Bitcoin and Ethereum Rise Arm in Arm

Having overcome the fear of the technical deadline at the end of May, confidence returns. But more needs to be done for confirmations.

"Wealth is like sea-water; the more we drink, the thirstier we become; and the same is true of fame."

Arthur Schopenhauer

It was 2016 when people started talking about Art & Blockchain at the first conferences on the subject, where the prospects for applying this new technology to art were all in the making.

Accomplice to the great hype of the moment about Blockchain, people in the field and some start-ups, including our Italian Art Rights, investigated the concrete application of the technology to the "physical" and traditional art world.

Some events in particular in 2018, such as the Deloitte Art&Finance in Luxembourg and the Christie's Art+Tech Summit, have been solid points to identify what are still the three main uses of Blockchain for the Art world. The Tokenisation of an artwork, the Certification of Digital Art, and the use as a Business Art Solution.

When we talk about the Tokenisation of a work of art, we refer to the possibility of securitising an asset into several parts - be it physical or digital - thanks to connected smart contracts, which regulate the rights of use, possession or commercial exploitation for each part.

Numerous platforms have tried to apply this condition to physical works, one of which is Maecenas, seeking to assimilate investment dynamics typical of the stock market and financial markets to assets linked to the art world.

However, to date, none has managed to emerge successfully due to problems linked to the liquidity of the Second Market (the sales following the first), i.e. the difficulty of reselling the shares in the short term and thus creating a profit, with a considerable problem linked to the low supply and demand.

Separate consideration deserves the management of the physical asset and, therefore, the verification of its authenticity, the attribution of its economic value and its preservation, often attributed to private owners of 60% of the shares.

More generally, the lack of security provided by the proposing platforms, often immature start-ups with low capitalisation and little structure in long-term management.

Another line of Blockchain application is the Certification of the Authenticity, or ownership, of a work of Digital Art, for which this technology is ideally suited.

If on one side, it offers the transparency of distributed databases, on the other, it allows the association, even cryptographic or shared, of a digital file to a smart contract including the now-famous NFT (Non-Fungible Token). We also think of the DAO (Decentralized Autonomous Organization) and other applications related to the validation time called "Timestamp".

If up until a few years ago, the solution encountered some obstacles, linked above all to the meagre value of the Digital Art market, after the explosion of the NFT market and more generally of Collectibles first, and Crypto Art later, the attention of artists and operators in the traditional art market has rapidly increased.

The latest application for this decentralised technology is the Art Business Solution to regulate, track, value, and validate economic transactions between players and professionals favouring Due Diligence and Provenance for the insurance, transport, handling, fruition and fruition sale of works of art.

The Blockchain can therefore be used as a binding, tracing and sometimes regulating technology for a market, like Art Services, worth around $20 billion globally, in addition to the exchange market worth around $50.1 billion, according to the latest Art Basel Global Market Report 2021, all in favour of authenticity and trust in the market.

Companies such as Artory, Verisart and Art Rights are among the few that have today created a concrete network of users between physical and digital; in particular, Art Rights, from the Italian start-up Art Backers, which today encompasses thousands of users and works (physical and digital) certified daily with the possibility of interacting with a community of Artists, Collectors, Gallerists and professionals, based entirely on certificates of authenticity recorded on the Blockchain.

If before, there was a diffidence and a more general and typical reluctance to change on the part of those working in the sector, with the ongoing pandemic, the lost physicality and the need to resort to the web forced them to think of a new "Post Coronavirus Art"; in particular after Christie's baptism and the sale to over 69 million dollars of the work "Everyday: the first 5000 days" by the artist Beeple, everything has changed.

Today, people no longer talk about Blockchain, the technology, how it works, or its doubts. Instead, today they only speak about NFT and how to be part of this world.

The sale of 11 March 2021 has decreed the breaking down of technological barriers to entry by the industry who, feeling validated and reassured. First by Christie's, then Phillips, and finally Sotheby's, and now by so many other artists and gatekeepers in the sector in recent months find themselves involved in discussing Art and NFT daily.

That is the role of innovation for art, where a trigger makes a technology or its use in a particular sector disruptive.

That is all part of the game, but the most exciting thing is that what has happened so far with NFTs has nothing to do with the canonical art world: they were established dynamics of the Cryptocurrency world.

Now it's time to talk and write the history and rules related to Art & NFT!

