The moment of weakness that characterized the beginning of last week saw prices react in the 55,600 USD area (1), a level that coincides with the bullish dynamic trendline that joins the rising lows since the end of January. The dynamic support level now passes above 58,000 USD (2), becoming an operational reference area for the next few days.

Technically, it will be important to understand where prices will break out of the sideways channel (purple rectangle on the chart) that has been forcing price movements between 50,000 and 60,000 USD for a month. The daily volatility index fell below 3%, the lowest level since mid-November, warning that when prices break out of the channel it is possible that the directional movement could be very fast.

The increase in Call options highlights the intentions of traders to hedge the risk of any price rises above previous highs. Looking at the 3 most used strikes (60,600 - 60,850 - 61,120) it is clear that selling options at price levels just below the historical highs of mid-March (61,700 USD) are mostly strategic positions. If the price were to rise above the highs the next area of resistance is in the 64,000 area (4) where Call options positions on various maturities have been increasing in recent days. An eventual rise above this last level (4) could trigger closures of sold positions or the purchase of futures to lock in the margin. A condition that would make the price run in a short time. On the downside, there are margins of movement down to the 57,500 area without causing dangerous tensions. Only a sinking under 50.000 could provoke a situation of coverages of the Put options, in contrast to that described above with the Call options.

Ethereum (ETH)

The rise above the previous highs of February (1) and the confirmation of having absorbed the mid-week drop which stopped exactly at the levels of the previous highs (2) reinforces the hypothesis of the start of a new quarterly cycle anticipated with the lows between the end of February (3) and mid-March (4). The bullish momentum that is characterizing the first part of the month of April records prices above 2,100 USD, validating the strength that accompanies the beginning of a new major cycle, in this case, the monthly cycle. If my approach to the new monthly cycle is correct, the price will have to consolidate above 1,900 USD to confirm the bullish trend for the whole week. Or, in the case of the closure of the monthly cycle expected within the next week, prices should not slip below 1,800 USD in order not to risk starting to jeopardize the work done so far. Should these confirmations arrive, the target for the coming weeks is in the 2,600 USD area.

Options

The breakdown of previous highs has forced traders to reposition hedging strategies. At the moment it is too early to understand the next levels of resistance. While on the downside it is clear that the support to defend in case of strong declines is positioned in the 1,600 USD area, a level 25% distant from the current values (2,130 USD) which coincides with the lows of the end of March.

Let’s Connect

DeFiToday is A FREE weekly newsletter covering all the top stories in DeFi:

Bitcoin, Ethereum and DeFi Charts

Esclusive Interviews

Curated content from industry leaders

Join our Telegram Channel - Follow us on Twitter - Subscribe