Decentralized Finance

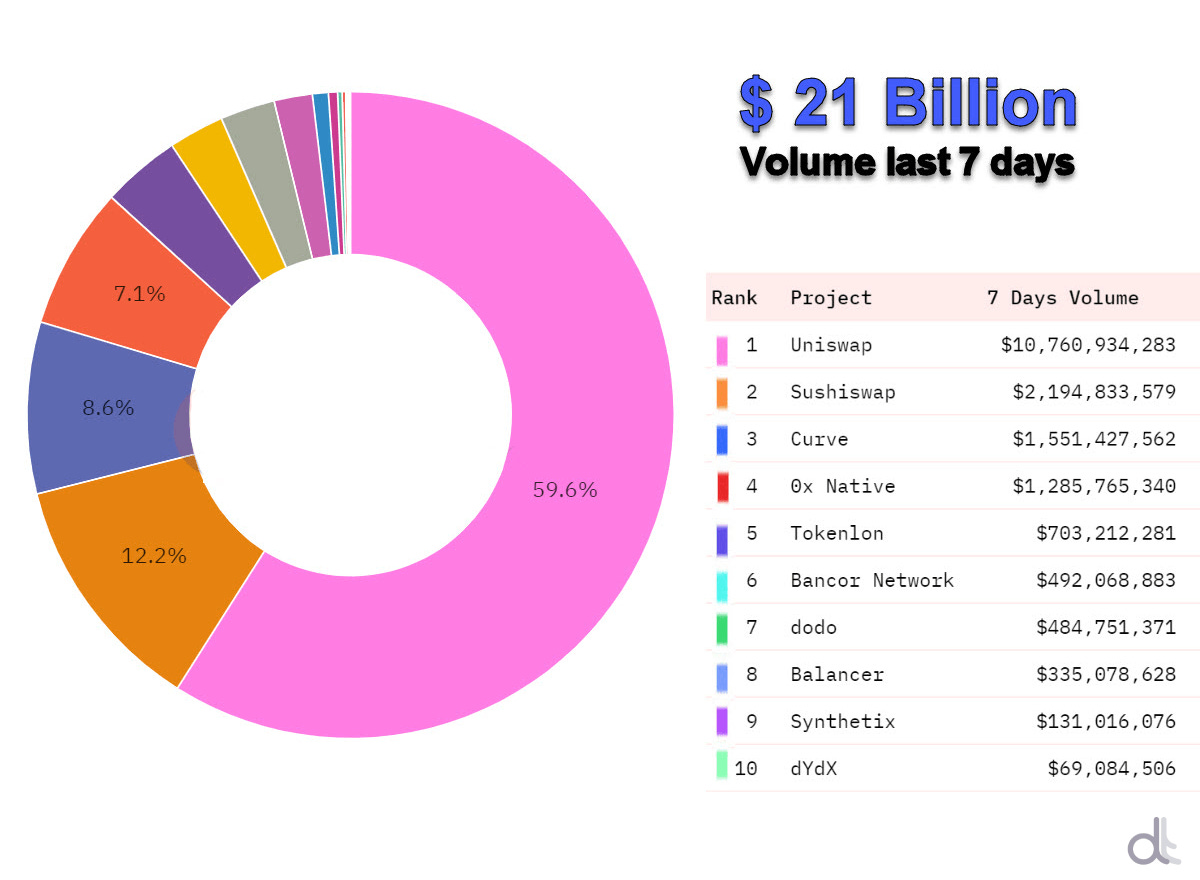

Despite the decline in traded volumes since last week, trading on the DEX Decentralized Exchanges has remained above the weekly average since the beginning of the year. Since last week, total volumes went from record highs of close to $50 billion on a weekly basis and $9 billion daily to $21 billion on average over the past seven days or about $2 billion over the past 24 hours.

With over $172 billion, May was the best month ever for DEX. There are several reasons for this impressive growth in an industry that only once a year ago, in the first half of 2020, managed to exceed $1.5 billion in monthly trading. That was helped by the upgrade of the Uniswap protocol from V2 to V3. This upgrade has brought many advantages for active users participating in yield farming who now have more options available depending on the risk chosen and for traders who benefit from better commissions. But also, what has happened in the last few weeks has contributed to the explosion in volumes, doubling the previous record volume in April to $82 billion. The movement of the entire sector, both in the early part of the month with most of DeFi's cryptos and tokens at all-time highs, as well as the strains of a bearish movement of an intensity not seen in over a year, caused trading volumes to explode on both the centralized CEX and decentralized DEX exchanges.

In the last seven days, the number of active traders on Uniswap, the most widely used platform, fell from over 360,000 to just over 235,000 per week. Despite the cooling down, the Uniswap protocol retains the confidence of most traders, accounting for just under 60% of the total market share.

Sushiswap followed with ⅙ of the trades, dropping from 20% to 12% of the market share.

Curve, the protocol used for buying and selling stablecoins, came third with $1.7 billion and 8% dominance.

The total volume of assets held by DeFi's Decentralized Finance projects (TVL) has stabilized at around $65 billion after being heavily impacted by the volatility of the prices of the various assets used by users to obtain returns through lending, financing and trading.

Aave's project climbs to the top of the podium with over $10 billion tied up. Unlike in recent weeks, it is the only project that has managed to stay above the double-digit mark. In fact, it is the only one of the leading projects managing to keep on top of the absolute highs. It has increased its holdings of tokenized BTC and DAI stablecoin, both at all-time highs in terms of the amount locked up by users who choose this platform for lending activities.

It is followed by Maker with around $9 billion and

Polygon with just under $8 billion, making it into the Top 3 for the first time. Former Matic Protocol achieves the highest fundraising ever. The project, born in 2017, ranks among the leading protocols for being a multichain offering effective scalability for the Ethereum network.

Non-Fungible Tokens

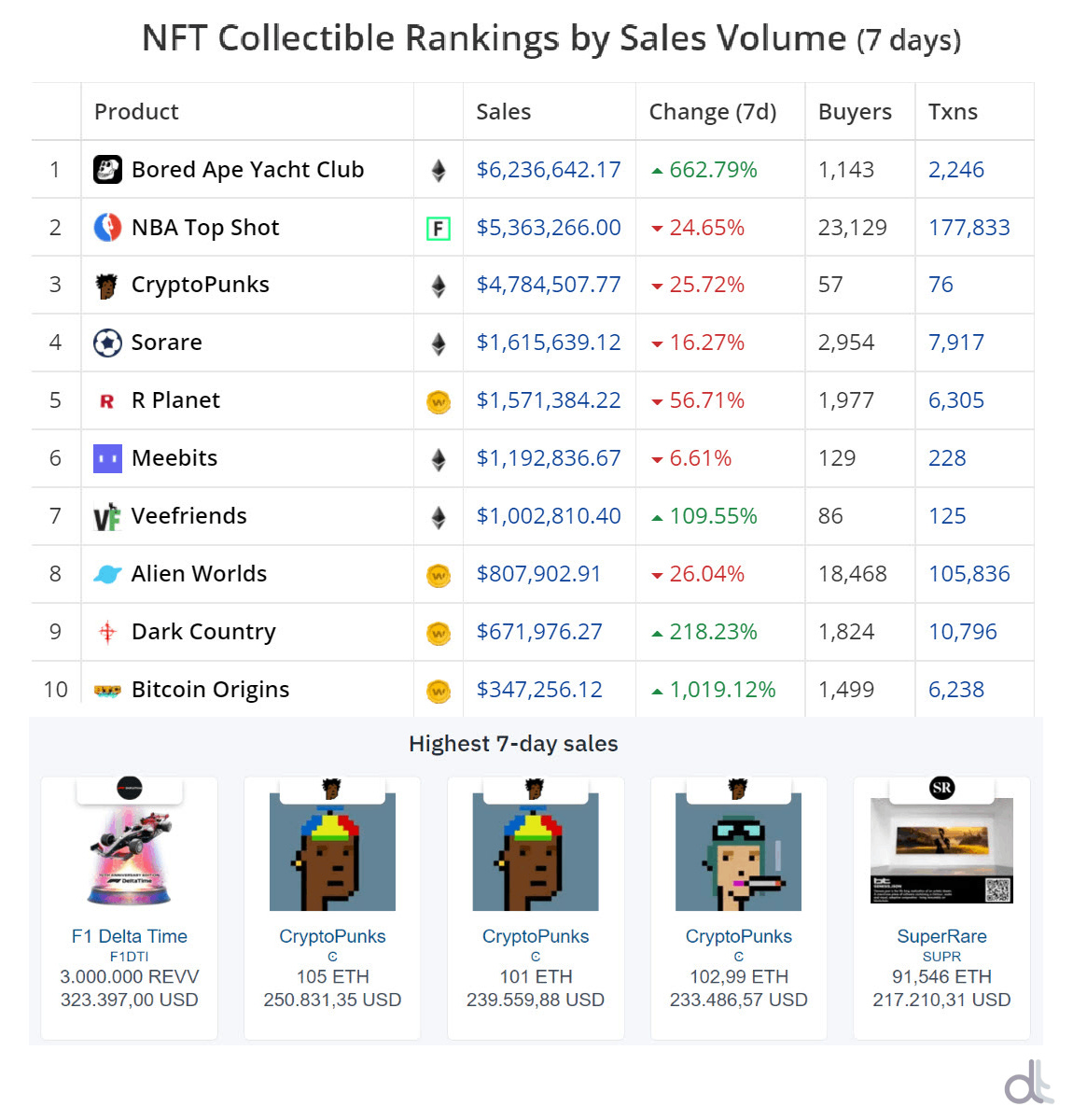

The downward trend in the turnover of the Non-Fungible Token sector continues. After the record-breaking peaks of March, the NFT sector is once again having to deal with a need for users to be more selective, even within the most prestigious projects.

Two of the highest-volume projects, NBA Top Shot and CryptoPunk, were down more than 20 per cent from last week's already declining turnover. Among the top 5 most traded projects, we have "Bored Ape Yacht Club", born a few weeks ago and reaching in a short time over $19 billion in total volume, including $6.2 billion in the last week and up 660% WTD. It is a collection of 10,000 unique digital collectable images based on Ethereum's blockchain as ERC-721 tokens and hosted on IPFS. Sold on Opensea's marketplace, each property allows access to the exclusive members-only virtual Yacht Club with restricted benefits. Most images are similar monkeys, while some have rare images acquiring more value in the secondary market. In the last few hours, Bored Ape #8023 sold for 49.9ETH or USD 119,561.00, the highest amount paid to date for a rare monkey image.

Of all NFT's projects over the past seven days, the highest sale was for EST #4186 for the Decentraland project, which sold for 759,361 MANA or 703,922.33 USD. That is followed by the 70th-anniversary image of Formula 1 transferred to the F1 Delta Time project, sold for REV 3,000,000 at a value of USD 323,397.00.

5 hottest DeFi news of the week

Uniswap to use Arbitrum layer 2 solution

A new DeFi passport to enable crypto loans

Belt finance to compensate users following the 6.2 million attack

Exodus to tokenize its stock on Algorand

Shopify for NFT to be launched on Solana

Technical Analysis

Bitcoin (BTC)

Ten days after the low of USD 29,500, the lowest point in the last three months, prices appear to be continuing their accumulation phase before resuming their climb and returning to more acceptable price levels. However, it is still too early to consider that the danger of any new declines has passed. Despite the rebound of prices in the USD 40,000 area (1), the intensity has not recovered more than 30% of the movement calculated from the record highs of mid-April (2) and the recent lows of March (3). For this reason, the current context indicates a technical rebound supported more by re-covering than by new purchases. To start considering something more than a simple technical rebound, prices will have to regain the 45,500 USD (4) level, which corresponds to 50% of the movement indicated. Analyzing the cyclicality in the short term, the current weekly cycle started with the recent lows of the weekend (5) despite the bullish trend of the last few hours, has not yet shown to have a bullish momentum equal to or greater than the previous weekly cycle. For this reason, within the next three days (June 6), it will be necessary for prices to return to, or even better exceed, the 40,000 USD (1). Otherwise, it will be essential to evaluate the maintenance of the supports of short and medium-term to understand the actual structure of the current cyclical phase.

BTC Options

Last week's monthly expiry allowed us to collect large premiums on open Put positions for the USD 40,000 strike, the second-highest number of positions after the USD 50,000 strike, has shuffled the cards. Put positions to protect against declines have increased in recent days, and the USD 40,000 strike now becomes the one with the most open options. At the moment, 11.9 thousand Bitcoins, equivalent to a counter value of 452 million dollars at current prices, are open. With 11,400 Bitcoins worth $433 million, the $50,000 strike is the second most traded option. Interestingly, 100,000 with 10,400 Bitcoins is the third most traded strike, 95% Call options.

The ratio between Put and Call options was reversed, slightly in favour of the former. That indicates a return of confidence among financial operators. On the upside, on the other hand, the first strikes used to protect the upside passed between 41,500 and 43,600 USD. These will be the hurdles to overcome in order to attack the 47,000 USD level.

Ethereum (ETH)

Ethereum's price structure shows an improved polish. The rise that began from the lows of May 23 (1) indicates a more toned-down setup. The recent uptrend in the weekly cycle that started on May 30 (2) in just a few days has brought prices back to the USD 2,800 area, just a step away from the recent highs of late May in the USD 2,900 area (3). Despite a better technical setup, the price of Ethereum is also in a technical rebound phase. To recover 50% of the Fibonacci retracement, a rise of around 15% from current price levels is needed, unlike Bitcoin, which requires another 25% from current levels. A clue that confirms a better shape for the queen of altcoins.

Analysing the current phase of the weekly cycle, which began on May 30 (2), prices must consolidate the holding of 2,600 USD (4) over the next few days. Otherwise, the short bullish trend would begin to make signs of a push no longer supported by actual purchases.

ETH Options

For Ethereum, traders remain cautious with a Put to Call ratio of 1:2 in favour of the latter. Therefore, for the operators, whichever return in low of the prices will not be considered dangerous until area 2.050, a level that corresponds to the minimums and where it passes the bullish trendline that joins the minimums increasing from last December, violated for some hour during the hours of panic of last May 23 and therefore without invalidating the effectiveness. On the upside, on the other hand, the area of 3,050 USD, a level that corresponds to 50% of Fibonacci as indicated above, is valid as protection against any upward breakout. In fact, the barriers that need to be overcome to confirm the transition from a technical rebound to a real rise are positioned between 2,850 and 3,050 USD.

Binance: first NFT artists to drop on the new marketplace revealed

Binance's new marketplace for non-fungible tokens (NFT) will finally open its doors on 24 June.

After the announcement last April, Binance has started contacting several artists from the global scene to collaborate with them. These 100 creators will then have the opportunity to be among the first to use the platform, benefiting from the marketing and numbers of Binance, which boasts millions of users worldwide.

In fact, those registered on Binance.com will also have full access to the NFT platform, thus opening up a vast audience, given that the exchange is among the most widely used in the market.

In a recent interview conducted by DeFi Today, the team explained:

"Binance has the largest user base in the cryptocurrency world, with users in over 180 countries and regions. Based on the number of users, the NFT platform could attract millions of potential NFT collectors worldwide, and Binance will aim to provide maximum liquidity and minimum fees for users. We have the best resources in the cryptocurrency world, and we have the best technical support to solve these problems."

We still don't know the list of all the 100 creators, but some have already been revealed. Among them, in the Italian scene, we find Dangiuz, Giovanni Motta, Emanuele Dascanio, Valentina Loffredo, Alessio Rio, Simon Dee.

In a recent interview, Dascanio stated:

"Those on the Binance NFT Marketplace will be my first dropped NFTs, a sort of digital baptism notarized on the blockchain and historicized by technology."

But Binance's platform for NFTs is not just for art; they can also be playing cards, sports, and gaming cards. And indeed, in this category, we also find Bayern Munich and Canadian football star Alphonso Davies.

This collection of non-fungible tokens will consist of three unique designs created by US illustrator Jack Perkins, along with input from Davies' followers, who will vote on each aspect of the designs.

The three lottery winners will receive the limited edition NFTs. One will also receive a golden ticket to meet Davies and receive an autographed UEFA Champions League winner's shirt.

Other creators already announced include Lewis Capaldi, Trevor Jones, Michael Owen, Alphonso Davies, WePlay Esports, FC Dynamo Kyiv, eStarPro.

How the marketplace works

To be among the artists or companies able to display their NFTs on the platform, Binance is collecting applications via email to nft@binance.com, so, as on other platforms, you have to be accepted by them.

Then, to drop your NFTs, you have to do so by logging onto Binance.com and completing the procedure as you would when signing up on the exchange. The fees will be paid in BNB, so Binance tokens are required to make the drops.

As for the fees, Binance has stated that it wants to be very economical, and in fact, the commissions are 10% on sales, while 1% fee to put their NFTs for sale on this marketplace. Also, 1% applied as a fee on royalties from artists and NFT creators.

"Transaction fees will be very competitive in the marketplace, and at the same time, we are providing royalty payments for creators so that they get benefits from each subsequent transaction. Users will be able to deposit and withdraw their NFTs freely on our platform, which means they have full ownership."

Let’s Connect

DeFiToday is A FREE weekly newsletter covering all the top stories in DeFi:

Bitcoin, Ethereum and DeFi Charts

Esclusive Interviews

Curated content from industry leaders

Join our Telegram Channel - Follow us on Twitter - Subscribe